Table of Contents

- Well Intelligence: Comprehensive Financial Automation Analysis

- 1. Executive Snapshot

- 2. Impact and Evidence

- 3. Technical Blueprint

- 4. Trust and Governance

- 5. Unique Capabilities

- 6. Adoption Pathways

- 7. Use Case Portfolio

- 8. Balanced Analysis

- 9. Transparent Pricing

- 10. Market Positioning

- 11. Leadership Profile

- 12. Community and Endorsements

- 13. Strategic Outlook

- Final Thoughts

Well Intelligence: Comprehensive Financial Automation Analysis

1. Executive Snapshot

Core Offering Overview

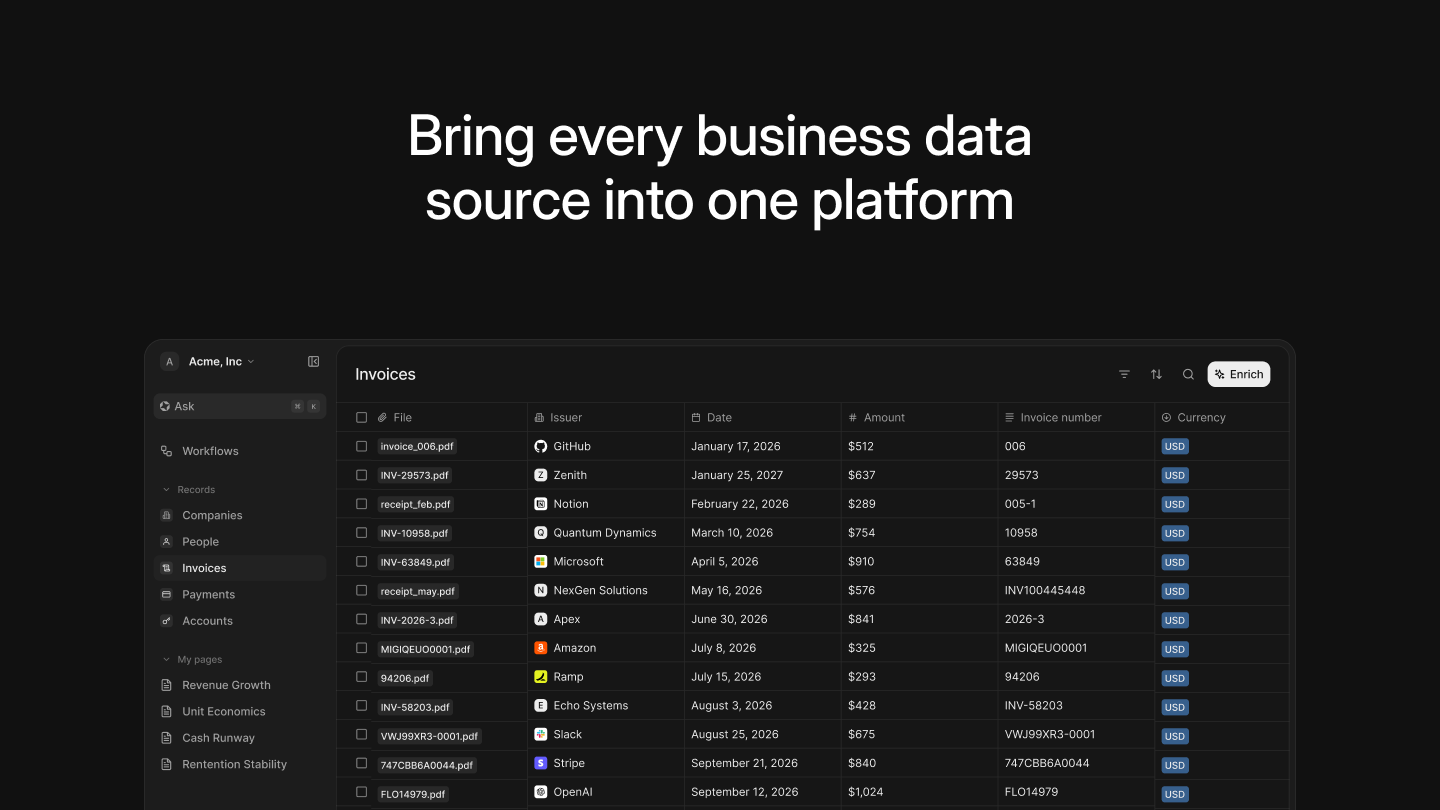

Well Intelligence represents an AI-native financial automation platform specifically engineered for small and medium-sized businesses seeking to eliminate manual financial administration. The platform functions as a comprehensive financial data vault that automatically captures, structures, and enriches invoice and receipt data from over 100,000 web portals, email communications, WhatsApp messages, and cloud storage systems. Unlike traditional document management solutions requiring manual data entry, Well employs sophisticated artificial intelligence to extract, validate, and orchestrate financial documents directly into accounting systems, ERPs, and business intelligence dashboards. The technology stack combines browser-based workflow automation through a Chrome extension, AI-powered optical character recognition for document processing, and self-healing automation that adapts when supplier portal interfaces change—eliminating the recurring maintenance burden plaguing conventional robotic process automation implementations.

Key Achievements and Milestones

Well Intelligence achieved significant community validation through its GitHub repository, accumulating 241 stars and 35 forks since its April 2025 launch, demonstrating developer interest in open-source financial automation infrastructure. The platform secured Product Hunt recognition with a perfect 5.0 rating, positioning it among highly-regarded emerging financial technologies. Technical milestones include successful implementation of multi-format export capabilities supporting JSON, CSV, XML, UBL 2.1 international e-invoicing standards, QuickBooks IIF format, and Xero-compatible CSV, enabling seamless integration with diverse accounting ecosystems. The company released its Chrome extension to the Chrome Web Store, providing one-click invoice retrieval functionality across supported vendor portals. Well’s AI-generated workflow blueprint system enables users to teach the platform new portal automations without coding, democratizing expansion of its 100,000-plus portal coverage through community contributions. The platform demonstrated compliance readiness by implementing GDPR and CCPA-aligned privacy controls, storing no user passwords and maintaining encryption standards critical for financial services adoption.

