Table of Contents

Overview

Aden is a Go-To-Market (GTM) infrastructure platform designed to help developers transform experimental AI agents into profitable enterprise-grade products. Functioning as the “Nervous System” for agentic fleets, it provides the governance, monetization, and security layers required to move from pilot to production. By offering hard budget caps, white-labeled trust centers, and granular cost attribution, Aden enables teams to focus on core AI logic while the platform handles the complexities of enterprise compliance and margin protection.

Key Features

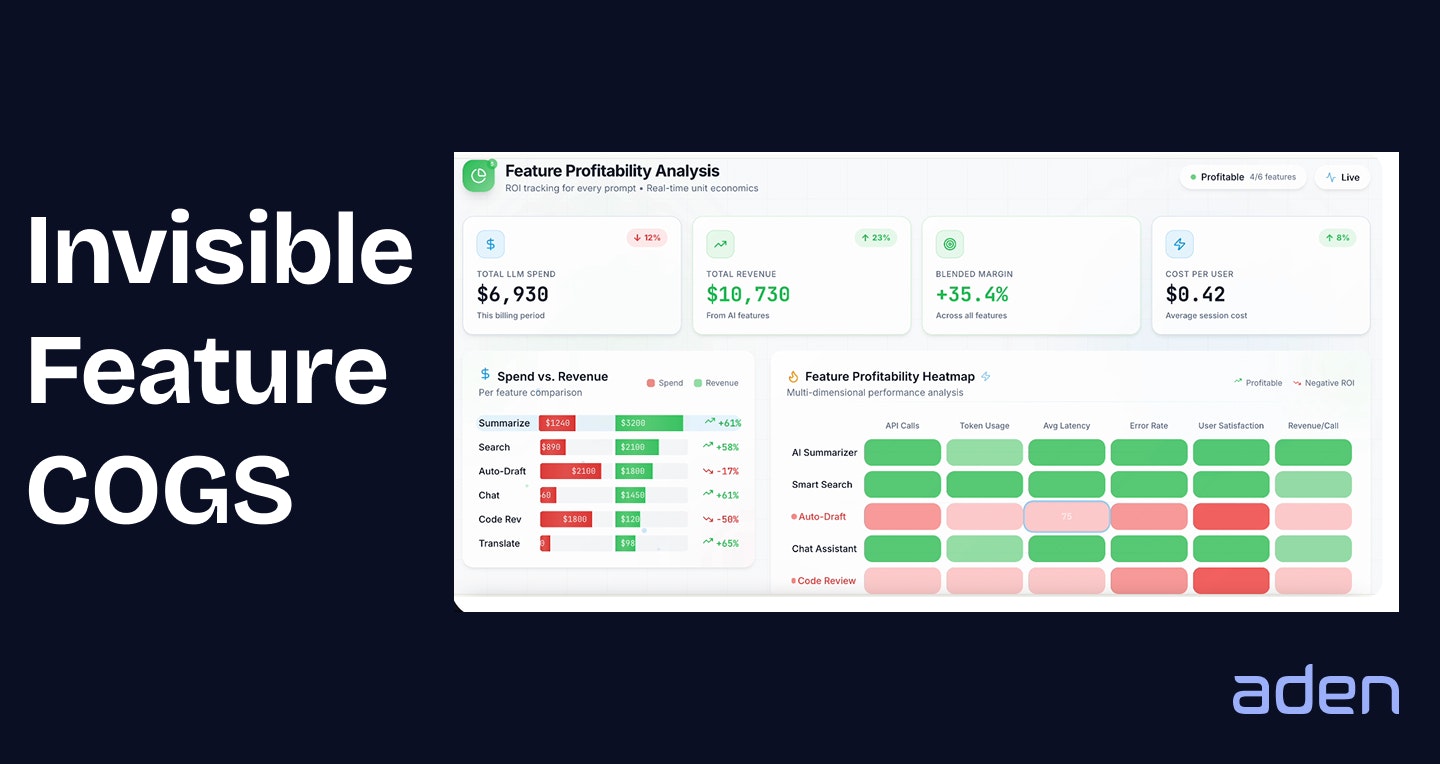

- Penny-Perfect Attribution: Links every granular model interaction and tool-call to specific user IDs and features, allowing for precise unit economic modeling and profitability tracking.

- Financial Circuit Breakers: Provides active protection against “bill shock” by enforcing session budgets with a <1ms response time to terminate infinite reasoning loops or runaway agents.

- Customer Trust Center: A white-labeled portal that provides enterprise customers with visibility into security status, audit trails, and compliance readiness (SOC 2, HIPAA).

