Table of Contents

Lums

Save time and money with intuitive AI money management. Build your budget in 2 minutes, manage multi-currency accounts, and let Lums auto-categorize every transaction for total financial clarity. Ask “What recurring charges do I have?” to find hidden costs instantly.

Key Features

- Auto-categorization: Intelligent sorting of transactions using merchant data.

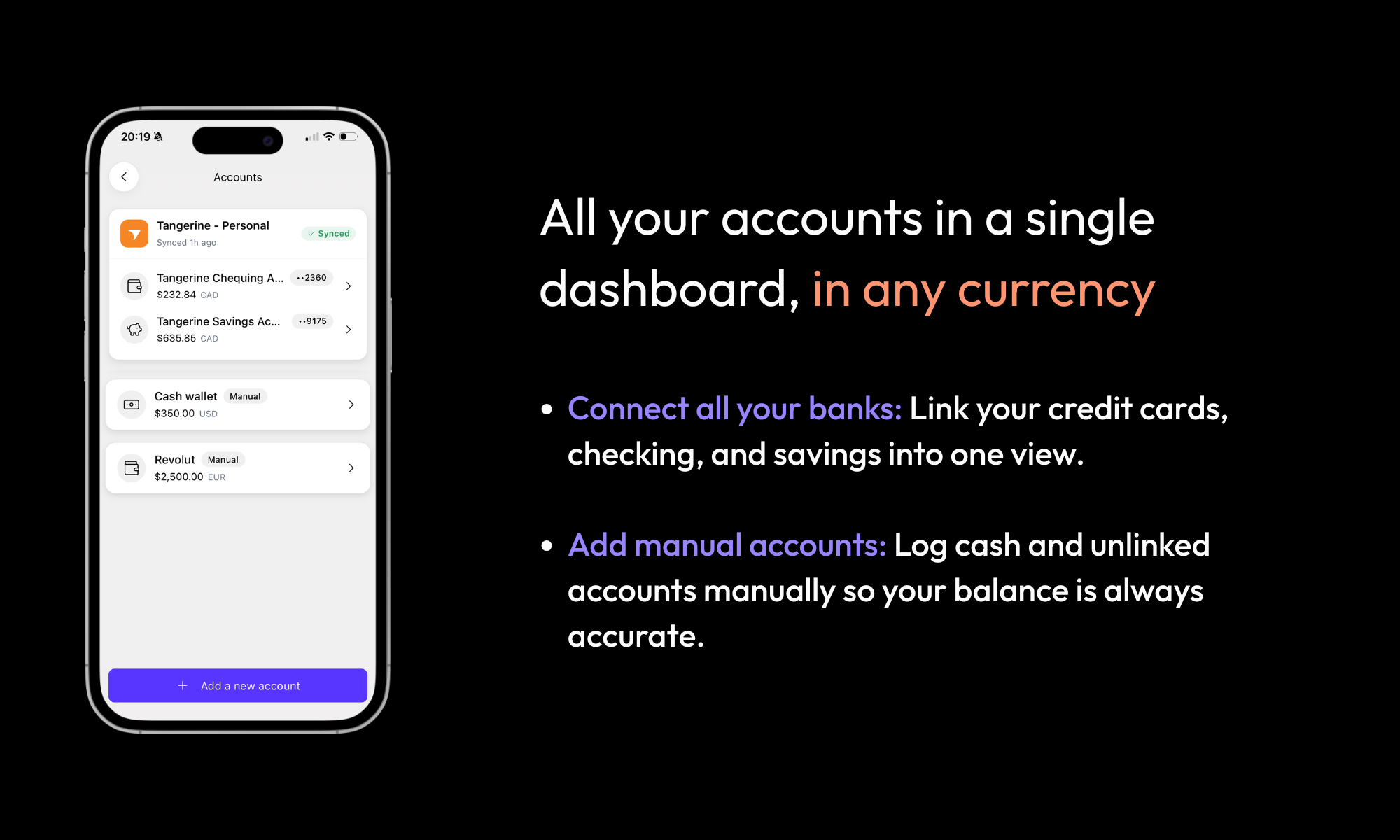

- Multi-currency Support: Native handling of global accounts (USD, EUR, GBP, JPY, etc.) in one view.

