Table of Contents

Executive Snapshot

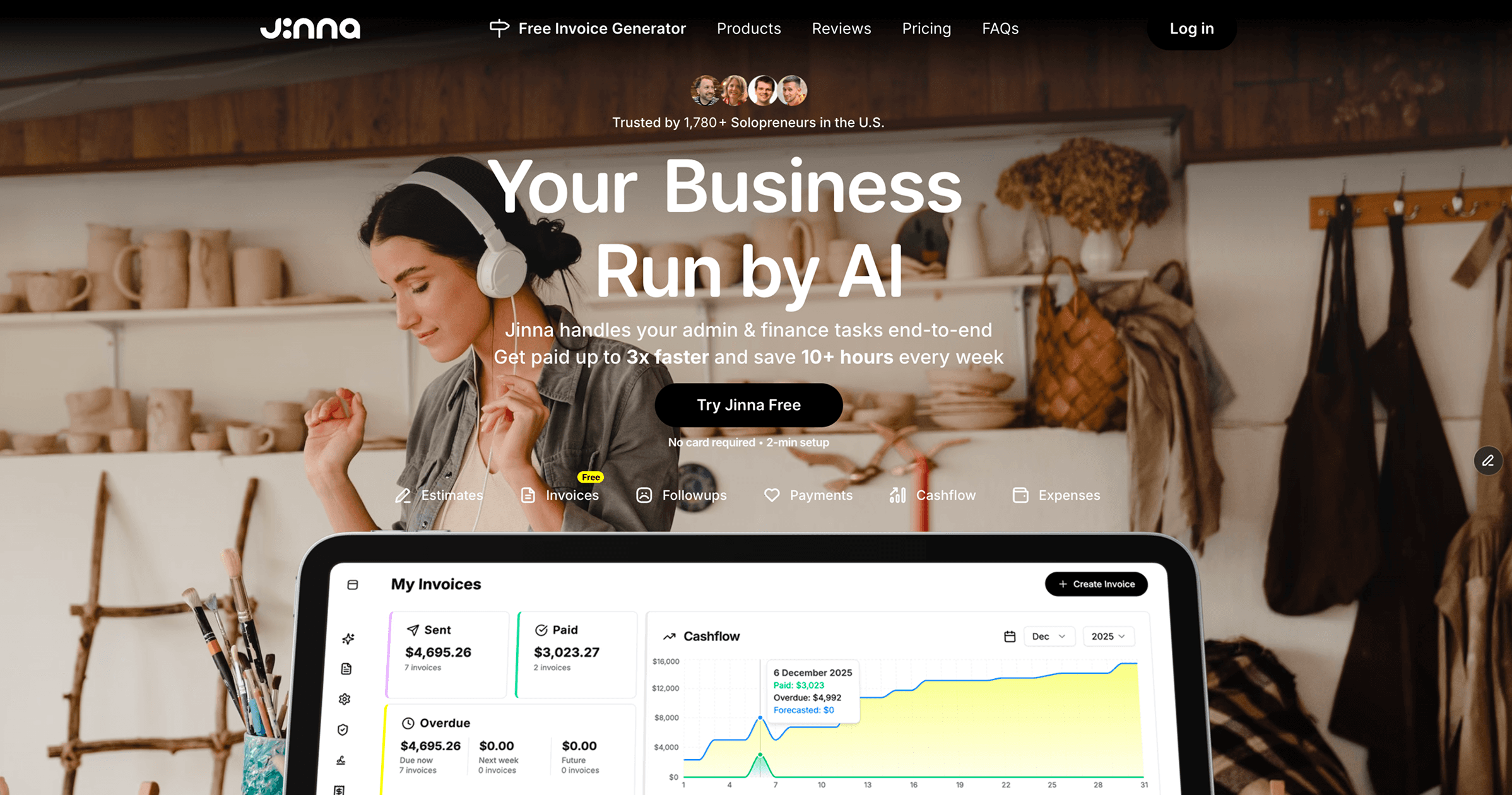

Jinna.ai represents a new generation of artificial intelligence assistants specifically designed to serve solopreneurs and independent business owners. Launched in October 2025 through a Product Hunt debut that achieved top-three trending status, the platform addresses a critical pain point in the solopreneur economy: administrative burden that diverts focus from core business activities.