- Agentic Development Toolkits (ADK): A comprehensive set of developer tools and an SDK used to instrument model registries and map LLM/API dependency graphs in real-time.

- Real-Time P&L Tracking: Enables finance and product teams to monitor the gross margin of specific AI features, helping identify and eliminate “zombie features” that drain margins.

- Usage-Based Pricing Logic: Supports complex monetization strategies where costs scale with agentic reasoning rather than simple seat counts.

How It Works

The platform integrates directly into an agent’s technical stack via the Aden SDK. Once deployed, the SDK instruments every tool-call and model registry interaction, creating a living network of data and intelligence. Aden maps the entire LLM and API dependency graph to identify hidden token waste and unmonitored agentic reasoning loops. Financial guardrails are activated in a staging environment to verify response times, and the production pipeline is secured with 99.9% invoice reconciliation. This infrastructure transforms cost uncertainty into a predictable, margin-guaranteeing engine for growth.

Use Cases

- Preventing Bill Shock: Engineering teams can set hard spending limits on API usage to avoid the catastrophic costs associated with autonomous agents getting stuck in loops.

- Enterprise Sales Acceleration: Sales teams can use the Security Status and Audit Readiness features to bypass “Infosec purgatory” and close deals 50% faster.

- Usage-Based Monetization: Startups can implement fair-use, dollar-based limits that protect COGS while offering flexible pricing to end-users.

- Engineering Analytics: Managers can gain visibility into where engineering time and model costs are actually being spent, linking development efforts to product ROI.

- Construction and Contracting: Specialized modules like AI Resource Planning (ARP) help contractors automate Bills of Materials (BOM) estimation and reduce bid turnaround time.

Pros & Cons

Advantages

- High Margin Protection: Atomic reservation systems and real-time kill switches ensure that AI COGS never exceed revenue.

- Enterprise Readiness: Built-in audit trails and security portals satisfy the rigorous demands of enterprise procurement departments.

- Infrastructure Independence: Works across all major foundational model providers and AI infrastructure layers.

- Developer Velocity: Saves up to 6 months of development time by providing pre-built ADK modules for monetization and governance.

Disadvantages

- Integration Requirement: Requires the manual integration of the Aden SDK into the agent’s codebase to enable full instrumentation.

- Credit Complexity: The credit-based pricing model may require initial calibration for teams to accurately forecast their monthly spending.

- Platform Learning Curve: Optimizing the LLM dependency graph and P&L modeling requires a deep understanding of the agent’s internal reasoning loops.

How Does It Compare?

Helicone

- Best For: Developers needing deep observability and request logging for LLM calls.

- Key Features: Comprehensive logging, caching, and basic cost tracking.

- Key Distinction: Helicone is primarily an observability tool; Aden is a GTM infrastructure platform. Aden adds the financial “nervous system” including billing logic, trust centers, and sub-1ms circuit breakers that Helicone lacks.

Stigg

- Best For: Generic SaaS companies looking to implement flexible pricing plans and entitlement management.

- Key Features: No-code pricing tables and usage-based entitlement logic.

- Key Distinction: Stigg is built for traditional SaaS seat-based or simple usage models. Aden is AI-native, specifically designed for the unpredictable “agentic Reasoning” costs that traditional SaaS pricing engines cannot handle effectively.

Portkey

- Best For: Teams needing an AI gateway for model routing, load balancing, and prompt management.

- Key Features: Multi-model gateway, virtual keys, and prompt versioning.

- Key Distinction: Portkey focuses on the “runtime” orchestration and model connectivity. Aden focuses on the “business” orchestration, managing the revenue, margins, and enterprise trust aspects of the agent fleet.

LangSmith (by LangChain)

- Best For: Developers focused on the debugging, testing, and evaluation (Eval) of LangChain-based agents.

- Key Features: Traceability, dataset management, and performance testing.

- Key Distinction: LangSmith is a development and testing platform. Aden is a production and monetization platform designed to take those agents from the lab to a profitable commercial market.

Final Thoughts

Aden provides the critical infrastructure required to move AI agents from “cool experiments” to “profitable business products.” By addressing the three pillars of enterprise AI—margin protection, security trust, and usage-based monetization—it solves the biggest bottlenecks in the current GTM process. While the SDK integration requires an initial effort, the reported savings of 6 months in roadmap development make it a high-value investment for serious agent builders. In an era where AI costs can be volatile, Aden’s “penny-perfect” attribution and financial circuit breakers offer the predictability that CFOs and investors now demand.