Table of Contents

Overview

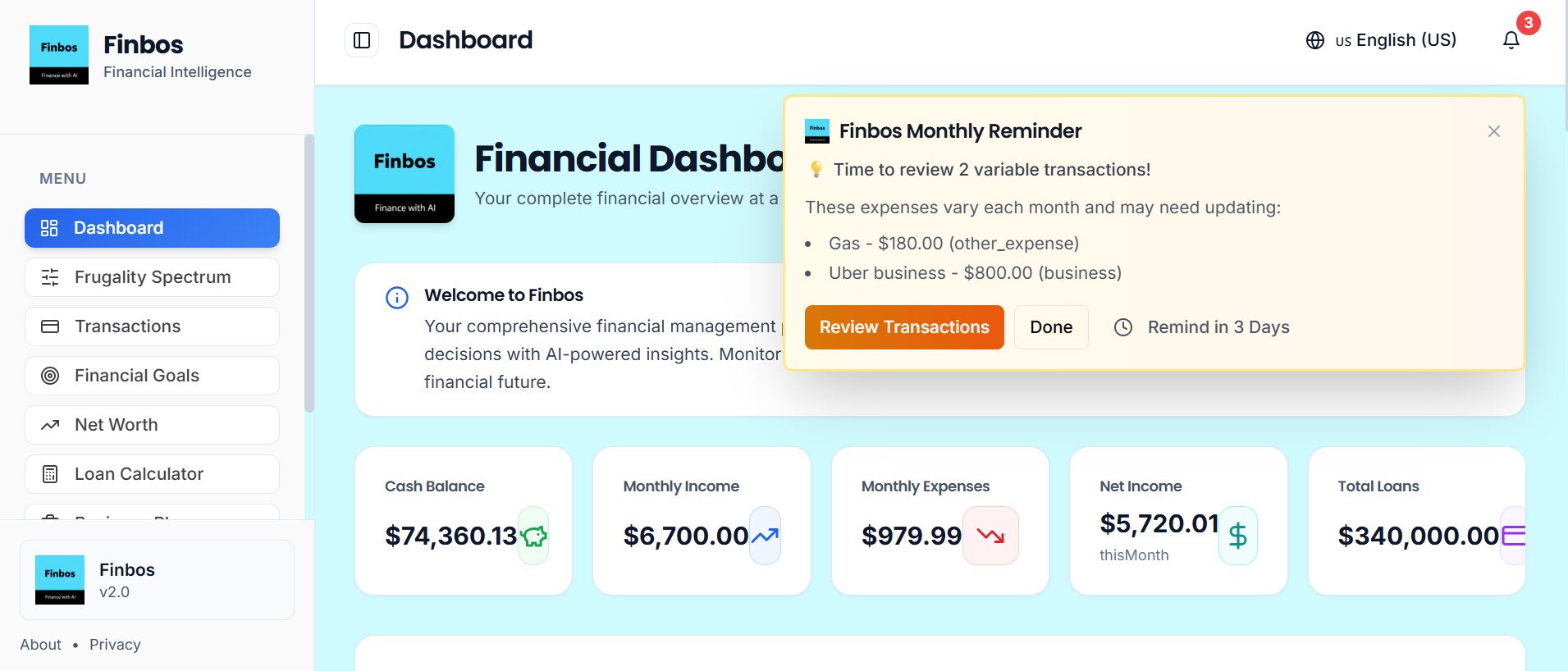

Personal finance management remains a persistent challenge—knowing where money goes, optimizing spending, eliminating debt, and building wealth requires discipline, tracking, and strategic decision-making many find overwhelming. Finbos, launched on Product Hunt on December 30, 2025, and subsequently released on the App Store in early 2026, positions itself as an AI-powered financial management platform combining traditional expense tracking with intelligent guidance. Built as a Progressive Web App (PWA) functioning across devices, Finbos integrates income and expense monitoring, loan amortization calculations, net worth tracking, and AI-driven decision assistance through GPT-4 integration answering financial questions based on users’ actual data. Developed by independent creator Bosun Abdul, the app targets individuals managing personal budgets, entrepreneurs requiring business financial forecasting, debt holders accelerating repayment strategies, and anyone seeking holistic financial clarity through technology-assisted planning. Offered free with premium ad-free tier at approximately \$2 monthly, Finbos supports over 10 languages serving global users through browser-based accessibility without mandatory app downloads.

