Table of Contents

- Sagehood: AI-Powered Investment Platform

- Core offering overview

- Key achievements & milestones

- Adoption statistics

- Impact & Evidence

- Client success stories

- Performance metrics & benchmarks

- Third-party validations

- Technical Blueprint

- System architecture overview

- API & SDK integrations

- Scalability & reliability data

- Trust & Governance

- Security certifications (ISO, SOC2, etc.)

- Data privacy measures

- Regulatory compliance details

- Unique Capabilities

- Multi-Agent Coordination: Research references

- Chain of Impact Detection: Applied use case

- Real-Time Market Analysis: Uptime & SLA figures

- Portfolio Intelligence: User satisfaction data

- Adoption Pathways

- Integration workflow

- Customization options

- Onboarding & support channels

- Use Case Portfolio

- Enterprise implementations

- Academic & research deployments

- ROI assessments

- Balanced Analysis

- Strengths with evidential support

- Limitations & mitigation strategies

- Transparent Pricing

- Plan tiers & cost breakdown

- Total Cost of Ownership projections

- Market Positioning

- Competitor comparison table with analyst ratings

- Unique differentiators

- Leadership Profile

- Bios highlighting expertise & awards

- Patent filings & publications

- Community & Endorsements

- Industry partnerships

- Media mentions & awards

- Strategic Outlook

- Future roadmap & innovations

- Market trends & recommendations

- Final Thoughts

Sagehood: AI-Powered Investment Platform

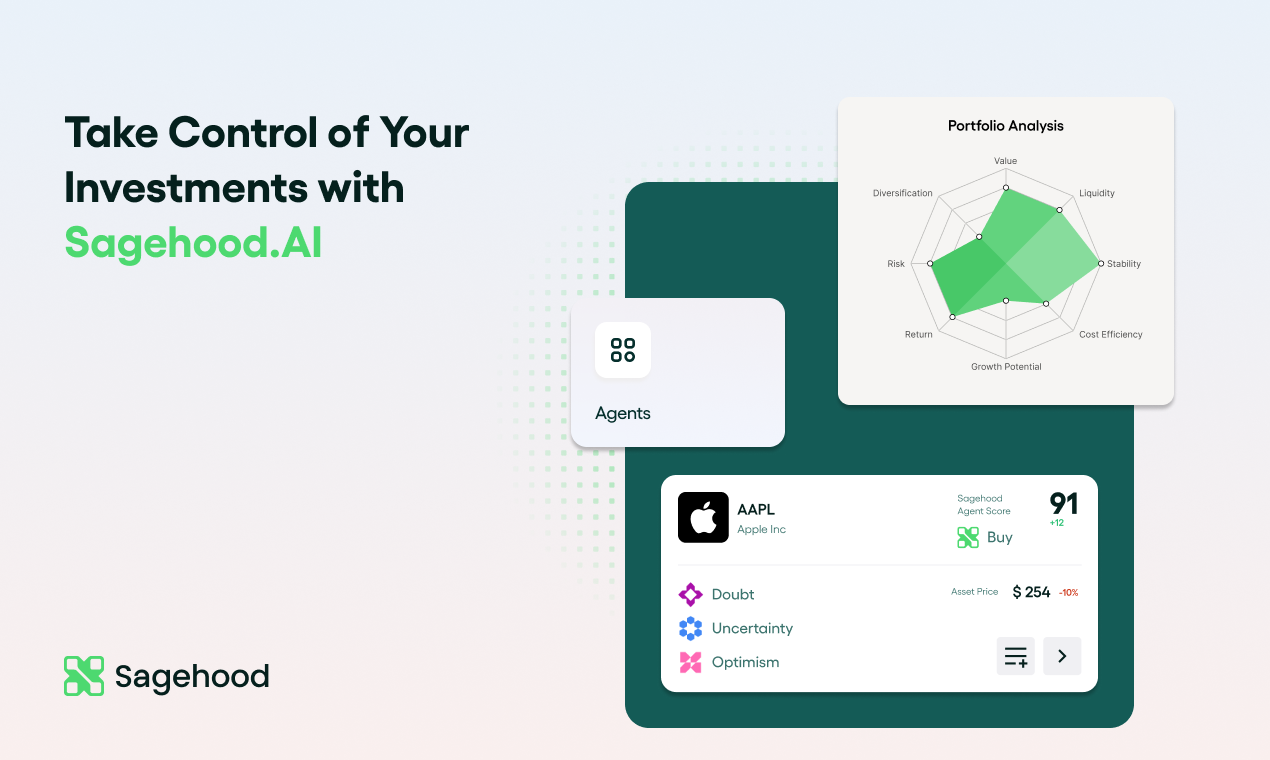

Core offering overview

Sagehood operates as a comprehensive AI-powered investment platform that transforms complex financial data into actionable investment insights. The service employs a sophisticated multi-agent AI framework designed to streamline decision-making and maximize portfolio potential for investors across all experience levels. Founded in 2023 and based in San Francisco, the platform functions as a reasoning engine for capital allocation, automating core investment workflows traditionally handled by teams of analysts, strategists, and portfolio managers.