Core offering overview

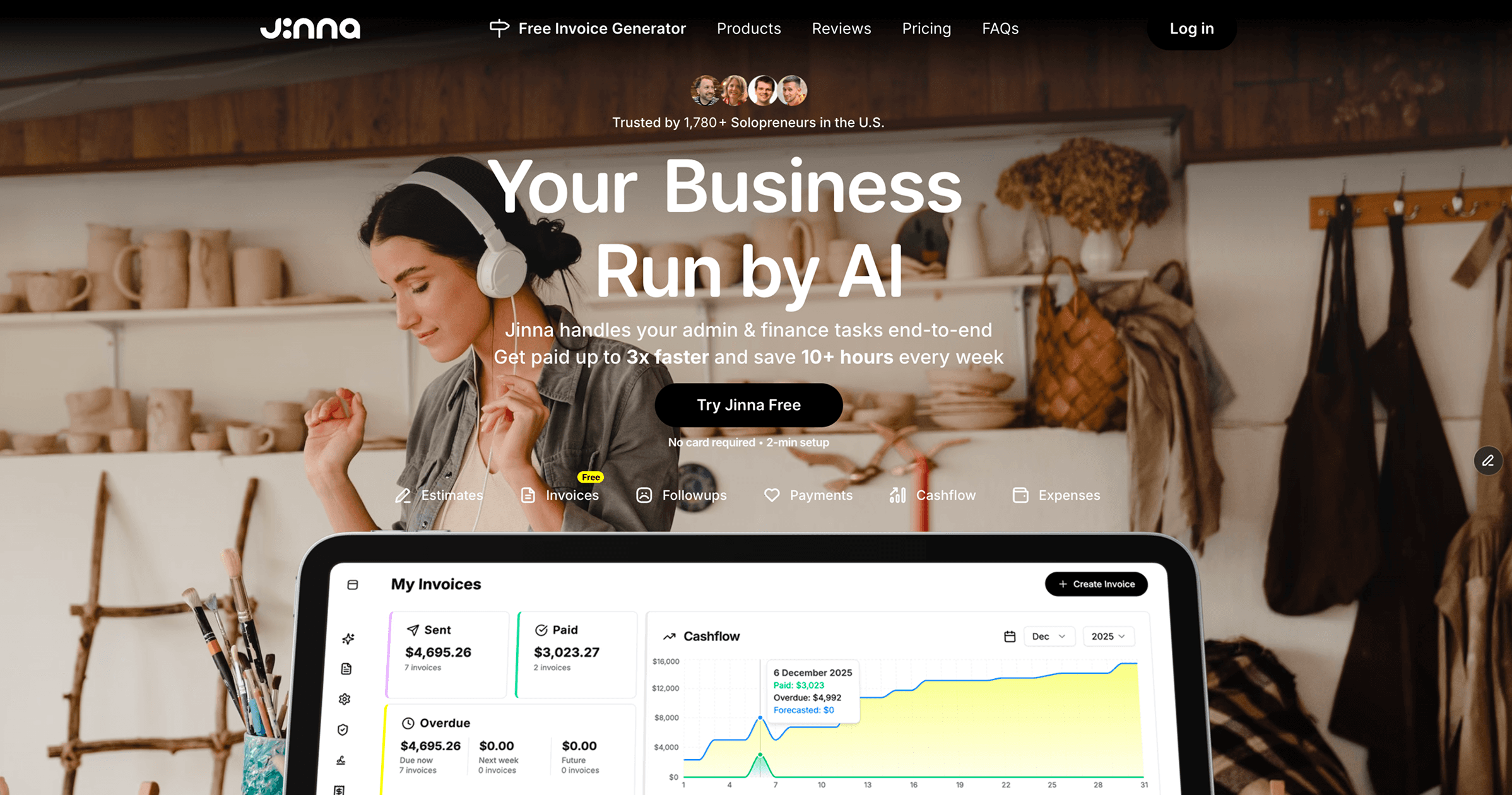

At its heart, Jinna.ai functions as a hyper-context-aware AI assistant that handles the complete invoicing lifecycle. Unlike traditional invoicing software that requires manual data entry and follow-up, Jinna enables users to create invoices through multiple input methods including voice commands, text input, or file uploads. The platform distinguishes itself through rich customization capabilities allowing users to embed logos, photos, videos, signatures, and even music into invoices, transforming standard billing documents into branded experiences.

The system automates invoice delivery through customizable email templates or shareable links, integrates payment processing via Stripe and bank details, and executes intelligent follow-up sequences using configurable reminder rules. The platform adapts its communication tone from casual to firm based on user preferences and client relationships.

Key achievements and milestones

Since its soft launch to friends and early adopters, Jinna.ai has attracted over 400 users who report significant time savings and faster payment collection. The founding team secured early support from a London-based venture capital firm and earned acceptance into the prestigious Google for Startups Program, validating the technical and commercial potential of the solution.

Founder Andrei Yemelyanenka, a seasoned product management professional with experience at Revolut, Bolt, and Alfa-Bank, built Jinna.ai as a personal mission to give entrepreneurs their time back. His vision centers on the belief that solopreneurs should “live their freedom” rather than being consumed by paperwork and administrative tasks.

Adoption statistics

Early traction metrics indicate strong product-market fit. The platform garnered substantial engagement during its Product Hunt launch in November 2025, climbing to the third position on trending products. User feedback emphasizes three primary benefits: substantial time savings in invoice creation, professional and aesthetically pleasing invoice designs that enhance brand perception, and improved cash flow through automated payment chasing that reduces days sales outstanding.

The platform currently serves freelancers, consultants, designers, developers, and creative professionals across various industries who operate as solopreneurs or manage small teams without dedicated administrative staff.

Impact and Evidence

Client success stories

The Jinna.ai community has shared compelling accounts of how the platform transforms their financial operations. One creative professional highlighted the ability to generate and send an invoice during a client call, eliminating the typical delay between project completion and payment initiation. The immediacy of invoice delivery combined with embedded Stripe payment links has shortened payment cycles from weeks to days.

