Table of Contents

Overview

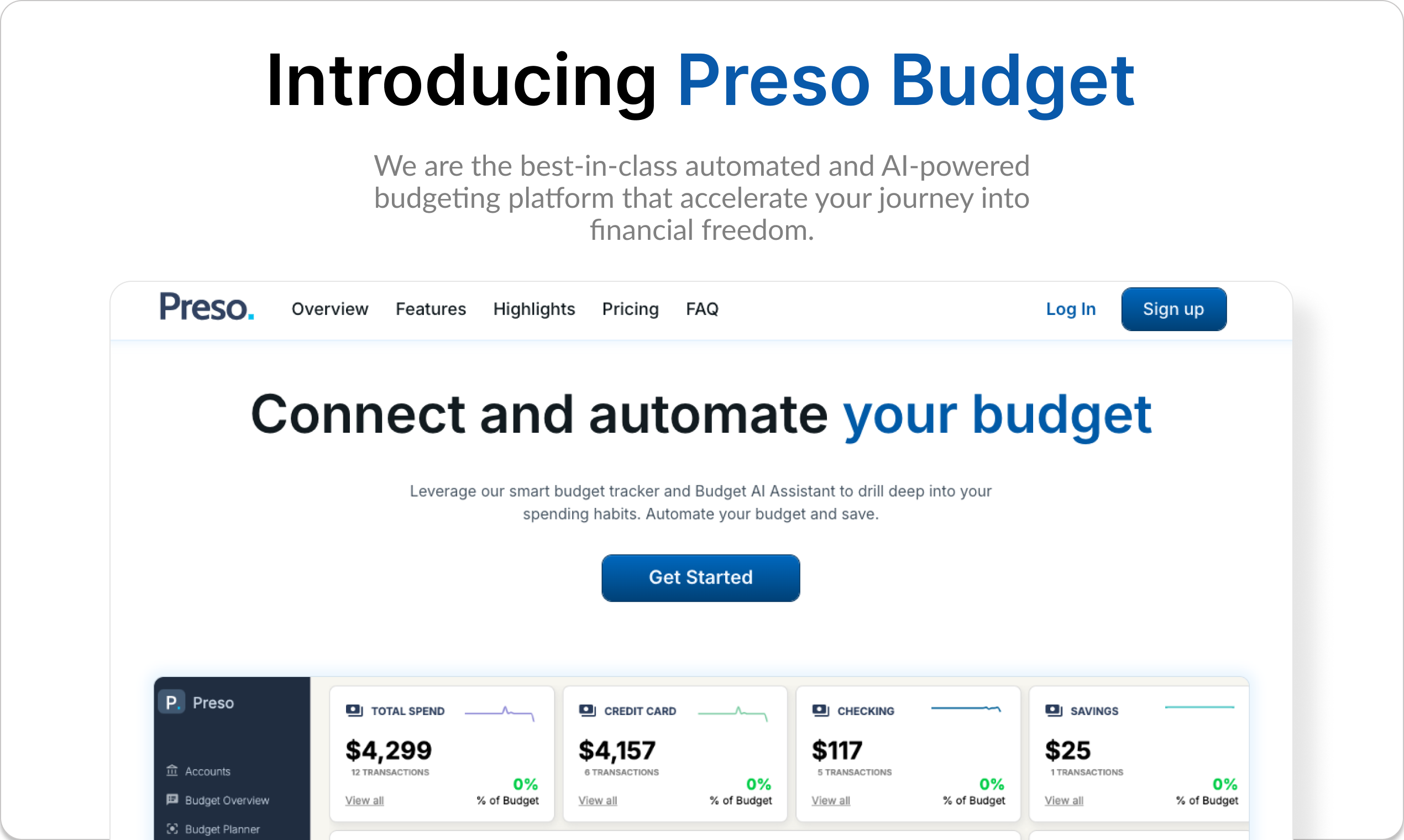

Struggling to get a handle on your finances? The hardest part of saving money often lies in truly understanding your spending habits and taking decisive control. Our latest review dives into an innovative, AI-powered budgeting platform designed to transform this challenge into an opportunity. Founded in 2023 and based in San Francisco, Preso Budget provides a comprehensive 360-degree view of your finances and automatically generates a customizable framework, empowering you to take charge of your money with unprecedented ease and insight.