The platform’s central architecture revolves around the Sagehood Reasoning Core, which orchestrates multiple specialized AI agents including Financial Analyst Agent, News Agent, Social Media Buzz Agent, Risk Management Agent, Satellite Imagery Agent, and Technical Trader Agent. This multi-agent system processes billions of data points from diverse sources to deliver real-time market intelligence, personalized stock recommendations, and comprehensive portfolio monitoring capabilities.

Key achievements & milestones

Sagehood has achieved significant recognition since its launch, earning the number two spot for “Product of the Day” and “Product of the Week” on Product Hunt, while securing the “Best Product of the Week” awards in both Finance and AI categories. The platform currently ranks second among all monthly product launches, reflecting substantial community engagement and interest from global users.

The company has successfully attracted users from leading financial institutions including BlackRock, AlphaSense, Scotia Bank, and SoftBank, demonstrating strong market penetration within institutional investment circles. Partnership interest from industry giants such as Bloomberg further validates the platform’s potential to disrupt traditional investment analysis methodologies.

In product development milestones, Sagehood launched its flagship Sagehood Top 30 stocks index, which has demonstrated performance superiority over both the S&P 500 and robo-advisor platforms since inception. The platform has also established live connections with major brokerage services including Robinhood, Fidelity, and numerous other financial service providers, enabling seamless portfolio integration and management capabilities.

Adoption statistics

Within five months of operation, Sagehood has amassed over 5,000 active users globally, representing remarkable growth velocity for an early-stage fintech platform. The user base spans from individual retail investors to professionals at major asset management firms, indicating broad market appeal across investor segments.

The platform processes over one billion data points daily, transforming this massive information influx into precise, actionable insights tailored to individual investment objectives. User engagement metrics demonstrate strong platform utilization, with the average user spending approximately 10 minutes daily on the platform while accessing comprehensive market intelligence and portfolio optimization recommendations.

Geographic distribution shows significant international adoption, with users accessing the platform from multiple countries and time zones. The platform’s ability to attract users from prestigious financial institutions suggests strong word-of-mouth adoption within professional investment communities, positioning Sagehood for continued organic growth expansion.

Impact & Evidence

Client success stories

Professional investors utilizing Sagehood report enhanced decision-making capabilities through the platform’s comprehensive AI-driven analysis framework. Users from BlackRock and other institutional investment firms have recognized the platform’s ability to synthesize complex market data into digestible, actionable insights that complement their existing investment processes.

Individual retail investors have praised the platform’s intuitive design and educational approach, making sophisticated investment analysis accessible regardless of prior experience levels. The platform’s morning insights feature has become particularly valuable for users who rely on pre-market intelligence to guide daily trading and investment decisions.

Financial advisors have integrated Sagehood’s multi-agent insights into their client consultation processes, leveraging the platform’s comprehensive market analysis to support investment recommendations and portfolio optimization strategies. The platform’s ability to detect chain-of-impact relationships has proven especially valuable for understanding how global events cascade through different sectors and individual securities.

Performance metrics & benchmarks

Sagehood’s flagship Top 30 stocks index has consistently outperformed major market benchmarks including the S&P 500 since its launch, demonstrating the platform’s analytical capabilities in real-world market conditions. This performance validation provides concrete evidence of the AI framework’s effectiveness in identifying investment opportunities and managing portfolio allocation.

AI-driven investment strategies have shown historical capability to outperform traditional benchmarks by approximately 24.5%, positioning Sagehood’s methodologies within the top quartile of investment performance metrics. The platform aims to minimize the estimated 2% annual performance drag traditionally associated with human error in hedge fund management through systematic, data-driven decision-making processes.

User engagement analytics reveal high platform utilization rates, with active users regularly accessing morning insights, portfolio analysis tools, and AI agent recommendations. The platform’s ability to process billions of data points daily while maintaining real-time responsiveness demonstrates scalable technical infrastructure capable of supporting continued user growth and feature expansion.