Key Features

- AI Financial Decision Assistant: Ask natural language financial questions and receive personalized answers powered by GPT-4 analyzing your specific income, expenses, assets, and liabilities rather than generic advice. The AI considers your actual financial situation when suggesting strategies for savings, debt repayment prioritization, emergency fund building, or major purchase decisions.

- Transaction Tracking with Intelligent Alerts: Monitor income and expenses through manual entry with automatic categorization and breach notifications alerting when spending in specific categories exceeds predefined thresholds or threatens budget goals, enabling proactive adjustment before overspending accumulates.

- Frugality Alerts and Spending Mindfulness: Receive AI-generated notifications identifying saving opportunities based on spending patterns, suggesting cost reduction strategies, flagging unnecessary subscriptions or recurring charges, and recommending behavioral adjustments maintaining financial discipline without constant manual review.

- Comprehensive Loan Calculator and Management: Calculate loan amortization schedules showing payment breakdowns over time, compare different loan scenarios evaluating impact of accelerated payments versus minimum payments, visualize interest costs across loan lifetime, and manage multiple debt accounts with payoff progress tracking.

- Net Worth Monitoring and Wealth Tracking: Aggregate assets including bank balances, investments, real estate, and valuables against liabilities like loans, mortgages, credit card debt creating holistic net worth snapshot tracking wealth accumulation or decline over time with trend visualization showing financial trajectory.

- Financial Goal Management and Progress Tracking: Set specific financial objectives including emergency fund targets, vacation savings, down payment accumulation, or debt elimination with timeline targets. The system tracks progress toward goals factoring current income, expenses, and savings rates, providing trajectory projections indicating whether current pace achieves targets.

- 5-Year Business Forecasting Tools: Entrepreneurs access specialized business planning features including projected profit and loss calculations, revenue forecasting, expense modeling, and long-term financial projections supporting strategic business decisions alongside personal finance management within unified platform.

- Multilingual Support for Global Users: Interface and functionality available in over 10 languages including English, Spanish, French, German, Portuguese, and others enabling global accessibility for non-English speaking users managing finances in native languages.

- Progressive Web App (PWA) Architecture: Functions seamlessly across desktop browsers, tablets, and smartphones without requiring platform-specific app downloads or installations. PWA capability enables offline functionality, home screen installation, and app-like experience through web technologies.

- Premium Ad-Free Experience: Free tier includes all core functionality supported by advertisements. Premium subscription at approximately \$2 monthly removes ads providing uninterrupted experience without feature restrictions beyond ad elimination.

How It Works

Finbos operates as web-based Progressive Web App accessed through standard browsers on any device. Users create accounts then begin inputting financial data including regular income sources with amounts and frequencies, recurring and one-time expenses categorized automatically or manually, outstanding loans with balances, interest rates and payment schedules, assets like savings, investments, property values, and credit card limits and balances.

The platform stores this financial data then processes it through multiple analytical layers. Basic tracking aggregates income versus expenses showing cash flow, categorizes spending revealing where money goes, and tracks trends over time identifying pattern changes month-to-month or year-over-year.

The loan calculator module uses inputted debt information generating amortization tables showing each payment’s principal versus interest breakdown across the loan lifetime. Users can model scenarios like extra payments, refinancing at different rates, or debt consolidation comparing total interest costs and payoff timeframes enabling informed debt management decisions.

Net worth calculation automatically aggregates total assets minus total liabilities producing single net worth figure updated as users modify values. Historical tracking shows net worth trajectory over months and years visualizing wealth building or erosion trends.

The AI decision assistant powered by GPT-4 integration represents Finbos’s core differentiator. Users pose financial questions in natural language like “Should I pay off my student loan faster or invest the extra money?” or “Can I afford this \$5,000 vacation based on my budget?” The AI analyzes your specific financial profile including actual income, current expenses, existing debt levels, savings rates, and stated goals, then provides contextualized advice considering your unique situation rather than generic recommendations disconnected from personal circumstances.

Frugality alerts run automatically analyzing spending patterns against historical baselines and budget targets. When the system detects concerning trends like dining expenses exceeding typical amounts or overall spending threatening savings goals, it generates proactive notifications prompting behavioral adjustment before excessive spending becomes problematic.

Goal tracking compares current financial metrics against target scenarios. If saving \$10,000 within 12 months but current monthly savings rate only yields \$8,000 over that period, the system flags shortfall projecting users won’t achieve goals at current pace, enabling proactive adjustments to income, expenses, or timelines.

