Table of Contents

Overview

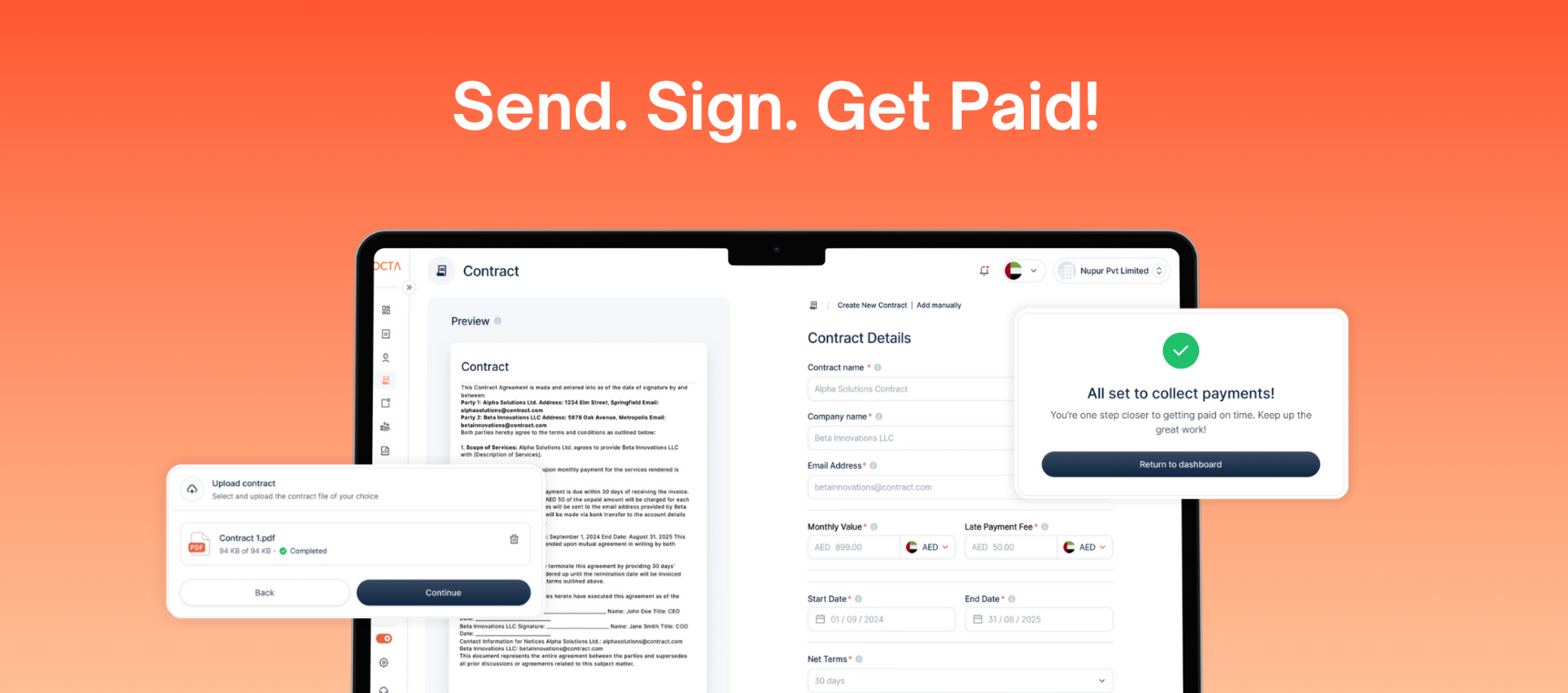

Tired of juggling multiple platforms for contracts, invoices, and payments? OCTA might be the solution you’ve been searching for. This AI-driven contract-to-cash platform is specifically designed to streamline the entire process for small and medium-sized businesses, from the initial agreement to getting paid. Let’s dive into what makes OCTA a contender in the world of business automation.

Key Features

OCTA boasts a range of features designed to simplify your financial workflows:

- Free e-signatures: Securely collect signatures on contracts without any upfront costs.

- Instant invoicing: Automatically generate invoices as soon as a contract is signed, saving you valuable time.

- Automated payment reminders: Never chase payments again! OCTA sends timely reminders to ensure you get paid on time.

- Global payment processing: Seamlessly accept payments from customers around the world, expanding your business reach.

- AI-powered workflow automation: OCTA leverages artificial intelligence to optimize each stage of the contract-to-cash process, increasing efficiency and reducing errors.

How It Works

OCTA simplifies the contract-to-cash cycle with an intuitive process. First, you create and send contracts for e-signature directly through the platform. Once the contract is signed, OCTA automatically generates an invoice based on the agreed-upon terms. The system then sends automated payment reminders to your client. Finally, OCTA handles the payment processing through secure, global channels, ensuring you get paid quickly and efficiently. AI powers each stage, optimizing the workflow for maximum efficiency.

Use Cases

OCTA is versatile and can be applied in various business scenarios:

- Contract management: Streamline the creation, signing, and storage of contracts, ensuring compliance and easy access.

- Invoice automation: Eliminate manual invoice creation and sending, freeing up your time for more strategic tasks.

- Small business billing: Simplify billing processes for small businesses, ensuring accurate and timely payments.

- Cross-border payments: Facilitate seamless and secure payments from international clients, expanding your global reach.

- Workflow optimization: Use AI-powered automation to streamline your contract-to-cash process, improving efficiency and reducing errors.

Pros & Cons

Like any tool, OCTA has its strengths and weaknesses. Let’s take a look:

Advantages

- End-to-end automation of the contract-to-cash process.

- Easy to use interface, making it accessible for users of all technical skill levels.

- Supports global payments, allowing you to transact with clients worldwide.

- Offers a free e-signature tool, providing immediate value.

Disadvantages

- May lack advanced features required by large enterprises with complex needs.

- Requires a stable internet connection to function effectively.

- Offers limited integrations with other business software.

How Does It Compare?

When considering contract-to-cash solutions, it’s important to understand how OCTA stacks up against the competition.

- DocuSign: While DocuSign excels in e-signatures, OCTA offers a more comprehensive solution by managing the entire contract-to-cash process.

- PandaDoc: PandaDoc provides robust templates for contract creation, but OCTA differentiates itself with its focus on AI-powered automation to optimize the entire workflow.

Final Thoughts

OCTA presents a compelling solution for small and medium-sized businesses seeking to streamline their contract-to-cash processes. Its focus on automation, global payments, and ease of use makes it a strong contender in the market. While it may not be the perfect fit for every enterprise, OCTA offers a valuable set of tools to improve efficiency and accelerate revenue generation for many businesses.