Table of Contents

Overview

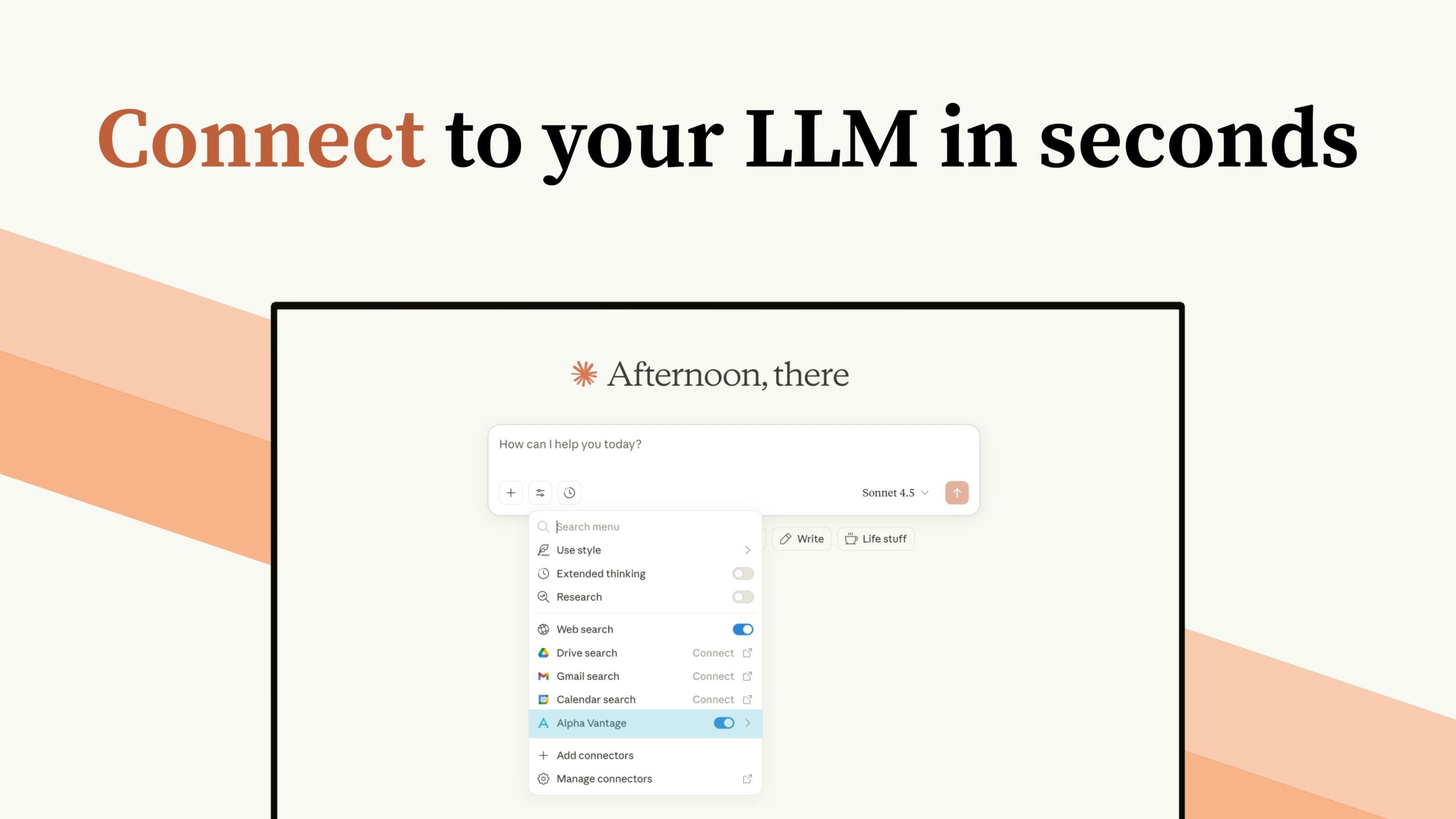

In the rapidly evolving world of financial technology, connecting large language models and AI agents to live market data represents a significant capability gap. Alpha Vantage MCP bridges this gap by enabling LLMs and agentic tools to access comprehensive real-time and historical financial market data through the Model Context Protocol, an emerging standard for AI tool integration. This connection happens seamlessly—in approximately 30 seconds, you can integrate your preferred LLM with access to real-time equities, options data, cryptocurrency markets, foreign exchange, commodities, fundamental company data, economic indicators, and extensive technical analysis signals. This rapid setup enables immediate financial data analysis without complex integration engineering.