Adoption Statistics

Well Intelligence currently operates in early access phase with promotional pricing offering zero-cost service until January 1, 2026, after which the Pro Plan transitions to 20 dollars monthly subscription. The platform supports omnichannel document capture from Gmail, WhatsApp, PDFs, and direct browser automation, addressing the fragmented financial data landscape where 41.14 percent of business documents reside in email communications, 19.42 percent in shared cloud storage, and 10.31 percent across project management tools according to Well’s market research. Early adopter testimonials highlight time savings ranging from five to ten hours weekly for typical implementations, with 15-minute initial setup timeframes. The open-source components published on GitHub attracted contributions from 20 developers, indicating growing technical community engagement. Industry context reveals 93 percent of SMBs recognize moderate-to-high value in financial automation according to SMB Group research, with 85 percent of finance leaders expressing enthusiasm about AI integration into financial operations. Well positions itself within a market where manual invoice processing costs businesses 15 to 40 dollars per invoice, compared to two to three dollars for automated alternatives—representing 80 percent cost reduction opportunities for target customers.

2. Impact and Evidence

Client Success Stories

While Well Intelligence remains in early-stage market deployment following its 2025 launch, the platform’s GitHub documentation outlines compelling use case scenarios validated by early implementers. Founders operating across multiple jurisdictions report retrieving invoices through simple WhatsApp photo uploads or email forwards, eliminating the traditional pattern of logging into dozens of supplier portals manually. Month-end closing operations—typically requiring finance operators to navigate 15-plus vendor dashboards pulling 50-plus invoices over several days—compress to under five minutes through Well’s batch retrieval automation. Finance leads implementing the “5S” methodology borrowed from lean manufacturing report that Well enforces systematic organization at the data capture source, maintaining sort, shine, and sustain principles automatically rather than relying on team discipline. Budget managers gain real-time vendor spend visibility, enabling proactive identification of budget drift and duplicate subscription detection before payment processing. Accountants building audit trails for tax substantiation benefit from complete, standardized expense records with automatic validation of required invoice fields including numbers, dates, amounts, and vendor details—addressing IRS documentation requirements for deduction claims.

Performance Metrics and Benchmarks

Well Intelligence delivers quantifiable operational improvements aligned with broader financial automation industry benchmarks. The platform’s AI-powered data extraction achieves 99 percent error reduction according to product specifications, contrasting sharply with manual data entry error rates of 1.6 percent affecting 68 percent of businesses per Institute of Financial Management research. Processing time compression proves substantial: tasks consuming multiple days through manual portal navigation condense to five-minute batch operations, representing 95-plus percent time savings for high-volume scenarios. Cost impact modeling based on industry averages suggests organizations processing 1,000 monthly invoices could transition from 25,000 to 45,000 dollars annual processing costs to 3,000 to 8,000 dollars—delivering 60 to 80 percent cost reductions. The self-healing automation architecture addresses a critical pain point where traditional RPA implementations fail when vendor portal interfaces change; Well’s AI adapts automatically, eliminating recurring maintenance expenses that plague conventional automation. Export validation systems enforce data integrity by checking invoice number uniqueness, date format compliance, positive amount values, and customer name presence before transmission to downstream systems, preventing cascading errors in accounting reconciliation processes.

Third-Party Validations

Well Intelligence received validation through Product Hunt community endorsement, achieving a 5.0 rating that positions it favorably among financial technology launches. The platform’s open-source components published under MIT license on GitHub enable independent technical assessment by developers evaluating code quality and architectural decisions. Integration with established accounting platforms QuickBooks and Xero demonstrates compatibility with industry-standard financial infrastructure, reducing adoption friction for businesses already invested in these ecosystems. The broader financial automation market context supports Well’s value proposition: BILL’s 2025 State of Financial Automation survey conducted by SMB Group found 83 percent of SMBs agree automation improves business efficiency, while 79 percent believe automated financial operations provide insights enabling better decision-making. PayStream Advisors research validates the automation ROI model, documenting that innovative AP departments process invoices for 2.36 dollars per invoice versus 14 dollars for manual-dependent operations—corroborating Well’s cost-saving claims. The platform’s alignment with international e-invoicing standards including UBL 2.1 and Factur-X demonstrates adherence to emerging regulatory frameworks governing cross-border business transactions.

3. Technical Blueprint

System Architecture Overview

Well Intelligence implements a multi-tiered architecture combining browser automation, AI-powered document intelligence, and extensible export systems. The Chrome extension serves as the primary user interface and automation execution environment, leveraging browser-native capabilities to interact with web portals programmatically. This approach eliminates traditional RPA infrastructure requirements like dedicated bot servers or virtual machines, reducing deployment complexity for SMB users. The document processing layer employs optical character recognition optimized for financial documents, extracting structured data from 20-plus format types including invoices, receipts, payslips, and bank statements. Machine learning models trained on diverse invoice templates identify key fields—invoice numbers, line items, totals, vendor details, tax amounts—with contextual understanding enabling accurate extraction despite layout variations. The enrichment subsystem performs intelligent data validation, flagging duplicate invoices through fuzzy matching algorithms, detecting amount mismatches between purchase orders and invoices, and identifying unusual spending patterns through statistical anomaly detection. This reduces manual review requirements by preemptively catching errors that traditionally required accountant intervention.