The business forecasting module provides entrepreneurs separate workspace projecting business revenues, operational expenses, profit margins, and cash flow needs across multi-year timeframes supporting strategic planning for startups or existing businesses.

All functionality operates through responsive web interface adapting to screen sizes from desktop monitors through tablets to smartphones. As PWA, users can install to device home screens accessing Finbos like native app despite browser-based implementation.

Use Cases

- Personal Budget Management: Individuals gain clarity on discretionary spending, identify wasteful expenses, establish spending limits by category, and receive alerts when approaching budget thresholds enabling living within means without constant manual calculation or spreadsheet maintenance.

- Accelerated Debt Elimination: Student loan holders, mortgage payers, and credit card debtors calculate optimized payment strategies, visualize long-term interest costs under different scenarios, prioritize high-interest debts for accelerated payoff, and track progress toward debt-free status with clear timelines.

- Entrepreneurial Financial Planning: Startup founders and small business owners access business-specific forecasting tools modeling revenue growth, expense scaling, cash runway, and profitability timelines supporting fundraising decisions, expansion planning, and operational sustainability beyond personal finance tracking.

- Net Worth Growth and Wealth Building: Savers and investors monitor holistic financial health beyond checking account balances, tracking asset appreciation, debt reduction impact on net worth, and long-term wealth accumulation trajectory measuring overall financial progress beyond simple budgeting.

- Financial Goal Achievement: Users saving for specific objectives like emergency funds, home down payments, wedding expenses, or retirement contributions set quantified targets with timelines, track automated progress, and receive projection warnings if current savings rates prove insufficient requiring behavioral adjustments.

- Multi-Language Financial Literacy: Non-English speakers managing finances in countries with limited native-language financial tools access comprehensive tracking and AI advice in over 10 languages supporting financial literacy and management for global user base.

Pros \& Cons

Advantages

- Comprehensive Unified Platform: Integrates expense tracking, debt management, net worth monitoring, goal setting, and AI advice eliminating need for multiple disconnected tools like separate budgeting apps, loan calculators, and spreadsheets creating fragmented financial picture.

- Personalized AI Guidance Based on Actual Data: Unlike generic financial advice articles or calculators providing one-size-fits-all recommendations, Finbos’s GPT-4 integration analyzes your specific income, debts, expenses, and goals delivering contextualized guidance relevant to personal circumstances.

- Affordable Premium Pricing: At approximately \$2 monthly for ad-free premium versus competitors charging \$8-15 monthly, Finbos offers accessible pricing for budget-conscious users seeking ad-free experience without significant subscription expense.

- Platform Flexibility Through PWA: Progressive Web App architecture eliminates app store downloads, platform-specific versions, or update delays, functioning identically across Windows, Mac, iOS, Android, and Linux devices through standard browsers with offline capability.

- Business Planning Integration: Rare combination of personal finance tracking with business forecasting tools serves entrepreneurs needing unified view of personal and business finances versus requiring separate business accounting software alongside personal budgeting apps.

- Global Accessibility via Multilingual Support: Over 10 language options enable non-English speakers to manage finances in native languages, supporting financial literacy and tool adoption for users underserved by English-only alternatives.

- Free Core Functionality: All essential features available without payment beyond optional ad removal, lowering barrier for users testing platform or unable to afford subscription-based alternatives like YNAB or Simplifi.

Disadvantages

- Manual Data Entry Requirement: Unlike competitors like Mint, Rocket Money, or Empower offering automated bank account linking via Plaid, Finbos requires manual transaction entry creating ongoing maintenance burden and potential for incomplete or inaccurate data if users fail to consistently log expenses.

- Limited Bank Integration: Absence of direct bank connectivity prevents automatic transaction import, real-time balance updates, or automated categorization based on merchant data, requiring disciplined manual tracking versus set-and-forget automated approaches.

- Privacy and Security Considerations: Any platform collecting detailed financial information including income, debts, assets, and spending patterns creates potential privacy exposure if security is compromised. Manual entry reduces some risk versus full bank account access but still centralizes sensitive data.

- New Platform Maturity: Launched December 2025 with limited user base means fewer reviews, minimal community-validated best practices, uncertain long-term viability, and potential bugs or feature limitations compared to established alternatives operating for years with extensive user feedback driving refinement.

- AI Response Quality Dependency: GPT-4-powered advice quality depends on accurate data input, appropriate question framing, and AI limitations understanding complex personal situations. Incorrect data or ambiguous questions may produce suboptimal recommendations, and AI cannot replace human financial advisors for complex tax, investment, or estate planning requiring specialized expertise.