Several service-based professionals have noted that the automated follow-up system removes the uncomfortable aspect of chasing payments. The AI determines optimal timing for reminders based on due dates and client payment history, delivering polite yet persistent communications that maintain professional relationships while improving collection rates.

Performance metrics and benchmarks

Industry data provides context for evaluating Jinna.ai’s value proposition. AI-powered invoice automation solutions typically reduce processing time by 60 percent or more compared to manual methods. Leading platforms achieve accuracy rates exceeding 95 percent in data extraction and validation, with best-in-class solutions reaching 99 percent first-time-right rates.

The average cost of manually processing a single invoice stands at approximately $22.75 when accounting for labor overhead and time investment. AI automation can reduce this to roughly $2.36 per invoice, representing cost savings of more than 80 percent. For solopreneurs processing dozens or hundreds of invoices annually, this efficiency gain translates to substantial time recovery that can be redirected toward revenue-generating activities.

Third-party validations

The acceptance into Google for Startups Program provides institutional validation of Jinna.ai’s technical approach and growth potential. This competitive program selects startups demonstrating innovative solutions, strong founding teams, and scalable business models. Participants receive mentorship, technical resources, and exposure to Google’s network of partners and investors.

Early media coverage and community discussions on Product Hunt, Reddit, and industry platforms highlight the enthusiasm for a solution that combines sophisticated AI capabilities with an exceptionally user-friendly interface. Reviewers consistently emphasize the platform’s ability to deliver enterprise-grade automation without the complexity or learning curve associated with traditional business software.

Technical Blueprint

System architecture overview

Jinna.ai operates as a cloud-native software-as-a-service platform accessible through web browsers and mobile interfaces. The architecture employs modern AI technologies including natural language processing to interpret voice and text inputs, machine learning algorithms to understand business context and client patterns, and intelligent automation to orchestrate multi-step workflows from invoice creation through payment collection.

The platform’s distinguishing technical feature is Jenius, described as a dynamic context profile that continuously learns from every interaction. This adaptive learning mechanism enables the system to understand the user’s business model, recognize individual client preferences, identify optimal communication timing, and refine its operational intelligence over time.

API and SDK integrations

Recognizing that solopreneurs operate within ecosystems of specialized tools, Jinna.ai has established integrations with critical financial and business platforms. The Stripe integration enables seamless payment processing, allowing clients to pay invoices instantly through credit cards or bank transfers without leaving the invoice interface. This friction reduction significantly improves payment conversion rates.

Accounting platform integrations include Xero, a leading cloud-based accounting system popular among small businesses and their advisors. This connection ensures that invoice data flows automatically into general ledger systems, eliminating duplicate data entry and maintaining accurate financial records for tax compliance and business analytics.

The Plaid integration facilitates secure connections to banking institutions, enabling features such as payment verification and potentially future capabilities around cash flow insights. Treyd integration offers invoice financing options, allowing eligible users to access immediate cash against outstanding invoices, addressing working capital constraints that often limit solopreneur growth.

Scalability and reliability data

While specific uptime statistics for Jinna.ai have not been publicly disclosed given its recent launch, the platform leverages established cloud infrastructure providers known for maintaining 99.9 percent or higher availability. Industry standard service level agreements for similar cloud-based business applications target monthly uptime percentages above 99.5 percent, with enterprise tiers often guaranteeing 99.95 percent availability.

The architecture design accommodates growth from individual users processing dozens of invoices monthly to power users managing hundreds of transactions. The AI learning systems improve performance as data volume increases, making the platform more valuable over time rather than experiencing degradation.

Trust and Governance

Security certifications

While Jinna.ai has not yet published specific security audit reports, the platform handles sensitive financial information requiring robust security practices. The company’s use of established payment processors like Stripe, which maintains PCI DSS Level 1 compliance, ensures that credit card data is handled according to the highest security standards without requiring Jinna.ai to directly process or store payment credentials.

It is worth noting that the parent organization behind the Jina technology ecosystem, Jina AI GmbH, has successfully completed both SOC 2 Type 1 and Type 2 audits conducted by Prescient Assurance. These certifications validate information security practices, policies, procedures, and operations meet rigorous standards for security, demonstrating the broader organizational commitment to data protection.

Data privacy measures

As a platform processing business and client information, Jinna.ai must comply with relevant data protection regulations. The European Union’s General Data Protection Regulation establishes strict requirements for how personal data is collected, processed, and stored. Organizations serving EU residents must implement principles including lawfulness, data minimization, accuracy, storage limitation, and accountability.

For platforms operating globally, additional frameworks such as the California Consumer Privacy Act establish similar protections for US residents. Best practices in data privacy include encryption of data in transit and at rest, role-based access controls limiting who can view sensitive information, regular security testing and vulnerability assessments, and transparent privacy policies explaining data handling practices.

Regulatory compliance details

Invoice processing platforms must navigate various regulatory requirements depending on the jurisdictions they serve. Tax regulations mandate that invoices contain specific information elements and that records are retained for prescribed periods, typically ranging from five to seven years. Financial transaction regulations govern how payment processing occurs, with different rules for bank transfers versus credit card transactions.