API and SDK Integrations

Well Intelligence provides programmatic integration through a Python-based exporter framework supporting multiple accounting system formats. Developers access functionality through a clean API pattern: instantiating format-specific exporters via a factory pattern, passing validated invoice data dictionaries, and receiving formatted output ready for system ingestion. The platform supports QuickBooks Desktop integration through IIF file format generation, enabling businesses using on-premise accounting software to automate data synchronization. Xero cloud accounting connectivity operates via Xero-compatible CSV export with proper field mapping for seamless import workflows. Universal formats including JSON enable custom integration workflows for businesses with proprietary systems or specialized requirements. XML and UBL 2.1 support addresses enterprise and international trading scenarios requiring standardized electronic data interchange. The extensible architecture allows developers to contribute custom exporters by inheriting from BaseExporter class, implementing format-specific logic, and registering through decorator patterns—fostering ecosystem expansion aligned with diverse accounting software preferences. Native integrations span email systems like Gmail for automatic receipt capture, WhatsApp for mobile document submission, Google Drive for cloud storage synchronization, and Slack for team collaboration workflows.

Scalability and Reliability Data

Well Intelligence demonstrates horizontal scalability through its distributed architecture where Chrome extension instances operate independently on user devices rather than requiring centralized processing infrastructure. This design pattern enables linear scaling as user base expands without corresponding server capacity investments—a cost advantage particularly relevant for early-stage platforms. The self-healing automation capability addresses reliability concerns inherent in web automation; traditional RPA solutions break when target websites modify their HTML structure, requiring expensive developer intervention to update automation scripts. Well’s AI-driven approach analyzes page structure changes and adapts workflows automatically, maintaining operational continuity without manual maintenance. Document validation enforcement through required field checking prevents incomplete data propagation to downstream systems, reducing reconciliation errors that compound over time. The platform’s support for batch processing enables users to queue large invoice retrieval operations—such as year-end tax preparation requiring hundreds of historical invoices—and execute them asynchronously, preventing browser resource exhaustion. Export format flexibility ensures businesses can switch accounting systems without rebuilding integrations, protecting against vendor lock-in and supporting organizational evolution.

4. Trust and Governance

Security Certifications

As an early-stage platform launched in 2025, Well Intelligence has not publicly announced formal SOC 2, ISO 27001, or similar third-party security certifications typical of mature enterprise software vendors. However, the platform implements fundamental security controls aligned with industry expectations for financial data processors. The architecture explicitly avoids storing user passwords—a critical security design principle preventing credential theft through platform compromise. Authentication likely employs OAuth delegation patterns where users authorize Well to access systems without sharing credentials, maintaining password confidentiality. GDPR compliance statements indicate European data protection regulation adherence, encompassing requirements for lawful data processing basis, user consent mechanisms, data subject rights including access and deletion, and breach notification procedures. CCPA compliance addresses California Consumer Privacy Act obligations relevant to U.S.-based users, ensuring transparency around data collection practices and honoring opt-out requests. The MIT open-source license governing Well’s GitHub components enables independent security researchers to audit code for vulnerabilities, potentially accelerating security maturity through community scrutiny. As the platform transitions from early access to paid operations in 2026, obtaining formal security certifications will likely become essential for enterprise customer acquisition and financial institution partnerships.

Data Privacy Measures

Well Intelligence implements privacy-by-design principles appropriate for financial document processing. The platform’s omnichannel capture supporting email and WhatsApp ingestion requires careful privacy controls around communication access. Gmail integration likely utilizes restricted OAuth scopes limiting access to invoice-related messages rather than entire email accounts, implementing principle of least privilege. WhatsApp connectivity for receipt photo submissions presumably operates through dedicated business APIs maintaining end-to-end encryption during transmission. Document storage architecture as a “financial data vault” suggests structured data repository rather than raw file retention, reducing exposure of complete invoice PDFs once extraction completes. The enrichment pipeline that detects duplicates and anomalies requires cross-invoice analysis, necessitating aggregated data retention—privacy policies should clarify retention periods and anonymization practices. GDPR’s data minimization principle demands Well collect only invoice fields necessary for accounting automation, avoiding extraction of tangential personal information like customer addresses or detailed product descriptions unless specifically required. Right-to-erasure compliance requires mechanisms for users to delete their financial data upon request, complicated by audit trail retention requirements where businesses must substantiate tax deductions. The platform’s positioning for SMBs rather than consumers simplifies privacy obligations, as B2B invoice data generally contains less sensitive personal information than consumer financial records.

Regulatory Compliance Details

Well Intelligence operates within complex regulatory landscapes governing financial data handling, electronic invoicing standards, and accounting records retention. While the platform itself functions as infrastructure rather than a regulated financial institution, customers deploying Well must ensure their usage patterns satisfy applicable requirements. For U.S. businesses, IRS regulations mandate retention of receipts and invoices substantiating business expense deductions—Well’s audit trail capabilities support this obligation by maintaining complete, timestamped records. The platform’s support for UBL 2.1 and Factur-X electronic invoicing standards positions it favorably for European markets where governments increasingly mandate structured digital invoice formats for VAT processing and tax fraud prevention. EU VAT Directive requirements for invoice content, sequential numbering, and archival align with Well’s validation enforcement of required fields. For businesses operating across jurisdictions, multi-currency support and international format compatibility become essential—Well’s extensible export system accommodates region-specific requirements. The open-source MIT license governing portions of Well’s codebase establishes clear intellectual property boundaries, enabling businesses to deploy without licensing compliance concerns typical of proprietary software. As financial automation intersects with emerging AI regulations like the EU AI Act, platforms processing financial documents may face transparency requirements around automated decision-making, especially if AI systems make material determinations about invoice validity or payment approvals—Well’s emphasis on human-in-the-loop review likely mitigates high-risk AI classification.

