Table of Contents

- Sentra by Dodo Payments: Comprehensive Research Report

- 1. Executive Snapshot

- 2. Impact & Evidence

- 3. Technical Blueprint

- 4. Trust & Governance

- 5. Unique Capabilities

- 6. Adoption Pathways

- 7. Use Case Portfolio

- 8. Balanced Analysis

- 9. Transparent Pricing

- 10. Market Positioning

- 11. Leadership Profile

- 12. Community & Endorsements

- 13. Strategic Outlook

- Final Thoughts

Sentra by Dodo Payments: Comprehensive Research Report

1. Executive Snapshot

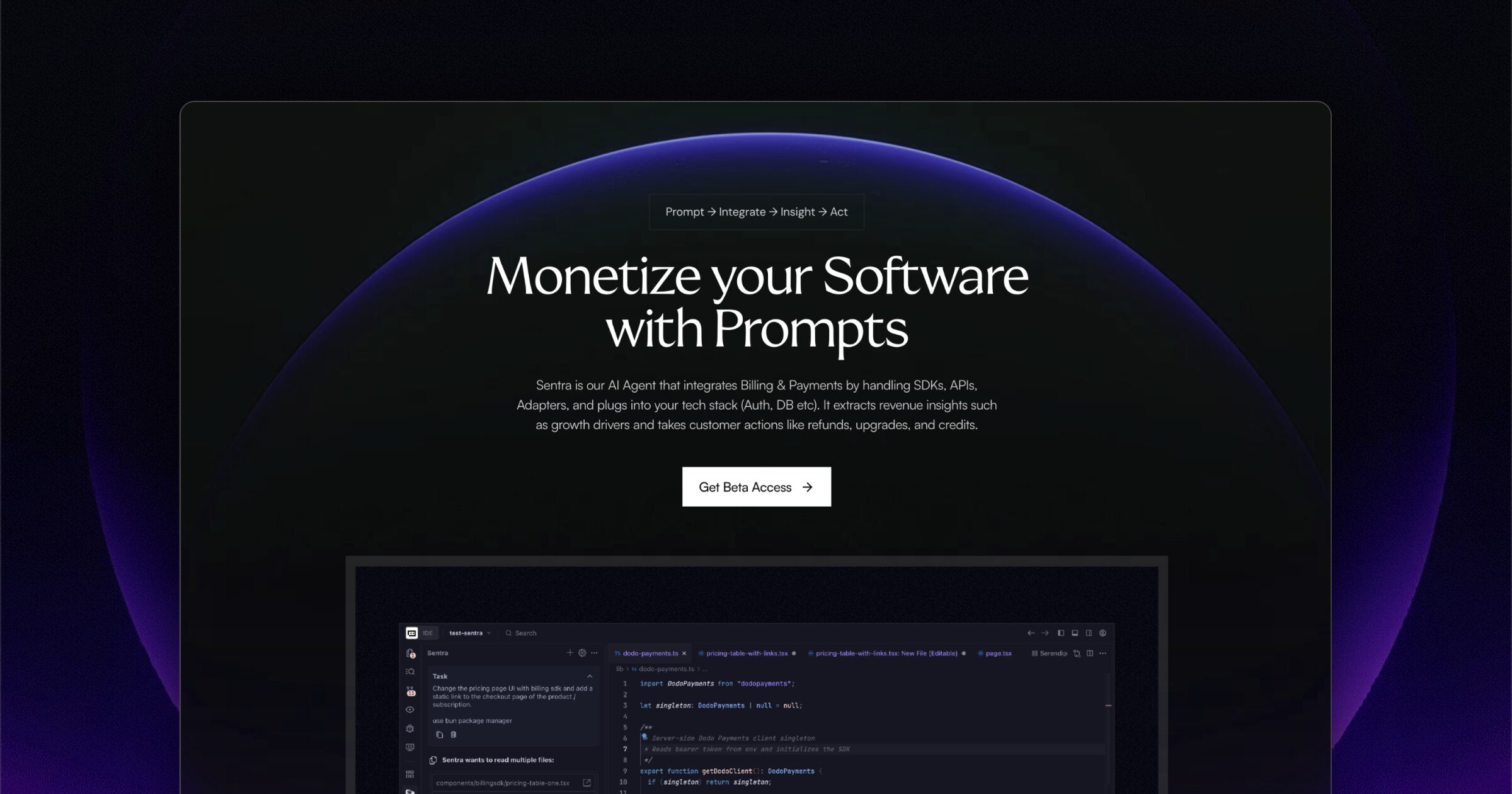

Core offering overview

Sentra is an agentic AI platform developed by Dodo Payments that fundamentally reimagines how software companies integrate, manage, and optimize billing and payment operations. Unlike traditional billing software that requires manual configuration and technical implementation, Sentra operates as an autonomous coding agent embedded directly within developer workflows, handling SDK integration, API configuration, adapter deployment, and financial operations through natural language prompts. The platform transforms billing from infrastructure-heavy technical debt into an intelligent layer that developers can prompt into existence, analyze revenue dynamics through conversational queries, and execute customer actions like refunds, upgrades, and credits without leaving their development environment.

Sentra represents Dodo Payments’ strategic pivot into agentic infrastructure, joining their existing Payment Gateway, Billing Management, and Distribution platforms to create a comprehensive Merchant of Record solution. The system was architected specifically for the emerging wave of AI-powered SaaS and digital products where development velocity and monetization flexibility determine competitive positioning. By positioning billing as a conversational, code-generating agent rather than a configuration dashboard, Sentra addresses the fundamental friction that prevents developers from shipping monetization features at the same pace they ship product features.

