Table of Contents

Overview

Cranston AI redefines accounting service delivery by operating as a full-stack autonomous accounting firm rather than software vendor or accounting tool provider. Founded by Max (formerly ran profitable accounting firm for five years) and Sean (ERP infrastructure background), Cranston launched publicly in November 2025 following YC S25 batch. The platform automatically handles bookkeeping, reconciliation, tax compliance, and financial reporting—processing 1.2M daily transactions across 147 active integrations—with every transaction supervised by licensed CPAs and 99.8% reconciliation match accuracy. Unlike accounting software requiring users to manage workflows, or chatbots overlaying basic automation on spreadsheets, Cranston operates as your accounting firm, charging $300+ monthly based on transaction volume, delivering 70% cost reduction versus traditional $1,500+ monthly accounting firms while handling month-end close in hours instead of weeks.

Key Features

Cranston combines proprietary AI specifically trained on accounting workflows with licensed CPA supervision:

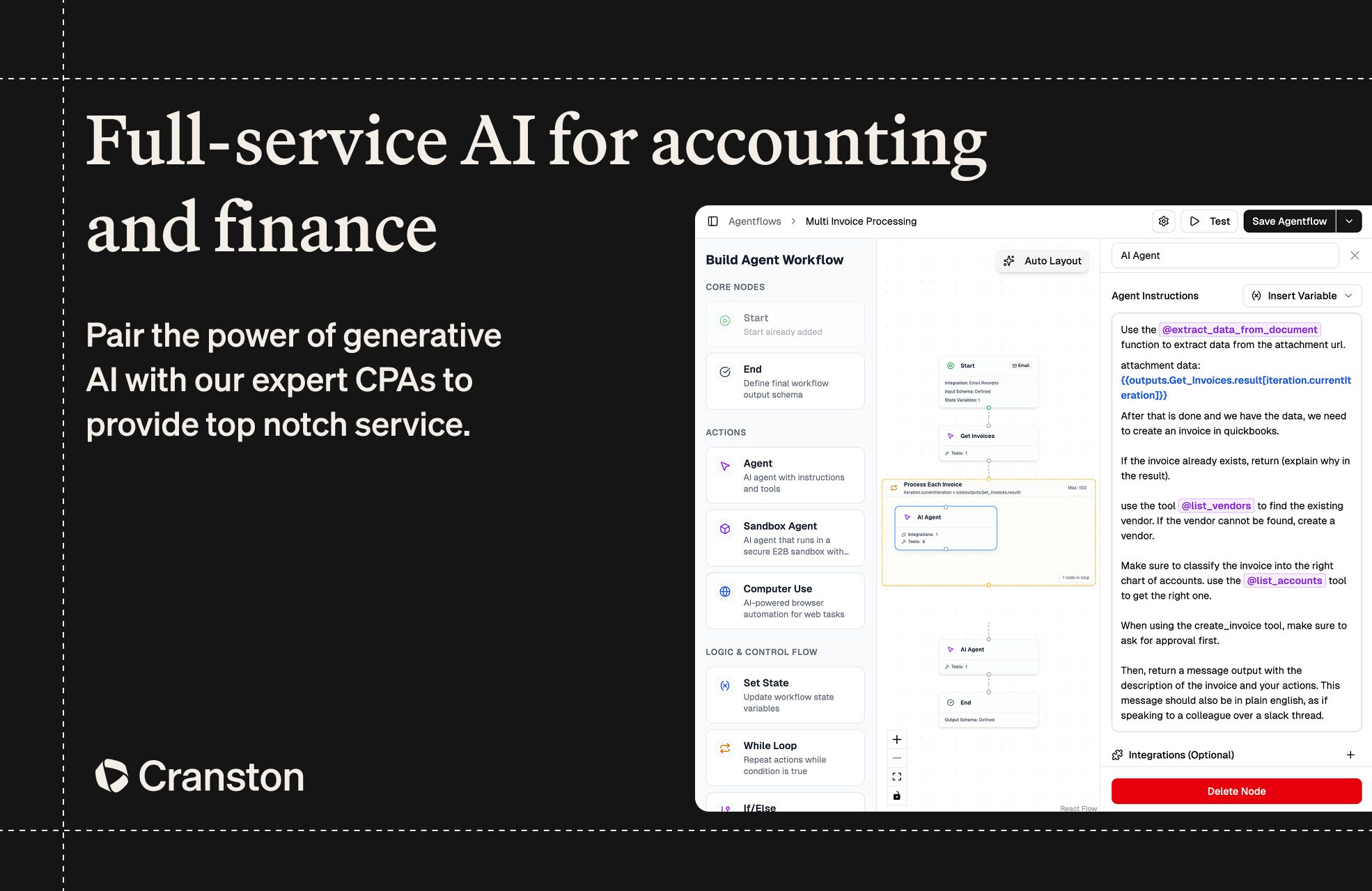

- Autonomous Transaction Processing: Purpose-built AI (not generic LLMs) trained on GAAP/IFRS compliance patterns and real accounting workflows automatically categorizes transactions, reconciles accounts, and detects anomalies with 99.8% accuracy. AI understands context—distinguishing between “Recurring Payment” vs. “Debit Card” for same vendor, identifying AWS charges as “Infrastructure > Cloud Services” by referencing contract terms and budget allocations.

- End-to-End Workflow Automation: Complete automation from data import through financial reporting—bank and card transaction matching, invoice processing (PDF extraction → ERP validation → approval routing), payroll processing, month-end close, tax preparation, and financial statement generation. What traditionally takes 3 days (month-end close) completes in 3 hours.

Licensed CPA Supervision: Every transaction and process supervised by licensed CPAs specializing in tax law and GAAP/IFRS regulations. AI outputs are cross-validated against audit trails and compliance requirements. Unlike pure AI systems, Cranston guarantees accuracy through binding professional oversight.