- 2-Minute Budget Builder: Rapid setup that guesses your budget based on history.

- Recurring Charge Detection: Automatically identifies subscriptions and repeat bills.

- Natural Language Chat: “Chat with your finances” interface to ask questions about spending.

- Privacy-Focused: Read-only bank access via Plaid; data is isolated and not used to train public AI models.

- Cash Flow Forecasting: Predicts your balance up to 14 days in the future.

How It Works

Users connect their bank accounts via secure read-only APIs (like Plaid). Lums analyzes transaction history to auto-categorize spending and identify subscriptions. Users can ask questions like “How much did I spend on coffee?” or “What are my recurring bills?” and receive instant answers and budget forecasts without navigating complex charts.

Use Cases

- Expat & Digital Nomad Finances: Managing bank accounts across multiple countries and currencies seamlessly.

- Personal Budget Tracking: Setting up a low-maintenance budget that tracks itself.

- Subscription Audit: Finding and cancelling unused subscriptions by asking the AI.

- Spending Analysis: Deeply understanding habits without maintaining manual spreadsheets.

- Cash Flow Forecasting: avoiding overdrafts by seeing projected future balances.

Pros & Cons

- Pros: Extremely fast setup (approx. 2 mins); Multi-currency support (rare in US-centric apps like Monarch); Chat interface reduces cognitive load; Privacy-first architecture (read-only access).

- Cons: “Read-only” means you cannot transfer money within the app; Accuracy depends on bank connection quality; Mobile-first focus may limit desktop power users; Newer entrant with less historical community support than YNAB.

Pricing

Freemium Model.

* Free: Basic connection and categorization features.

* Premium: Unlocks unlimited connected accounts, advanced AI insights, and custom categories (typically ~$5-10/month via in-app purchase).

How Does It Compare?

Lums differentiates itself by combining “Chat” (like Cleo) with serious “Tracking” (like Copilot), plus the unique multi-currency engine.

- vs. Monarch Money / Copilot Money:

- The Difference: Monarch and Copilot are powerful, dashboard-heavy tools for US users. They excel at granular data editing but often struggle with international banks and non-USD currencies.

- Winner for you?: Choose Lums if you have international accounts or prefer chatting over clicking charts. Choose Monarch if you want deep, desktop-based customization for purely US finances.

- vs. Cleo:

- The Difference: Cleo is an AI chatbot famous for its “roast mode” and personality-driven engagement. Lums offers a similar chat interface but focuses more on professional utility, forecasting, and clean visualization rather than gamification.

- Winner for you?: Choose Lums for serious financial clarity. Choose Cleo if you need humor and motivation to save.

- vs. YNAB (You Need A Budget):

- The Difference: YNAB requires active, manual “zero-based budgeting” (assigning every dollar a job). Lums is more automated and passive—it tells you what happened, rather than forcing you to plan every move.

- Winner for you?: Choose YNAB for strict debt payoff discipline. Choose Lums for effortless tracking and forecasting.

- vs. Rocket Money:

- The Difference: Rocket Money is specialized in negotiating bills and cancelling subscriptions. While Lums detects subscriptions, it does not offer a concierge service to cancel them for you.

Final Thoughts

Lums addresses a specific gap in the modern fintech stack: a tool that is as easy to use as a chat bot but as powerful as a spreadsheet, specifically for users with a global financial footprint. While power users might miss the granular manual controls of YNAB, the “Chat with your money” feature makes financial awareness accessible to anyone who finds traditional dashboards overwhelming. It is the best starting point for digital nomads or multi-currency earners in 2026.