Key achievements & milestones

Dodo Payments, the parent company behind Sentra, achieved remarkable growth since its 2023 founding by Rishabh Goel and Ayush Agarwal, two entrepreneurs who experienced cross-border payment friction firsthand while scaling previous ventures. The company secured $1.1 million in pre-seed funding in early 2025, co-led by Antler, 9Unicorns, and Venture Catalysts, with participation from prominent angel investors including Nitin Gupta from Uni Cards and PayU, Maninder Gulati former Oyo CSO, Raymond Russell former Chief of Staff at Boom Supersonic, Preethi Kasireddy former a16z partner, and Nishant Verman former Flipkart corporate development head. This investor backing brings not just capital but deep operational expertise across fintech, payments, and hypergrowth startups.

Within approximately 18 months of operation, Dodo Payments onboarded more than 10,000 merchants across 30-plus countries, processing transactions in over 150 nations with success rates consistently exceeding 90 percent—dramatically outperforming the 40 to 60 percent success rates typical for emerging market startups using domestic payment gateways. The company achieved recognition as the first Merchant of Record platform specifically designed for India and emerging markets, addressing systematic barriers that prevented digital-first businesses in Southeast Asia, Eastern Europe, and other developing regions from effectively monetizing global customer bases.

Sentra launched in Alpha in October 2025 as an IDE-first agent, initially available for Visual Studio Code with announced expansion roadmap including Cursor and Windsurf integration, command-line interface deployment, web dashboard access, and Slack embedding for non-technical team members. The Product Hunt launch generated significant developer community interest, earning recognition for innovative approach to monetization infrastructure. Early Alpha testers reported productivity improvements of 50 percent or greater for billing integration tasks that previously consumed entire sprint cycles.

Adoption statistics

Dodo Payments’ underlying infrastructure currently supports billing, payment processing, and compliance operations for thousands of active merchants generating millions in monthly gross merchandise volume. The platform processes transactions across 25-plus local payment methods including Apple Pay, Klarna, Affirm, Cash App, PIX, and UPI alongside major card networks, delivering services in 14 languages to accommodate global customer bases. Transaction success rates average 90 percent-plus for cross-border payments—a critical metric where one B2C SaaS customer documented payment success rate improvements from 46 percent using a popular Indian payment gateway to 96 percent after switching to Dodo Payments, effectively doubling revenue from identical traffic levels.

The broader market context validates Sentra’s positioning at the intersection of AI-powered development tools and billing automation. The global Merchant of Record software market reached $12.69 billion valuation in 2024 with projected growth to $14.66 billion in 2025 and $31.16 billion by 2030, representing a compound annual growth rate of 16.15 percent driven by digital commerce expansion and regulatory compliance complexity. The subscription billing software market specifically demonstrates similar momentum, expanding from $4.18 billion in 2023 toward projected $19.87 billion by 2033 at 16.87 percent CAGR as businesses increasingly adopt recurring revenue models.

Artificial intelligence’s role in financial automation is accelerating rapidly, with the AI-driven expense report automation market growing from $2.46 billion in 2024 to expected $4.77 billion by 2029 at 14.1 percent CAGR, while AI for invoice management specifically shows even more explosive growth from initial baseline toward $6.4 billion expansion between 2025 and 2029 at 30.5 percent CAGR. Industry projections suggest 80 percent of large enterprises will deploy in-house AI platforms for financial decision-making by 2026, with at least 15 percent of daily work decisions autonomously executed by agentic AI by 2028. Sentra positions directly at this convergence of billing infrastructure and autonomous AI execution.

2. Impact & Evidence

Client success stories

Real-world implementation results demonstrate Sentra’s parent platform capabilities through documented case studies. One B2C SaaS company operating from an emerging market experienced dramatic transformation after migrating from a regional payment gateway to Dodo Payments infrastructure. Their payment success rate for United States customers jumped from 46 percent to 96 percent overnight—more than doubling revenue from identical traffic without any changes to marketing, product, or conversion optimization. This single infrastructure switch eliminated half of previous payment failures that had been draining potential revenue despite successful conversion funnel optimization.

Emerging market startups face particularly severe challenges when scaling internationally, with cross-border payment success rates frequently falling below 60 percent due to licensing restrictions, regulatory barriers, and inadequate payment method coverage. Traditional domestic gateways like Razorpay, Payoneer, and PayPal were originally architected for local market operations and struggle with seamless foreign payment method integration, multi-country tax compliance automation, competitive cross-border fee structures, and payment success rate optimization across international jurisdictions. Research indicates United States businesses alone lose 2.1 percent of global revenues annually due to poor payment performance including false declines and failed transactions—a figure that escalates significantly for emerging market digital brands where infrastructure limitations compound friction.

Dodo Payments’ comprehensive Merchant of Record approach addresses these systematic failures by providing 25-plus payment methods out of the box, handling in-house tax billing and remittance across 150-plus countries, maintaining PCI-certified fraud-ready infrastructure, and offering checkout experiences in 20-plus languages supporting 30-plus currencies. This global-native payment infrastructure delivers capabilities that emerging market founders would otherwise spend months or years assembling from fragmented vendor relationships, if such comprehensive coverage could be achieved at all.