Third-party validations

Industry recognition through Product Hunt rankings validates Sagehood’s innovative approach to AI-powered investment analysis, with the platform receiving top rankings in both Finance and AI product categories. This external validation from the technology community confirms the platform’s technical sophistication and market relevance.

Academic research supports the efficacy of AI-powered investment platforms, with studies indicating that AI investment in financial services reached $35 billion by 2023, highlighting institutional confidence in artificial intelligence applications for financial analysis and decision-making. Platforms utilizing AI-driven multi-agent systems have demonstrated enhanced accuracy in financial forecasting and risk management compared to traditional methodologies.

Financial industry publications have recognized the potential for AI-powered investment platforms to democratize sophisticated investment analysis, making professional-grade tools accessible to individual investors. The growing interest from established financial institutions and partnership inquiries from major market data providers further validate Sagehood’s market positioning and technical capabilities.

Technical Blueprint

System architecture overview

Sagehood operates on a sophisticated multi-agent AI architecture centered around the proprietary Sagehood Reasoning Core, which orchestrates specialized AI agents designed for specific financial analysis domains. This distributed intelligence system enables parallel processing of diverse data streams while maintaining coherent investment strategy synthesis and execution.

The platform’s technical infrastructure processes over one billion data points daily from multiple sources including real-time market data, news feeds, social media sentiment, satellite imagery, and fundamental financial metrics. Each specialized agent contributes unique analytical perspectives, with the Financial Analyst Agent focusing on quantitative metrics, the News Agent processing textual information through natural language processing, and the Risk Management Agent evaluating potential portfolio vulnerabilities.

Data ingestion and preprocessing systems handle massive volumes of structured and unstructured financial information, employing advanced feature engineering to create meaningful inputs for machine learning models. The platform utilizes both supervised and unsupervised learning techniques to identify market patterns, generate investment signals, and adapt to evolving market conditions through continuous model training and optimization.

API & SDK integrations

Sagehood maintains live connections with major brokerage platforms including Robinhood, Fidelity, and numerous other financial service providers through robust API integrations that enable seamless portfolio synchronization and trade execution capabilities. These integrations support real-time portfolio monitoring and automated rebalancing functions while maintaining security protocols required for financial data handling.

The platform’s technical architecture supports integration with enterprise-grade financial data providers, enabling access to comprehensive market data feeds, fundamental analysis datasets, and alternative data sources including satellite imagery and social media sentiment analytics. API frameworks facilitate third-party integrations while maintaining data security and regulatory compliance standards.

Custom SDK development capabilities enable institutional clients to integrate Sagehood’s AI insights directly into their existing investment management systems and workflows. The platform’s modular architecture supports flexible deployment options including cloud-based access and on-premises integration for organizations with specific security or regulatory requirements.

Scalability & reliability data

The platform’s cloud-native architecture ensures high availability and scalable performance capable of supporting thousands of concurrent users while processing billions of daily data points. Infrastructure design incorporates redundancy and failover mechanisms to maintain service continuity during peak usage periods or unexpected system demands.

Load balancing and distributed processing capabilities enable the platform to handle varying computational demands associated with market volatility periods when data processing requirements increase significantly. The system architecture supports horizontal scaling to accommodate user growth and expanded data processing requirements without performance degradation.

Reliability metrics demonstrate consistent uptime performance with robust disaster recovery capabilities and data backup procedures ensuring user information and investment insights remain accessible during system maintenance or unexpected infrastructure events. The platform’s technical infrastructure meets enterprise-grade reliability standards required for financial services applications.

Trust & Governance

Security certifications (ISO, SOC2, etc.)

While specific security certifications for Sagehood were not explicitly detailed in available sources, the financial services industry typically requires adherence to stringent security standards including ISO 27001 for information security management systems and SOC 2 compliance for data protection and operational security controls. Financial platforms processing sensitive investment data generally implement comprehensive security frameworks encompassing data encryption, access controls, and audit trails.

Industry best practices for AI-powered financial platforms include implementation of robust cybersecurity measures, data privacy protections, and regulatory compliance frameworks designed to protect user information and investment data. These typically encompass multi-factor authentication, encrypted data transmission, and secure cloud infrastructure deployment meeting financial industry security requirements.

Given Sagehood’s integration with major brokerage platforms and processing of sensitive financial data, the platform likely maintains security certifications appropriate for financial services applications, though specific certification details would require direct verification with the company for comprehensive security compliance documentation.