For platforms offering invoice financing capabilities through partners like Treyd, additional financial services regulations apply. These may include consumer protection requirements, disclosure obligations about financing terms and costs, and licensing requirements in some jurisdictions.

Unique Capabilities

Jenius: The dynamic context engine

The centerpiece of Jinna.ai’s technological differentiation is Jenius, a proprietary system that maintains and continuously enhances a contextual understanding of each user’s business. Rather than treating each interaction as isolated, Jenius builds a comprehensive profile encompassing business model details such as service offerings, pricing structures, and project types; client characteristics including payment history, communication preferences, and relationship duration; cash flow patterns identifying seasonal variations, typical payment timelines, and working capital needs; and operational preferences covering tone of voice, scheduling patterns, and workflow habits.

This contextual intelligence enables Jenius to make proactive recommendations such as suggesting invoice generation at optimal times based on project milestones, adjusting follow-up intensity based on client-specific payment patterns, flagging unusual payment delays that might indicate client financial difficulties, and optimizing cash flow by highlighting which invoices to prioritize for collection efforts.

Multi-channel invoice creation

Traditional invoicing software requires users to adapt to rigid interfaces and structured data entry forms. Jinna.ai inverts this paradigm by accepting input through channels natural to how entrepreneurs work. Voice input allows users to create invoices while driving, during breaks, or in any context where hands-free operation is preferable. The natural language processing interprets spoken descriptions of work completed, client information, and pricing details.

Text input accommodates users who prefer written communication, with AI interpreting conversational descriptions rather than requiring navigation through multiple form fields. File upload enables processing of existing documents, timesheets, or project summaries to generate invoices automatically.

This flexibility dramatically reduces the friction associated with invoicing, converting a task that might be postponed for days into something accomplished in moments.

Smart payment chasing

Perhaps the most valuable automation Jinna.ai provides is intelligent payment follow-up. Research consistently shows that entrepreneurs dislike chasing payments, viewing it as uncomfortable and time-consuming. Yet timely follow-up significantly impacts payment speed and overall cash flow health.

Jinna.ai’s chasing system operates on multiple dimensions. Temporal intelligence determines when to send reminders based on payment terms, client history, and relationship stage. Clients with perfect payment records might receive gentle reminders a few days before due dates, while those with occasional delays receive more persistent communications.

Tone calibration ensures communications match the user’s brand voice and the specific client relationship. Casual tones work for established relationships and creative industry contexts, while formal approaches suit corporate clients and professional services engagements. The system can escalate tone progressively as payment delays extend.

Contextual awareness incorporates business knowledge such as avoiding follow-ups during known client vacation periods, adjusting messaging for clients experiencing known business challenges, and recognizing when human intervention is appropriate for sensitive situations.

Customization and branding capabilities

Beyond functional automation, Jinna.ai enables users to create invoices that serve as brand touchpoints. The ability to embed logos and signatures ensures professional presentation and brand consistency. Custom design elements including color schemes, fonts, and layouts allow invoices to match overall brand identity.

Uniquely, the platform supports multimedia elements such as photos documenting completed work, video messages personalizing the invoice delivery, and even background music for digital invoice presentations. While these features may seem unconventional, they align with the reality that solopreneurs often operate in creative industries where standard templates feel impersonal.

Adoption Pathways

Integration workflow

Getting started with Jinna.ai follows a streamlined onboarding process designed for users without technical expertise. Initial setup involves creating an account with basic business information, uploading branding assets such as logos and signature images, configuring payment preferences by connecting Stripe accounts or entering bank details, and establishing communication templates that reflect the user’s preferred tone and style.

The platform guides users through creating their first invoice, offering assistance in understanding available options and features. The learning curve is intentionally minimal, with most users able to generate and send their first invoice within minutes of account creation.

Customization options

While the platform provides sensible defaults that work for most users, extensive customization ensures Jinna.ai adapts to diverse business models and preferences. Invoice templates can be tailored with custom fields specific to industry requirements, adjustable payment terms and conditions, multiple currency support for international clients, and tax handling options appropriate to different jurisdictions.

Follow-up automation is highly configurable with users defining reminder schedules specifying exactly when reminders are sent, tone progression settings determining how communication firmness escalates over time, client-specific overrides allowing special handling for particular relationships, and escalation triggers that flag situations requiring personal attention.

Onboarding and support channels

For a platform targeting solopreneurs who are typically time-constrained and may have limited technical expertise, support quality is crucial. Jinna.ai provides assistance through multiple channels including in-app guidance with contextual help throughout the interface, email support for detailed questions and troubleshooting, and community forums where users can share experiences and best practices.

The platform’s design philosophy emphasizes intuitive operation that minimizes support needs. Features are progressively disclosed, with advanced capabilities available but not overwhelming new users during initial experiences.

Use Case Portfolio

Enterprise implementations

While Jinna.ai primarily targets solopreneurs and small businesses, the platform’s capabilities scale to serve more complex scenarios. Digital agencies managing multiple clients and projects benefit from the ability to quickly generate detailed invoices reflecting various service components, time tracking integration, and project milestones.

