Table of Contents

Overview

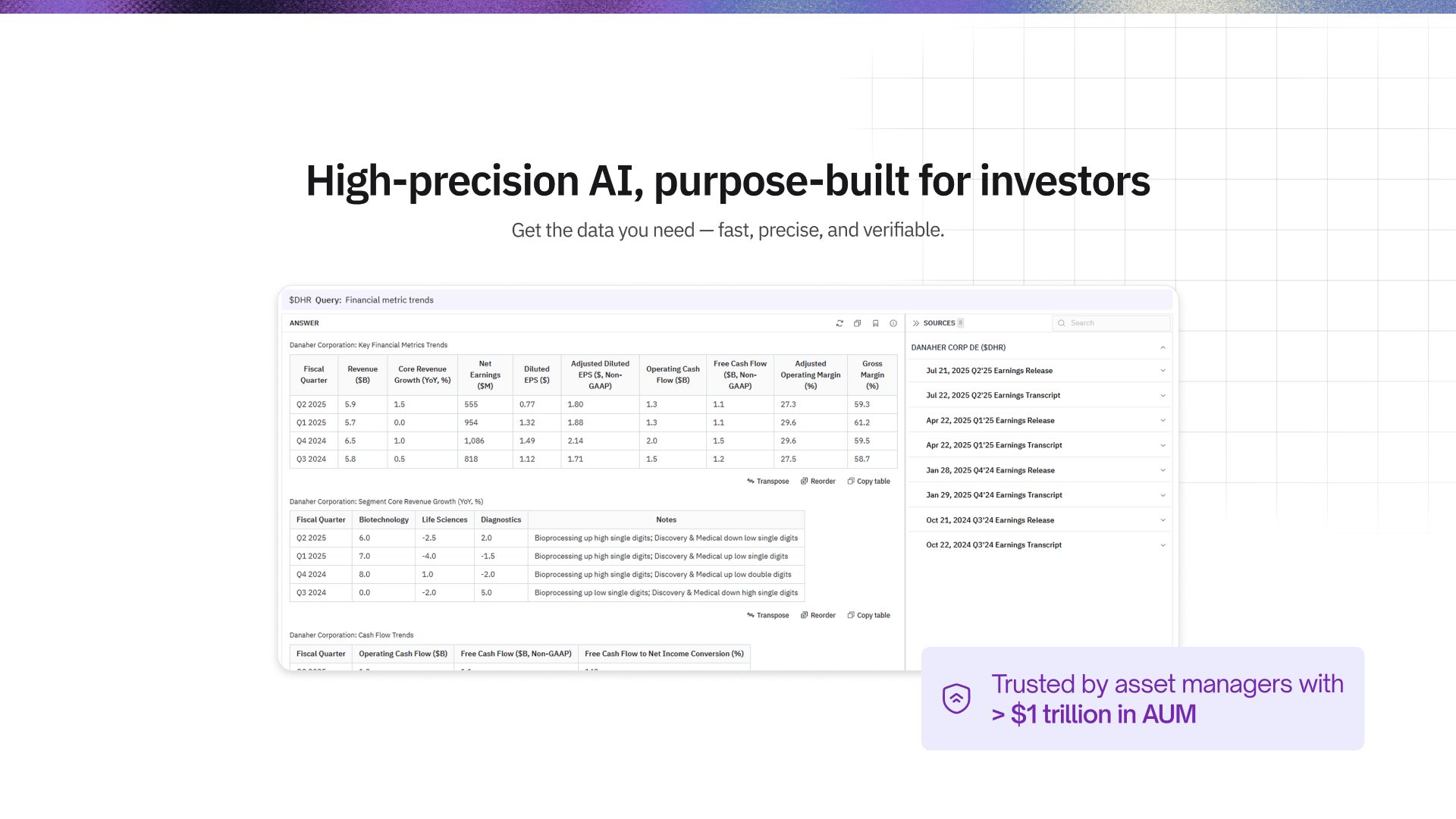

Hudson Labs Co-Analyst represents a significant advancement in institutional financial research technology, combining the analytical rigor of traditional financial terminals with the adaptive intelligence of modern AI systems. Built specifically for institutional equity research professionals, this platform addresses the critical challenge of extracting precise, verifiable insights from vast amounts of unstructured financial data while maintaining the accuracy standards essential for high-stakes investment decisions.