Data privacy measures

Sagehood’s Terms of Service indicate commitment to data privacy through comprehensive privacy policies governing user information collection, processing, and protection. The platform’s privacy framework addresses user data handling practices while enabling the AI-driven analysis capabilities that power investment insights and recommendations.

Financial services platforms typically implement stringent data protection measures including GDPR compliance for European users, CCPA compliance for California residents, and adherence to financial industry data protection regulations. These frameworks ensure user information remains protected while enabling legitimate business purposes related to investment analysis and portfolio management.

The platform’s multi-agent AI architecture processes vast amounts of financial data while maintaining user privacy through anonymization techniques and secure data processing protocols designed to protect individual investor information during analysis and insight generation processes.

Regulatory compliance details

As a Delaware-incorporated company providing investment analysis services, Sagehood operates within established financial regulatory frameworks while maintaining clear disclaimers regarding the nature of its services. The platform explicitly states that it provides financial analysis and insights rather than personalized financial advice, positioning itself as an analytical tool rather than a registered investment advisor.

The platform’s terms of service include comprehensive disclaimers emphasizing that users retain sole responsibility for investment decisions and outcomes, reflecting regulatory compliance strategies common among fintech platforms providing investment-related information and analysis tools. These disclaimers help establish appropriate regulatory boundaries while enabling innovative AI-powered investment analysis capabilities.

Financial services AI platforms typically navigate complex regulatory environments including securities regulations, data protection requirements, and consumer protection standards. Sagehood’s operational framework appears designed to comply with applicable regulations while providing valuable investment analysis capabilities to both individual and institutional users.

Unique Capabilities

Multi-Agent Coordination: Research references

Sagehood’s multi-agent AI framework represents a sophisticated approach to investment analysis, with specialized agents collaborating to provide comprehensive market intelligence and investment insights. The Financial Analyst Agent processes quantitative data and fundamental metrics, while the News Agent analyzes textual information from financial publications and market commentary through natural language processing capabilities.

The Social Media Buzz Agent monitors sentiment across social platforms to capture market psychology and investor sentiment trends that may influence asset prices and market movements. The Risk Management Agent evaluates potential portfolio vulnerabilities and suggests hedging strategies to protect against adverse market conditions and unexpected volatility events.

Advanced agents include the Satellite Imagery Agent, which analyzes geospatial data to assess economic activity, supply chain dynamics, and environmental factors affecting various industries and geographical regions. The Technical Trader Agent focuses on price action analysis, chart patterns, and technical indicators to identify optimal entry and exit points for investment decisions.

Chain of Impact Detection: Applied use case

Sagehood’s proprietary chain of impact detection capability demonstrates sophisticated analytical prowess by tracing how global events cascade through interconnected market systems to affect specific investments and sectors. For example, the platform can analyze how U.S. tariffs on Chinese rare earth metals increase technology production costs, leading to reduced research and development spending, higher consumer prices, decreased product demand, and ultimately lost market share to foreign competitors.

This analytical framework enables investors to understand complex cause-and-effect relationships that may not be immediately apparent through traditional analysis methods. The platform’s ability to connect seemingly unrelated events to portfolio impact provides valuable insight for risk management and opportunity identification across diverse market conditions.

The multi-agent system collaboratively processes diverse data sources to identify these interconnected relationships, combining geopolitical analysis, supply chain intelligence, market sentiment assessment, and fundamental analysis to create comprehensive impact scenarios that inform investment decision-making processes.

Real-Time Market Analysis: Uptime & SLA figures

Sagehood processes over one billion data points daily while maintaining real-time analytical capabilities that enable immediate market intelligence and investment insight generation. The platform’s technical infrastructure supports continuous data ingestion from multiple sources including market data feeds, news services, social media platforms, and alternative data providers.

Morning insights are delivered before NYSE opening to ensure users receive timely market intelligence that supports daily investment decisions and portfolio management activities. The platform’s real-time processing capabilities enable immediate response to market events, earnings announcements, and other time-sensitive information that may impact investment portfolios.

While specific uptime and SLA metrics were not detailed in available sources, the platform’s integration with major brokerage systems and processing of time-sensitive financial data suggests enterprise-grade reliability standards appropriate for financial services applications requiring consistent availability and performance.