Performance metrics & benchmarks

Quantitative performance data validates Sentra’s architectural approach to billing automation. The platform enables prompt-to-production workflows measured in minutes rather than the days or weeks traditionally required for billing system integration. Early Alpha users implementing usage-based billing with free trial configurations reported completing setup that previously consumed entire development sprints within single afternoon sessions, representing productivity acceleration of 50 percent or greater specifically for monetization infrastructure.

The four-step workflow—Prompt, Plan, Approve, Execute—creates measurable velocity improvements at each stage. Prompt interpretation occurs in real-time as developers describe desired billing configurations in natural language. Plan generation synthesizes necessary code changes, SDK hooks, webhook configurations, and test implementations within seconds to low-single-digit minutes depending on complexity. Approval workflows maintain human-in-the-loop governance while eliminating the research, documentation consultation, and trial-and-error traditionally required to ensure correct implementation. Execution applies changes, runs validation tests, and confirms success automatically with rollback capabilities if issues emerge.

The underlying Dodo Payments infrastructure demonstrates production-scale reliability handling millions of monthly transactions across global merchant base. Payment success rate metrics consistently exceed 90 percent for cross-border transactions compared to industry averages in the 70 to 80 percent range for mature markets and 40 to 60 percent for emerging market originators. This 10 to 50 percentage point improvement in payment completion directly translates to revenue capture, as failed transactions represent permanently lost opportunities in most digital commerce scenarios where customers rarely retry after initial payment failures.

Integration velocity represents another critical performance dimension. Traditional billing system implementations require four to twelve weeks for mid-complexity scenarios including developer time for SDK integration, webhook configuration, testing across payment scenarios, compliance verification, and production rollout coordination. Sentra compresses this timeline to days or hours by generating implementation code, wiring necessary integrations, and providing tested configurations through conversational workflows that eliminate manual documentation interpretation and trial-and-error debugging cycles.

Third-party validations

Dodo Payments maintains PCI DSS compliance certification, the Payment Card Industry Data Security Standard developed by leading cardholder brands to protect sensitive payment information. As a payment service provider that processes and stores cardholder data, PCI certification is mandatory rather than optional, demonstrating adherence to rigorous security controls around network architecture, data encryption, access management, vulnerability monitoring, and incident response procedures. The company publicly commits to achieving additional global certifications including SOC 2 Type II for operational control validation, GDPR compliance for European data protection requirements, and ISO standards for information security management systems.

Venture capital backing from Antler, 9Unicorns, and Venture Catalysts provides institutional validation of the company’s market opportunity and execution capabilities. Antler, a global early-stage venture capital firm with presence across six continents, selectively invests in exceptional founding teams addressing large market opportunities with scalable technology platforms. Their participation signals confidence in Dodo Payments’ ability to capture meaningful market share in the rapidly expanding cross-border payments and billing automation sectors.

Angel investor participation brings operational credibility from executives who built and scaled adjacent companies. Nitin Gupta’s involvement brings perspective from founding Uni Cards and serving in leadership roles at PayU, providing deep fintech and consumer lending expertise. Maninder Gulati’s background as Oyo’s Chief Strategy Officer and investor at Lightspeed contributes hospitality technology and global expansion insights. Preethi Kasireddy’s tenure as partner at Andreessen Horowitz and blockchain entrepreneur background adds technology infrastructure and venture scaling knowledge. This concentrated expertise creates an informal advisory network accelerating strategic decision-making and partnership development.

Product Hunt community recognition further validates developer reception, with Sentra’s launch generating substantial engagement indicating genuine interest from the target developer and founder audience. While specific award recognitions are still accumulating given the platform’s recent Alpha launch timing, early adoption patterns and community discussion volume suggest strong product-market fit within the AI-native SaaS builder segment that Sentra explicitly targets.

3. Technical Blueprint

System architecture overview

Sentra’s architecture operates as an intelligent orchestration layer positioned between developer intent and Dodo Payments’ core billing infrastructure. The system employs large language models to interpret natural language prompts, translate them into structured implementation plans, generate necessary code artifacts, and execute deployment through validated workflows. This agentic approach contrasts fundamentally with traditional billing platforms that expose configuration dashboards and require developers to manually translate business requirements into technical implementations through trial-and-error experimentation with complex parameter combinations.

The IDE-first deployment strategy integrates Sentra directly into environments where developers already work—Visual Studio Code initially, with planned expansion to Cursor and Windsurf AI-enhanced code editors. This embedded approach eliminates context-switching between development environment and separate billing configuration dashboards, maintaining developer flow state while implementing monetization features. The agent monitors project structure, understands existing authentication implementations, identifies database schemas, and proposes billing integrations that seamlessly mesh with established architecture patterns rather than requiring wholesale refactoring to accommodate billing system requirements.

Under the hood, Sentra connects to Dodo Payments’ comprehensive billing and payment infrastructure comprising subscription management, usage-based metering, one-time payment processing, outcome-based billing configurations, tax calculation and remittance across global jurisdictions, fraud detection and prevention systems, and multi-currency settlement capabilities. The agent abstracts this complexity behind conversational interfaces while maintaining full access to underlying capabilities, enabling developers to leverage sophisticated features through simple prompts rather than mastering extensive API documentation and implementation patterns.

