Table of Contents

Overview

Juggling the demands of a startup or small business often leaves founders with little time for crucial financial management. Enter Mesh, an AI-powered bookkeeping assistant designed to simplify finances and provide real-time insights. Imagine having a virtual CFO available 24/7 through a simple chat interface. Mesh promises to eliminate the headache of spreadsheets and complex financial statements, allowing you to focus on what truly matters: growing your business. Let’s dive into what Mesh has to offer.

Key Features

Mesh boasts a range of features designed to streamline bookkeeping and provide valuable financial insights:

- Real-time financial insights via chat: Get instant answers to your financial questions through an intuitive chat interface, eliminating the need to sift through reports.

- Automated daily reconciliation: Mesh continuously reconciles transactions, ensuring your books are always up-to-date without manual effort.

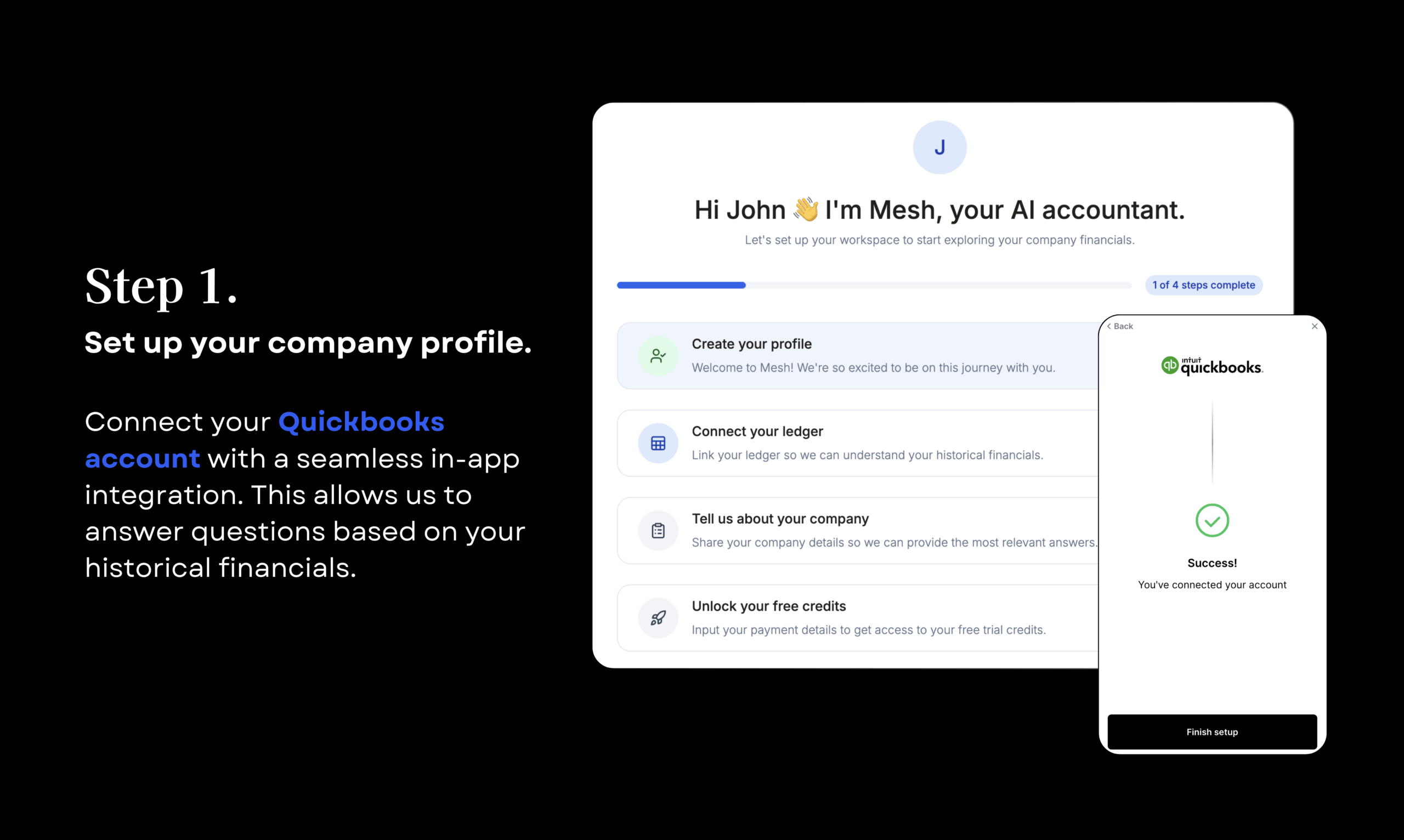

- Seamless integration with accounting tools: Connect Mesh to your existing accounting software for a smooth and integrated experience.

- Virtual CFO experience: Access expert-level financial insights and guidance without the cost of hiring a full-time CFO.

- Instant responses to financial queries: Receive immediate, contextual responses to your financial questions, empowering you to make informed decisions quickly.

How It Works

Mesh simplifies financial management by connecting directly to your company’s general ledger and financial tools. The AI-powered chat interface allows you to ask questions about your finances and receive immediate, contextual answers. Behind the scenes, the system continuously reconciles transactions, ensuring your books are always accurate and up-to-date. This automation eliminates the need for manual reconciliation, saving you time and reducing the risk of errors.

Use Cases

Mesh is particularly well-suited for the following scenarios:

- Startup founders managing finances without a CFO: Provides essential financial insights and support for early-stage companies.

- Small businesses seeking real-time financial visibility: Offers a clear and up-to-date view of your financial performance.

- Bookkeepers needing automation: Automates repetitive tasks, freeing up time for more strategic work.

- Finance teams looking to reduce manual reconciliation: Streamlines the reconciliation process, reducing errors and saving time.

Pros & Cons

Like any tool, Mesh has its strengths and weaknesses. Let’s take a look at the advantages and disadvantages.

Advantages

- Simplifies bookkeeping with automation

- Offers instant insights through its chat interface

- Reduces errors through real-time reconciliation

- User-friendly chat interface makes it easy to use

Disadvantages

- Limited customization for complex accounting needs

- Pricing details not transparently listed

How Does It Compare?

When considering bookkeeping solutions, it’s essential to compare Mesh with its competitors.

- QuickBooks: Offers broader accounting features but lacks the real-time chat insights provided by Mesh.

- Pilot: Provides similar automation capabilities but doesn’t include the interactive AI chat interface that makes Mesh unique.

Final Thoughts

Mesh presents a compelling solution for startups and small businesses seeking to simplify their bookkeeping and gain real-time financial insights. While it may not be suitable for companies with highly complex accounting needs, its user-friendly interface and AI-powered chat make it a valuable tool for those looking to streamline their financial management and focus on growth. The lack of transparent pricing may be a concern for some, but the potential time savings and improved financial visibility could make Mesh a worthwhile investment.