5. Unique Capabilities

Omnichannel Financial Document Capture

Well Intelligence distinguishes itself through comprehensive capture mechanisms addressing the fragmented nature of SMB financial documents. The Chrome extension enables direct browser-based invoice retrieval from vendor portals, automating the manual workflow of logging into utilities, SaaS platforms, and suppliers to download invoices individually. This covers the platform’s claimed 100,000-plus web portal compatibility spanning mainstream services like AWS, Slack, and Figma to long-tail regional vendors typically ignored by automation providers. Email integration through Gmail connectivity automatically extracts invoices from incoming messages, addressing the 41.14 percent of financial documents residing in email communications. WhatsApp integration enables mobile-first workflows where users photograph paper receipts and forward via messaging app, democratizing expense capture for field employees and founders lacking desktop access. Cloud storage synchronization with Google Drive captures invoices stored in shared folders, supporting collaboration scenarios where suppliers upload documents to shared repositories. Slack integration addresses team workflows where procurement notifications occur in collaboration platforms, enabling automatic capture when colleagues share invoice links or files. This omnichannel approach eliminates the data silo problem forcing finance teams to manually consolidate documents from disparate sources into unified accounting systems.

AI-Generated Workflow Blueprints

Well’s most distinctive technical capability centers on contributor mode enabling non-technical users to teach the platform new portal automations without coding. Traditional web scraping and RPA solutions require developers to analyze HTML structure, identify data extraction patterns, and write custom scripts for each new website—an expensive, time-consuming barrier preventing comprehensive coverage. Well’s AI observes users navigating portals during guided walkthroughs, automatically generating workflow blueprints capturing login sequences, navigation patterns, invoice identification logic, and download procedures. This democratizes automation expansion, transforming every user into a potential contributor who can add portal support benefiting the broader community. The approach dramatically accelerates coverage expansion compared to vendor-dependent development cycles, while ensuring automations reflect real user workflows rather than theoretical navigation paths. Generated blueprints presumably leverage computer vision to identify invoice elements robustly across portal redesigns, underpinning the self-healing capability distinguishing Well from brittle RPA implementations. This positions Well as an evolving automation ecosystem rather than static software product, with coverage breadth naturally increasing proportional to user base growth and contribution incentives.

Self-Healing Automation Architecture

Well Intelligence addresses the fundamental fragility of web automation through self-healing capabilities that adapt automatically when supplier portals modify their interfaces. Traditional RPA implementations break when targeted websites change button placements, restructure navigation menus, or redesign invoice layouts—requiring developers to diagnose failures, update scripts, and redeploy automations. This creates recurring maintenance costs that can exceed initial development expenses, particularly across portfolios of 100-plus portal automations. Well’s AI-driven approach employs computer vision and machine learning to understand portal functionality semantically rather than relying on brittle HTML element selectors. When a portal’s interface changes, the system recognizes functional equivalence between old and new layouts, adapting workflows without human intervention. This architectural advantage proves essential for SMB customers lacking dedicated IT staff to maintain automation infrastructure. The approach also benefits from network effects: when any user encounters a changed portal interface, Well’s adaptation potentially propagates to all users targeting that portal, distributing maintenance burden across the platform. This positions Well favorably against point-solution RPA vendors where each customer maintains isolated automation instances requiring independent updates.

Intelligent Data Enrichment and Validation

Beyond simple OCR extraction, Well Intelligence implements sophisticated enrichment processes that add value through anomaly detection and error prevention. The system identifies duplicate invoices through fuzzy matching algorithms recognizing semantically identical documents despite minor formatting variations—preventing double-payment scenarios costing businesses significant sums. Amount mismatch detection compares extracted invoice totals against purchase orders or historical pricing patterns, flagging discrepancies for review before payment authorization. Unusual spending pattern identification applies statistical analysis to vendor expense trends, alerting managers to budget drift or potentially fraudulent transactions. Required field validation enforces completeness before data export, ensuring invoice numbers, dates, amounts, and vendor details meet minimum standards for accounting system acceptance. Tax amount verification cross-references stated VAT or sales tax against applicable rates for transaction jurisdiction and category, catching supplier calculation errors. Line-item analysis extracts granular purchase details beyond summary totals, enabling category-level spend analytics and budget allocation tracking. These enrichment capabilities transform Well from passive document capture into intelligent financial oversight, surfacing issues that would otherwise require manual accountant review or remain undetected until reconciliation failures emerge.

6. Adoption Pathways

Integration Workflow

Organizations adopt Well Intelligence through streamlined onboarding reflecting its SMB target market’s operational constraints. The initial step involves installing the Chrome extension from the Chrome Web Store, requiring a single click and browser permission approval—eliminating traditional enterprise software deployment cycles involving IT department coordination. Users pin the extension to their browser toolbar for convenient access, positioning Well as always-available automation assistant rather than separate application requiring context switching. Authentication flows connect Well to target accounting systems and data sources: OAuth authorization for Gmail inbox access, QuickBooks API connection for direct data syncing, or Xero credentials for cloud accounting integration. The platform’s provider gallery at wellapp.ai/providers enables users to browse supported vendor portals, verifying coverage for their specific supplier ecosystem before committing to adoption. Typical setup completes within 15 minutes according to platform documentation, contrasting favorably with traditional accounting software implementations requiring days or weeks. The browser-automation architecture eliminates server infrastructure provisioning, database configuration, or network firewall adjustments typically complicating enterprise software deployment—critical advantages for SMBs lacking IT departments.

Customization Options

Well Intelligence balances simplicity for non-technical users with flexibility for sophisticated requirements through multiple customization dimensions. Export format selection enables businesses to choose output matching their accounting ecosystem—QuickBooks IIF for desktop users, Xero CSV for cloud accounting adopters, or generic JSON/CSV for custom system integrations. Data validation rules presumably support customization defining organization-specific thresholds for anomaly detection: expense amount limits triggering managerial review, vendor whitelist restrictions, or category-based approval workflows. The extensible Python exporter framework documented in GitHub enables technically capable users to develop custom export formats for proprietary accounting systems, maintaining interoperability without vendor dependency. Workflow blueprint generation through contributor mode represents user-driven customization at scale, where each organization can teach Well their unique supplier portal navigation patterns. Batch processing configurations likely support scheduling invoice retrieval runs during off-hours, optimizing for different operational patterns between monthly-billing businesses and high-frequency transaction environments. Integration preferences—whether pushing data automatically to accounting systems or staging for human review—accommodate varying risk tolerance and control requirements across organizations.