Key Features

Alpha Vantage MCP delivers a comprehensive toolkit specifically designed for LLM-driven financial analysis. These features establish it as a practical solution for teams integrating AI with financial markets:

- Real-time market data streaming: Instant access to live price updates, trading volumes, and market movements across various financial instruments, ensuring analysis always reflects current market conditions.

- Comprehensive asset coverage: Access real-time and historical data across equities (stocks), cryptocurrency markets, foreign exchange (forex), commodities, and other asset classes through a unified interface.

Technical and fundamental data richness: Includes extensive technical analysis indicators plus fundamental company data, economic indicators, and historical time series spanning 20+ years for deep analytical work.

50+ technical indicators: Leverage a comprehensive catalog of technical analysis signals including moving averages, RSI, MACD, Bollinger Bands, and other indicators for sophisticated market analysis and pattern identification.

Seamless LLM integration: Designed specifically for Model Context Protocol compatibility, integrating directly with Claude, Claude Code, Cursor, VS Code, and other AI-capable applications without requiring complex API configuration.

Fundamental and macro data: Access company financial statements, earnings data, economic indicators, and other fundamental metrics alongside market prices for comprehensive analysis.

How It Works

Alpha Vantage MCP operates through a straightforward workflow designed for both quick prototyping and sophisticated analysis. The process involves three key steps:

First, you connect your chosen LLM or AI application to the Alpha Vantage MCP server. This connection can use either the remote server endpoint or local deployment, depending on your infrastructure preferences. Setup requires minimal configuration—typically just providing your Alpha Vantage API key.

Second, once connected, the LLM gains immediate access to Alpha Vantage’s complete financial data library. The Model Context Protocol handles the communication layer, translating natural language requests from your LLM into structured queries against the Alpha Vantage backend and formatting responses in formats optimized for AI processing.

Third, your LLM or agent can then query financial data, analyze market conditions, and generate insights conversationally. For example, you could ask your LLM to analyze a stock’s technical indicators, compare performance across sectors, identify market trends, or synthesize data for investment decisions—all with direct access to live financial data rather than relying on training data cutoffs.

Use Cases

Alpha Vantage MCP’s flexibility makes it valuable across multiple financial and research scenarios:

- Quantitative analysis and backtesting: Conduct sophisticated market analysis using historical data combined with AI-driven insights. LLMs can synthesize complex datasets, identify patterns, and generate analytical reports at scale.

Conversational financial analysis: Query financial data through natural language. Ask your AI assistant questions about market trends, individual stock performance, sector comparisons, or technical patterns—receiving intelligent analysis in response.

Automated investment research: Deploy AI agents that continuously monitor markets, analyze emerging patterns, and generate research summaries or trading signals based on real-time data.

Educational and prototyping platforms: Build financial education applications or rapidly prototype trading strategies without infrastructure complexity. The 30-second setup enables experimentation.

Market intelligence and monitoring: Stream real-time market data to AI systems that identify significant events, anomalies, or opportunities requiring human attention.

Pros & Cons

Advantages

Alpha Vantage MCP offers several compelling benefits for financial AI applications:

- Rapid LLM integration: Connecting your AI to live financial data typically takes less than a minute, significantly faster than traditional API integration approaches.

Comprehensive data breadth: Eliminates the need to juggle multiple financial data APIs. Stocks, crypto, forex, commodities, fundamentals, and technical indicators are available through one unified interface.

Developer-friendly MCP standard: Uses the emerging Model Context Protocol, a standard designed specifically for LLM integration, simplifying long-term maintainability and compatibility with evolving AI tools.

