Table of Contents

MarketCrunch AI

What Is It?

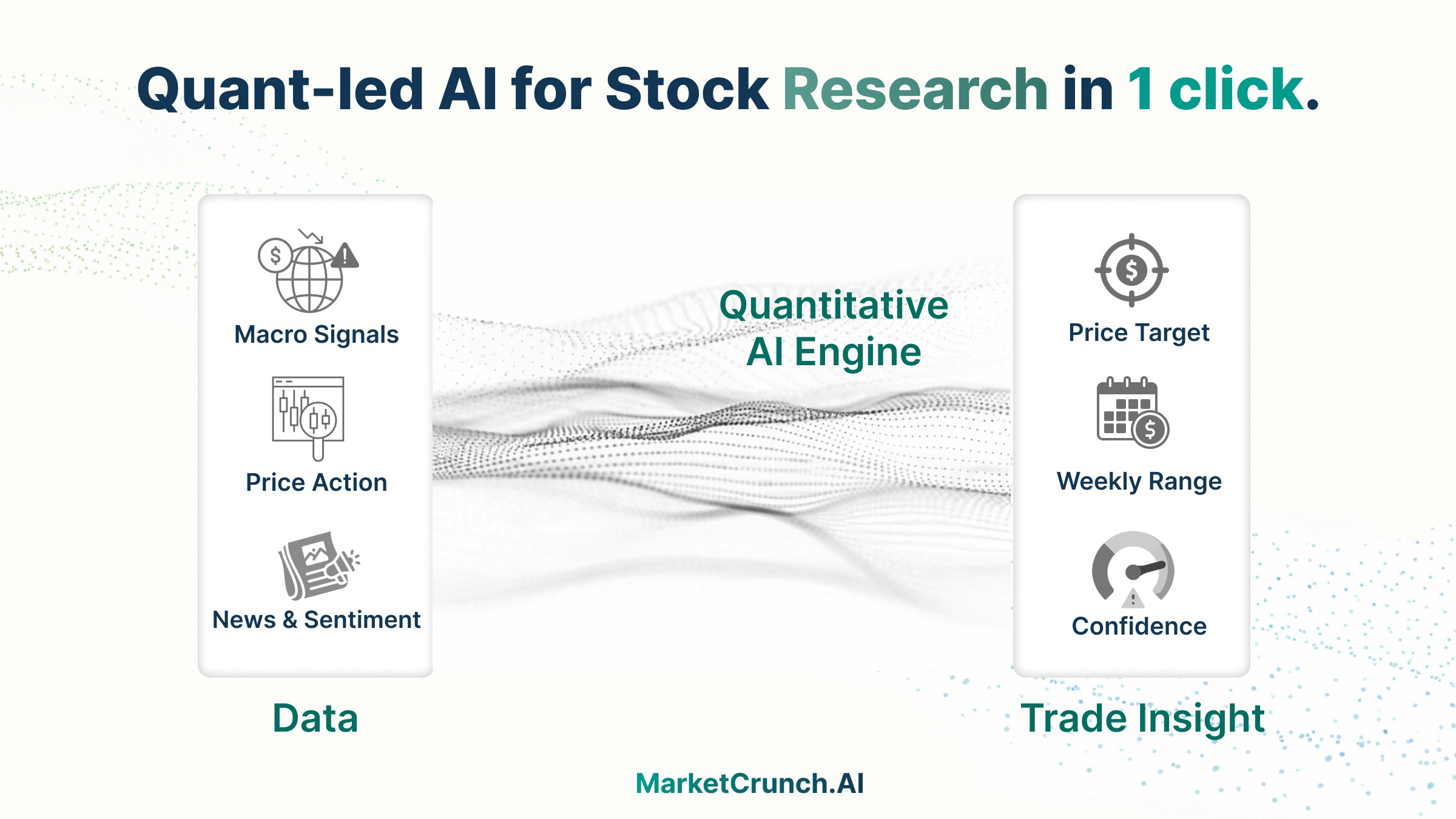

While many “AI stock research” tools are essentially wrappers around ChatGPT, MarketCrunch AI is a purpose-built quantitative analyst. Instead of just summarizing text, it uses a proprietary deep-learning model to analyze over 300 million data points daily—including macroeconomics, price action, and news sentiment. The goal is to provide retail traders with institutional-grade, 1-click price targets for the next day and upcoming week.

Key Features

- Deep-Learning Quantitative Model: Unlike LLMs that predict words, this model processes vast numerical datasets to forecast price movements.

- Actionable Price Targets: Provides specific “Next-Day” and “Weekly” price targets rather than vague sentiments.

- Explainable AI (White Box): The AI “shows its work” by displaying confidence markers, backtest performance, and clear “Why” drivers for every prediction.

- “Bloomberg for Retail”: Designed to offer the depth of a professional terminal with a UX simple enough for Robinhood users.

Best For

- Swing Trading: Ideal for traders looking for short-term opportunities (1–5 days).

- Data-Driven Research: Validating trade ideas with quantitative backing rather than gut feeling.

- Risk Management: Using confidence intervals to decide on position sizing or when to stay in cash.

Pros & Cons

- Pros: High transparency (shows historical accuracy/backtests); distinguishes between high-confidence and low-confidence setups; focuses on numerical data rather than just news summaries.

- Cons: Short-term predictions are highly volatile; purely quantitative models may miss qualitative nuances (like CEO scandals) that LLMs catch; past backtest performance does not guarantee future returns.

How Does It Compare?

MarketCrunch AI occupies a specific niche for short-term predictive signals, distinguishing it from other market tools:

- vs. Danelfin:

- Danelfin is the industry leader for “Explainable AI” stock picking, but it focuses on a medium-term horizon (3 months) with a probability score (1-10) of beating the market.

- MarketCrunch AI differentiates itself by focusing on short-term (Next-Day/Weekly) price targets, making it more suitable for active swing traders rather than quarterly investors.

- vs. FinChat.io:

- FinChat.io is a Generative AI platform (an “LLM for Finance”) excellent for summarizing earnings calls and finding fundamental data.

- MarketCrunch AI is a predictive engine. You use FinChat to read about a company, but you use MarketCrunch to predict its price action.

- vs. TradingView:

- TradingView is the gold standard for manual technical analysis and charting. It requires you to draw the lines and interpret the indicators.

- MarketCrunch AI automates this process, providing the “answer key” (targets and support/resistance) without requiring manual charting work.

- vs. Bloomberg Terminal:

- Bloomberg is a comprehensive professional ecosystem costing ~$24k/year, offering execution, chat, and raw data for institutions.

- MarketCrunch AI extracts the “predictive analytics” slice of that value proposition and packages it for individual traders at a fraction of the cost.

Final Thoughts

MarketCrunch AI is a compelling tool for the active retail trader who feels underserved by generic stock screeners and overwhelmed by complex charting software. By focusing on “Explainable AI”—telling you why a target was set—it bridges the gap between a “black box” signal service and a research platform.

However, users should treat it as a probability enhancer, not a crystal ball. It is best used to validate your own thesis: if your technical analysis aligns with MarketCrunch’s quantitative signal, you can trade with higher conviction.

> Disclaimer: This content is for informational purposes only and does not constitute financial advice. AI models are probabilistic and trading stocks involves significant risk.