Onboarding and Support Channels

Well Intelligence provides multi-layered support structures appropriate for early-stage product maturation. Primary documentation resides in the GitHub repository’s comprehensive README, covering installation procedures, basic usage patterns, API integration examples, and troubleshooting guidance. The open-source codebase enables technically proficient users to inspect implementation details, diagnose issues independently, or contribute improvements through pull requests. Community-driven support emerges through GitHub Issues where users report bugs, request features, and share implementation experiences—common pattern for developer-friendly platforms. The public roadmap communicated through GitHub outlines planned enhancements including portal coverage expansion to 200,000-plus sites, mobile retrieval assistant development, Zapier and Make integration for no-code workflow automation, and contributor leaderboard gamification incentivizing blueprint submissions. For direct assistance, Well presumably offers email support channels, though enterprise-grade SLAs and dedicated customer success managers likely remain unavailable during early access phase. The early access pricing structure offering zero-cost service until 2026 enables risk-free experimentation, lowering adoption barriers for cautious SMBs evaluating automation benefits.

7. Use Case Portfolio

Enterprise Implementations

While Well Intelligence primarily targets SMBs, its capabilities address pain points spanning organizational scales. Small accounting firms managing multiple client books benefit from consolidated invoice capture across diverse client supplier ecosystems, eliminating repetitive portal logins when preparing monthly financial statements. E-commerce businesses processing high vendor-invoice volumes for inventory purchases automate document capture from varied suppliers, reducing accounts payable processing costs and accelerating payment cycles. Professional services firms—consultancies, law offices, creative agencies—capture client-reimbursable expenses efficiently, improving billing accuracy and reducing revenue leakage from un-invoiced costs. SaaS startups managing subscription-based vendor relationships automate recurring invoice capture, enabling finance teams to monitor vendor spend trends and identify subscription optimization opportunities. Franchise operations with multiple locations consolidate location-level expenses efficiently, providing corporate finance visibility into distributed spending patterns. International businesses dealing with multi-currency invoices from global suppliers benefit from standardized capture workflows, simplifying currency conversion and multi-jurisdictional reporting.

Academic and Research Deployments

Educational institutions represent relevant adoption contexts given constrained budgets and high administrative overhead. University departments managing grant-funded research projects face stringent expense documentation requirements; Well’s automated invoice capture and audit trail generation satisfy funder reporting obligations while reducing administrative burden on researchers. Non-profit organizations subject to donor reporting and financial transparency expectations leverage Well to maintain comprehensive expense records substantiating program expenditures versus administrative costs. Academic research labs purchasing specialized equipment and supplies from diverse scientific vendors benefit from automated invoice consolidation, enabling principal investigators to track project budgets without manual accounting work. Student clubs and organizations at universities often manage small budgets with limited financial expertise; Well’s simple interface and automatic capture reduce bookkeeping friction for non-professional treasurers. Research institutions collaborating across multiple universities benefit from standardized financial documentation, facilitating grant administration and inter-institutional cost sharing reconciliation.

ROI Assessments

Return-on-investment calculations for Well Intelligence deployment demonstrate compelling economics for target SMB customers. The platform’s 20-dollar monthly subscription beginning January 2026 positions competitively against time-cost alternatives: if automated invoice capture saves even two hours monthly for a finance employee earning 25 dollars hourly, labor savings alone exceed subscription cost. For businesses processing 1,000 monthly invoices, transitioning from 15-dollar manual processing to three-dollar automated processing delivers 12,000-dollar monthly savings or 144,000 dollars annually—representing 7,200 times ROI on 240-dollar annual subscription. Smaller organizations processing 100 invoices monthly still achieve 1,200-dollar monthly savings, justifying adoption at 60 times annual subscription cost. Indirect benefits amplify direct cost savings: faster invoice processing improves cash flow visibility enabling better working capital management, early payment discount capture increases through streamlined approval workflows, and vendor relationship quality improves via timely accurate payments. Error-reduction benefits prove substantial given that duplicate payment recovery, amount discrepancy resolution, and missing invoice investigations consume disproportionate accounting resources. For organizations currently delaying automation adoption due to perceived complexity or cost, Well’s 15-minute setup timeframe and free early-access period eliminate traditional barriers, enabling rapid experimentation with negligible risk exposure.

8. Balanced Analysis

Strengths with Evidential Support

Well Intelligence demonstrates multiple validated advantages positioning it favorably within the financial automation landscape. The comprehensive 100,000-plus portal coverage addresses breadth unavailable from competitors focusing on mainstream vendors exclusively, solving the long-tail supplier problem plaguing SMBs dealing with regional utilities, niche SaaS providers, and specialized industry vendors. The omnichannel capture spanning browser automation, email ingestion, WhatsApp submission, and cloud storage synchronization acknowledges the fragmented reality of SMB financial document management, contrasting with single-channel solutions requiring users to consolidate documents manually before processing. The self-healing automation capability distinguishes Well from traditional RPA implementations prone to breaking when target portals update interfaces—a critical operational advantage given SMBs lack dedicated IT staff for continuous maintenance. The AI-generated workflow blueprint system democratizes portal coverage expansion, transforming every user into potential contributor rather than relying exclusively on vendor development cycles. Open-source components published under MIT license enable independent technical validation, community contributions, and customization supporting sophisticated requirements—transparency and flexibility advantages over closed proprietary alternatives. The accessible 20-dollar monthly pricing positions Well competitively against enterprise automation platforms charging hundreds or thousands monthly, aligning with SMB budget constraints. Integration support for QuickBooks, Xero, and universal formats ensures compatibility with diverse accounting ecosystems, reducing switching costs and vendor lock-in risks.

