Table of Contents

No Cap: World’s First AI Angel Investor

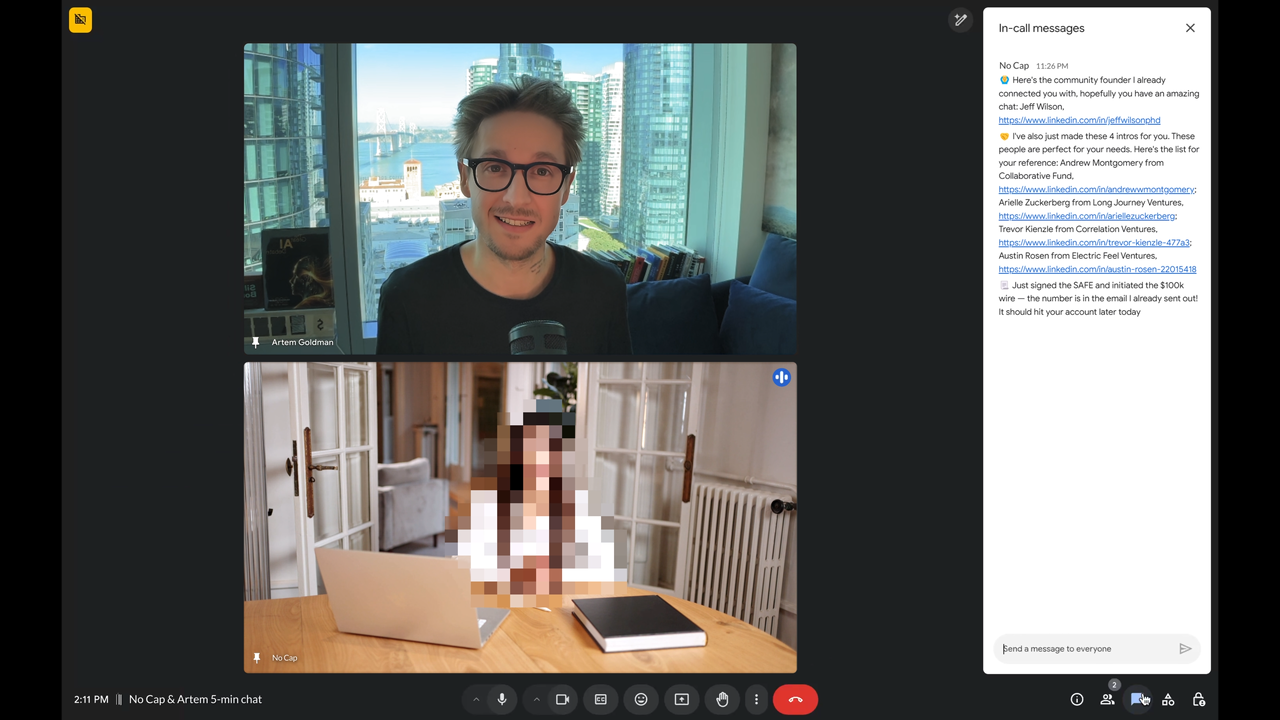

No Cap represents a groundbreaking innovation in venture capital, being the world’s first artificial intelligence system capable of autonomously making investment decisions. This AI investor has successfully completed its first \$100,000 investment in Wonder Family, demonstrating the potential for AI to revolutionize startup funding by eliminating traditional inefficiencies in the fundraising process.Description Rewrite

No Cap is an AI-powered angel investor that autonomously evaluates startup pitches and makes investment decisions without human intervention. Unlike traditional venture capital firms, No Cap can sign SAFE agreements, wire funds, and provide valuable network introductions within minutes rather than months. The AI system is trained by over 60 Y Combinator alumni founders who collectively have raised nearly \$1 billion and built hundreds of companies. No Cap aims to eliminate the traditional fundraising challenges of sending thousands of emails and taking hundreds of calls just to secure a few investments, instead providing immediate access to elite founder networks for fundraising, business development, hiring, and public relations.Deep Service Report

No Cap operates as a revolutionary AI investor that has fundamentally changed how startup funding works. The system leverages artificial intelligence to analyze startup potential based on comprehensive data analysis and historical patterns from successful companies. Rather than requiring lengthy pitch processes, multiple meetings, and extended due diligence periods, No Cap can complete entire investment cycles in a matter of days.The AI investor’s first major success came with its investment in Wonder Family, an agentic e-commerce brand builder founded by Artem Goldman. The entire process from introduction to signed SAFE agreement took just a few days, with the closing call lasting only three minutes. During this brief interaction, No Cap signed the SAFE agreement, wired \$100,000, introduced the founder to five new investors, and provided a lead for a potential hire.No Cap is backed by Y Combinator and trained by what the founders call the “No Cap Mafia” – a community of over 50 exceptional founders, with 80% being top Y Combinator alumni. This training ensures that No Cap can provide ongoing coaching, advising, and crucial networking support beyond just financial investment.The system addresses major pain points in traditional venture capital, including lengthy response times, vague rejection feedback, and ghosting behaviors. When No Cap passes on an investment, it provides specific, detailed reasons for the decision along with suggestions for improvement, maintaining ongoing communication rather than disappearing like many traditional investors.Country

