Table of Contents

Overview

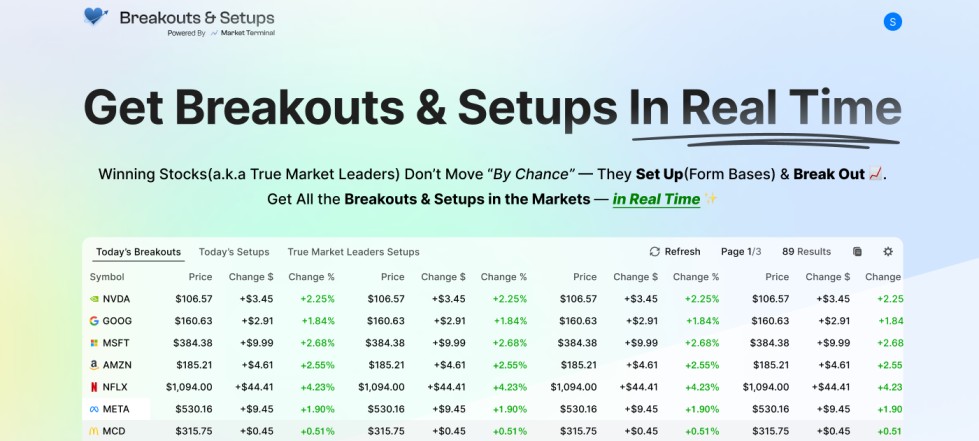

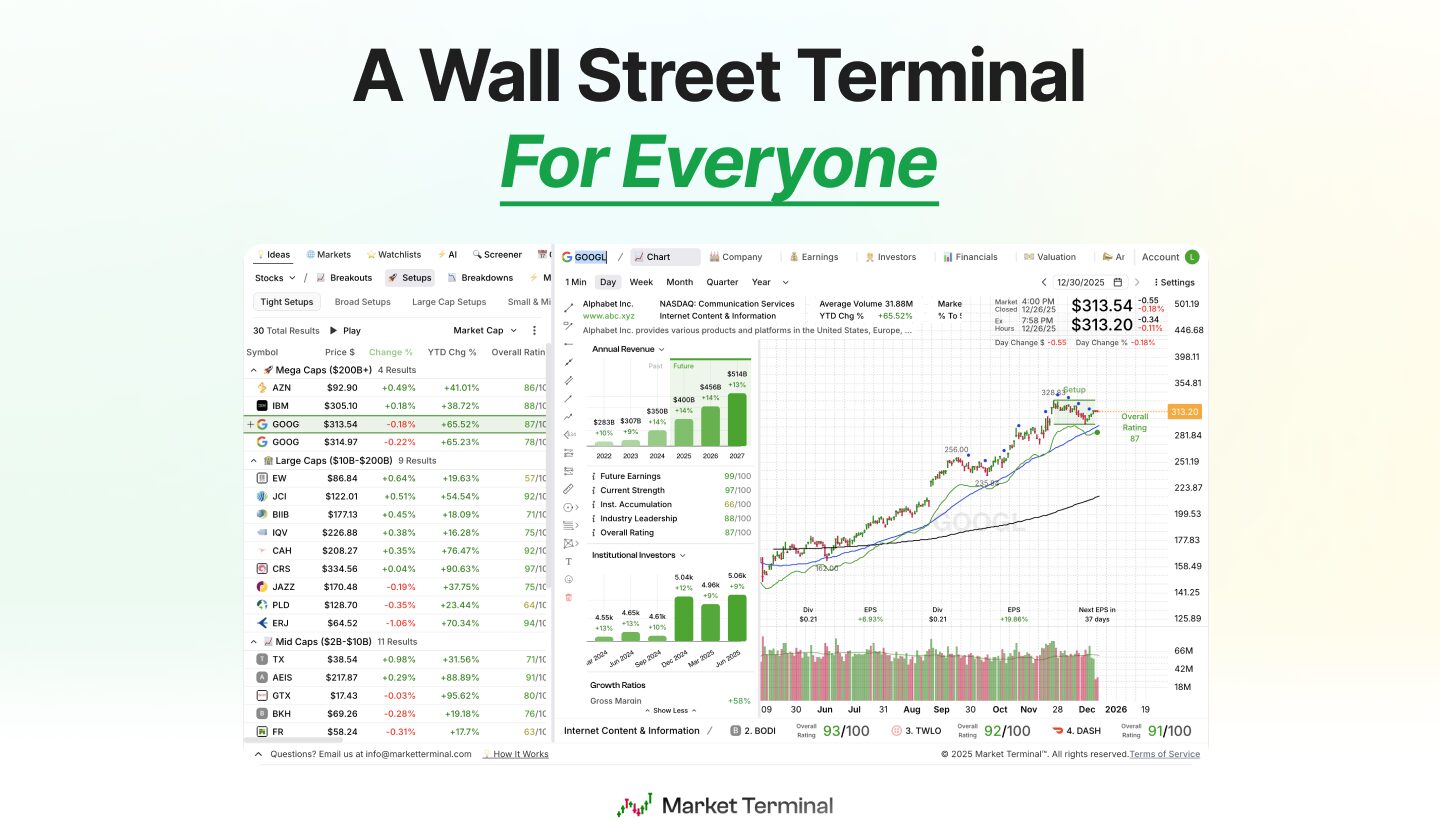

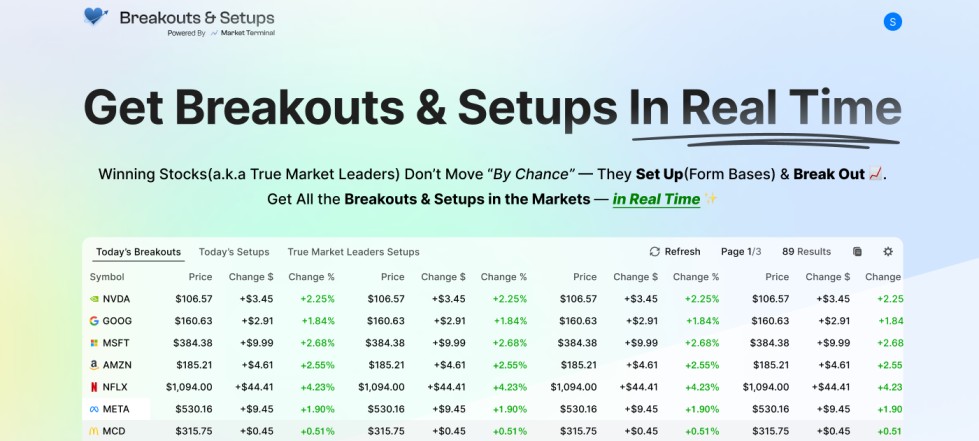

The platform functions as a real-time command center for the modern investor, aggregating fragmented data streams into a single, actionable interface. By combining institutional-grade data feeds—including dark pool transactions, SEC filings, and options flow—with proprietary AI algorithms, Market Terminal surfaces high-probability trade setups as they happen. It eliminates the information gap between retail and institutional players, empowering users with professional-grade analytics, automated Congressional trade tracking, and millisecond-level breakout detection.

Key Features

- Real-Time Breakout Detection: Utilizes algorithmic pattern recognition to scan equities, forex, and crypto for volume spikes and price acceleration within 50ms of data ingestion.

- Smart Money Tracking: Monitors institutional activity via SEC Form 4/13F filings, dark pool transactions, and advanced options flow to reveal where the largest players are positioning.

- Congressional Trade Alerts: Automates the tracking of stock moves by members of Congress and other politically-connected figures, providing users with instant transparency.

- AI-Powered Edge Scoring: Features a proprietary algorithm that quantifies trade setup strength by synthesizing technical indicators, fundamental data, and alternative sentiment.

- Institutional Sentiment Analysis: Employs Natural Language Processing to scan news headlines, earnings transcripts, and social media for emerging shifts in market psychology.

- API & Webhook Integration: Enables users to connect signals directly to automated trading platforms like Interactive Brokers or custom execution bots.

- Customizable Command Dashboards: Offers a densely packed, information-rich environment optimized for rapid navigation and high-frequency data consumption.

How It Works

Market Terminal operates as a SaaS-based intelligence layer. Upon logging in, the platform’s engine begins aggregating real-time feeds from major exchanges and secondary databases. The internal AI models constantly process this data to identify anomalies—such as an unusual surge in pre-market momentum or an unexpected large insider purchase. These signals are pushed instantly to the user’s dashboard or via mobile alerts, accompanied by an “Edge Score” that indicates the historical success rate of similar setups. This allow traders to move from raw data to executed trades without the need for manual scanning across multiple disjointed tools.

Use Cases

- Day & Swing Trading: Capitalizing on pre-market momentum shifts and intra-day breakouts identified by real-time scanners.

- Institutional Mirroring: Adjusting personal portfolios based on aggregated dark pool and 13F data to follow “smart money” trends.

- Policy-Linked Investing: Tracking legislative trades to identify sectors that may benefit from upcoming government policy shifts.