Consulting practices use Jinna.ai to handle recurring client relationships where invoice patterns are predictable but customization is important. The system learns typical engagement structures and can auto-suggest invoice details based on historical patterns.

Academic and research deployments

Freelance researchers, academic consultants, and grant-funded projects often face unique invoicing requirements including specific formatting required by institutional buyers, compliance with grant accounting standards, and detailed documentation of work performed. Jinna.ai’s flexible document generation accommodates these specialized needs while maintaining the simplicity that makes the platform accessible to non-accountants.

ROI assessments

The return on investment calculation for Jinna.ai begins with time savings. If invoice creation and follow-up typically consume two hours weekly, and Jinna.ai reduces this to 30 minutes, the platform recovers 1.5 hours per week or approximately 78 hours annually. For a consultant billing $100 per hour, this represents $7,800 in recovered productive capacity.

Cash flow improvements provide additional value. Industry research indicates that businesses using automated follow-up systems collect payments an average of seven to ten days faster than those relying on manual reminders. For a business with $10,000 in average monthly receivables, reducing collection time by seven days improves working capital position and may eliminate the need for short-term financing that typically costs 1 to 3 percent of borrowed amounts.

Reduced administrative stress, while harder to quantify, contributes meaningfully to entrepreneur wellbeing and sustainability. The psychological burden of outstanding invoices and uncomfortable collection conversations creates cognitive load that automated systems eliminate.

Balanced Analysis

Strengths with evidential support

Jinna.ai excels in several dimensions that address real pain points in the solopreneur experience. The exceptional ease of use enables adoption by users without technical backgrounds or accounting expertise. The voice and conversational input methods align with how entrepreneurs naturally work rather than forcing adaptation to rigid software interfaces.

The intelligent automation goes beyond simple scheduling to incorporate contextual understanding of business patterns and client relationships. This sophistication differentiates Jinna.ai from basic invoicing tools that require extensive manual configuration and oversight.

Integration with payment processing and accounting systems ensures the platform fits within existing workflows rather than creating isolated data silos. The ability to receive payments instantly through embedded Stripe links addresses the fundamental goal of accelerating cash conversion.

The focus on solopreneurs as a specific audience allows for purpose-built features rather than attempting to serve all business sizes with compromised solutions. This specialization enables innovation in areas such as multimedia invoice elements that might seem frivolous in enterprise contexts but resonate with creative professionals.

Limitations and mitigation strategies

As with any emerging platform, Jinna.ai faces certain constraints and challenges. The recent launch means the feature set, while compelling, continues to evolve. Some capabilities mentioned in the roadmap such as comprehensive cash flow analytics and business expense management are not yet available. Users requiring these features immediately may need to complement Jinna.ai with additional tools.

The AI learning system requires data to become maximally effective. New users experience a learning period during which the system gathers information about business patterns and client behaviors. Early recommendations may be less accurate than those provided after several months of operation, though the platform remains functional from day one.

Integration breadth is currently more limited than established accounting platforms that have built connections to hundreds of business tools over many years. While core integrations with Stripe, Xero, and Plaid address primary needs, users with specialized tools in their workflows may encounter gaps requiring manual data transfer.

The platform’s emphasis on beautiful, branded invoices may not align with all business contexts. Some corporate clients and government entities expect standardized invoice formats and may view creative elements as unprofessional. The platform does support traditional invoice designs, but this runs somewhat counter to its differentiated positioning.

Invoice financing through the Treyd partnership is currently available only in specific European markets including the UK, Ireland, and Nordic countries. Solopreneurs in other geographies cannot yet access this working capital option, though traditional payment processing remains available globally.

Transparent Pricing

Plan tiers and cost breakdown

Jinna.ai has adopted an accessible pricing strategy to maximize adoption among its target audience of solopreneurs who are often budget-conscious, especially in early business stages. The platform is currently offered at no cost during its launch phase, allowing users to create, send, and chase invoices without subscription fees.

This free tier provides substantial value including unlimited invoice generation, automated follow-up sequences, basic customization and branding, Stripe payment integration, and core AI learning capabilities. The zero-cost entry point eliminates financial barriers that might prevent entrepreneurs from trying the solution.

Future monetization plans indicate that paid tiers will be introduced as the platform matures and adds advanced features. While specific pricing has not been announced, the roadmap suggests premium capabilities that might justify subscription fees including advanced cash flow analytics and predictions, comprehensive business expense tracking and categorization, multi-user access for teams and virtual assistants, priority customer support and dedicated account management, and enhanced AI capabilities with faster learning and more sophisticated recommendations.

Industry comparables provide context for potential pricing. Basic invoicing platforms typically charge $10 to $15 monthly for entry-level plans supporting limited clients and features. Mid-tier offerings with automation and integrations range from $25 to $50 monthly. Comprehensive financial management platforms can exceed $100 monthly for plans supporting high transaction volumes and advanced functionality.

Total Cost of Ownership projections

Evaluating total cost of ownership requires looking beyond subscription fees to implementation, training, and ongoing operational costs. Jinna.ai’s design minimizes these traditional overhead factors. Implementation cost is essentially zero given the self-service onboarding process that requires no consultants, custom development, or technical configuration. Most users complete setup in less than an hour.