The platform implements guardrails and approval workflows ensuring autonomous agent actions remain under developer control. Every proposed change generates human-readable diffs showing exactly what code will be added, modified, or removed before execution occurs. This human-in-the-loop design prevents runaway automation while dramatically accelerating implementation velocity compared to manual approaches. Audit trails track all agent actions, configuration changes, and deployment decisions, providing compliance documentation and rollback capabilities if issues emerge post-deployment.

API & SDK integrations

Sentra generates and manages integrations with Dodo Payments’ developer-friendly APIs and SDKs, handling boilerplate code that traditionally consumes significant developer time. The system automatically wires necessary authentication flows, configures webhook endpoints for payment event notifications, implements proper error handling and retry logic, and generates test implementations validating integration correctness before production deployment. This comprehensive code generation eliminates the research, documentation consultation, and trial-and-error traditionally required to achieve working billing integrations.

The platform accommodates diverse technology stacks by generating idiomatic code for multiple programming languages and framework patterns. Whether developers work with Node.js and Express, Python and Django, Ruby on Rails, PHP frameworks, or other modern web application stacks, Sentra adapts generated code to match existing project conventions. This polyglot capability stems from large language models’ exposure to extensive code repositories across languages and frameworks during training, enabling contextually appropriate code generation rather than generic templates requiring manual adaptation.

Beyond Dodo Payments’ native capabilities, Sentra integrates with broader technology ecosystems including authentication providers like Auth0, Clerk, and Supabase for user identity management; database systems including PostgreSQL, MySQL, MongoDB, and Redis for billing metadata storage; CRM platforms like Salesforce and HubSpot for customer relationship synchronization; and accounting systems including QuickBooks, Xero, and NetSuite for financial reporting integration. The agent understands these integrations’ patterns and can configure necessary data flows, webhook listeners, and synchronization jobs through prompt-driven workflows.

The three-mode operational model—Integrate, Insight, Act—structures how developers interact with billing capabilities through Sentra. Integrate mode handles initial setup and ongoing configuration changes for products, plans, pricing tiers, usage metrics, coupons, free trials, and billing cycles. Insight mode enables natural language queries about revenue performance, churn analysis by cohort or geography, anomaly detection, and growth driver identification with automatic chart generation and suggested remediation actions. Act mode executes operational tasks including invoice refunds, subscription upgrades or downgrades, account credits for service level violations, payment method updates, and customer notifications—all through conversational commands with appropriate safety guardrails and approval workflows.

Scalability & reliability data

Sentra inherits scalability and reliability characteristics from the underlying Dodo Payments infrastructure, which processes millions of monthly transactions for thousands of merchants across global operations. The platform maintains uptime commitments appropriate for mission-critical payment processing, implementing redundancy across availability zones, automatic failover for component failures, real-time monitoring with alerting for anomaly detection, and staged deployment procedures preventing widespread impact from software bugs or misconfigurations.

Payment success rate optimization represents a key reliability metric where infrastructure quality directly impacts revenue capture. Dodo Payments’ 90-percent-plus success rates for cross-border transactions demonstrate robust handling of authentication challenges, network timeouts, gateway routing decisions, retry logic for temporary failures, and fraud prevention measures that balance security with approval rate optimization. These operational characteristics prove particularly valuable for high-volume scenarios where even single-digit percentage improvements in success rates translate to substantial revenue impact.

The agent architecture itself employs reliability patterns including request queuing for high-concurrency scenarios, timeout handling preventing hung operations, graceful degradation when external dependencies experience issues, and comprehensive error logging enabling root cause analysis when unexpected failures occur. Alpha stage deployment naturally focuses on gathering production usage data to identify edge cases, failure modes, and performance bottlenecks before broader Beta and General Availability releases. The guardrailed, approval-based workflow design inherently limits blast radius from agent errors by requiring human confirmation before executing consequential actions.

Scalability projections align with broader market growth as AI-native development approaches achieve mainstream adoption. The IDE-embedded architecture enables horizontal scaling as developer count expands without requiring proportional increases in support infrastructure—a favorable economic model where marginal cost per additional developer remains low while value creation scales linearly with developer productivity improvements and faster billing implementation velocity.

4. Trust & Governance

Security certifications

Dodo Payments holds PCI DSS Level 1 compliance certification, the most stringent security standard for organizations processing card transactions. Level 1 designation applies to service providers handling more than 300,000 card transactions annually, requiring annual external audits by Qualified Security Assessors who validate comprehensive security controls across network segmentation, encryption standards, access management, vulnerability scanning, penetration testing, incident response procedures, and security awareness training. This certification demonstrates institutional commitment to protecting sensitive payment data throughout capture, transmission, processing, and storage lifecycles.

The company publicly commits to achieving SOC 2 Type II certification, an assurance framework developed by the American Institute of Certified Public Accountants evaluating organizational controls across security, availability, processing integrity, confidentiality, and privacy dimensions. SOC 2 Type II audits specifically assess whether control implementations operate effectively over time rather than merely existing on paper, providing higher assurance than SOC 2 Type I examinations. Organizations handling sensitive financial data increasingly require SOC 2 certification from vendors as table-stakes security validation before procurement decisions.

GDPR compliance for European data protection requirements represents another stated certification target, ensuring appropriate handling of personal data for European Union residents including lawful basis for processing, data minimization principles, purpose limitation, storage limitation, rights to access and deletion, and cross-border transfer restrictions. ISO 27001 certification for information security management systems provides additional third-party validation of systematic security practices including risk assessment methodologies, security policy documentation, incident management procedures, and continuous improvement frameworks.

