Table of Contents

Overview

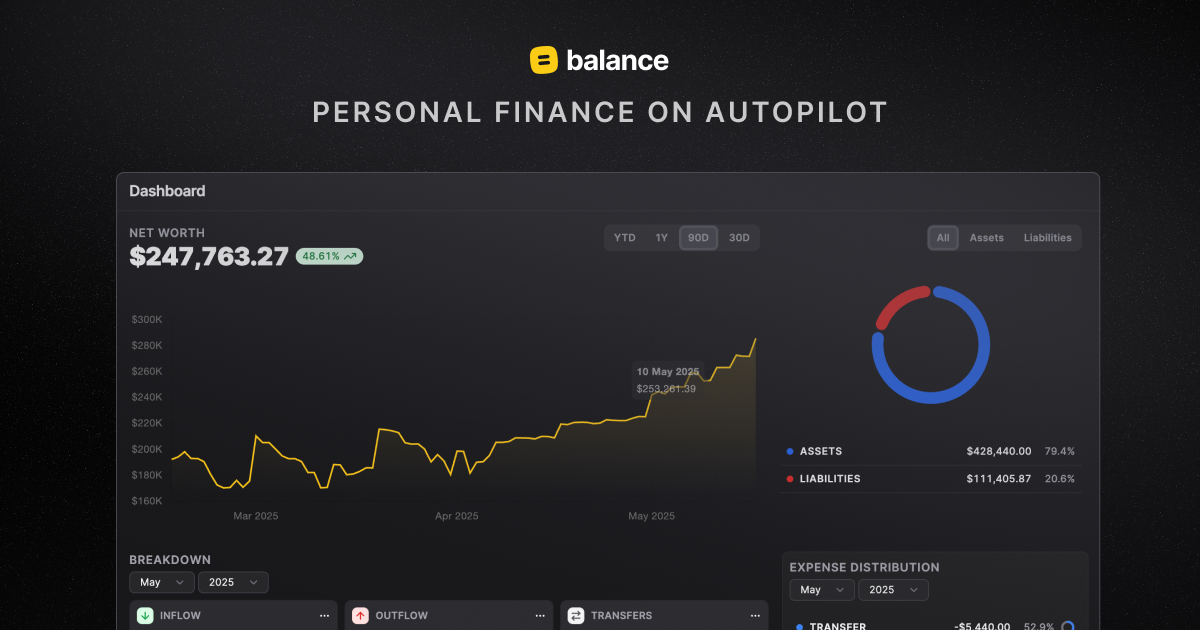

Are you tired of complicated spreadsheets and confusing financial jargon? Balance offers a refreshing approach to personal finance, promising to simplify your money management with its intuitive design and automated features. This modern app aims to give you a clear, holistic view of your financial health, empowering you to make smarter decisions and achieve your financial goals. Let’s dive into a comprehensive review of Balance and see if it lives up to its promise.Key Features

Balance boasts a streamlined set of features designed to make personal finance less of a chore. Here’s a breakdown:- Spending Tracker: Automatically tracks your expenses by categorizing transactions from linked accounts, giving you a clear picture of where your money is going.

- Budget Management: Allows you to set monthly budgets for various categories and monitor your progress, helping you stay on track with your financial goals.

- Financial Insights Dashboard: Presents your financial data in visually appealing charts and graphs, providing valuable insights into your spending habits and overall financial health.

- Clean UI: Offers a user-friendly interface that is easy to navigate and understand, even for those new to personal finance apps.

- Automated Categorization: Automatically categorizes transactions, saving you time and effort compared to manual tracking methods.

How It Works

Balance simplifies personal finance by automating much of the tedious work. The process begins with securely linking your financial accounts – bank accounts, credit cards, and investment accounts – to the app. Once linked, Balance automatically imports your transaction data and categorizes each transaction based on the merchant and type of purchase. You can then set monthly budgets for different spending categories. The app tracks your expenses against these budgets, providing visual insights and alerts to help you stay on track. This allows you to easily monitor your spending habits and make informed decisions about your money.Use Cases

Balance is a versatile tool that can be applied to various personal finance scenarios:- Daily Expense Tracking: Monitor your daily spending to identify areas where you can cut back and save money.

- Monthly Budget Planning: Create and manage monthly budgets to ensure you’re staying within your financial limits.

- Financial Goal Monitoring: Track your progress towards specific financial goals, such as saving for a down payment on a house or paying off debt.

- Spending Habit Analysis: Analyze your spending patterns to identify trends and make adjustments to improve your financial health.

- Personal Finance Education: Gain a better understanding of your finances through visual insights and data-driven analysis.

Pros & Cons

Like any tool, Balance has its strengths and weaknesses. Let’s take a look:Advantages

- Simple and intuitive UI makes it easy to use, even for beginners.

- Time-saving automation eliminates the need for manual transaction tracking.

- Holistic view of finances provides a comprehensive understanding of your financial health.

- Visual insights help you identify spending patterns and make informed decisions.

Disadvantages

- Requires linking your financial accounts, which may be a concern for some users.

- Feature set may be basic for power users who need more advanced financial planning tools.

- Currently has limited support for non-US banks, restricting its usability for international users.