- Unclear Data Storage and Privacy Policies: For independent app without extensive public documentation, users may lack clarity on data storage locations, encryption standards, third-party data sharing, regulatory compliance, or what happens to financial data if service discontinues.

- Limited Investment Portfolio Tracking: While tracking net worth, platform appears to lack sophisticated investment portfolio analysis including performance tracking, asset allocation analysis, dividend tracking, or tax-loss harvesting capabilities offered by dedicated investment platforms.

How Does It Compare?

The personal finance app landscape in 2026 spans free ad-supported tools, premium subscription services, and specialized solutions. Here’s how Finbos positions itself:

Mint (Intuit)

Mint pioneered free budgeting apps with automated bank account linking, transaction categorization, bill tracking, credit score monitoring, and spending alerts supported by financial product recommendations. At its peak, Mint served millions of users before Intuit announced shutdown in late 2023, migrating users to Credit Karma. Mint offered comprehensive free tracking with strong automation but monetized through intrusive financial product promotions. Finbos and Mint both provide free budget tracking and alerts. Mint offered superior automation through bank linking eliminating manual entry versus Finbos requiring manual transaction logging. Finbos differentiates through AI decision assistant answering personalized financial questions Mint lacked, business forecasting tools Mint didn’t provide, and \$2 monthly ad-free option versus Mint’s ad-supported free-only model. Mint suited users prioritizing automation and accepting financial product marketing. Finbos serves users comfortable with manual entry wanting AI guidance without bank connectivity or willing to pay minimal fees for ad-free experience.

YNAB (You Need A Budget)

YNAB delivers zero-based budgeting methodology assigning every dollar a specific job, emphasizing proactive planning over reactive tracking. The platform provides robust budgeting workflows, financial education resources, and active community support. Pricing at \$14.99 monthly or \$109 annually (\$99 for first year) positions YNAB as premium solution with 34-day free trial. YNAB focuses on budgeting philosophy and behavioral change through its four-rule methodology. Both YNAB and Finbos offer comprehensive budget management with goal tracking. YNAB provides deeper budgeting methodology with extensive educational content teaching financial discipline through its specific approach. Finbos offers AI question-answering capability YNAB lacks, business forecasting YNAB doesn’t emphasize, and dramatically lower pricing at \$2 monthly versus YNAB’s \$15. YNAB suits users wanting structured budgeting methodology with community support and willing to pay premium for proven system. Finbos serves users seeking AI-assisted decision-making at minimal cost without commitment to specific budgeting philosophy.

Rocket Money (Formerly Truebill)

Rocket Money specializes in subscription management, bill negotiation, spending tracking, and automated savings. The platform excels at identifying and canceling unwanted subscriptions, negotiating lower bills for services like internet and insurance, and providing concierge features. Free tier offers basic tracking; premium subscription ranges \$7-14 monthly based on custom pricing. Rocket Money emphasizes subscription waste elimination and bill negotiation. Rocket Money and Finbos both track expenses and identify saving opportunities. Rocket Money provides superior subscription detection and bill negotiation services Finbos doesn’t offer, plus automated bank connectivity. Finbos differentiates through AI decision assistant answering complex financial questions, comprehensive loan amortization tools, business forecasting features, and lower maximum pricing at \$2 monthly versus Rocket Money’s \$7-14 range. Rocket Money suits users wanting hands-off subscription management and bill negotiation services. Finbos serves users prioritizing AI guidance and debt management over automated bill negotiation.

Quicken Simplifi

Quicken Simplifi delivers streamlined personal finance management from the established Quicken brand, offering automated transaction sync, spending plan features, watchlists for specific expenses, and investment tracking. Pricing starts around \$2.99-7.92 monthly depending on billing frequency with free 30-day trial. Simplifi emphasizes simplicity and modern interface over Quicken’s traditional desktop complexity. Simplifi and Finbos both provide comprehensive budget tracking with goal management. Simplifi offers automated bank connectivity and investment portfolio tracking Finbos lacks, plus established brand reputation and extensive integrations. Finbos provides AI decision assistant for personalized financial questions Simplifi doesn’t feature, business forecasting tools, multilingual support exceeding Simplifi’s offerings, and comparable premium pricing. Simplifi suits users wanting automated tracking with investment features from trusted brand. Finbos serves users prioritizing AI guidance and business planning over investment tracking sophistication.