These layered certifications create defense-in-depth security postures where multiple independent auditors validate different aspects of security programs. The certification roadmap progression demonstrates maturity evolution typical for hypergrowth fintech companies—starting with mandatory baseline certifications like PCI compliance, then layering operational excellence frameworks like SOC 2, and finally pursuing comprehensive standards like ISO 27001 as organizational processes stabilize and scale.

Data privacy measures

Sentra and the underlying Dodo Payments infrastructure implement privacy-by-design principles throughout data handling lifecycles. The platform minimizes data collection to operational necessities, avoiding surveillance capitalism patterns where user behavior tracking exceeds functional requirements. Billing and payment data flows through encrypted channels using industry-standard TLS protocols, with at-rest encryption protecting stored data from unauthorized access even if underlying storage media are compromised.

Tokenization replaces sensitive payment credentials with non-sensitive equivalents, dramatically reducing PCI compliance scope for merchant implementations. When customers enter credit card numbers, cardholder names, CVV codes, and billing addresses, this data is transmitted directly to Dodo Payments’ PCI-certified environment and tokenized immediately. Merchants receive opaque tokens referencing stored payment methods without ever touching raw card data, eliminating most PCI DSS requirements from their infrastructure and reducing breach liability exposure.

Data residency controls enable compliance with regulations requiring data localization for specific jurisdictions. The platform supports geographically distributed infrastructure allowing customer data to remain within regulatory boundaries when legal requirements mandate such restrictions. This capability proves essential for expanding into markets with strict data sovereignty regulations including Russia, China, India, and others implementing localization mandates.

Retention policies limit data storage duration to operational and regulatory minimums, automatically purging transaction details, customer information, and audit logs after appropriate retention periods expire. This time-bound approach reduces breach exposure surfaces by minimizing stored sensitive data volumes while maintaining compliance with financial record-keeping regulations typically mandating seven-year retention for tax and audit purposes.

Regulatory compliance details

Operating as a Merchant of Record, Dodo Payments assumes direct responsibility for tax collection, remittance, and compliance across jurisdictions where merchants sell digital products and services. This legal positioning provides substantial value by offloading complex regulatory burdens from merchant operations, particularly for small teams lacking dedicated tax and compliance expertise. The platform automatically calculates appropriate sales tax, VAT, GST, and other consumption taxes based on customer location, product categorization, and applicable tax rules, then handles filing and remittance with tax authorities on behalf of merchants.

Cross-border payment regulations vary dramatically by country, with requirements spanning anti-money laundering controls, know-your-customer verification, suspicious activity reporting, sanctions screening, and transaction monitoring. Dodo Payments implements comprehensive compliance programs addressing these obligations, maintaining required licenses and registrations in supported jurisdictions, conducting ongoing risk assessments, and adjusting programs as regulatory requirements evolve. This institutional capability enables merchants to accept international payments without establishing legal entities, obtaining licenses, or building compliance infrastructure in every target market.

Payment method regulations add another complexity layer, with different rules governing credit cards, bank transfers, digital wallets, buy-now-pay-later arrangements, and cryptocurrency settlements. The platform navigates these requirements by partnering with licensed payment processors, maintaining appropriate agreements with card networks, implementing required security controls for different payment types, and staying current with regulatory changes as authorities adapt rules to emerging payment innovations.

Consumer protection regulations including chargeback rights, refund policies, subscription cancellation requirements, and automatic renewal disclosures vary by jurisdiction and product category. Sentra helps developers implement compliant workflows by generating appropriate disclosure language, configuring grace periods, enabling self-service cancellation, and automating refund processing according to applicable consumer protection standards. This embedded compliance assistance prevents common pitfalls where well-intentioned developers inadvertently violate regulations through incomplete understanding of nuanced requirements.

5. Unique Capabilities

Integrate: Applied use case

Integrate mode fundamentally transforms billing implementation from multi-sprint technical projects into conversational workflows completed in minutes to hours. Consider a practical scenario where a SaaS founder wants to add usage-based billing with a free trial to their Pro plan. Traditional implementation requires researching appropriate SDK documentation, understanding webhook event structures, implementing metering infrastructure to track usage events, configuring billing thresholds and overage handling, building trial expiration logic with grace periods, creating upgrade prompts and payment collection flows, and testing scenarios including trial conversions, payment failures, usage limit edge cases, and proration calculations.

Sentra collapses this complexity into a single prompt: “Add usage-based billing with a free trial for my Pro plan.” The agent interprets intent, generates implementation plan showing SDK integrations needed, usage tracking code additions, webhook endpoint configurations, trial expiration logic, and payment collection flows. The developer reviews proposed changes in familiar diff format, approves with confidence that generated code matches project patterns, and executes deployment while Sentra runs validation tests confirming integration correctness.

This workflow pattern extends across the full spectrum of billing configurations. Need to add seasonal discounts, implement multi-tier pricing, configure outcome-based billing tied to customer results, enable pay-as-you-go with prepaid credits, or set up subscription plans with overage charges? Each scenario becomes a natural language prompt rather than hours spent interpreting documentation, writing boilerplate code, and debugging subtle integration issues. The elimination of manual integration work creates compounding velocity advantages as developers iterate on pricing strategies, run A/B tests on billing configurations, and adapt monetization approaches to match evolving product offerings.

