Table of Contents

Overview

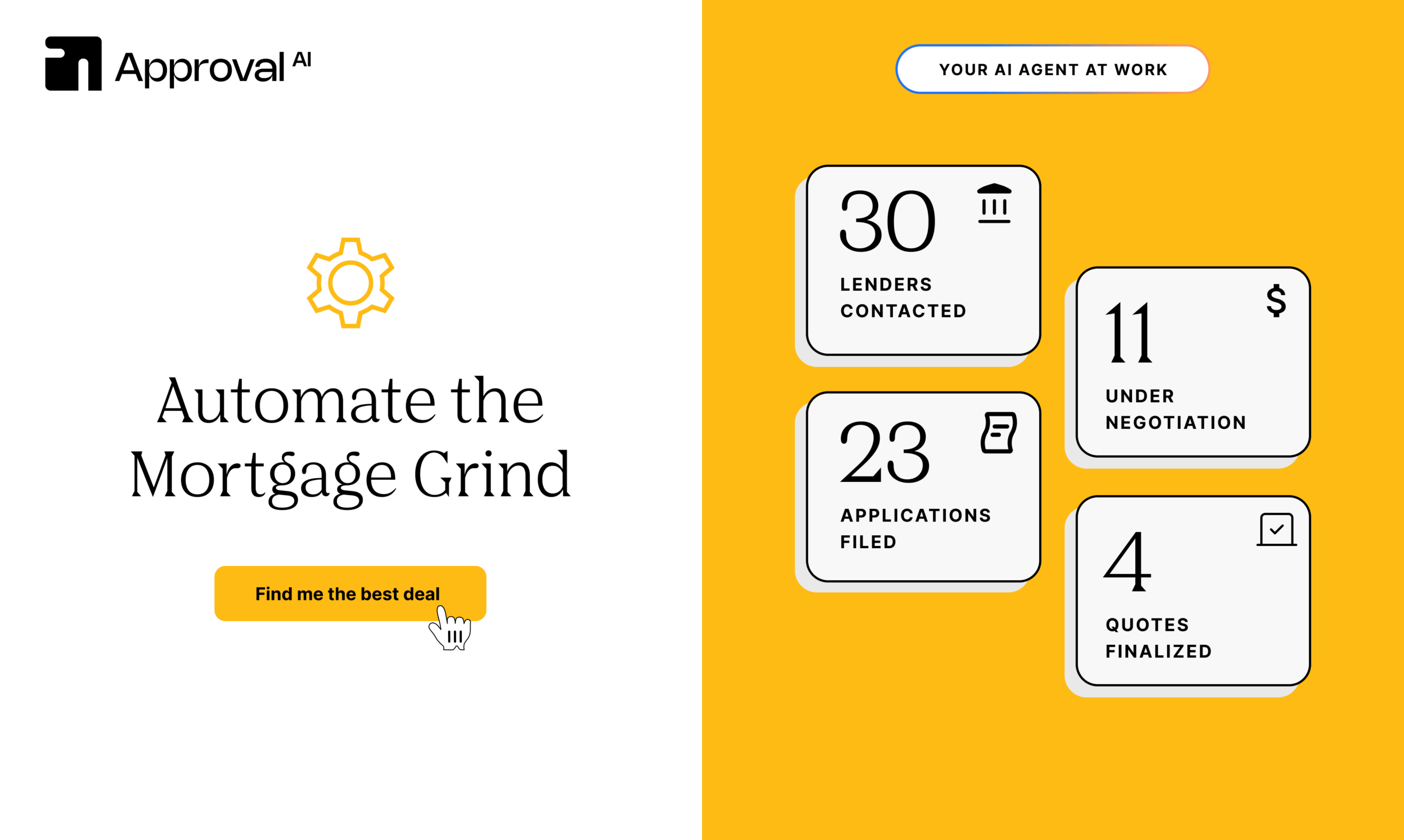

Buying a home can be one of the most stressful experiences in life. Juggling paperwork, comparing rates, and negotiating terms can feel overwhelming. But what if AI could step in and simplify the entire process? That’s the promise of Approval AI, the first AI-powered mortgage platform in the U.S. designed to streamline the homebuying journey. Let’s dive into what Approval AI offers and whether it’s the right tool for you.

Key Features

Approval AI boasts a range of features designed to make securing a mortgage easier than ever:

- AI-powered mortgage automation: Automates the pre-approval process, saving you time and effort.

- Document digitization: Converts physical documents into digital formats, simplifying organization and sharing.

- Rate comparison engine: Compares mortgage rates from multiple lenders to help you find the best deal.

- Negotiation assistance: Provides AI-driven insights to help you negotiate better mortgage terms.

- Real-time status tracking: Keeps you informed about the progress of your mortgage application every step of the way.

How It Works

Approval AI aims to simplify the mortgage process from start to finish. Users begin by signing up on the Approval AI platform. Next, they upload necessary documents, such as pay stubs and bank statements, and input their financial information. The AI engine then takes over, automating the pre-approval process. It compares rates from a wide range of lenders, presenting you with the best options available. Finally, Approval AI provides assistance in negotiating terms, helping you secure the most favorable mortgage possible.

Use Cases

Approval AI offers benefits to a variety of users:

- First-time homebuyers: Simplifies the complex process of securing a first mortgage.

- Mortgage refinancing: Streamlines the refinancing process to help homeowners secure better rates.

- Financial planning: Provides insights into mortgage options to aid in long-term financial planning.

- Streamlining broker operations: Automates tasks for mortgage brokers, increasing efficiency.

- Loan comparison shopping: Allows users to easily compare loan options from different lenders.

Pros & Cons

Like any tool, Approval AI has its strengths and weaknesses. Let’s take a look at the advantages and disadvantages.

Advantages

- Time-saving and efficient: Automates many tasks, significantly reducing the time required to secure a mortgage.

- Transparent rate comparisons: Provides clear comparisons of rates from multiple lenders, empowering informed decision-making.

- Reduces paperwork burden: Digitizes documents, eliminating the need for physical paperwork.

Disadvantages

- May not cover all lenders: The platform may not include every lender in its rate comparisons, potentially missing some options.

- Less personalized than human brokers: While efficient, it may lack the personalized touch of a traditional mortgage broker.

How Does It Compare?

When considering AI-powered mortgage platforms, it’s important to look at the competition. Better.com offers a broader ecosystem with the added benefit of human advisors, providing a blend of AI and personalized support. Rocket Mortgage is a more established player with deeper lender integration, offering a wide range of mortgage products. Approval AI differentiates itself by focusing specifically on AI-powered automation and negotiation assistance.

Final Thoughts

Approval AI offers a promising solution for simplifying the often-complicated mortgage process. Its AI-powered automation, rate comparison engine, and negotiation assistance can save time and potentially secure better mortgage terms. While it may not replace the personalized touch of a human broker for everyone, it’s a valuable tool for those seeking a more efficient and transparent mortgage experience. If you’re comfortable with a tech-driven approach, Approval AI is definitely worth considering.