Empower Personal Dashboard (Formerly Personal Capital)

Empower provides free personal finance dashboard combining budget tracking with comprehensive investment portfolio analysis, retirement planning tools, net worth monitoring, and fee analysis. The platform emphasizes wealth management and investment optimization with premium service offering human financial advisor access. Free tier includes robust investment tracking making it popular among investors. Empower and Finbos both offer free net worth monitoring and financial tracking. Empower provides far superior investment portfolio analysis including performance attribution, asset allocation, fee analysis, and retirement projections Finbos completely lacks. Finbos differentiates through AI question-answering for personalized guidance, comprehensive business forecasting, loan amortization tools, and frugality alerts Empower doesn’t emphasize. Empower suits investors prioritizing portfolio analysis and retirement planning. Finbos serves broader audience including entrepreneurs and debt managers prioritizing guidance over sophisticated investment analytics.

PocketGuard

PocketGuard focuses on showing “In My Pocket” spending power after accounting for bills, goals, and necessities, providing simple clarity on discretionary funds available. The platform offers automated tracking, bill management, subscription detection, and spending limits. Free version provides basic features; Plus subscription costs \$12.99 monthly or \$74.99 annually. PocketGuard emphasizes simplicity and immediate spending clarity. PocketGuard and Finbos both track spending with alerts and goal features. PocketGuard provides automated bank connectivity and simpler “In My Pocket” calculation quickly showing available discretionary funds. Finbos offers AI decision assistant for complex financial questions, business forecasting, comprehensive loan tools, and lower premium pricing at \$2 versus PocketGuard’s \$12.99 monthly. PocketGuard suits users wanting simple automated tracking with instant spending power visibility. Finbos serves users comfortable with manual entry wanting AI guidance and business tools.

Monarch Money

Monarch Money positions as premium collaborative budgeting platform emphasizing family financial management with partner/family access included, net worth tracking, custom categories, flexible budgeting approaches, and investment account linking. Pricing at \$14.99 monthly or \$99.99 annually includes free partner/spouse access making it cost-effective for couples. 30-day free trial available. Monarch and Finbos both provide comprehensive financial management with goal tracking and net worth monitoring. Monarch offers superior collaborative features for couples/families, automated bank connectivity, and investment tracking Finbos lacks. Finbos provides AI decision assistant answering personalized questions Monarch doesn’t feature, business forecasting, and significantly lower individual pricing at \$2 monthly versus Monarch’s \$15. Monarch suits couples or families wanting shared financial management with automation. Finbos serves individuals or entrepreneurs prioritizing AI guidance and business tools over collaboration features.

Goodbudget

Goodbudget implements envelope budgeting methodology digitally, allocating funds into virtual envelopes for different spending categories without requiring bank account connections. Free version supports up to 20 envelopes; Plus subscription at \$10 monthly or \$80 annually enables unlimited envelopes, longer history, and multiple devices. Goodbudget suits users preferring manual entry with envelope methodology. Goodbudget and Finbos both function without mandatory bank connectivity emphasizing manual budget control. Goodbudget focuses specifically on envelope budgeting philosophy with dedicated tools for that methodology. Finbos provides AI decision assistant, loan calculators, business forecasting, and net worth tracking Goodbudget doesn’t emphasize, plus lower premium pricing. Goodbudget serves users committed to envelope budgeting approach. Finbos offers broader functionality beyond single budgeting methodology.

Copilot (iOS Exclusive)

Copilot delivers beautiful, thoughtful budgeting app exclusively for iOS with automated bank connectivity, recurring transaction detection, investment tracking, spending insights, and Amazon purchase categorization. Pricing at \$95 annually or \$13 monthly emphasizes premium quality. 30-day free trial enables evaluation. Copilot targets iOS users wanting elegant design with comprehensive automation. Copilot and Finbos both provide expense tracking with goal management. Copilot offers superior automated bank connectivity, investment tracking, iOS-native design, and Amazon integration. Finbos provides cross-platform PWA accessibility beyond iOS, AI decision assistant, business forecasting, and lower annual cost at \$24 versus Copilot’s \$95. Copilot suits iOS users prioritizing automation and design willing to pay premium annual fee. Finbos serves cross-platform users comfortable with manual entry wanting AI guidance at lower cost.