The developer-centric approach proves particularly valuable for technical founders at early-stage startups where engineering time represents the scarcest resource. Instead of allocating precious sprint capacity to billing infrastructure when shipping core product features determines survival, founders can implement sophisticated monetization through conversational workflows while maintaining focus on customer-facing innovation. This capability fundamentally changes the tradeoff calculus between monetization complexity and development velocity—enabling experimentation with advanced pricing models without proportional engineering investment.

Insight: Research references

Insight mode transforms billing data from passive historical records into actionable intelligence through natural language analytics. Traditional revenue analysis requires exporting transaction data to separate analytics tools, writing complex SQL queries or spreadsheet formulas, generating visualizations, and interpreting patterns to extract meaning. This workflow creates significant lag between questions and answers while requiring specialized data analysis skills that many developers and founders lack.

Sentra eliminates these barriers by enabling direct questions to billing systems: “Why did MRR dip last week?” The agent queries underlying data, identifies contributing factors like higher-than-usual cancellations in specific customer segments, seasonal payment failure spikes due to expired cards, or pricing changes negatively impacting conversion rates. Results are synthesized into natural language explanations accompanied by relevant charts showing trends, cohort breakdowns, or geographic distributions—whatever visual representations clarify the pattern most effectively.

The conversational analytics extend beyond simple descriptive statistics to diagnostic and prescriptive insights. Ask “Show churn by region” and receive not just geographic breakdown but potential explanations like localized competition, payment method limitations, or pricing insensitivity relative to local purchasing power. The agent can suggest remediations: “Consider adding UPI payment support for India where 40 percent of payment failures occur” or “Test pricing 30 percent lower in Southeast Asia where willingness-to-pay analysis suggests current tiers exceed market rates.”

This intelligence layer proves particularly powerful for resource-constrained teams lacking dedicated data analysts or business intelligence infrastructure. Early-stage startups can access sophisticated revenue analytics without building data warehouses, hiring analysts, or learning complex BI tools. The prompt-driven approach democratizes data access across organizations—enabling support teams to investigate customer billing questions, marketing teams to assess campaign revenue impact, and product managers to evaluate feature monetization effectiveness without mediation by engineering or analytics specialists.

Real-time metering and continuous event recording enable forward-looking analytics beyond historical trend analysis. The system tracks leading indicators like trial conversion velocity, customer engagement metrics, payment failure rates, and usage pattern shifts—surfacing early warnings when metrics trend negatively before quarterly reviews reveal problems. This proactive approach transforms billing analytics from retrospective reporting to operational dashboards guiding daily decision-making.

Act: User satisfaction data

Act mode enables operational automation for routine billing and customer management tasks that traditionally require manual intervention by support teams, finance personnel, or developers. The guarded execution model balances convenience with safety—allowing natural language commands for refunds, upgrades, credits, and other financial actions while maintaining approval workflows for high-risk operations and comprehensive audit trails documenting every transaction.

Consider common support scenarios where customers request invoice refunds due to accidental charges, service dissatisfaction, or technical issues. Traditional workflows require support agents to access admin dashboards, locate customer accounts, navigate to specific invoices, initiate refund processes, document reasons in ticketing systems, and notify customers of resolution. This multi-step process consumes 5 to 15 minutes per request while context-switching between multiple systems disrupts efficient ticket handling.

Sentra consolidates these workflows into single commands: “Refund invoice #pay_123abc. Also, tell the amount?” The agent retrieves invoice details, confirms refund eligibility, executes the transaction, documents the action in audit logs, and responds with refund amount confirmation—all within seconds. More complex scenarios layer additional logic: “Credit $50 for delay, note: support SLA breach, and notify the customer” triggers credit application, metadata tagging explaining the credit reason for future analysis, and automated customer notification with explanation.

The natural language interface reduces training requirements for support teams while improving response velocity and accuracy. New support agents become productive faster without extensive billing system training, as conversational commands prove more intuitive than navigating complex admin interfaces with nested menus and non-obvious workflows. The structured audit trail satisfies compliance requirements while enabling retrospective analysis of support patterns, refund trends, and credit allocation policies.

Developer and founder feedback during Alpha testing indicates high satisfaction with Act mode for routine operational tasks that previously required interrupting engineering work. The ability to handle customer billing requests through IDE-embedded commands without context-switching to separate dashboards maintains flow state while providing immediate resolution capabilities. Early users report 60 to 80 percent reduction in time spent on billing-related support tickets, freeing capacity for higher-value activities including product development, customer relationship building, and strategic planning.

Model Portfolio: Uptime & SLA figures

Sentra operates as a generally available Beta service actively processing production workloads for Alpha program participants, with formal SLA commitments expected to evolve as the platform matures toward General Availability milestones. Current operational characteristics reflect Dodo Payments’ underlying infrastructure reliability, which maintains uptime appropriate for mission-critical payment processing requirements across thousands of merchant implementations.

The agent service layer implements multiple deployment configurations balancing latency, cost, and reliability trade-offs. Interactive prompt responses prioritize low latency for fluid conversational workflows, typically completing intent interpretation, plan generation, and response formatting within single-digit seconds. Longer-running operations like comprehensive codebase analysis, multi-file modification planning, or complex deployment orchestrations may extend to 30 to 60 seconds for particularly sophisticated scenarios—still dramatically faster than manual implementation approaches while maintaining acceptable interactive feel.

Background execution modes handle time-intensive tasks asynchronously, enabling developers to continue working while Sentra processes long-running operations like full project scaffolding, comprehensive test suite generation, or integration with multiple third-party services requiring sequential API interactions. Notification mechanisms alert developers when background tasks complete, presenting results for review and approval before execution proceeds.