Launched on ProductHunt in July 2025 and achieving a respectable #14 daily ranking, Preso Budget represents the latest evolution in AI-driven personal finance management, offering users a fully automated approach to budgeting that removes traditional barriers to financial control.

Key Features

This powerful platform comes packed with features designed to simplify your financial life and foster healthy money habits through intelligent automation and personalization.

- Automated Budgeting Framework: Say goodbye to manual budget creation. The platform automatically generates a personalized budget based on your unique spending patterns and financial goals, analyzing your baseline spending across all linked accounts to create actionable insights.

- 360-Degree Financial View: Gain a complete, holistic perspective of all your financial accounts, transactions, and assets in one centralized dashboard that provides real-time updates and comprehensive financial health monitoring.

- AI-Powered Expense Analysis: Leverage advanced artificial intelligence to categorize your spending automatically, identify meaningful trends, and pinpoint specific areas where you can optimize your financial habits more effectively.

- Customizable Budget Templates: While the AI provides an intelligent starting point, you maintain complete flexibility to tailor budget templates to perfectly fit your lifestyle, financial objectives, and personal preferences.

- Real-time Tracking and Insights: Monitor your spending and budget adherence in real-time through automated workflows and AI-driven analysis, ensuring you’re always aware of your current financial standing and progress toward goals.

- Interactive Data Features: Access the innovative chat-with-your-data feature (currently in beta) that allows you to ask natural language questions about your transactions, account details, and spending patterns for deeper financial insights.

How It Works

Getting started with this AI-powered budgeting tool is designed to be intuitive, secure, and streamlined, reducing the traditional complexity of financial management to a simple, automated process.

Users begin by securely connecting their bank accounts and other relevant financial data sources through bank-grade encryption protocols. Once connected, Preso Budget’s sophisticated AI engine analyzes your historical spending habits, income patterns, and financial behaviors to automatically generate a custom budget framework tailored specifically to your financial situation. The platform distinguishes between essential and non-essential expenses, providing clear categorization and spending recommendations.

Throughout your financial journey, users receive proactive insights through pre-defined AI workflows, timely alerts, and personalized recommendations that help identify savings opportunities, adjust spending behaviors, and maintain progress toward financial goals without requiring manual data entry or constant oversight.

Use Cases

The versatility of this AI budgeting platform makes it suitable for a wide range of individuals and financial situations, offering tailored solutions that adapt to diverse lifestyle needs and financial objectives.

- Individuals Managing Personal Finances: Perfect for anyone seeking to gain meaningful control over personal spending, build consistent savings habits, and achieve financial independence through automated guidance and intelligent insights.

- Families Tracking Household Spending: Helps households consolidate complex family finances, track shared expenses across multiple accounts, and manage collective budgets efficiently while accommodating different spending priorities and family financial goals.

- Students Learning Financial Discipline: Provides a practical, AI-guided approach for students to understand fundamental budgeting principles, manage limited funds effectively, and build responsible financial habits early in their financial journey.

- Freelancers Managing Variable Incomes: Offers a flexible, intelligent framework to manage fluctuating income streams, plan strategically for leaner months, and optimize savings strategies while adapting to irregular cash flow patterns.

- Small Business Owners: Enables entrepreneurs and small business owners to manage both personal and business finances efficiently, track business expenses, and maintain clear financial boundaries between personal and professional spending.

Pros \& Cons

Like any sophisticated financial tool, this AI budgeting platform comes with distinct advantages and important considerations for potential users.

Advantages

- Comprehensive Automation: Significantly reduces the time and effort traditionally required to create, maintain, and optimize a budget through intelligent AI workflows and automatic categorization systems.