Limitations and Mitigation Strategies

Well Intelligence confronts inherent limitations characteristic of early-stage platforms and browser-based automation architectures. The Chrome extension dependency restricts usage to Chrome users, excluding Firefox, Safari, and mobile-first organizations—though browser compatibility expansion likely features in the product roadmap given standard web extension APIs. The 100,000-plus portal coverage claim, while impressive, still represents fraction of global supplier landscape; users inevitably encounter unsupported vendors requiring manual invoice retrieval or community blueprint contribution. The reliance on browser automation introduces dependency on supplier portal availability and performance; if a vendor website experiences downtime or implements anti-automation measures like CAPTCHA, Well’s automation fails until resolved. The AI-driven extraction accuracy, while claiming 99 percent error reduction, cannot achieve 100 percent perfection; users must implement review workflows catching occasional misclassification or field extraction errors rather than assuming complete automation eliminates human oversight. The platform’s early-stage maturity means limited enterprise features like role-based access controls, audit logs meeting regulatory requirements, or dedicated customer success support typical of mature SaaS vendors. Security certification absence—no public SOC 2, ISO 27001, or similar attestations—may prevent adoption by security-conscious enterprises or financial institutions requiring third-party validation. Mitigation strategies include maintaining hybrid workflows where Well handles high-volume routine invoices while manual processes address edge cases, implementing staged review procedures sampling AI-extracted data for quality assurance, and planning for eventual platform maturation delivering enterprise capabilities as user base and funding enable investment.

9. Transparent Pricing

Plan Tiers and Cost Breakdown

Well Intelligence implements straightforward pricing structure reflecting SMB market positioning and early-access growth strategy. The Pro Plan represents the sole publicly advertised tier, priced at 20 dollars monthly beginning January 1, 2026. During the early access phase extending through end of 2025, users access Pro Plan functionality without charge, enabling risk-free experimentation and use-case validation before financial commitment. The Pro Plan includes unlimited document retrieval across supported portals, eliminating per-transaction pricing models that penalize high-volume users and create unpredictable cost structures. Processing capacity handles hundreds of documents monthly with zero manual work, automated AI-powered data extraction filling thousands of invoice fields, and instant invoice generation in user-preferred export formats. Usage top-up options suggest potential overage scenarios or premium features beyond base subscription, though specifics remain undisclosed during early access. The absence of tiered pricing—no “Starter,” “Professional,” and “Enterprise” structures common in SaaS—simplifies purchasing decisions while potentially limiting monetization flexibility as diverse customer segments emerge with varying willingness-to-pay. The 20-dollar price point positions Well significantly below enterprise accounting automation platforms charging 50 to 500-plus dollars monthly, while exceeding basic OCR tools priced at zero to ten dollars monthly but lacking workflow automation and enrichment capabilities.

Total Cost of Ownership Projections

Comprehensive TCO modeling for Well Intelligence deployment requires accounting for subscription fees, implementation effort, ongoing operational costs, and opportunity costs relative to alternatives. The subscription component proves straightforward: 240 dollars annually for single-user Pro Plan access, scaling linearly with additional team members requiring Chrome extension access. Implementation costs remain minimal given 15-minute setup timeframe and browser-extension architecture eliminating IT infrastructure provisioning; even calculating setup at fully-loaded employee cost of 100 dollars hourly yields 25 dollars one-time implementation expense. Training costs similarly prove negligible given intuitive interface design targeting non-technical users, though organizations should budget two to four hours for finance team members to familiarize with workflow blueprints, export configurations, and exception handling procedures. Ongoing operational costs include time spent reviewing AI-extracted data for accuracy and resolving exceptions flagged by validation systems; assuming 95 percent automation rate, organizations processing 1,000 monthly invoices allocate approximately 50 hours annually for human oversight at perhaps 1,500 dollars labor cost. Opportunity costs manifest as foregone alternative solutions: maintaining manual processes, deploying enterprise RPA platforms, or engaging offshore data-entry services—each carrying distinct cost structures and operational trade-offs. Over three-year planning horizon, Well’s TCO approximates 2,000 dollars (720 subscription, 25 implementation, 1,275 ongoing labor), compared to 45,000-plus dollars for maintaining manual invoice processing workflows or 15,000-plus dollars for enterprise automation platforms requiring implementation consultants and annual licensing fees. Break-even analysis suggests organizations saving merely one hour weekly through Well automation—valued at 25 dollars hourly—achieve positive ROI within two months, with subsequent 34 months generating net value.

10. Market Positioning

Competitor Comparison Analysis

| Platform | Coverage Breadth | Pricing Model | Primary Strength | Target Market | Integration Approach |

|---|---|---|---|---|---|

| Well Intelligence | 100,000+ portals | $20/month flat | Self-healing automation, omnichannel capture | SMBs, solopreneurs | Native QuickBooks, Xero, universal exports |

| Dext (Receipt Bank) | Limited major platforms | $24-40/month | Established brand, accounting firm partnerships | SMBs, accounting practices | Xero, QuickBooks, major accounting platforms |

| Hubdoc (Xero) | Major vendors only | $12-30/month | Deep Xero integration, bill fetch automation | Xero ecosystem users | Xero-native, QuickBooks secondary |

| Expensify | Expense-focused | $5-18/user/month | Corporate card integration, expense management | Mid-market enterprises | ERP and accounting integrations |

| BILL (Divvy) | AP automation | Free-$Custom | Corporate cards, approval workflows | US mid-market | QuickBooks, NetSuite, enterprise ERPs |

| Nanonets | Custom AI training | First 500 pages free, usage-based | End-to-end workflow automation, custom models | Enterprises, high-volume | API-first, extensive integrations |