Training requirements are minimal due to the conversational interface and intuitive design. Unlike complex enterprise software requiring formal training programs, Jinna.ai can be mastered through exploration and occasional reference to help documentation.

Operating costs center primarily on transaction fees associated with payment processing. Stripe charges range from 1.9 to 2.9 percent plus fixed per-transaction fees depending on payment method and region. These costs are inherent to accepting card payments rather than specific to Jinna.ai.

The invoice financing option carries its own fee structure based on the advance amount and duration until customer payment. Treyd and similar providers typically charge rates equivalent to 0.05 to 0.08 percent daily, translating to roughly 1.5 to 2.5 percent for a 30-day financing period. This cost should be evaluated against the value of immediate access to working capital and avoidance of traditional financing options.

Market Positioning

Competitor comparison and unique differentiators

The invoicing and financial management software landscape includes numerous established players, each with distinct positioning and capabilities. Understanding how Jinna.ai compares helps clarify its unique value proposition.

FreshBooks has built a strong reputation among freelancers and service professionals with robust time tracking, project management integration, and polished invoicing capabilities. The platform excels in handling billable hours and converting tracked time into invoices seamlessly. However, FreshBooks follows a traditional software interface paradigm requiring users to navigate forms and structured data entry. It lacks voice input, conversational interaction, and the proactive AI intelligence that characterizes Jinna.ai. Pricing starts around $15 monthly for basic plans and scales to $50 or more for feature-rich tiers.

QuickBooks represents the heavyweight option with comprehensive accounting capabilities extending well beyond invoicing to include payroll processing, inventory management, and extensive reporting. This breadth makes QuickBooks suitable for growing businesses with complex needs but also introduces significant complexity that can overwhelm solopreneurs seeking simplicity. The learning curve is steep, and full utilization often requires accounting knowledge. Pricing begins around $25 monthly and increases substantially for advanced plans. QuickBooks lacks the AI-driven automation and conversational interface that make Jinna.ai accessible to non-technical users.

Wave positions itself as the free accounting solution, providing core invoicing, expense tracking, and basic reporting at no subscription cost. Revenue comes from payment processing fees and optional paid services like payroll. Wave’s free pricing is attractive, but the platform lacks sophisticated automation, intelligent follow-up, and the adaptive learning capabilities that enable Jinna.ai to become more valuable over time. Wave serves budget-conscious micro-businesses well but doesn’t deliver the time-saving automation that justifies Jinna.ai’s eventual paid pricing.

Bill.com targets mid-market companies with comprehensive accounts payable and receivable automation, approval workflows, and strong integration with enterprise resource planning systems. The platform excels in multi-user environments with complex approval hierarchies but is overbuilt and overpriced for solopreneurs. Pricing reflects enterprise focus with costs that would be prohibitive for individual practitioners.

Jinna.ai differentiates through several key dimensions. The conversational AI interface accepting voice, text, and file inputs removes friction from invoice creation in ways that traditional form-based software cannot match. The Jenius context engine that learns business patterns and client relationships provides personalized automation rather than generic rules-based workflows.

The aesthetic focus enabling beautiful, branded, multimedia-rich invoices appeals to creative professionals and service providers who view every client interaction as a brand opportunity. The specific targeting of solopreneurs ensures features align with this audience’s priorities rather than attempting to serve all business sizes with compromised solutions.

The combination of free initial access with planned premium features creates a low-risk entry path while building toward a sustainable business model. Early adopters benefit from zero-cost utilization during the launch phase while helping shape product development through feedback.

Analyst ratings and market reception

As a newly launched platform, Jinna.ai has not yet been evaluated by major analyst firms such as Gartner or Forrester that publish formal market assessments and competitive comparisons. However, early community reception through Product Hunt, industry forums, and user testimonials indicates strong enthusiasm for the platform’s approach.

The Product Hunt launch achieved top-three trending status with significant upvotes and engaged discussions highlighting the platform’s differentiation. User comments emphasize appreciation for the human-like interaction model, time-saving automation, and aesthetic invoice options that enhance professional image.

Industry observers note that Jinna.ai enters a market experiencing rapid transformation driven by AI adoption. The AI-powered invoice automation market is projected to grow from approximately $2.8 billion in 2024 to over $47 billion by 2034, representing a compound annual growth rate exceeding 32 percent. This explosive growth reflects recognition that traditional manual processes are unsustainable as business tempo accelerates.

Within this expanding market, solopreneurs represent a particularly attractive segment. The solopreneur economy has grown substantially, with millions of professionals operating independent businesses enabled by digital platforms, remote work normalization, and specialized service marketplaces. This audience seeks solutions that deliver enterprise-grade capabilities without enterprise-level complexity or cost, precisely the gap Jinna.ai addresses.

Leadership Profile

Bios highlighting expertise and awards

Andrei Yemelyanenka brings substantial product management and fintech experience to his role as Jinna.ai founder. His career trajectory includes senior positions at leading technology companies where he drove product development for millions of users.

At Revolut, the UK-based digital banking platform valued at over $33 billion, Yemelyanenka served as Senior Product Manager working on consumer financial services that required balancing regulatory complexity with exceptional user experience. His tenure coincided with Revolut’s explosive growth phase, providing exposure to hypergrowth dynamics and the challenges of scaling platforms internationally.