The Co-Analyst emerged from extensive development by Hudson Labs, a financial AI company founded in 2019 that pioneered the first LLM-powered financial application in 2021. Following comprehensive beta testing with hedge funds, asset managers, and family offices managing over \$1 trillion in combined assets, the platform officially launched in September 2024, demonstrating substantial improvements in research efficiency while preserving the accuracy, reliability, and auditability that institutional investors require.

Key Features

The Co-Analyst delivers a comprehensive suite of specialized capabilities engineered specifically for institutional equity research workflows:

- Terminal-Grade Precision with AI Adaptability: Combines the accuracy standards of traditional financial terminals with the flexibility of conversational AI, minimizing common AI hallucination risks through proprietary retrieval systems and custom financial models designed specifically for investment analysis.

- Comprehensive Multi-Document Synthesis: Seamlessly integrates and analyzes information across diverse financial documents including SEC filings, earnings call transcripts, investor presentations, and press releases, providing holistic insights that would traditionally require hours of manual cross-referencing.

- Automated Company Intelligence Generation: Creates detailed background memos for companies with market capitalizations exceeding \$300 million, automatically extracting key business fundamentals, competitive positioning, and strategic initiatives from comprehensive document analysis.

- Advanced Risk Analytics and Compliance Monitoring: Provides sophisticated forensic risk scoring capabilities and SEC enforcement prediction models, alongside real-time tracking of bankruptcy indicators and internal control weaknesses to support comprehensive risk assessment frameworks.

- Source-Verified Intelligence with Full Traceability: Ensures complete data integrity through direct citations and links to original source documents, enabling analysts to verify every insight and maintain full audit trails for compliance and due diligence requirements.

- Specialized Short-Selling Research Tools: Offers dedicated analytical capabilities designed specifically for short-selling research and forensic analysis, helping identify potential red flags and investigative opportunities that traditional research tools might overlook.

How It Works

The Co-Analyst operates through an sophisticated AI-powered research workflow designed to maximize both efficiency and accuracy. Users initiate research by inputting specific queries about public companies, market trends, or investment themes through an intuitive interface that accepts natural language instructions without requiring complex prompt engineering.

The platform’s proprietary AI engine immediately activates comprehensive document analysis processes, accessing and processing vast repositories of financial documents including SEC filings, earnings transcripts, analyst presentations, and regulatory submissions. Through advanced natural language processing and custom financial models, the system identifies relevant information, extracts key insights, and synthesizes findings across multiple data sources.

The platform then delivers structured, source-verified responses complete with direct citations and links to original documents, enabling analysts to immediately validate findings and explore supporting evidence. This integrated approach eliminates the traditional workflow bottlenecks of manual document searching, reading, and cross-referencing, reducing typical research timelines from hours to minutes while maintaining institutional-grade accuracy and transparency standards.

Use Cases

The Co-Analyst’s specialized architecture addresses critical research needs across multiple institutional investment scenarios:

- Comprehensive Due Diligence and Investment Analysis: Enables thorough evaluation of potential investment opportunities by automatically synthesizing complex financial histories, management commentary, business model evolution, and competitive positioning from extensive document sets, supporting both long and short investment strategies.

- Forensic Financial Analysis and Risk Investigation: Supports sophisticated investigative research through advanced pattern recognition in financial disclosures, management communications, and regulatory filings, particularly valuable for identifying accounting irregularities, undisclosed risks, or management credibility issues.

- Portfolio Management and Strategic Decision Support: Provides ongoing intelligence for portfolio managers and investment committees by tracking company developments, management guidance changes, and competitive dynamics across portfolio holdings and watchlist companies.

- Earnings Season Efficiency and Analysis: Dramatically accelerates earnings analysis workflows by automatically extracting key metrics, management commentary, and forward guidance from earnings materials, enabling rapid evaluation of multiple companies during concentrated reporting periods.

- Regulatory Compliance and Governance Monitoring: Supports compliance teams and risk managers through systematic monitoring of regulatory filings, management changes, and potential red flags that could impact investment positions or regulatory exposure.

- Competitive Intelligence and Market Research: Facilitates comprehensive competitive analysis by synthesizing information across industry participants, tracking market share dynamics, product development initiatives, and strategic positioning changes over time.

Advantages and Considerations

Advantages

- Institutional-Grade Accuracy with Generative Efficiency: Delivers the precision and reliability required for institutional investment decisions while providing the speed and adaptability advantages of modern AI technology, addressing the traditional trade-off between accuracy and efficiency.

- Complete Transparency and Verification: Every insight includes full source attribution with direct links to supporting documents, enabling immediate verification and creating comprehensive audit trails essential for institutional compliance and governance requirements.

