Table of Contents

Overview

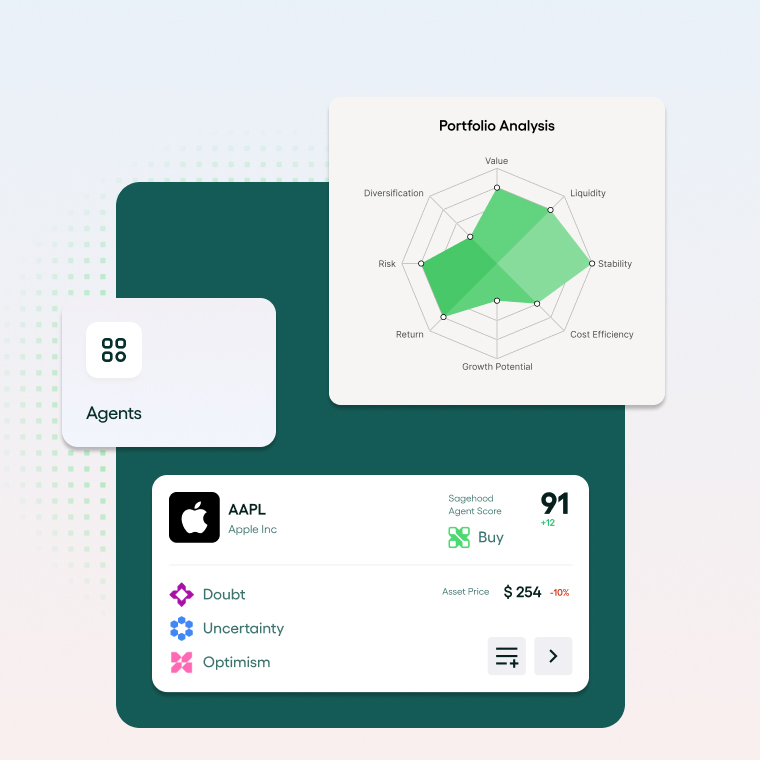

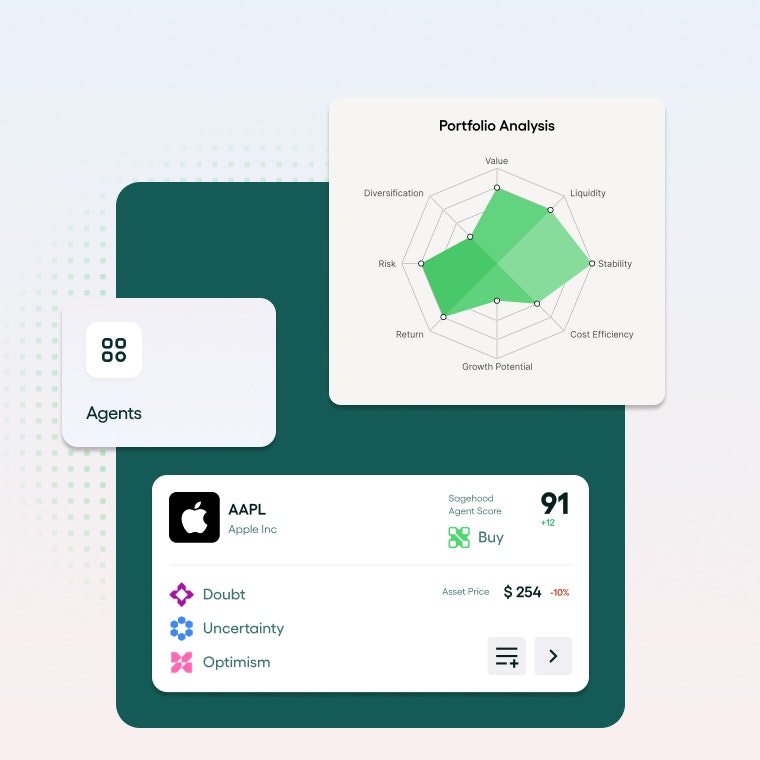

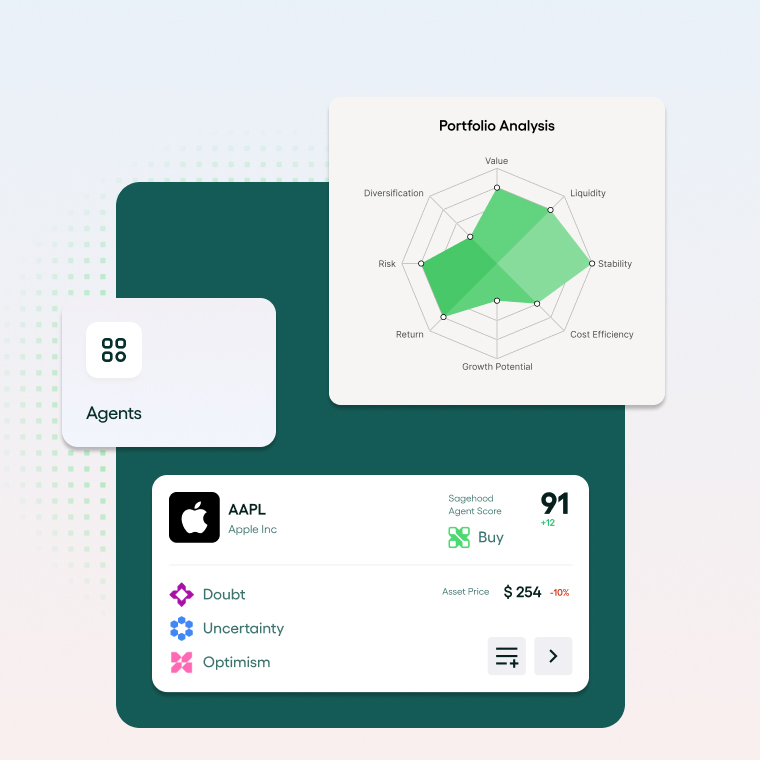

Navigating the stock market can feel like traversing a minefield, especially for individual investors. Wouldn’t it be great to have an expert financial advisor constantly analyzing your portfolio and providing actionable insights? That’s the promise of Sagehood AI, a stock market intelligence platform that leverages the power of AI to help you analyze, diagnose, and optimize your investment portfolio. Let’s dive into what makes Sagehood AI tick and whether it’s the right tool for you.