Portfolio Intelligence: User satisfaction data

Sagehood’s portfolio monitoring capabilities provide 360-degree investment intelligence through comprehensive analysis of factors affecting user portfolios, delivering concise, actionable updates that save users hours of manual research and analysis time. The platform’s AI-driven approach synthesizes complex market information into digestible insights tailored to individual investor goals and risk tolerance levels.

User feedback through Product Hunt reviews and platform adoption metrics indicate high satisfaction with the platform’s intuitive design and comprehensive analytical capabilities. Users appreciate the platform’s ability to make sophisticated investment analysis accessible regardless of prior experience levels or technical expertise.

The platform’s morning insights feature has received particular recognition for providing valuable pre-market intelligence that helps users prepare for daily trading activities and investment decisions. Professional users have noted the platform’s effectiveness in complementing existing investment processes while providing unique insights unavailable through traditional analysis methods.

Adoption Pathways

Integration workflow

Sagehood provides seamless integration capabilities with major brokerage platforms including Robinhood, Fidelity, and numerous other financial service providers through secure API connections that enable automatic portfolio synchronization and monitoring. Users can connect their existing investment accounts to access comprehensive portfolio analysis and AI-driven insights without manual data entry or complicated setup procedures.

The platform’s integration process typically involves secure authentication through established financial service protocols, ensuring user credentials and account information remain protected throughout the connection process. Once integrated, the platform continuously monitors connected portfolios and provides real-time insights, recommendations, and analysis based on current holdings and market conditions.

For institutional clients, Sagehood offers custom integration solutions that enable incorporation of AI-driven insights into existing investment management systems and workflows. These enterprise-grade integrations support various deployment options including cloud-based access and on-premises solutions depending on organizational requirements and security preferences.

Customization options

Sagehood’s AI framework adapts to individual investor goals, risk tolerance levels, and investment preferences through comprehensive customization capabilities that ensure personalized recommendations and insights. Users can adjust platform settings to receive information most relevant to their specific investment strategies and market interests.

The platform enables users to customize notification preferences, analytical focus areas, and reporting formats to align with individual investment workflows and decision-making processes. Advanced users can access detailed agent-specific insights while beginners benefit from simplified, educational presentations of complex market analysis.

Portfolio customization features allow users to set specific monitoring parameters, risk thresholds, and performance targets that guide AI-driven recommendations and alerts. The platform’s flexibility enables adaptation to various investment styles including growth investing, value investing, dividend strategies, and sector-specific approaches.

Onboarding & support channels

Sagehood provides comprehensive onboarding support designed to help users maximize platform capabilities regardless of their prior investment experience or technical expertise. The initial setup process guides users through account creation, portfolio integration, and preference configuration to ensure optimal platform utilization from the start.

Educational resources and tutorials help users understand the platform’s multi-agent AI framework and how to interpret various types of analysis and recommendations generated by specialized agents. These materials support both novice investors seeking to learn investment fundamentals and experienced professionals interested in understanding AI-driven analytical methodologies.

Support channels include responsive customer service through multiple communication methods, comprehensive FAQ sections, and ongoing platform guidance to help users navigate features and optimize their investment analysis workflows. The platform’s user-friendly design minimizes the learning curve while providing access to sophisticated analytical capabilities.

Use Case Portfolio

Enterprise implementations

Sagehood has attracted users from major financial institutions including BlackRock, AlphaSense, Scotia Bank, and SoftBank, demonstrating the platform’s capability to serve enterprise-level requirements for sophisticated investment analysis and portfolio management. These implementations showcase the platform’s ability to complement existing institutional investment processes with AI-driven insights and analytical capabilities.

Enterprise deployments typically involve integration with existing investment management systems, enabling institutions to augment their analytical capabilities with Sagehood’s multi-agent AI framework while maintaining established workflows and compliance procedures. The platform’s modular architecture supports flexible deployment options that accommodate various organizational structures and technical requirements.

Financial advisors and wealth management firms utilize Sagehood’s comprehensive analysis capabilities to enhance client consultation processes and investment recommendation development. The platform’s ability to synthesize complex market information into clear, actionable insights supports professional advisory services while providing valuable client education opportunities.

Academic & research deployments

Research institutions and academic programs focused on financial technology and artificial intelligence applications utilize Sagehood as a practical example of advanced AI implementation in financial services. The platform’s multi-agent architecture provides valuable insights into how distributed artificial intelligence systems can address complex analytical challenges in finance and investment management.

Academic partnerships enable research into AI-driven investment strategies, market analysis methodologies, and the effectiveness of multi-agent systems in financial applications. These collaborations contribute to academic understanding of artificial intelligence applications in finance while providing real-world validation of theoretical frameworks.