Unique Differentiators

Well Intelligence occupies a distinctive position emphasizing accessibility, comprehensiveness, and technological sophistication unavailable in comparable offerings. The 100,000-plus portal coverage dwarfs competitors like Dext and Hubdoc focusing on mainstream vendors, solving the long-tail supplier challenge where SMBs interact with regional utilities, niche software providers, and specialized industry vendors ignored by traditional solutions. The AI-generated workflow blueprint system enabling community-driven portal additions creates network effects impossible for vendor-dependent alternatives; Well’s coverage naturally expands proportional to user base growth, while competitors require internal development resources for each new integration. The self-healing automation architecture addresses the fundamental RPA fragility problem where minor website changes break traditional automations—Well’s semantic understanding adapts automatically, eliminating recurring maintenance costs plaguing enterprise RPA deployments. The omnichannel capture spanning browser automation, email, WhatsApp, and cloud storage acknowledges SMB operational reality where invoices arrive through diverse channels; competing solutions typically focus single-channel extraction requiring manual pre-consolidation. The accessible 20-dollar monthly flat pricing contrasts with per-user models that penalize team growth and usage-based pricing creating cost unpredictability—particularly advantageous for price-sensitive SMBs requiring budget certainty. The open-source components under MIT license enable transparency, community contributions, and customization freedoms impossible with proprietary black-box alternatives, appealing to technically sophisticated users and building developer ecosystem engagement. Well’s positioning as financial data vault with intelligence layer rather than narrow invoice-processing tool suggests strategic vision toward becoming comprehensive financial operating system for SMBs—analogous to Salesforce for CRM or HubSpot for marketing—rather than remaining point-solution addressing isolated pain points.

11. Leadership Profile

Bios Highlighting Expertise and Awards

Well Intelligence’s leadership and contributor structure reflects its open-source, community-driven orientation rather than traditional corporate hierarchy. The GitHub repository lists 20 contributors actively developing the platform’s technical infrastructure, though detailed founder biographies remain unpublished on current marketing materials. This community-centric model aligns with modern software development patterns where distributed teams collaborate on shared codebases rather than centralized command structures. The technical contributors’ GitHub profiles demonstrate relevant expertise in TypeScript (65.5 percent of codebase), Python (32.7 percent), and JavaScript, indicating full-stack engineering capabilities spanning browser extension development, backend data processing, and AI model integration. The platform’s positioning as founder-focused solution—”every founder’s best friend when accounting season hits”—suggests entrepreneurial background among core team members who experienced invoice management frustrations firsthand while building companies. The MIT license choice and comprehensive GitHub documentation indicate commitment to open-source principles and developer community engagement, philosophies typically embraced by technically sophisticated founders valuing transparency and ecosystem collaboration over proprietary control. The rapid development timeline from initial concept to functional Chrome extension with 100,000-plus portal coverage demonstrates execution capability and technical depth uncommon in early-stage financial software ventures.

Patent Filings and Publications

As an early-stage platform launched in 2025, Well Intelligence has not publicly disclosed patent applications or academic research publications. The open-source MIT licensing strategy for significant platform components suggests philosophical alignment with open innovation principles rather than intellectual property protection through patents. This approach contrasts with traditional enterprise software vendors aggressively patenting algorithmic innovations and user interface designs, instead fostering community contributions and rapid iteration unencumbered by patent thickets. The AI-generated workflow blueprint technology represents potentially patentable innovation given its novel approach to democratizing web automation without coding; however, defensive publication or open-source release may serve similar strategic purposes by establishing prior art preventing competitor patent blocking. The self-healing automation architecture similarly embodies technical innovation worthy of academic publication, particularly if benchmarked against traditional RPA failure modes and quantifying maintenance cost reductions. As the platform matures and research collaborations develop, technical papers at conferences like ACM CHI (human-computer interaction), AAAI (artificial intelligence), or domain-specific venues like International Conference on E-Business and E-Commerce could validate technical approaches and build academic credibility. The absence of current publications likely reflects startup prioritization of product development and customer acquisition over research dissemination during critical early-growth phase.

12. Community and Endorsements

Industry Partnerships

Well Intelligence operates primarily through direct-to-user distribution channels, with limited public disclosure of formal industry partnerships typical of early-stage platforms. The integration capabilities with QuickBooks and Xero suggest technical partnerships or API agreements enabling native connectivity, though these likely represent standard developer program participation rather than strategic alliances. The Chrome extension distribution through Chrome Web Store constitutes partnership with Google’s browser ecosystem, inheriting Google’s security vetting and user trust mechanisms. The open-source components hosted on GitHub leverage Microsoft’s developer platform, benefiting from version control infrastructure, issue tracking, and community engagement tools supporting collaborative development. The platform’s support for international e-invoicing standards like UBL 2.1 and Factur-X positions Well favorably for future partnerships with accounting associations, industry consortia, and government digitization initiatives promoting standardized electronic invoicing. The roadmap mentioning Zapier and Make integrations suggests planned partnerships with leading no-code automation platforms, potentially exposing Well to their combined user bases exceeding millions of automation enthusiasts. As the platform matures, accounting firm partnerships become strategically valuable given firms’ role as trusted advisors recommending financial technology to SMB clients—Dext’s success partly stems from such channel partnerships that Well could emulate.

Media Mentions and Awards

Well Intelligence received recognition through Product Hunt platform, achieving a 5.0 rating highlighting positive initial reception from technology early adopters. Product Hunt validation carries significance within startup ecosystems as indicator of product-market fit and viral potential, often catalyzing user acquisition momentum. The GitHub repository’s 241 stars represent organic developer community endorsement, suggesting technical credibility among engineering audiences evaluating code quality and architectural decisions. Media coverage remains limited given the platform’s November 2025 launch timeframe, though financial technology publications, SMB-focused business media, and accounting industry outlets represent logical coverage targets as adoption accelerates. The broader market context supports Well’s positioning: BILL’s 2025 State of Financial Automation survey generated significant media attention highlighting SMB automation trends, providing environmental validation for platforms like Well addressing documented pain points. Industry analyst firms like Gartner, Forrester, and IDC periodically publish financial automation market reports where emerging vendors gain visibility through inclusion or mention. Well’s open-source components and technical innovation potentially attract coverage from developer-focused media like TechCrunch, VentureBeat, or Hacker News, particularly if community contribution dynamics demonstrate traction. As funding rounds or significant customer milestones occur, traditional business press coverage typically follows, expanding awareness beyond technology-native audiences to mainstream SMB decision-makers.

