Table of Contents

Overview

Tired of feeling like you’re always one step behind the Wall Street pros? Prospero.Ai is an AI-powered investment platform designed to level the playing field. It takes complex, institutional-level trading signals and distills them into simple, actionable insights for everyday retail investors. Think hedge fund-grade analytics, but without the need for a PhD in finance. Founded by CEO George Kailas, this free platform democratizes access to institutional financial data that was previously available only to professional investors.

Key Features

Prospero.Ai boasts a range of features designed to empower investors of all experience levels:

AI-based stock picking: Utilizes advanced machine learning algorithms to identify high-potential stocks based on complex trading signals and vast institutional data analysis

Institutional signal simplification: Translates complex hedge fund strategies into easy-to-understand recommendations with clear weekly entries

Performance tracking dashboard: Provides a customizable dashboard with real-time insights into your portfolio’s performance and the accuracy of Prospero.Ai’s picks

Weekly investment recommendations: Delivers timely insights and suggestions for potential investment opportunities in accessible long/short format

Real-time market analysis: Processes vast amounts of unstructured data including news and social media sentiment for immediate market insights

Retail-friendly UX: Offers an intuitive and user-friendly interface, making it accessible to investors of all backgrounds

Model Portfolio tracking: Features a continuously performing model portfolio with transparent results

How It Works

Prospero.Ai operates by aggregating and interpreting trading signals commonly employed by hedge funds and other institutional investors. The platform processes millions of data points and combines vast amounts of unstructured data including news articles and social media sentiment analysis. The sophisticated machine learning models pinpoint stocks with strong potential for growth, delivering insights through its dashboard and mobile app. Crucially, Prospero.Ai highlights key entry and exit points with clear rationale behind each recommendation, helping users understand the market dynamics at play.

Use Cases

Prospero.Ai can be a valuable asset for a variety of investment strategies:

Retail investing: Provides AI-driven stock picks to enhance your investment decisions

Portfolio enhancement: Identifies opportunities to diversify and improve overall performance of existing portfolios

Trend tracking: Helps stay ahead of market trends by leveraging AI-powered analysis of institutional trading behavior

Learning institutional tactics: Offers insights into strategies used by sophisticated investors

Active trading: Particularly valuable for active traders seeking immediate insights with real-time analysis

Strategic investment planning: Provides scenario analysis tools for comprehensive investment planning

Pros & Cons

Like any investment tool, Prospero.Ai has its strengths and weaknesses:

