Table of Contents

Overview

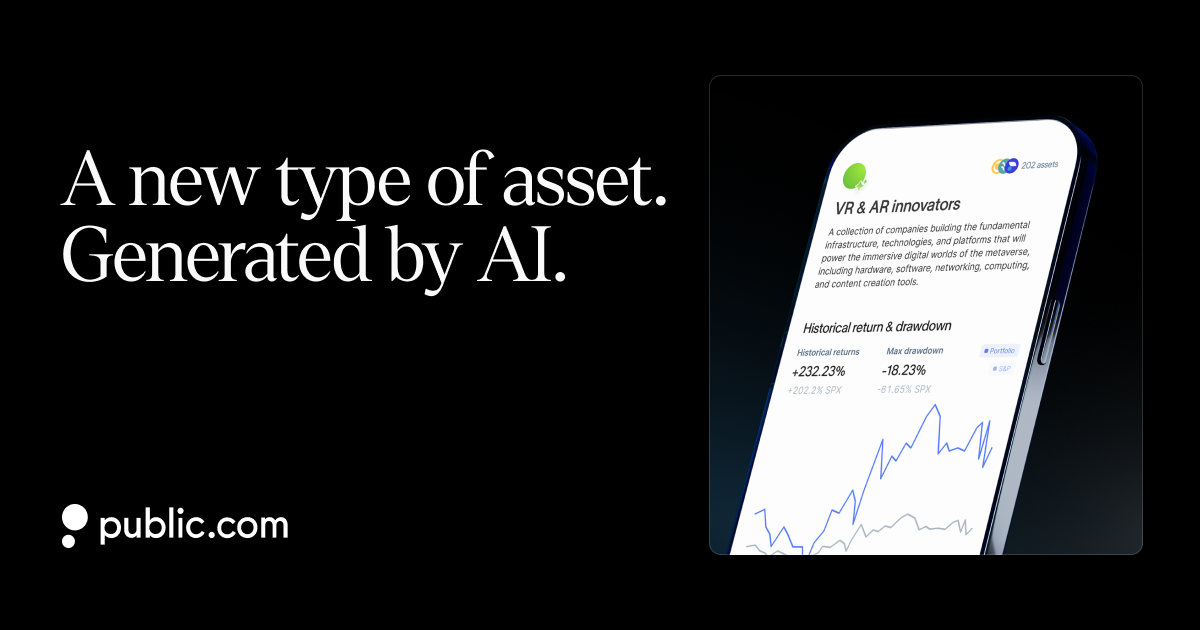

Tired of generic investment options? Imagine crafting your own investment strategy, tailored to your specific interests and beliefs. Generated Assets, an AI-powered tool from Public.com, makes this a reality. It allows you to create custom investable indexes based on any idea or theme, screening thousands of stocks to build a portfolio that truly reflects your vision. Let’s dive into how this innovative tool can empower your investment journey.

Key Features

Generated Assets boasts a range of features designed to simplify and personalize the investment process:

- AI-Driven Custom Index Creation: Input your investment idea or theme, and the AI engine will generate a custom index tailored to your specifications.

- Screening of Thousands of Stocks: The platform sifts through a vast database of stocks to identify those that align with your chosen investment theme.

- Backtesting Against Benchmarks: Evaluate the historical performance of your custom index against benchmarks like the S&P 500 to assess its potential.

- Interactive Analysis and Portfolio Management Tools: Gain insights into your index’s composition and performance with interactive charts and data.

- Ability to Share and Compare Custom Indexes: Share your investment ideas with the Public.com community and compare your index’s performance against others.

How It Works

The process of creating a custom index with Generated Assets is surprisingly straightforward. First, you input your investment idea or theme into the platform. This could be anything from “companies focused on renewable energy” to “businesses benefiting from the metaverse.” Next, the AI engine analyzes your prompt and screens a vast database of stocks, identifying those that best match your criteria. The tool then constructs a tailored index based on these stocks. Finally, you can review the index’s composition, analyze its performance against benchmarks, and manage it as needed. You can also share your creation with the Public.com community and see how it stacks up against other custom indexes.

Use Cases

Generated Assets can be a valuable tool for a variety of investors:

- Investors Seeking Personalized Investment Strategies: Create indexes that align with your unique values and interests, going beyond traditional investment options.

- Users Interested in Thematic Investing: Explore specific investment themes like sustainability, technology, or healthcare with a custom-built index.

- Individuals Wanting to Explore and Backtest Custom Investment Ideas: Test the viability of your investment ideas by creating and backtesting custom indexes.

- Financial Enthusiasts Aiming to Share and Compare Investment Themes: Share your investment strategies with the Public.com community and compare your index’s performance.

Pros & Cons

Like any tool, Generated Assets has its strengths and weaknesses. Let’s break them down:

Advantages

- Empowers users with personalized investment tools, allowing for greater control over their investment strategies.

- Simplifies the creation of thematic indexes, making it easier to invest in specific sectors or trends.

- Enhances engagement through sharing and comparison features, fostering a community of investors.

Disadvantages

- Currently does not support direct investment through the platform, requiring users to implement their strategies elsewhere.

- May require financial literacy to interpret results effectively, as understanding index performance and risk metrics is crucial.

How Does It Compare?

When considering alternatives to Generated Assets, it’s important to understand the landscape of thematic and personalized investing.

- Motif Investing: Previously offered thematic investing but ceased operations, leaving a gap in the market that Generated Assets aims to fill.

- ETFs: Provide thematic exposure but lack the customization offered by Generated Assets, as they are pre-defined and cannot be tailored to individual preferences.

- Robo-advisors: Offer automated investing but may not support user-defined themes, focusing instead on broad market diversification.

Final Thoughts

Generated Assets offers a compelling way to personalize your investment strategy and explore thematic investing. While it doesn’t yet offer direct investment capabilities, its powerful AI-driven index creation and backtesting features make it a valuable tool for investors seeking greater control and customization. If you’re looking to express your investment ideas in a tangible way and engage with a community of like-minded individuals, Generated Assets is definitely worth exploring.