Table of Contents

Overview

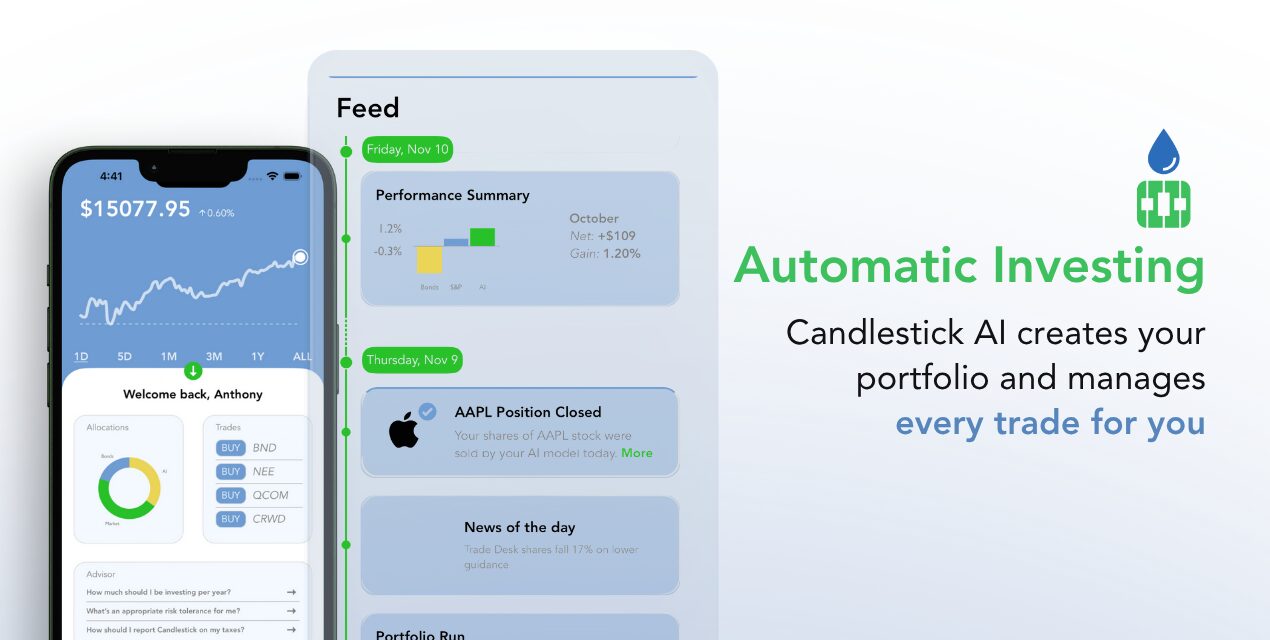

Navigating the complex world of investments often feels overwhelming, filled with complicated data analysis and impenetrable financial jargon. Candlestick represents a breakthrough in AI-powered financial advisory services, designed to democratize sophisticated investing strategies previously available only to institutional investors and hedge funds. This intelligent platform combines automated portfolio management with transparent, narrative-driven explanations, ensuring users understand both the “what” and “why” behind every investment decision while building personalized wealth-building strategies.

Key Features

Discover the comprehensive functionalities that establish Candlestick AI as a transformative investment management solution:

- AI-powered portfolio management: Utilizes advanced machine learning algorithms to analyze thousands of stocks, integrating financial data, market news, and technical indicators for intelligent portfolio construction and ongoing optimization

- Narrative investment explanations: Delivers clear, story-based investment reports that translate complex market movements and investment decisions into accessible language, eliminating dependency on traditional spreadsheets

- Real-time monitoring and optimization: Continuously tracks market conditions and portfolio performance with daily reviews, implementing automatic adjustments to maintain optimal growth trajectories

- Transparent performance insights: Provides comprehensive visibility into portfolio performance metrics, risk assessments, and decision-making rationale through an intuitive dashboard interface

- Conversational AI advisor: Features an integrated GPT-4-powered chatbot that answers investment questions, analyzes company earnings, provides market insights, and offers personalized financial guidance

- Automated rebalancing: Maintains target asset allocations through intelligent rebalancing mechanisms that respond to market volatility and performance deviations

How It Works

Candlestick streamlines the entire investment process through seamless integration with existing brokerage accounts via partnerships with SEC-registered custodians like Alpaca Securities LLC. Once connected, users complete a brief assessment of their financial goals, risk tolerance, and investment preferences. The platform’s sophisticated AI algorithms then construct a personalized portfolio, continuously analyzing market conditions, business news, and technical indicators to identify investment opportunities and execute trades automatically. Through its proprietary “Smart Weighting” methodology, the system manages portfolio allocations while providing detailed, narrative-driven reports explaining each decision, ensuring users remain informed without requiring constant oversight.