Advantages

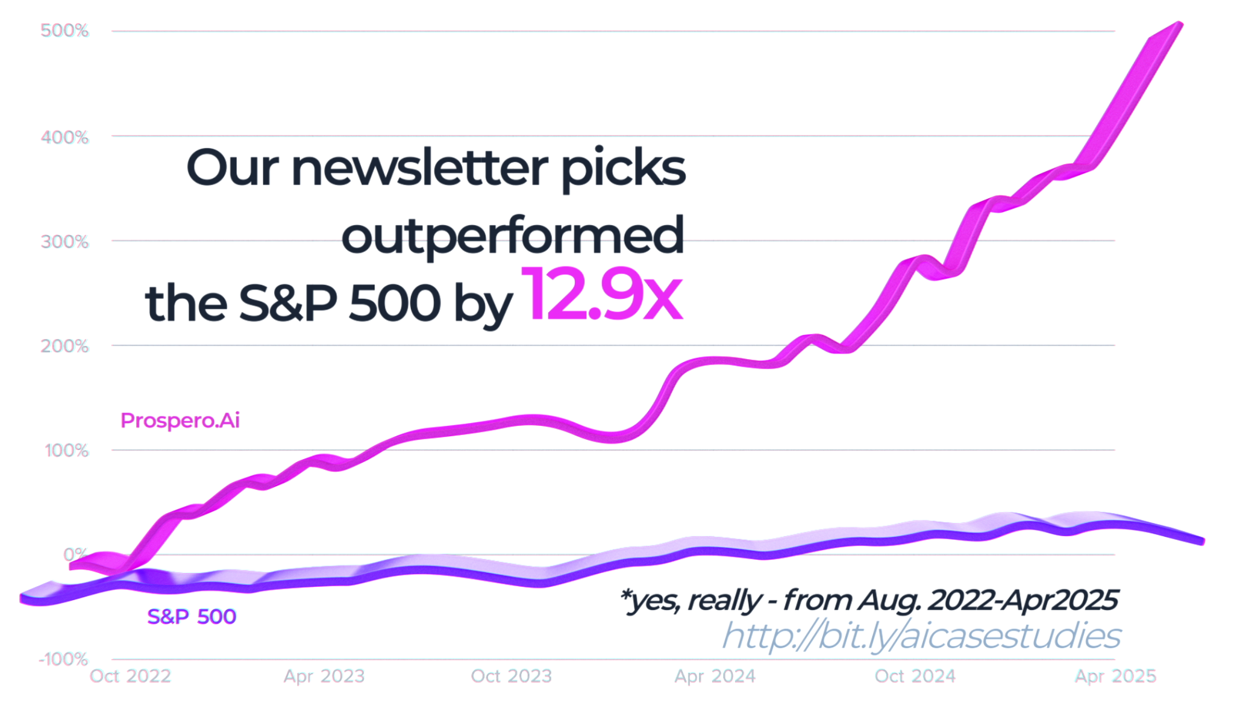

Proven track record: In 2023, 91 out of 151 picks (60%) outperformed S&P 500 benchmarks with an average performance 47% above the S&P 500

Strong Model Portfolio performance: 28% above S&P 500 with 60% win rate on 521 investments (as of December 2023)

Free access: Unlike many competitors, the platform is available at no cost

Easy-to-follow recommendations: Simplifies complex trading signals into actionable advice

Built for non-experts: Designed with user-friendly interface for investors of all levels

Real-time capabilities: Offers immediate market insights and customizable alert systems

Disadvantages

Dependent on model accuracy: Effectiveness relies heavily on accuracy of AI models and data quality

Technical understanding beneficial: May require certain level of technical understanding to maximize utility

Market volatility impact: Performance can be affected by difficult market conditions

May not suit long-term conservative investors: Focus on identifying high-potential stocks may not align with risk tolerance of all investors

How Does It Compare?

When considering AI-powered investment platforms, here’s how Prospero.Ai stacks up against the competition:

Prospero.Ai vs. Traditional Platforms:

AlphaSense: While AlphaSense excels in corporate research reports, Prospero.Ai focuses on real-time stock prediction using AI-driven pattern recognition

Yahoo Finance Premium: More customizable interface than straightforward platforms, though may require deeper understanding of financial analytics

Seeking Alpha: Offers crowd-sourced investment insights, while Prospero.Ai provides algorithmic precision with AI-driven analysis

Prospero.Ai vs. AI Competitors:

Kensho: While Kensho offers broad macroeconomic analytics, Prospero.Ai’s strength lies in extensive integration of unstructured data sources and real-time sentiment analysis

Other AI platforms: Stands out due to its free access model and proven track record of outperforming market benchmarks

Performance Track Record

2023 Results:

151 total picks with 60% success rate

Average performance 47% above S&P 500

Model Portfolio: 28% above S&P 500 on 521 investments

Successful pivot from options strategies to more accessible long/short format

Final Thoughts

Prospero.Ai offers a compelling approach to democratizing access to hedge fund-level investment strategies through its free AI-powered platform. With proven results showing significant outperformance of market benchmarks and a user-friendly interface designed for retail investors, it represents a valuable tool for enhancing portfolio performance. The platform’s combination of institutional-level analysis, real-time insights, and accessible format makes it particularly attractive for both novice and experienced investors. However, users should understand the platform’s reliance on model accuracy and consider their own risk tolerance. As with any investment strategy, thorough research and careful consideration of personal financial goals remain essential before making investment decisions.