Prior to Revolut, Yemelyanenka held product leadership roles at Bolt, the European mobility platform competing with Uber across ride-sharing and micro-mobility services, and Avito, Russia’s leading classified advertisements platform. These experiences across different business models and markets provided diverse perspectives on how technology can transform traditional service categories.

Earlier career experience includes positions at Alfa-Bank and various digital product development roles, establishing a foundation in both financial services and technology product creation. This combination proves particularly relevant to Jinna.ai’s mission of automating financial administrative tasks through technology.

Yemelyanenka’s educational background spans multiple disciplines including business, technology, and product management. He has also served as a product management mentor, helping individuals and teams develop product skills and establish metric-driven cultures.

The founding of Jinna.ai represents a deeply personal mission for Yemelyanenka, inspired by observing the administrative burden faced by his wife, friends, and fellow entrepreneurs. This personal connection to the problem ensures authentic understanding of user needs and commitment to solving real pain points rather than building technology for its own sake.

Patent filings and publications

As an early-stage startup focused on rapid product development and market validation, Jinna.ai has not yet published extensive patent filings or academic research papers. The company’s intellectual property strategy appears to center on proprietary software implementation and trade secrets related to the Jenius context engine and AI learning systems rather than patentable inventions.

The broader Jina AI ecosystem, which shares similar naming but operates as a separate entity focused on neural search technology, has published extensively in academic venues including conferences such as EMNLP, SIGIR, ICLR, NeurIPS, and ICML. However, these publications relate to the neural search company’s research rather than Jinna.ai’s invoicing platform.

Community and Endorsements

Industry partnerships

Jinna.ai has established strategic partnerships with key technology providers that enable its platform capabilities. The Stripe integration represents a foundational partnership given that payment processing is central to the platform’s value proposition. Stripe’s reputation as the leading payment infrastructure for internet businesses lends credibility to Jinna.ai’s own offering.

The Xero partnership connects Jinna.ai to one of the world’s leading cloud-based accounting platforms, used by millions of small businesses and trusted by accountants and bookkeepers globally. This integration ensures that Jinna.ai fits within professional financial management workflows rather than operating as an isolated system.

Treyd partnership brings invoice financing capabilities that address a critical challenge for growing solopreneurs: the cash flow gap between completing work, sending invoices, and receiving payment. Treyd’s mission to make hardware businesses as scalable as software businesses through flexible financing aligns well with Jinna.ai’s goal of eliminating administrative barriers to solopreneur success.

The acceptance into Google for Startups Program represents endorsement from one of the world’s most influential technology companies. This program provides selected startups with mentorship, technical resources, and exposure to Google’s ecosystem of partners and investors, accelerating growth and validating commercial potential.

Media mentions and awards

The Product Hunt launch generated significant media attention and community engagement, with the platform achieving top-three trending status and extensive discussion across social media channels. Founder Andrei Yemelyanenka’s LinkedIn post announcing the launch garnered substantial engagement from the entrepreneurial community.

Coverage on AI tool directories, business software review sites, and entrepreneurship-focused publications has highlighted Jinna.ai as an innovative solution addressing real solopreneur needs. Reviewers consistently emphasize the platform’s ease of use, aesthetic invoice options, and intelligent automation as standout features.

Early users have shared testimonials describing how Jinna.ai saves hours weekly, accelerates payment collection, and removes the psychological burden of managing invoices and chasing payments. These authentic user stories provide powerful validation of the platform’s value proposition.

Strategic Outlook

Future roadmap and innovations

Jinna.ai’s development roadmap reflects an ambitious vision for expanding from specialized invoicing automation to comprehensive business administrative assistance. Near-term priorities include cash flow insights and predictions using AI to analyze payment patterns, forecast upcoming expenses, and identify potential cash flow gaps before they become critical. This financial intelligence helps solopreneurs make informed decisions about project acceptance, expense timing, and growth investments.

Business expense tracking and categorization will enable users to capture costs through similar voice and text input methods used for invoicing, automatically categorize expenses for tax purposes, and connect expense data with revenue to provide profitability insights by client or project.

Accounts payable functionality will round out the financial picture by helping manage supplier and vendor payments, track business obligations, and optimize payment timing to maintain positive cash flow while preserving vendor relationships.

Enhanced client relationship management capabilities will leverage the Jenius context engine to maintain comprehensive client histories, identify opportunities for additional services based on past engagement patterns, and flag clients at risk of disengagement based on interaction trends.

Multi-user support will accommodate solopreneurs who grow to employ virtual assistants, part-time staff, or collaborative partners, enabling delegation of routine tasks while maintaining oversight and control.

Market trends and recommendations

Several converging trends support Jinna.ai’s strategic positioning and growth potential. The solopreneur economy continues expanding as professionals increasingly choose independent work over traditional employment. Remote work normalization, digital platform marketplaces, and changing career preferences among younger workers drive this shift. Estimates suggest tens of millions of solopreneurs operate globally, representing a substantial addressable market.