Final Thoughts

Finbos enters the crowded personal finance management space attempting to differentiate through AI-powered decision assistance rather than focusing solely on automated tracking. By integrating GPT-4 to answer personalized financial questions based on users’ actual income, expenses, debts, and assets, Finbos offers guidance capability competitors emphasizing automation over intelligence don’t provide.

The platform’s strongest value proposition centers on affordable AI-assisted financial decision-making for users comfortable with manual data entry. At approximately \$2 monthly for premium tier, Finbos costs 85% less than alternatives like YNAB at \$15 monthly or Monarch at \$15 monthly, making it accessible for budget-conscious users seeking guidance without significant subscription expense. The ability to ask natural language questions and receive contextualized answers analyzing personal financial situations provides intelligence unavailable in passive tracking tools.

Business forecasting integration serves entrepreneurs and freelancers needing unified personal and business financial management without maintaining separate tools or paying for comprehensive business accounting software. This dual-purpose functionality addresses underserved segment wanting holistic financial visibility across personal and business domains.

Progressive Web App architecture delivers genuine cross-platform flexibility functioning identically across Windows, Mac, iOS, Android, and Linux through standard browsers without app store downloads or platform-specific development. Multilingual support in 10+ languages expands accessibility for non-English speakers underserved by English-only alternatives.

However, significant limitations warrant consideration. Manual data entry requirement creates ongoing maintenance burden competitors with bank connectivity eliminate. Users must discipline themselves to consistently log transactions or face incomplete data undermining the platform’s analytical value. For those prioritizing automation and set-and-forget convenience, established alternatives with Plaid integration deliver superior experience despite lacking AI decision assistance.

The platform’s newness—launched December 2025—means limited user base, minimal independent reviews, uncertain long-term viability, and potential undiscovered bugs. Independent apps developed by individual creators face sustainability challenges as user growth demands infrastructure investment, customer support scaling, and ongoing development without guaranteed revenue at \$2 monthly premium pricing.

AI guidance quality depends entirely on data accuracy and appropriate question framing. Manual entry introduces error risk, and GPT-4’s general financial knowledge cannot replace specialized human advisors for complex tax optimization, estate planning, or sophisticated investment strategy requiring expertise beyond general advice. Users must understand AI limitations and validate recommendations against personal research or professional consultation.

Absence of sophisticated investment portfolio tracking limits appeal for investors seeking comprehensive wealth management. While tracking net worth captures asset values, the platform apparently lacks performance attribution, asset allocation analysis, dividend tracking, or tax-loss harvesting offered by investment-focused alternatives like Empower or Simplifi.

Privacy and data security considerations merit attention. Any platform collecting detailed financial information creates potential exposure if security is compromised. For independent app without extensive public documentation, users may lack clarity on encryption standards, data storage locations, regulatory compliance, or what happens to financial data if service discontinues.

The competitive landscape shows established alternatives excel in automation, brand trust, specific methodologies, or specialized features. YNAB teaches disciplined budgeting philosophy. Rocket Money negotiates bills. Empower analyzes investments. Monarch enables family collaboration. Finbos’s differentiation rests on AI decision assistance at minimal cost—whether that unique capability justifies manual entry friction versus competitors’ automated convenience depends entirely on individual priorities.

Ideal users for Finbos include budget-conscious individuals seeking AI financial guidance unwilling or unable to afford \$10-15 monthly alternatives, entrepreneurs wanting unified personal and business financial forecasting, users in countries with limited banking integration making automated tools impractical, non-English speakers needing native-language financial management, and those philosophically preferring manual entry control over automated bank connectivity.

Conversely, Finbos poorly suits users demanding automated convenience through bank connectivity, investors requiring sophisticated portfolio analysis, families needing collaborative multi-user features, those prioritizing established brand reputation and proven longevity, or individuals lacking discipline for consistent manual transaction entry.

As the platform matures, critical success factors include maintaining affordable pricing avoiding significant increases, potentially adding optional bank connectivity for users wanting automation without sacrificing current manual approach, developing mobile-specific optimizations beyond PWA, building community features enabling user knowledge sharing, and generating case studies demonstrating measurable financial improvements through AI guidance validating the platform’s core value proposition.

For users willing to accept manual entry friction in exchange for affordable AI-assisted financial decision-making, Finbos offers compelling value. The ability to ask complex financial questions and receive answers analyzing personal situations provides intelligence passive tracking tools cannot match. Whether that intelligence justifies maintenance burden versus competitors’ automated convenience represents the fundamental tradeoff users must evaluate based on personal preferences, technical comfort, and financial priorities.