Non-Disruptive Integration: Connects directly to existing ERPs (QuickBooks, NetSuite, SAP, Xero) and systems through API-based integrations without requiring infrastructure replacement or data migration. Maintains bidirectional synchronization with bank accounts, credit cards, and payment processors for real-time updates.

Real-Time Financial Dashboards: Live P&L margins, cash flow runway tracking, accounts receivable aging analysis, and expense breakdowns. Monitor automated workflows including invoice processing progress and bank reconciliation status in real time with point-in-time restore capabilities.

Anomaly Detection and Compliance: Smart flagging identifies duplicate entries, timing discrepancies, unusual transactions, and fraud indicators automatically. System flags mismatches for CPA resolution with annotated reports explaining variances (e.g., “$125 Office Depot duplicate flagged” with context).

Enterprise-Grade Security: SOC 2 Type II certification, AES-256 encryption for all financial data, AICPA compliance, bank-level security protocols, and 24/7 transaction monitoring with 99.99% uptime SLA across 1.2M daily transactions.

Direct Service Model: Cranston operates as your accounting firm, not software vendor. No software to buy, install, or manage. No IT infrastructure overhead. Clients engage directly with Cranston as service provider, receiving results through their dashboard without managing underlying systems.

How It Works

Cranston operates as a fully integrated accounting services firm:

Initial Setup and Integration: Client engages Cranston and specifies accounting needs. Cranston’s implementation team connects existing ERPs and financial systems through API integrations without disrupting workflows. Historical data is organized and years of messy data are consolidated into unified system in approximately 30 minutes for most businesses.

Autonomous AI Processing Begins: Transactions flow continuously from connected accounts. Purpose-built AI automatically processes all transactions—categorizing, reconciling, matching—achieving 99.8% match accuracy. Real-time processing handles 1.2M+ daily transactions automatically.