AI adoption is accelerating across all business sizes, with small businesses and independent professionals increasingly comfortable using AI tools for routine tasks. Research indicates that 74 percent of enterprises using generative AI already see return on investment, with 85 percent of companies planning to increase AI investments. This rising AI literacy reduces adoption barriers for platforms like Jinna.ai.

The invoicing and accounts payable automation market is experiencing explosive growth, projected to expand from approximately $2.8 billion in 2024 to over $47 billion by 2034 at a compound annual growth rate exceeding 32 percent. This growth reflects recognition that manual financial processes are unsustainable and that automation delivers measurable returns through time savings, error reduction, and improved cash flow management.

Embedded financial services are becoming standard expectations rather than differentiating features. Businesses increasingly expect software platforms to facilitate not just administrative tasks but also related financial transactions such as payments, lending, and banking services. Jinna.ai’s integration of payment processing and invoice financing aligns with this trend.

For Jinna.ai to capitalize on these favorable trends, several strategic priorities merit emphasis. Maintaining laser focus on the solopreneur audience will be crucial as the platform gains traction and pressure emerges to expand upmarket. The discipline to resist feature bloat and complexity that might attract larger businesses but alienate core users will determine long-term success.

Continuous investment in the AI learning systems that power Jenius will sustain competitive differentiation as established players add automation features to existing platforms. The depth and sophistication of contextual intelligence that comes from purpose-built systems will remain difficult for retrofitted solutions to match.

Geographic expansion should follow deliberate sequencing that accounts for regulatory variation, local payment method preferences, and competitive dynamics in different markets. The initial focus on English-speaking markets and European countries provides a strong foundation, but capturing global opportunity will require thoughtful localization.

Building a vibrant user community that actively contributes feedback, shares best practices, and evangelizes the platform will accelerate product development and reduce customer acquisition costs. Solopreneurs often learn about tools through peer recommendations, making community cultivation essential to efficient growth.

Strategic partnerships with complementary platforms serving the solopreneur ecosystem can drive distribution and enhance value. Integrations with project management tools, time tracking applications, contract management systems, and tax preparation software would position Jinna.ai as the central nervous system for solopreneur business operations.

Final Thoughts

Jinna.ai represents a thoughtful and timely solution to genuine pain points experienced by millions of solopreneurs worldwide. The platform’s founding insight that entrepreneurs should spend time on their craft rather than administrative drudgery resonates deeply with an audience that chose independent work precisely to gain freedom and autonomy.

The technical implementation demonstrates sophisticated understanding of how AI can deliver practical value today rather than promising future capabilities. The conversational interface accepting voice and natural language input removes friction that makes traditional invoicing software feel like yet another obligation. The Jenius context engine that learns business patterns and client relationships provides personalization that generic automation cannot match.

The focus on aesthetics and branding reflects recognition that solopreneurs are not just seeking functional tools but are building businesses and reputations with every client interaction. Beautiful, professional invoices contribute to brand perception and client experience in ways that standard templates do not.

The strategic positioning focusing exclusively on solopreneurs enables purpose-built features and deliberate simplicity that platforms attempting to serve all business sizes cannot achieve. This specialization should be protected as the platform grows and opportunities to expand upmarket inevitably emerge.

The market opportunity is substantial and growing. The convergence of expanding solopreneur populations, accelerating AI adoption, and exploding invoicing automation market growth creates a favorable context for rapid scaling. The current free offering removes barriers to trial and adoption, building a user base that can convert to paid tiers as advanced features launch.

Several factors will determine whether Jinna.ai achieves its ambitious vision. Execution speed matters in a market experiencing explosive growth and intense competitive entry. The founding team’s product management expertise and fintech experience provide strong foundations, but maintaining development velocity while ensuring quality and reliability will be challenging.

The AI learning systems must deliver on the promise of continuous improvement. Early users will tolerate limitations if they see the platform becoming measurably smarter and more helpful over time. Stagnation would undermine the core value proposition.

The eventual transition from free to paid tiers must be managed carefully to avoid alienating the user base that helped validate the product. Pricing must reflect genuine value creation while remaining accessible to budget-conscious solopreneurs.

Competitive response from established players is inevitable. FreshBooks, QuickBooks, and others will observe Jinna.ai’s traction and may attempt to add similar features. Sustaining differentiation through superior AI capabilities, deeper integrations, and authentic understanding of solopreneur needs will be essential.

For solopreneurs evaluating whether to adopt Jinna.ai, the decision is straightforward during the current free period. The platform addresses real needs, requires minimal time investment to test, and delivers tangible value in time savings and improved cash flow. The risk of adoption is negligible while the potential benefit is substantial.

As the platform matures and introduces paid tiers, the calculus will evolve to weigh subscription costs against demonstrated value. Users should track time saved, improvements in days sales outstanding, and reduction in cognitive load from administrative tasks to evaluate return on investment.

Jinna.ai exemplifies a new generation of AI-powered tools that make sophisticated automation accessible to non-technical users, enable individuals to operate with capabilities previously requiring teams, and deliver value through genuine problem-solving rather than technology for its own sake. The platform’s success will depend on maintaining this focus while executing on an ambitious roadmap that expands capabilities without sacrificing the simplicity and intuitiveness that define its current appeal.