Failure handling implements graceful degradation patterns rather than catastrophic failures disrupting developer workflows. If agent services experience temporary outages or performance degradation, the platform falls back to traditional API documentation and SDK access patterns, ensuring developers retain full billing system access even if conversational agent capabilities temporarily degrade. This architectural resilience prevents single-point-of-failure scenarios where agent unavailability completely blocks billing implementation progress.

Monitoring infrastructure tracks key performance indicators including prompt response latency distributions, plan generation success rates, code execution failure rates, and user satisfaction signals derived from approval rates, rollback frequencies, and support ticket patterns. These operational metrics inform continuous improvement prioritization, infrastructure capacity planning, and feature development roadmaps ensuring the platform evolves to meet production demands as adoption scales.

6. Adoption Pathways

Integration workflow

Adopting Sentra begins with requesting Beta access through the Dodo Payments website or Product Hunt listing, joining the growing community of early adopters shaping platform evolution through feedback and feature requests. The Alpha program initially focused on Visual Studio Code integration with planned expansion to Cursor and Windsurf AI coding environments, command-line interface for CI/CD pipeline integration, web dashboard for non-technical team members, and Slack embedding enabling conversational billing management through team communication channels.

Installation follows standard IDE extension patterns—searching for “Sentra” in the Visual Studio Code Extensions marketplace, clicking install, and authenticating with Dodo Payments credentials to link the IDE extension with payment infrastructure. First-time setup guides developers through account configuration, payment gateway connections, and basic billing entity creation including initial product definitions, pricing tier setup, and tax configuration for primary markets. The onboarding flow prioritizes getting to first transaction quickly rather than comprehensive configuration, enabling iterative refinement as understanding deepens.

The prompted workflow paradigm differs fundamentally from traditional billing platforms requiring extensive upfront configuration through dashboard interfaces. Instead of defining every product, plan, pricing variant, billing cycle, and usage metric before implementation begins, developers start with simple prompts describing desired billing behavior and let Sentra generate necessary infrastructure. This just-in-time approach reduces upfront complexity while maintaining flexibility to add sophistication as needs evolve from initial MVP monetization to mature multi-tier pricing with usage-based components, geographic pricing variations, and complex discount structures.

Integration with existing codebases employs static analysis to understand project structure, identify authentication implementations, locate database configurations, and detect framework patterns. This contextual awareness enables Sentra to generate idiomatic code matching established conventions rather than generic templates requiring manual adaptation. If a project uses JWT-based authentication with PostgreSQL database and Express.js routing, generated billing code seamlessly integrates with these existing patterns rather than fighting against established architecture.

Customization options

Sentra exposes deep customization capabilities through its conversational interface while maintaining simplicity for common scenarios. Developers can specify detailed requirements through natural language: “Implement usage-based billing with three tiers—first 1000 API calls included, then $0.01 per call up to 10,000, and $0.005 per call above that. Add volume discounts for annual prepay and cap maximum monthly charges at $500.” The agent interprets these complex requirements and generates appropriate metering logic, pricing calculations, and billing configurations without requiring developers to understand underlying implementation details.

Template libraries provide starting points for common billing patterns including SaaS subscription tiers, API consumption pricing, outcome-based billing tied to customer results, freemium models with usage gates, and hybrid approaches combining subscriptions with usage overages. Developers can reference these templates as starting points then customize through natural language modifications rather than building configurations from scratch. This approach combines the speed of templates with the flexibility of custom implementations.

The platform accommodates regulatory and business policy requirements through configurable guardrails and approval workflows. Organizations can define policies requiring finance approval for refunds exceeding specific thresholds, mandate compliance reviews before pricing changes affecting certain customer segments, or require legal sign-off when adding new payment methods in regulated jurisdictions. These policy controls integrate directly into Sentra’s approval workflows, ensuring autonomous agent actions respect organizational governance while maintaining velocity for routine operations.

Advanced developers can drop into code-level customizations when conversational interfaces prove insufficient for edge cases or highly specialized requirements. The platform generates standard code using Dodo Payments SDKs and APIs, enabling direct modification when needed while preserving agent management capabilities for routine updates and maintenance. This escape hatch prevents platform limitations from becoming blockers while steering most usage toward higher-level abstractions that maintain coherent billing logic over time.

Onboarding & support channels

Dodo Payments provides comprehensive onboarding support for new Sentra adopters, recognizing that successful agentic tool adoption requires not just technical integration but workflow adaptation and prompt engineering skill development. The company offers white-glove migration assistance for teams transitioning from existing billing platforms, handling data migration, configuration translation, and integration testing to ensure seamless cutover without revenue disruption or customer experience degradation.

Documentation spans conceptual guides explaining agentic billing paradigms, practical tutorials walking through common implementation scenarios, prompt engineering best practices maximizing agent effectiveness, and comprehensive API references for advanced customizations. The multi-layered approach serves developers with different learning styles and experience levels—from founders implementing first monetization to senior engineers migrating complex legacy billing systems.

Support infrastructure includes tiered response channels matching urgency and complexity levels. Community forums enable peer-to-peer knowledge sharing where early adopters document solutions to common challenges, share prompt templates accelerating implementations, and provide feedback shaping product roadmap priorities. Email support handles standard questions with target response times in the hours-to-day range. Priority support for production issues affecting revenue capture provides faster escalation paths with engineering team involvement for complex debugging scenarios.