- Risk Management: Using AI-driven predictive confidence scores to adjust position sizing based on model-derived risk assessments.

Pros and Cons

- Pros: Delivers 90% of a Bloomberg Terminal’s core utility for roughly 4% of the cost. Consolidates multiple expensive subscriptions (charts, news, flow) into one. Built-in automation for niche data like Congressional trades.

- Cons: The depth of information can be overwhelming for total beginners without prior market experience. While the AI provides high-probability signals, they are not guaranteed to be profitable and require human validation.

Pricing

- Starter Plan: Starting at $99/month. Includes real-time breakout detection, basic smart money tracking, and core AI analysis tools.

- Pro Tier: Targeted at high-frequency traders, offering full API access, priority data feeds, and advanced alternative data signals.

- Enterprise: Custom pricing for small hedge funds or proprietary trading desks requiring dedicated white-label terminals and higher API limits.

How Does It Compare?

- Bloomberg Terminal: The industry standard for investment banks. While Bloomberg offers proprietary chat (IB) and deep banking tools, Market Terminal is the superior choice for traders who only need data and signals without the $30k price tag.

- Koyfin: Excellent for fundamental data and visualization. Market Terminal differentiates itself by focusing on “active signals” like real-time breakouts and AI sentiment, whereas Koyfin is more research-oriented.

- FinChat: An AI-first platform focusing on financial statement analysis and earnings calls. Market Terminal is better for “active market movement” and real-time trade execution signals.

- Ticker Terminal: A strong competitor in the retail institutional-grade space. Market Terminal stands out with its specific focus on Congressional trades and its proprietary “Edge Score” algorithm.

- OpenBB: An open-source command-line interface. While free, it requires more technical setup and maintenance than the “ready-to-use” SaaS experience of Market Terminal.

- Quiver Quantitative: Specialist in “alternative data” like Congressional trades. Market Terminal integrates this as just one feature within a full-featured trading terminal.

Final Thoughts

Market Terminal is a foundational tool for the “retail-institutional” revolution of 2026. By removing the financial gatekeepers that have historically limited access to high-end data, it allows independent traders to compete on merit rather than capital access. The platform’s ability to turn noisy market data into a single “Edge Score” makes it particularly valuable in an era where speed and data-driven conviction are the only ways to maintain a competitive advantage. While it does not replace the deep professional network of a Bloomberg, for the active trader focused on execution and alpha, it is arguably the most cost-effective intelligence asset currently available.