CPA Review and Approval: Licensed CPAs review automated processes and outputs. For transactions flagged by AI as requiring human judgment, CPAs provide resolution and context. All month-end closes, tax filings, and compliance items receive explicit professional review.

Real-Time Visibility and Insights: Clients access real-time dashboards showing financial position, cash flow, expense patterns, and automated workflow status. Predictive analytics provide cash runway forecasting and financial scenario planning. All data remains audit-ready through complete transaction audit trails.

Monthly Delivery of Results: Financial statements prepared automatically, delivered through dashboard with CPA sign-off. Tax preparation artifacts generated automatically for annual tax filing. Compliance documentation maintained for audits. All outputs audit-ready without additional preparation.

Continuous Optimization: System learns transaction patterns over time, improving categorization accuracy and spotting opportunities (e.g., previously missed tax deductions). Anomaly detection continuously monitors for potential issues.

Use Cases

Cranston serves diverse accounting scenarios:

- SaaS and Tech Startups: Automatic handling of recurring revenue recognition, cloud infrastructure cost allocation across AWS/Google Cloud, complex multi-entity accounting, and accelerated month-end closes enabling faster financial reporting for investor updates and board meetings.

E-commerce and Marketplace Businesses: Automated reconciliation of multi-channel payment processors (Stripe, PayPal, Square), automatic inventory accounting updates, sales tax compliance, and real-time cash position visibility for seasonal businesses with volatile transaction volumes.

Professional Services Firms: Automated time and expense tracking integration, project-based profitability analysis, and automatic invoice-to-collection tracking with aged receivables monitoring and delinquency alerts.

Manufacturing and Complex Businesses: Handling multi-location accounting, complex inventory valuation, fixed asset depreciation management, intercompany transactions, and consolidated financial reporting across multiple legal entities.

High-Growth Companies: Scaling accounting function without proportional headcount—companies processing thousands of monthly transactions can maintain clean books with small accounting teams augmented by Cranston automation.

Consolidation and Acquisition Support: Handling integration of multiple accounting systems, consolidation workflows for entities with different accounting systems, and unified financial reporting post-acquisition.

Compliance-Heavy Industries: Automated compliance tracking and documentation for regulated industries requiring audit-ready records, compliance-driven category mapping, and automatic generation of required regulatory reports.

Pros & Cons

Advantages

- Genuinely Autonomous Service: Unlike software platforms requiring user expertise, Cranston operates as accounting firm. Set up your integrations and Cranston handles everything—no technical knowledge required.

Licensed CPA Guarantee: Every transaction and output reviewed by licensed CPAs, providing binding professional guarantees on accuracy, compliance, and audit readiness. This distinction is critical—pure AI systems lack professional accountability.

Dramatic Cost Reduction: Typical 70% cost reduction versus traditional accounting firms ($300+ vs. $1,500+ monthly). No hidden fees or contracts. Pricing scales transparently with business size.

Preserved Infrastructure: Non-disruptive integration preserves existing ERP investments and workflows. No need to abandon QuickBooks, NetSuite, or custom systems for migration.

Faster Financial Closes: Month-end closes compressed from 3 weeks to 3 hours. Tax preparation automated rather than manual. Real-time financial visibility enables faster decision-making.

Enterprise-Grade Compliance: SOC 2 Type II certification, AICPA compliance, and bank-level security standards exceed requirements of most accounting firms.

Rapid Implementation: 30-minute setup for typical businesses. Live within day. No lengthy IT projects or data migration timelines.

Disadvantages

Service Model, Not Software: Clients must accept outsourcing accounting function to Cranston rather than maintaining in-house team or traditional accounting firm relationships. Organizations preferring in-house control may require adjustment.

CPA Review Workflow: All outputs require CPA review, which can create processing delays for unusually complex edge cases. Standard workflows are fast; complex scenarios requiring extended CPA deliberation may take longer.

Emerging Company Risk: Launched November 2025, still operating as early-stage company. Long-term viability and feature roadmap represent business continuity considerations for organizations making critical accounting outsourcing decisions.