Generous free tier: Provides free access to core functionality, lowering barriers for experimentation, research, and prototype development.

20+ years of historical data: Extensive historical time series enable robust backtesting and long-term trend analysis.

Disadvantages

While powerful for specific use cases, Alpha Vantage MCP has meaningful limitations:

- Rate limiting on free tier: Free account includes API call rate limits, which may constrain heavy analysis workloads. Paid tiers remove or increase these limits.

Requires API key management: Users must manage Alpha Vantage API credentials securely and have some familiarity with API concepts for advanced configurations and customization.

Different specialization than competitors: Unlike platforms focused exclusively on deep fundamental analysis (like Financial Modeling Prep) or ultra-low-latency trading data (like Polygon.io), Alpha Vantage provides general-purpose breadth rather than specialization in specific domains.

MCP is still emerging: The Model Context Protocol is relatively new. Long-term platform support, feature additions, and community ecosystem growth remain uncertain, though major AI platforms are adopting it.

How Does It Compare?

Alpha Vantage MCP operates in a expanding competitive landscape. Understanding how it compares to alternatives helps determine which tool best fits specific use cases.

Finnhub MCP Server (launched May 2025) represents the most direct competitive alternative. Both provide MCP-native financial data integration with LLMs. Finnhub emphasizes institutional-grade real-time data and offers market news alongside pricing data. The choice between Alpha Vantage and Finnhub often depends on specific data needs—Alpha Vantage provides broader technical indicator coverage, while Finnhub emphasizes news sentiment and professional-grade data quality.

IEX Cloud offers the broadest financial data platform with 200+ datasets, including equities, crypto, forex, news, and alternative data. IEX Cloud provides more data diversity but requires traditional API integration rather than MCP. It serves organizations prioritizing maximum data breadth and sophistication over ease-of-integration.

Polygon.io specializes in low-latency, tick-level market data with WebSocket support for reactive systems. Polygon’s strength lies in performance for high-frequency use cases and developer-focused architecture. For quantitative trading requiring minimal latency (20ms average), Polygon outperforms Alpha Vantage, though it lacks the quick LLM integration that Alpha Vantage provides.

Yahoo Finance (via community-maintained yfinance library) provides free historical data and basic fundamentals but lacks official API support. Yahoo Finance works well for basic educational analysis but doesn’t offer the real-time capabilities or institutional-grade reliability needed for professional applications.

Quandl remains functional for financial data access but has reduced market prominence since its acquisition and now serves primarily specialized research use cases.

Finnhub API (non-MCP) offers professional-grade financial data including news sentiment and earnings, suitable for teams preferring traditional REST APIs over MCP integration.

Alpha Vantage MCP’s actual competitive advantages center on rapid LLM integration through MCP standard support, comprehensive general-purpose data coverage at no up-front cost, and extensive technical indicator libraries. It’s optimally positioned for teams prioritizing quick AI integration and general financial analysis over specialization in narrow domains or ultra-low-latency requirements.

Final Thoughts

Alpha Vantage MCP represents a practical solution for connecting AI systems to live financial markets with minimal friction. For teams building conversational financial analysis applications, automated research tools, or educational platforms, the combination of rapid setup, comprehensive data coverage, and MCP standard compatibility creates genuine advantages.

The platform’s primary strength lies in democratizing LLM access to financial data, enabling experimentation and prototyping without substantial infrastructure investment. Its comprehensive data coverage—spanning equities, crypto, forex, commodities, fundamentals, and technical analysis signals—eliminates the integration complexity of combining multiple specialized APIs.

Users should note that Alpha Vantage MCP sits in the “broad general-purpose” quadrant of the market rather than claiming superiority in specialized domains. For high-frequency trading, ultra-deep fundamental analysis, or professional institutional requirements, more specialized alternatives exist. But for teams seeking to integrate AI with financial markets quickly and cost-effectively, Alpha Vantage MCP merits serious consideration as part of the financial AI toolchain.