13. Strategic Outlook

Future Roadmap and Innovations

Well Intelligence’s public roadmap outlines ambitious expansion plans scaling platform capabilities and market reach. Portal coverage expansion to 200,000-plus sites doubles current breadth, addressing even longer-tail supplier scenarios and international vendor diversity. Mobile retrieval assistant development extends automation beyond desktop workflows, enabling field employees to capture receipts through native iOS and Android applications rather than WhatsApp workarounds. Zapier and Make integrations connect Well to broader automation ecosystems supporting 5,000-plus application connectors, enabling sophisticated workflow chains like “when invoice captured, send Slack notification to manager, create approval task in Asana, and post to accounting channel.” Contributor leaderboard gamification introduces social mechanics incentivizing community portal blueprint submissions, potentially accelerating coverage growth through competitive dynamics and public recognition. The evolution from document capture tool toward comprehensive “financial data vault” and “business memory” suggests product vision transcending invoice automation to become system-of-record for SMB financial intelligence—storing, analyzing, and surfacing insights from all monetary transactions. Advanced natural language query capabilities like “how much is our AWS spend” or “what’s our burn rate this month” position Well as conversational business intelligence platform, democratizing financial analytics previously requiring SQL expertise or expensive BI tools. Integration with banking APIs for automated bank reconciliation and real-time cash flow tracking could complete the financial visibility spectrum.

Market Trends and Recommendations

The financial automation sector exhibits robust growth drivers favorable to Well Intelligence’s value proposition. SMB financial automation adoption accelerated dramatically post-pandemic as remote work necessitated digital-first operations; BILL’s research indicates 93 percent of SMBs now recognize moderate-to-high value in automation, up from much lower pre-2020 levels. AI integration enthusiasm proves particularly strong with 85 percent of finance leaders expressing enthusiasm and 73 percent reporting existing AI impact—validating Well’s AI-native positioning rather than traditional rules-based automation. Inflation concerns dominating SMB mindsets (62 percent cite as top challenge) drive cost-reduction imperatives favoring automation delivering 60-to-80 percent processing expense reductions. Cashflow management intensifies during economic uncertainty, increasing demand for real-time financial visibility that Well’s intelligence layer promises to deliver. The shift from manual spreadsheet-based workflows to integrated financial platforms continues accelerating, with 87 percent of SMBs considering consolidated financial software adoption within 12-to-24 months—creating greenfield opportunity for platforms offering unified invoice capture, processing, and intelligence. Regulatory trends toward mandatory electronic invoicing in European Union markets and standardized formats for VAT processing favor platforms like Well supporting UBL and Factur-X standards. The accounting technology ecosystem’s API-first evolution enables integration-friendly solutions like Well to flourish where prior generations required expensive custom development.

Organizations evaluating Well Intelligence adoption should assess readiness across operational, technical, and strategic dimensions. Operationally, businesses experiencing manual invoice-processing pain points—finance team members spending hours monthly logging into supplier portals, duplicate payment incidents, missing invoice chaos during tax season—represent ideal candidates. Technical prerequisites remain minimal given Chrome extension architecture, though organizations should verify supplier portal coverage for critical vendors through Well’s provider gallery before committing. Strategic alignment requires clarifying whether financial process automation, cash visibility improvement, or accounting-labor cost reduction constitute primary objectives, as these goals suggest different success metrics and ROI calculations. Early adopters willing to embrace platform evolution, contribute workflow blueprints for unsupported portals, and provide product feedback stand to influence roadmap direction while benefiting from zero-cost early access through 2025. Conservative organizations preferring mature platforms with extensive security certifications and large user bases should monitor Well’s progression over 12-to-18 months, evaluating community growth, feature maturation, and formal security attestation achievement before production deployment.

Final Thoughts

Well Intelligence represents an innovative approach to SMB financial automation, combining comprehensive portal coverage, AI-driven intelligence, and community-extensible architecture into an accessible platform addressing genuine pain points. The technology demonstrates sophistication through self-healing automation addressing traditional RPA fragility, AI-generated workflow blueprints democratizing coverage expansion, and intelligent enrichment transforming passive document capture into proactive financial oversight. The positioning as “financial data vault” and conversational intelligence layer suggests strategic ambition transcending narrow invoice-processing toward comprehensive financial operating system for resource-constrained SMBs.

However, the platform’s early-stage maturity demands realistic assessment of current limitations. The absence of formal security certifications, limited enterprise features, and dependency on browser automation introduce constraints affecting certain adoption scenarios. Organizations requiring rigorous compliance attestations, sophisticated access controls, or guaranteed uptime SLAs should await platform maturation before production deployment. The long-tail portal coverage, while impressive at 100,000-plus, cannot universally address every global supplier—users inevitably encounter gaps requiring manual fallback workflows or blueprint contributions.

The economic value proposition proves compelling for target SMBs: 20-dollar monthly subscription delivering 60-to-80 percent invoice processing cost reductions, five-to-ten weekly hours saved, and 99-percent error rate improvements justifies adoption for virtually any organization processing more than 50 monthly invoices. The zero-risk early access period extending through 2025 eliminates financial barriers enabling experimentation without commitment.

For stakeholders evaluating Well Intelligence, the platform merits serious consideration where invoice-processing burden consumes disproportionate finance team capacity, manual errors plague accounting reconciliation, or real-time cash visibility gaps hinder decision-making. Organizations comfortable with early-stage technology evolution, willing to contribute workflow blueprints for unsupported vendors, and seeking cost-effective automation addressing genuine operational constraints will likely find substantial value. As the platform matures through 2026 and beyond—adding security certifications, expanding integrations, and refining intelligence capabilities—Well Intelligence positioned to capture meaningful market share within the multi-billion-dollar SMB financial automation sector experiencing accelerating digital transformation.