Transaction-Based Pricing: Pricing scales with transaction volume. High-volume businesses or those with complex multi-subsidiary structures may face higher costs than fixed-fee accounting firms, requiring cost analysis.

Limited to Bookkeeping and Core Accounting: Specialized services like forensic accounting, complex litigation support, or sophisticated tax planning still require supplementary professional services.

How Does It Compare?

Cranston occupies a distinct position within accounting services, functioning as autonomous accounting firm rather than software platform or hybrid tool.

Botkeeper functions as AI-powered bookkeeping platform for accounting firms, automating transaction categorization, reconciliation, and bill payment to help firm teams focus on advisory work. Botkeeper’s core value lies in augmenting existing accounting firm capacity—firms remain in control, Botkeeper automates routine tasks. However, Botkeeper is software sold to accounting firms, not a direct accounting services provider. Firms must still employ their own accountants or use bookkeeping outsourcing partners separately. Botkeeper enhances accounting firm operations; Cranston is the accounting firm. Botkeeper serves as tool for accountants; Cranston serves as outsourced accounting function.

Bench provides human-focused bookkeeping service combining professional bookkeepers with software platform. Bench’s dedicated bookkeeper teams handle your monthly accounting. Bench emphasizes human expertise with software assistance. While Bench provides service (not just software), it focuses on traditional bookkeeping rather than autonomous automation. Bench remains labor-intensive (bookkeepers manually review transactions); Cranston is predominantly autonomous (AI handles bulk of work, CPAs audit outcomes). Bench is people-first with software assistance; Cranston is AI-first with professional oversight. Both serve small-to-mid-market businesses; Bench emphasizes human relationship, Cranston emphasizes automation and efficiency.

Trullion specializes in specific complex accounting domains—ASC 842 lease accounting, ASC 606 revenue recognition, and audit automation. Trullion focuses on specialized compliance workflows rather than comprehensive general accounting. Trullion serves primarily accounting and audit teams; Cranston serves businesses needing complete accounting services. Trullion solves specific technical problems; Cranston handles complete accounting function.

Traditional Accounting Firms remain the baseline comparison—typically charging $1,500+ monthly for bookkeeping services performed by accountants. Cranston delivers comparable services at 80% cost reduction through autonomous AI with CPA verification rather than traditional accountant labor, enabling dramatically lower pricing while maintaining professional accountability.

Cranston’s distinctive positioning emerges through: autonomous operation as accounting firm (not software or hybrid tool), licensed CPA verification on all work (professional guarantee), dramatic cost reduction (80% cheaper than traditional firms), non-disruptive integration with existing systems, and pure automation focus (not requiring human effort except professional review). While Botkeeper augments firm capacity and Bench provides people-focused service, Cranston uniquely provides complete autonomous accounting function with professional accountability at fraction of traditional firm cost.

Final Thoughts

Cranston represents a meaningful structural disruption in accounting services by demonstrating that autonomous AI with professional CPA supervision can deliver accounting services at 70-80% cost reduction versus traditional firms while actually improving speed and accuracy. Its combination of purpose-built AI for accounting workflows, non-disruptive system integration, licensed CPA verification, and transparent transaction-based pricing creates compelling value for businesses of all sizes seeking to eliminate accounting overhead.

For businesses managing substantial accounting work (monthly transaction volumes over 500-1000 transactions), those seeking faster financial closes, or those requiring compliance documentation at scale, Cranston delivers practical efficiency improvements and cost reductions that justify outsourcing accounting function to autonomous system with professional oversight.

However, organizations preferring to maintain in-house accounting control, those with highly specialized accounting needs beyond general bookkeeping and tax preparation, or those uncomfortable outsourcing financial functions entirely should evaluate maintaining traditional relationships or hybrid approaches. Cranston optimizes specifically for autonomous operation with professional verification rather than serving as advisory partner or in-house tool.