- Domain-Specific Optimization: Built exclusively for financial workflows with deep understanding of investment research methodologies, accounting principles, and regulatory requirements, eliminating the imprecision common in general-purpose AI tools applied to financial contexts.

- Proven Institutional Validation: Demonstrated effectiveness through extensive testing with over \$1 trillion in assets under management, including positive feedback from sophisticated investors at Princeton Value Partners, Telos Research, and Fundamental Edge, validating real-world performance.

- Substantial Productivity Enhancement: Beta testing results confirm research time reductions exceeding 50% while maintaining quality standards, enabling analysts to focus on strategic interpretation and decision-making rather than data gathering and document processing.

Considerations

- Enterprise-Focused Investment Model: Designed for institutional users with corresponding pricing structures that may limit accessibility for individual investors or smaller investment firms without substantial research budgets.

- US Public Equity Market Specialization: Current capabilities focus specifically on US public companies and markets, potentially limiting utility for international equity research, private company analysis, or alternative investment strategies.

- Financial Domain Expertise Requirements: Optimal utilization requires users with substantial financial analysis backgrounds to properly interpret results and ask sophisticated research questions, potentially limiting effectiveness for users without institutional research experience.

- Limited Trial Period for Evaluation: The 14-day trial period, while available, may provide insufficient time for thorough evaluation of capabilities across diverse research scenarios, particularly for large institutions requiring comprehensive testing protocols.

How Does It Compare?

The AI-powered financial research landscape of 2024-2025 presents a complex ecosystem of platforms, each addressing different aspects of institutional investment research needs. Understanding the Co-Analyst’s positioning requires examining how it relates to both traditional financial data providers and emerging AI-native solutions.

Enterprise Search and Intelligence Platforms: AlphaSense, which acquired Sentieo in 2022, represents the established leader in AI-powered financial search with access to over 10,000 data sources including Wall Street research, expert call transcripts, and global filings. This platform excels in broad content coverage and search capabilities but focuses primarily on information discovery rather than analytical synthesis. The integration of Sentieo’s workflow capabilities has strengthened AlphaSense’s position in institutional research, particularly for firms requiring comprehensive content libraries and collaborative features.

Traditional Financial Data Terminals: Bloomberg Terminal and Refinitiv (LSEG Data \& Analytics) continue to dominate the institutional market with comprehensive real-time data coverage, proprietary news services, and established workflow integration. Bloomberg’s annual cost exceeding \$24,000 per user reflects its comprehensive feature set including messaging, trading capabilities, and extensive analytical tools. However, these platforms require significant learning investments and primarily serve as data aggregation rather than intelligent analysis tools.

AI-Native Financial Chatbots: FinChat.io (Fiscal.ai) has emerged as a prominent AI-powered financial research tool with pricing from \$29-79 monthly, offering natural language queries against S\&P Capital IQ data and AI-generated chart capabilities. While more accessible than enterprise solutions, FinChat focuses primarily on basic financial data queries rather than the sophisticated document synthesis and forensic analysis capabilities required for institutional research.

Specialized Document Analysis Platforms: Emerging solutions like Fintool and Captide focus specifically on AI-powered analysis of SEC filings and earnings transcripts, offering capabilities similar to the Co-Analyst’s document processing features. These platforms typically serve niche use cases within broader research workflows rather than providing comprehensive institutional research capabilities.

Comprehensive Investment Analysis Platforms: Reflexivity and similar platforms offer institutional-grade investment analysis combining multiple data sources with AI-powered insights, portfolio analysis, and market simulation capabilities. These solutions compete more directly with the Co-Analyst’s comprehensive approach but often lack the specialized focus on document synthesis and forensic analysis.

Data Automation and Integration Solutions: Daloopa has carved out a successful niche by automating financial data extraction and Excel model updates, addressing the operational challenges of maintaining financial models rather than the analytical challenges of research synthesis that the Co-Analyst addresses.

The Co-Analyst differentiates itself through several critical innovations:

Analytical Synthesis vs. Data Aggregation: While most platforms focus on providing access to information, the Co-Analyst emphasizes intelligent synthesis and analysis of that information, transforming raw documents into actionable insights with maintained source verification.

Financial Domain Precision: Unlike general-purpose AI tools adapted for financial use, the Co-Analyst was built specifically for institutional equity research workflows, incorporating deep understanding of financial analysis methodologies, accounting principles, and investment research requirements.

Forensic and Investigative Capabilities: The platform’s specialized features for forensic risk scoring, SEC enforcement prediction, and investigative analysis address sophisticated research needs that general financial AI tools typically cannot support effectively.