United States (specifically based in San Francisco, California)Pros & Cons

Pros

- Dramatically reduces fundraising timeline from months to days

- Provides immediate, specific feedback on investment decisions

- Offers 24/7 availability across all time zones and languages

- Eliminates common VC behaviors like ghosting and vague responses

- Provides ongoing support through elite founder network access

- Automates administrative tasks like contract signing and fund transfers

- Trained by highly successful Y Combinator alumni with proven track records

- Offers continuous coaching and advisory support beyond initial investment

Cons

- Limited track record with only one publicly documented investment

- Potential concerns about AI decision-making replacing human judgment in complex investment scenarios

- May lack the nuanced understanding of market dynamics that experienced human investors provide

- Unclear how the AI handles edge cases or highly innovative business models outside its training data

- Questions about long-term relationship building and mentorship capabilities compared to human investors

- Potential over-reliance on data patterns rather than intuitive founder assessment

Pricing

No Cap operates on an investment model rather than a traditional subscription or service fee structure. As an angel investor, No Cap provides capital investment (demonstrated with the \$100,000 investment in Wonder Family) in exchange for equity stakes in startups. The specific investment amounts and equity percentages are negotiated on a case-by-case basis, similar to traditional angel investing. There are no upfront costs for founders to pitch to No Cap, and the value proposition includes both financial investment and access to the extensive founder network for ongoing support.Competitor Comparison

| Feature | No Cap | Traditional Angel Investors | AngelList | Techstars |

|---|---|---|---|---|

| Decision Speed | Days | Months | Weeks | Months |

| Availability | 24/7 | Limited hours | Business hours | Limited |

| Feedback Quality | Detailed, specific | Often vague | Varies | Structured |

| Network Access | 60+ YC alumni | Individual networks | Large platform | Alumni network |

| Investment Process | Automated | Manual | Platform-assisted | Program-based |

| Ongoing Support | AI-powered coaching | Personal mentoring | Limited | Intensive program |

| Geographic Reach | Global | Often local | Global | Global with offices |

| Investment Amount | \$100k demonstrated | Varies widely | Varies | \$20k-100k+ |

Team Members

- Jeff Wilson (Co-Founder)

- Alexander Nevedovsky (Co-Founder)

- Slava Solonitsyn (Co-Founder)

Team Members About

- Jeff Wilson is a serial entrepreneur and 3x founder with extensive experience in the startup ecosystem. He previously founded Jupe (YC S21), focusing on universal autonomous housing solutions, and Kasita, a modular housing company. Wilson has a unique background that includes academic experience as Dean and Environmental Science Associate Professor at Huston-Tillotson University and postdoctoral research at Harvard University. He holds multiple patents related to modular housing units and has received recognition as Top Professor in the University of Texas System.

- Alexander Nevedovsky is a repeat AI founder with a successful exit to Farfetch. He brings significant experience in artificial intelligence and e-commerce, having built and scaled AI-driven companies. His background demonstrates strong expertise in training AI systems and understanding market dynamics in the technology sector.

- Slava Solonitsyn is an experienced entrepreneur and investor with a diverse portfolio of successful ventures. He currently serves as CEO and Co-founder of Intently (YC W23), which leverages AI to analyze data for B2B lead generation. Solonitsyn also holds positions as Chairman of Socap.ai (YC W23) and Co-founder and board member of Mighty Buildings. His investment experience includes positions in companies like Boom Supersonic, PreNav, and Revl. He serves as a Venture Partner at Ruvento Ventures, a Singapore-based seed firm investing in IoT, robotics, and emerging technologies.

Team Members SNS Links

Jeff Wilson:- LinkedIn: https://www.linkedin.com/in/jeffwilsonphd

- Twitter/X: @profdumpster

- Instagram: @profdumpster

- Personal website: jeffwilson.co

Alexander Nevedovsky:

- LinkedIn: Available through his posts and activity on the platform

- Active on LinkedIn with regular updates about No Cap developments

Slava Solonitsyn:

- LinkedIn: https://www.linkedin.com/in/solonitsyn

- Professional presence through multiple company profiles and board positions