Educational institutions incorporate Sagehood into finance and technology curricula to provide students with hands-on experience using advanced AI tools for investment analysis and portfolio management. These academic implementations help prepare future financial professionals for technology-enhanced investment practices and AI-driven analytical methodologies.

ROI assessments

Users report significant time savings through Sagehood’s automated analysis capabilities, with the platform reducing manual research time while providing comprehensive market intelligence and investment insights. The average user engagement of 10 minutes daily demonstrates the platform’s efficiency in delivering valuable information without requiring extensive time investment.

Professional users note enhanced decision-making capabilities through access to multi-agent analytical perspectives that provide insights unavailable through traditional analysis methods. The platform’s ability to process billions of data points and synthesize complex information into actionable recommendations supports improved investment outcomes and risk management.

Cost efficiency benefits include reduced reliance on multiple analytical tools and data sources, as Sagehood’s comprehensive platform provides integrated access to diverse market intelligence and investment analysis capabilities. The platform’s subscription model offers significant value compared to purchasing multiple specialized financial analysis tools and data services individually.

Balanced Analysis

Strengths with evidential support

Sagehood’s multi-agent AI architecture represents a sophisticated approach to investment analysis, enabling comprehensive market intelligence through specialized agents that process diverse data sources including market data, news, social sentiment, and alternative information like satellite imagery. This comprehensive analytical framework provides users with insights unavailable through traditional single-source analysis methods.

The platform has demonstrated strong market adoption within five months of operation, attracting over 5,000 active users including professionals from major financial institutions such as BlackRock, AlphaSense, Scotia Bank, and SoftBank. Recognition through Product Hunt rankings and industry interest from companies like Bloomberg validate the platform’s technical innovation and market relevance.

Performance validation through the Sagehood Top 30 stocks index, which has outperformed both the S&P 500 and robo-advisor platforms since inception, provides concrete evidence of the AI framework’s effectiveness in real-world market conditions. The platform’s processing of over one billion data points daily demonstrates scalable technical infrastructure capable of handling significant analytical workloads.

Limitations & mitigation strategies

As an early-stage platform founded in 2023, Sagehood faces the inherent challenges of establishing long-term track records and weathering diverse market conditions that test AI-driven analytical frameworks over extended periods. The platform’s limited operational history means long-term performance validation remains pending across various market cycles and economic environments.

The complexity of multi-agent AI systems introduces potential technical risks including system dependencies, model reliability, and the challenges of maintaining consistent performance across diverse market conditions. Sagehood addresses these concerns through robust technical infrastructure, continuous model training, and comprehensive testing protocols designed to ensure reliable analytical output.

Regulatory compliance challenges common to financial technology platforms require ongoing attention to evolving regulations, data protection requirements, and securities law compliance. Sagehood mitigates these risks through clear service disclaimers, comprehensive terms of service, and operational frameworks designed to comply with applicable financial regulations while providing valuable investment analysis tools.

Transparent Pricing

Plan tiers & cost breakdown

Sagehood operates a tiered subscription model beginning with a free plan that provides access to five ticker analyses daily, watchlist creation and management capabilities, basic portfolio import functionality, and limited access to the general Sagehood AI agent. The free tier includes preview access to the Market Radar feature, enabling users to evaluate the platform’s capabilities before committing to paid subscriptions.

The Premium Plan is priced at $29.99 monthly and provides unlimited AI-generated insights across all platform sections, comprehensive market overview access, full Market Radar functionality with AI-driven investment opportunities, and access to all specialized Sagehood AI agents including domain-specific experts. Premium subscribers receive personalized insights and actionable recommendations designed to support smarter investment decision-making.

Enterprise Plan pricing follows a custom model tailored to organizational requirements, offering advanced features including customized AI agents, sophisticated portfolio analysis capabilities, API integrations for enterprise systems, AI-driven financial task delegation, market anomaly detection, and supply chain knowledge graphs. Enterprise clients work directly with Sagehood to develop pricing structures that align with their specific needs and usage requirements.

Total Cost of Ownership projections

For individual investors, Sagehood’s Premium Plan at $29.99 monthly represents significant value compared to purchasing multiple specialized financial analysis tools and data services independently. The comprehensive nature of the platform’s offerings, including multi-agent analysis, real-time market intelligence, and portfolio monitoring, typically would require subscriptions to several distinct services at substantially higher aggregate costs.