Use Cases

Candlestick’s versatile platform addresses diverse investment scenarios and user profiles:

- Retail investing automation: Ideal for individual investors seeking professional-grade portfolio management without traditional advisory fees or minimum balance requirements

- Passive wealth building: Perfect for long-term investors who prefer automated growth strategies with minimal manual intervention while maintaining full transparency

- Financial literacy development: Serves as an educational tool through detailed investment explanations that help users understand market dynamics and investment principles

- Busy professional solutions: Provides comprehensive investment management for time-constrained individuals who need their portfolios actively managed without constant attention

- Beginning investor guidance: Offers an accessible entry point into sophisticated investing with clear explanations and gradual complexity introduction

- Goal-based investing: Supports specific financial objectives through customizable investment strategies aligned with individual timelines and risk profiles

Pros \& Cons

Understanding Candlestick’s strengths and limitations enables informed decision-making:

Advantages

- Institutional-grade AI technology: Provides access to advanced investment algorithms traditionally limited to hedge funds and professional money managers

- Transparent decision-making: Offers detailed explanations for every investment choice, promoting financial literacy and building user confidence in automated decisions

- Comprehensive automation: Eliminates the need for manual portfolio management while maintaining full transparency and user control over investment parameters

- Low barrier to entry: Requires no minimum investment amount and charges competitive fees starting at \$6 monthly plus 1.25% annual AUM fee

- Integrated financial guidance: Combines portfolio management with conversational AI support for comprehensive financial planning assistance

Disadvantages

- Limited advanced customization: May not satisfy experienced investors seeking granular control over individual security selection or complex trading strategies

- Relatively new platform: As an emerging service, it lacks the extensive track record and comprehensive feature set of established robo-advisors

- Dependency on AI decisions: Users seeking more conservative, human-verified investment approaches may prefer traditional advisory services

- Market volatility exposure: Like all investment platforms, subject to market risks and potential performance variations during economic downturns

How Does It Compare?

In the competitive landscape of AI-powered investment platforms, Candlestick distinguishes itself against established market leaders:

Wealthfront manages over \$75 billion in assets and offers comprehensive features including tax-loss harvesting, direct indexing for accounts over \$100,000, and Smart Beta strategies for accounts exceeding \$500,000. While both platforms charge 0.25% management fees, Wealthfront provides more advanced tax optimization tools and requires a \$500 minimum investment compared to Candlestick’s no-minimum approach.

Betterment oversees \$45.9 billion in assets under management and provides goal-based investing with optional human advisor access through its Premium tier (0.65% fee). While Betterment offers more established customer service and comprehensive financial planning tools, Candlestick’s focus on AI-driven narrative explanations provides unique educational value for users seeking investment understanding.

SoFi Automated Investing charges a 0.25% management fee with a \$50 minimum and provides access to certified financial planners. However, it lacks tax-loss harvesting capabilities that many competitors offer, while Candlestick focuses on AI-powered insights and automated decision-making.

Empower Personal Strategy (formerly Personal Capital) requires a \$100,000 minimum and charges 0.89% annually but provides dedicated human advisors and comprehensive wealth management services. This represents a more traditional hybrid model compared to Candlestick’s purely AI-driven approach.

Acorns specializes in micro-investing through round-up features and charges monthly fees ranging from \$3-12, serving beginning investors with smaller account balances but offering less sophisticated portfolio management than Candlestick’s institutional-grade algorithms.

The robo-advisor market, valued at approximately \$10.86 billion in 2025 and projected to reach \$69.32 billion by 2032, continues evolving toward AI-enhanced platforms. Candlestick’s unique positioning combines institutional-quality investment algorithms with educational transparency, appealing to investors seeking both automated management and financial literacy development.

Final Thoughts

Candlestick AI represents a significant advancement in democratizing sophisticated investment management, making institutional-grade algorithms accessible to individual investors regardless of account size. By prioritizing transparency through narrative-driven explanations, the platform bridges the gap between automated efficiency and user understanding, creating an educational investment experience that builds both wealth and financial literacy. While the platform may not satisfy advanced investors seeking granular control or extensive human advisor access, it excels in providing intelligent, automated portfolio management with unprecedented transparency. As the robo-advisory industry continues expanding, Candlestick’s focus on AI-powered education and institutional-quality algorithms positions it as a compelling choice for investors seeking professional-grade automation combined with clear, accessible investment insights.