Key Features

Sagehood AI boasts a robust suite of features designed to empower investors. Here’s a breakdown of what you can expect:

AI-driven portfolio analysis: Get a comprehensive overview of your portfolio’s strengths and weaknesses, powered by sophisticated multi-agent AI systems.

Expert financial insights: Benefit from specialized AI agents including Financial Analyst, Risk Management, News Agent, Social Media Buzz Agent, and Sector Analyst that provide context and perspective on market trends and investment opportunities.

Rebalancing recommendations: Receive data-driven suggestions on how to reallocate your assets to better align with your financial goals and risk tolerance.

Investment diagnostics: Identify potential risks and imbalances within your portfolio, allowing you to make informed decisions to mitigate potential losses.

Real-time stock market tracking: Stay up-to-date with the latest market movements and news, ensuring you’re always informed.

Personalized investment advice: Get tailored recommendations based on your individual investment profile and objectives.

Valuation projection analysis: Access three-scenario forecasting for stock performance to navigate market uncertainty.

How It Works

Sagehood AI simplifies complex portfolio analysis through an intuitive multi-agent system. Users begin by connecting their existing investment portfolios to the platform through supported brokerages like Fidelity, Schwab, or Robinhood. Once connected, Sagehood’s specialized AI agents analyze your holdings against vast arrays of market data, processing billions of data points from diverse sources. The AI identifies imbalances, assesses risk factors, and generates reallocation strategies tailored to your specific goals and current market trends. The platform presents these insights through an easy-to-understand interface, empowering you to make smarter, faster investment decisions.

Use Cases

Sagehood AI caters to a variety of investment needs. Here are key use cases:

Retail investor portfolio optimization: Individual investors can use Sagehood AI to fine-tune their portfolios for better performance and risk management.

Risk management for individual traders: Traders can leverage the platform’s diagnostic tools to identify and mitigate potential risks in their investment strategies.

Investment strategy planning: Plan and execute your investment strategy with data-driven insights and AI-powered recommendations.

Real-time financial monitoring: Keep constant watch over your portfolio’s performance and receive alerts for significant market events.

Market trend analysis: Utilize specialized agents for news analysis, social media sentiment, and sector-specific insights.

Pricing

Free Plan: 5 daily insights, watchlist management, basic portfolio import, general AI agent access

Premium Plan: $29.99/month (40% discount for new subscribers), unlimited insights, full agent access, personalized recommendations

Enterprise Plan: Custom pricing for advanced API integrations and custom AI agents

14-day free trial available for Premium features

Pros & Cons

Advantages

Comprehensive AI agent system: Multiple specialized agents provide diverse analytical perspectives

Real-time market intelligence: Processes billions of data points for up-to-date insights

User-friendly interface: Intuitive design suitable for both beginners and experienced investors

Flexible pricing: Free tier available with meaningful functionality

Specialized analysis: Dedicated agents for technical, fundamental, and sentiment analysis

Disadvantages

U.S. market focus: Currently limited to U.S. stock markets, excluding international opportunities

Requires ongoing data access: Platform effectiveness depends on continuous portfolio data connections

Premium features behind paywall: Advanced functionality requires paid subscription

Relatively new platform: Limited long-term track record compared to established competitors

How Does It Compare?

When considering AI-powered investment tools in 2025, the competitive landscape has evolved significantly:

Traditional Robo-Advisors:

Vanguard Digital Advisor: Morningstar’s top-ranked robo-advisor with low 0.20% fees and comprehensive portfolio management

Betterment: Leading platform with AI-enhanced features, tax-loss harvesting, and recent strategic acquisitions

Wealthfront: Offers sophisticated portfolio management, direct indexing, and advanced tax optimization strategies

AI Research Platforms:

Fiscal.ai (formerly FinChat): Conversational AI platform combining institutional-grade data with natural language queries

AlphaSense: $4B valuation platform serving 80% of top asset management firms with AI-powered market intelligence

Range: AI-focused wealth management startup with $40M+ funding, targeting high-net-worth individuals

Key Differentiators:

Sagehood AI distinguishes itself through its multi-agent approach, offering specialized AI analysts for different market aspects. While traditional robo-advisors focus on portfolio construction, Sagehood emphasizes ongoing analysis and insights. Compared to research platforms like Fiscal.ai or AlphaSense, Sagehood targets retail investors with more accessible pricing and user experience.

Final Thoughts

Sagehood AI presents a compelling option for retail investors seeking to leverage AI for enhanced portfolio management. The platform’s multi-agent architecture and focus on actionable insights address key gaps in traditional robo-advisory services. While it faces strong competition from established players and newer AI-driven platforms, its specialized approach to U.S. market analysis and accessible pricing structure make it valuable for investors seeking data-driven portfolio optimization. The 14-day free trial provides an excellent opportunity to evaluate whether the platform’s AI-powered insights align with your investment strategy and decision-making needs.