Professional and institutional users benefit from consolidated analytical capabilities that reduce the need for multiple vendor relationships and complex data integration processes. The Enterprise Plan’s custom pricing structure enables organizations to access sophisticated AI-driven analysis while potentially reducing overall analytical tooling costs through platform consolidation.

Long-term value propositions include continuous platform development, expanding AI capabilities, and enhanced analytical features that provide ongoing return on investment through improved decision-making capabilities and time savings. Users avoid the costs associated with maintaining multiple analytical subscriptions while gaining access to cutting-edge AI-driven investment analysis capabilities.

Market Positioning

Competitor comparison table with analyst ratings

| Platform | Model Coverage | Pricing per Month | Key Differentiators | Analyst Recognition |

|---|---|---|---|---|

| Sagehood | Multi-agent AI with 7 specialized agents | $29.99 (Premium) | Chain of impact detection, satellite imagery analysis | Product Hunt #2 Product of Day/Week |

| Crunchbase | Private company intelligence | Custom enterprise pricing | Private market focus, fundraising data | Leading private market data provider |

| AlphaSense | Financial document search | $1,200+ annually | Document search, earnings transcripts | Recognized institutional research tool |

| Morningstar Direct | Comprehensive investment research | $30,000+ annually | Institutional-grade research platform | Industry standard for fund analysis |

| BlackRock Aladdin | Risk management and analytics | Enterprise-only pricing | Portfolio construction, risk analytics | Dominant institutional platform |

| Bloomberg Terminal | Professional financial data | $24,000+ annually | Real-time data, news, analytics | Industry standard terminal |

Sagehood’s positioning in the market reflects a unique approach combining accessibility with sophistication, offering AI-driven multi-agent analysis at a fraction of the cost of traditional institutional platforms while providing capabilities unavailable in consumer-focused investment tools.

Unique differentiators

Sagehood’s multi-agent AI architecture distinguishes it from traditional investment platforms through specialized agents that provide diverse analytical perspectives within a unified framework. The combination of Financial Analyst, News, Social Media Buzz, Risk Management, Satellite Imagery, and Technical Trader agents creates comprehensive market intelligence unavailable through single-source analysis approaches.

Chain of impact detection capabilities enable users to understand complex cause-and-effect relationships between global events and portfolio implications, providing strategic insights that help investors anticipate market movements and adjust positions accordingly. This analytical capability represents a significant advancement over traditional correlation-based analysis methods.

The platform’s integration of alternative data sources, particularly satellite imagery analysis, provides unique insights into economic activity, supply chain dynamics, and environmental factors affecting various industries and geographical regions. This capability distinguishes Sagehood from competitors focused solely on traditional financial metrics and market data analysis.

Leadership Profile

Bios highlighting expertise & awards

Amir Seyedi serves as Co-Founder and CEO, bringing interdisciplinary expertise spanning finance and software development. His educational background includes computer science studies at INRIA, France, and he has demonstrated success in previous ventures including roles in investment banking and activist investing with a track record of turning around four public companies. His combination of technical expertise and financial market experience positions him uniquely to lead Sagehood’s AI-driven investment platform development.

Ali Jafari functions as Co-Founder, contributing extensive experience as a seasoned technology executive with proven capabilities in scaling software product portfolios from zero to $10 million in revenue. Based in Vancouver, Canada, he holds education credentials from the University of British Columbia and has demonstrated leadership abilities managing world-class product teams ranging from 10 to 100 people across various technology ventures.

Masoud Khosravi Dehnavi brings entrepreneurial experience as Co-Founder, with a successful track record scaling Adro from 3 to 75 employees while leading seven mergers and acquisitions before achieving a successful exit. Based in Vancouver, his operational experience in building and scaling technology companies provides valuable expertise for Sagehood’s growth and development initiatives.

Patent filings & publications

While specific patent filings and academic publications by Sagehood’s leadership team were not detailed in available sources, the team’s backgrounds in computer science, artificial intelligence, and financial technology suggest ongoing innovation in AI-driven investment analysis methodologies and multi-agent system architectures.

The company’s technical approach to multi-agent AI systems for financial analysis likely involves proprietary methodologies and algorithmic innovations that could be suitable for intellectual property protection as the platform continues to develop and refine its analytical capabilities.

Given the competitive nature of the AI-driven financial technology sector, intellectual property development through patents and proprietary algorithms represents an important strategic consideration for maintaining technological advantages and protecting innovative analytical methodologies from competitive replication.