- Advanced Personalization: Budgets are intelligently tailored to individual spending habits, financial situations, and personal goals rather than following generic templates or one-size-fits-all approaches.

- Habit Development Support: Through real-time tracking, intelligent insights, goal setting, and personalized recommendations, the platform actively encourages and facilitates the development of strong, sustainable saving and spending habits.

- Accessibility and Ease of Use: Removes traditional barriers to effective budgeting by automating complex processes and providing clear, actionable insights without requiring extensive financial knowledge.

Disadvantages

- Account Linking Requirements: To leverage its full AI capabilities, users must securely link their bank accounts and financial data sources, which may concern privacy-conscious individuals despite bank-grade security measures.

- Subscription-Based Model: While offering a 14-day free trial, ongoing access to advanced features requires a monthly subscription at \$7.99, which represents a 60% premium compared to similar basic personal finance software.

- Beta Feature Limitations: Some advanced features like the chat-with-your-data functionality are currently in beta testing, potentially limiting immediate access to full feature sets.

How Does It Compare?

When evaluating AI-powered budgeting tools in 2025, it’s essential to understand how Preso Budget positions against the current competitive landscape, which has evolved significantly following major market changes and new platform entries.

Compared to YNAB (You Need A Budget): YNAB remains the gold standard for proactive, zero-based budgeting with its philosophy of “giving every dollar a job.” However, YNAB requires significant manual input and active budget management, with pricing at \$14.99 monthly or \$109 annually. Preso Budget offers superior automation and AI-driven insights at a lower price point (\$7.99/month), making advanced budgeting more accessible while requiring less hands-on management.

Compared to Monarch Money: Monarch Money excels in comprehensive wealth tracking, investment monitoring, and collaborative budgeting for couples, priced at \$14.99 monthly or \$99.99 annually. While Monarch offers broader financial services including net worth tracking and investment analysis, Preso Budget focuses specifically on AI-powered budgeting automation, providing more targeted and affordable solutions for users primarily seeking budgeting assistance rather than comprehensive wealth management.

Compared to PocketGuard: PocketGuard simplifies budgeting by showing available spending money after bills and goals, with pricing at \$12.99 monthly for Plus features. Both platforms emphasize simplicity, but Preso Budget’s AI-driven analysis and automated framework generation provide more sophisticated insights and planning capabilities, while PocketGuard focuses primarily on spending control and basic categorization.

Compared to the discontinued Mint: Since Mint’s discontinuation in October 2023 and integration into Credit Karma, former Mint users seeking AI-powered alternatives will find Preso Budget offers superior automation compared to Mint’s primarily tracking-focused approach. While Mint provided broader financial tools including credit monitoring, Preso Budget’s specialized AI budgeting focus delivers more targeted and actionable financial planning capabilities.

Final Thoughts

Preso Budget represents a compelling advancement in AI-powered personal finance management, successfully addressing the common pain points that prevent many people from maintaining effective budgets. By leveraging artificial intelligence to automate budgeting, provide comprehensive financial insights, and offer personalized guidance, it transforms the traditionally daunting task of financial planning into an accessible and empowering experience.

The platform’s combination of sophisticated AI analysis, user-friendly automation, and competitive pricing positions it well in the evolving personal finance technology landscape. While it requires account linking and operates on a subscription model, its ability to deliver meaningful financial insights, build sustainable money habits, and provide actionable recommendations makes it a valuable investment for users serious about improving their financial health.

As the personal finance industry continues embracing AI-driven solutions, Preso Budget’s focused approach to budgeting automation, combined with its strong ProductHunt validation and growing user base, suggests significant potential for users seeking to move beyond passive expense tracking toward proactive, intelligent financial management. For individuals, families, and professionals looking to gain genuine control over their money through cutting-edge technology, Preso Budget offers a compelling solution that balances sophisticated AI capabilities with practical, everyday usability.