Institutional Validation and Trust: The extensive beta testing with over \$1 trillion in AUM and positive testimonials from sophisticated institutional investors provide credibility that many newer AI financial tools lack.

The platform’s positioning suggests it serves as a complement to rather than replacement for traditional data terminals, providing the analytical layer that transforms terminal data into investment insights while maintaining the accuracy and verification standards institutional investors require.

Enhanced Technical Context and Market Position

Proprietary Technology Architecture

Hudson Labs has developed sophisticated proprietary technology specifically designed to address the unique challenges of financial document analysis. The platform employs custom retrieval systems that understand the structure and context of financial documents, enabling more accurate extraction of quantitative data, qualitative insights, and forward-looking statements than general-purpose AI systems.

The company’s noise suppression technology addresses a critical challenge in financial AI applications: the ability to distinguish between relevant and irrelevant information in complex financial documents. This capability is essential for maintaining accuracy in analytical outputs and reducing the hallucination risks that plague general-purpose AI applications in financial contexts.

Leadership and Technical Expertise

The founding team brings complementary expertise that directly informs the platform’s capabilities. CEO Kris Bennatti combines data science expertise with CPA credential and capital markets experience, providing deep understanding of both technical AI capabilities and institutional research requirements. CTO Suhas Pai, author of “Designing Large Language Model Applications” (O’Reilly), contributes cutting-edge AI research expertise specifically focused on LLM applications.

This combination of financial domain expertise and advanced AI technical capabilities differentiates Hudson Labs from both traditional financial technology companies and general AI companies attempting to address financial use cases.

Market Timing and Regulatory Environment

The Co-Analyst’s launch in September 2024 coincides with increasing institutional acceptance of AI tools in investment workflows, while regulatory emphasis on transparency and auditability aligns with the platform’s source-verification capabilities. The platform’s focus on maintaining complete audit trails and source attribution addresses growing compliance requirements in institutional investment management.

Trial Availability and Enterprise Adoption

The availability of a 14-day trial period provides institutional users opportunity to evaluate the platform’s capabilities within their specific research workflows before committing to enterprise licensing arrangements. This approach reflects understanding of institutional decision-making processes and the need for thorough evaluation of mission-critical research tools.

Final Thoughts

Hudson Labs Co-Analyst represents a significant advancement in AI-powered institutional financial research, successfully addressing the fundamental challenge of combining AI efficiency with the precision and transparency requirements of professional investment analysis. The platform’s focus on document synthesis, forensic analysis, and source verification creates a compelling value proposition for institutional investors seeking to enhance research productivity without compromising analytical rigor.

The extensive validation through beta testing with over \$1 trillion in assets under management provides substantial credibility for the platform’s effectiveness in real-world institutional environments. Client testimonials from sophisticated investors including Princeton Value Partners and Telos Research confirm meaningful productivity improvements while maintaining the accuracy standards essential for investment decision-making.

However, the platform’s enterprise focus and specialized capabilities position it as a sophisticated tool requiring substantial financial expertise to maximize effectiveness. The emphasis on US public equity markets, while providing deep specialization, may limit applicability for global investment strategies or alternative asset classes.

For institutional equity research teams, hedge funds, and sophisticated investment analysts, the Co-Analyst offers compelling advantages over both traditional financial data tools and general-purpose AI solutions. The combination of proprietary financial AI technology, comprehensive document synthesis capabilities, and institutional-grade accuracy standards addresses critical pain points in modern investment research workflows.

The platform’s success in demonstrating that AI can enhance rather than compromise analytical precision may influence the development direction of financial AI tools across the industry. As institutional investors increasingly seek to leverage AI capabilities while maintaining rigorous research standards, solutions like the Co-Analyst that prioritize accuracy and transparency alongside efficiency will likely become increasingly valuable.

The emergence of the Co-Analyst also highlights the growing sophistication of financial AI applications, moving beyond simple data retrieval toward intelligent synthesis and analysis capabilities that can genuinely enhance human analytical capabilities. This evolution suggests continued development toward more specialized, domain-expert AI tools that complement rather than replace human expertise in complex analytical domains.

For the institutional investment community, the Co-Analyst represents both an immediate productivity enhancement opportunity and an indication of the direction AI development is taking in sophisticated professional applications. Its success in maintaining institutional accuracy standards while providing substantial efficiency gains demonstrates the potential for AI to meaningfully enhance rather than compromise professional analytical capabilities.