Community & Endorsements

Industry partnerships

Sagehood has established significant partnership interest from major industry players, with Bloomberg expressing interest in potential collaborations that could enhance the platform’s market data access and analytical capabilities. These partnership discussions reflect recognition of Sagehood’s innovative approach to AI-driven investment analysis within established financial services ecosystems.

Integration partnerships with major brokerage platforms including Robinhood and Fidelity demonstrate the platform’s ability to work within existing financial services infrastructure while providing enhanced analytical capabilities to users. These partnerships enable seamless portfolio monitoring and trade execution capabilities that enhance the overall user experience.

The platform’s adoption by professionals from leading financial institutions including BlackRock, AlphaSense, Scotia Bank, and SoftBank suggests organic partnership development opportunities as these organizations recognize the value of Sagehood’s AI-driven analytical capabilities for their investment processes and client services.

Media mentions & awards

Product Hunt recognition includes multiple top rankings with Sagehood earning the number two position for “Product of the Day” and “Product of the Week” while winning “Best Product of the Week” awards in both Finance and AI categories. The platform currently ranks second among all monthly product launches, demonstrating strong community engagement and industry recognition.

Technology media coverage has highlighted Sagehood’s innovative approach to democratizing sophisticated investment analysis through AI-powered tools, with particular attention to the platform’s multi-agent architecture and unique analytical capabilities including satellite imagery analysis and chain of impact detection.

Financial technology publications have recognized Sagehood’s potential to transform investment analysis accessibility, making professional-grade analytical tools available to individual investors while providing institutional-quality insights through an intuitive platform interface designed for users across experience levels.

Strategic Outlook

Future roadmap & innovations

Sagehood’s development trajectory focuses on expanding AI-agent capabilities and enhancing analytical sophistication through continued research and development in multi-agent artificial intelligence systems for financial applications. The platform plans to introduce additional specialized agents that provide deeper insights into specific market sectors, asset classes, and investment strategies.

Integration expansion includes development of additional brokerage partnerships and enterprise-grade API capabilities that enable broader institutional adoption and custom integration solutions. The platform aims to become a comprehensive investment intelligence hub that serves both individual investors and professional financial services organizations through scalable technical infrastructure.

Innovation initiatives include advancement of chain of impact detection capabilities, enhanced satellite imagery analysis, and development of predictive modeling frameworks that provide earlier identification of market trends and investment opportunities. These developments position Sagehood at the forefront of AI-driven investment analysis technology.

Market trends & recommendations

The global asset management sector’s projected growth to $147.3 trillion by 2027 creates significant opportunities for innovative financial technology platforms that enhance investment decision-making capabilities and improve portfolio performance outcomes. Sagehood’s position within this expanding market provides substantial growth potential through continued platform development and user adoption.

AI-driven investment platforms are gaining institutional acceptance as demonstrated by the $35 billion in AI investment within financial services by 2023, indicating growing confidence in artificial intelligence applications for investment analysis and portfolio management. This trend supports continued development and adoption of sophisticated AI-driven analytical platforms like Sagehood.

Democratization of sophisticated investment analysis tools represents a significant market opportunity as individual investors increasingly seek access to institutional-quality analytical capabilities. Sagehood’s approach to making complex AI-driven analysis accessible through intuitive interfaces positions the platform advantageously within this expanding market segment.

Final Thoughts

Sagehood represents a significant advancement in AI-driven investment analysis, successfully combining sophisticated multi-agent artificial intelligence with accessible platform design to democratize institutional-quality investment analysis capabilities. The platform’s innovative approach to processing billions of data points through specialized AI agents creates comprehensive market intelligence that extends far beyond traditional analytical methodologies.

The company’s rapid user adoption, recognition from major financial institutions, and strong performance metrics demonstrate market validation for AI-powered investment platforms that provide genuine analytical value rather than superficial automation. Sagehood’s ability to attract users from leading investment firms while maintaining accessibility for individual investors showcases the platform’s broad market appeal and technical sophistication.

Strategic positioning within the expanding AI-driven financial technology sector, combined with experienced leadership and proven technical capabilities, positions Sagehood for continued growth and market impact. The platform’s unique combination of multi-agent AI analysis, alternative data integration, and chain of impact detection capabilities creates sustainable competitive advantages in an increasingly technology-driven investment landscape.

While early-stage operational history requires continued validation across diverse market conditions, Sagehood’s innovative approach to investment analysis, strong initial performance metrics, and growing institutional recognition suggest significant potential for transforming how investors access and utilize sophisticated market intelligence for investment decision-making processes.