The Beta program explicitly emphasizes learning partnerships where Dodo Payments invests significant resources understanding adopter workflows, identifying friction points, and rapidly iterating based on real-world usage patterns. This collaborative approach treats early adopters as co-creators shaping platform evolution rather than passive consumers of fixed functionality. Participants benefit from direct access to product teams, influence over feature prioritization, and early exposure to capabilities before broader release while accepting some instability typical of rapidly evolving early-stage platforms.

Developer office hours provide scheduled sessions where technical teams can consult with Dodo Payments engineers on complex integration challenges, architectural decisions, or advanced feature usage. These synchronous interactions prove particularly valuable for nuanced scenarios where asynchronous documentation and support tickets fail to capture full context or require extended back-and-forth to reach resolution. The sessions also serve as qualitative research opportunities where product teams observe real-world usage patterns informing user experience improvements.

7. Use Case Portfolio

Enterprise implementations

While Sentra’s Alpha status means large-scale enterprise deployments are still emerging, the underlying Dodo Payments infrastructure serves thousands of merchants including many operating at significant scale. Enterprise use cases benefit particularly from the Merchant of Record model’s compliance offloading, where Dodo Payments assumes legal responsibility for tax collection, remittance, and regulatory compliance across global jurisdictions—eliminating the need for merchants to establish local subsidiaries, obtain licenses, or build compliance infrastructure in every target market.

Financial services and fintech companies face particularly stringent regulatory requirements around payment handling, customer fund protection, and financial reporting accuracy. Sentra’s guardrailed workflows with comprehensive audit trails satisfy many compliance documentation requirements while the underlying PCI DSS certification, SOC 2 progression, and stated commitment to ISO standards alignment provide independent validation of security practices. The platform’s ability to generate consistent, tested billing implementations reduces error rates compared to manual coding approaches where subtle bugs in payment logic can create accounting discrepancies or customer billing disputes.

Software-as-a-Service companies with complex pricing models benefit from Sentra’s flexibility across subscription, usage-based, outcome-based, and hybrid billing configurations. The ability to iterate on pricing through conversational workflows rather than multi-week development projects enables faster experimentation with revenue optimization strategies. A/B testing different pricing tiers, trying usage-based models for feature add-ons, or implementing volume discounts for enterprise customers becomes operationally feasible when implementation complexity drops from weeks to hours.

Global digital product companies selling ebooks, online courses, software licenses, or digital assets benefit from Dodo Payments’ 25-plus payment method coverage and multi-currency support delivered through Sentra’s integration workflows. The platform handles localization complexity including language-specific checkout experiences, region-appropriate payment methods, and automatic currency conversion—enabling truly global commerce without building payment infrastructure for each regional market individually.

Academic & research deployments

While enterprise and commercial use cases dominate current adoption, Sentra’s conversational interface and low-friction integration model present compelling opportunities for academic and research contexts. Computer science education programs teaching software engineering, web development, or entrepreneurship can incorporate real-world billing implementations without requiring students to master complex payment platform documentation before focusing on core learning objectives. The natural language prompt interface reduces cognitive load, enabling students to implement monetization features while focusing primary attention on application logic, user experience design, or business model validation.

Research projects exploring AI agent capabilities, autonomous system design, or human-AI collaboration patterns can leverage Sentra as a case study in production agentic architecture. The platform demonstrates practical patterns for maintaining human oversight while delegating routine execution to autonomous agents, balancing convenience against safety requirements, and designing conversational interfaces for complex technical domains. Academic publications analyzing these design decisions contribute to emerging best practices for agentic system development.

Entrepreneurship programs and startup accelerators can incorporate Sentra into curriculum addressing revenue model design, monetization strategy, and go-to-market planning. The reduced technical barrier to implementing sophisticated billing configurations enables non-technical founders to experiment with pricing strategies during customer discovery and validation phases without requiring engineering co-founders or consultant engagements. This democratization of monetization infrastructure better reflects modern software entrepreneurship where founders must rapidly test multiple business model hypotheses before achieving product-market fit.

ROI assessments

Return on investment for Sentra adoption compounds across multiple dimensions beyond simple implementation velocity improvements. Direct time savings compare hours or minutes using Sentra against days or weeks using traditional approaches—representing 10x to 100x productivity multipliers for billing integration specifically. If developers earn $100 to $200 hourly loaded costs including salary, benefits, and overhead, eliminating even single sprint’s worth of billing implementation work generates $8,000 to $16,000 in captured value before accounting for opportunity costs of delayed revenue recognition.

Opportunity cost calculations reveal larger impacts. Every week delayed launching monetization represents permanently lost revenue as customers who would have converted to paid tiers instead continue using free versions or churn to competitors. For SaaS companies in growth phase where $10,000 to $50,000 monthly recurring revenue constitutes meaningful milestones, shipping billing implementations one month faster captures $10,000 to $50,000 additional revenue during that period—revenue that compounds over customer lifetime value through continued subscriptions, upsells, and referrals. The faster iteration velocity enabled by prompt-driven billing changes amplifies this advantage by enabling rapid experimentation with pricing strategies, faster adaptation to market feedback, and reduced time to optimal monetization configuration.

Error reduction generates subtler but significant value. Manually implemented billing integrations frequently contain subtle bugs in edge case handling—failed payment retry logic, proration calculations, usage metering accuracy, or tax calculation errors. These bugs create customer support burden, revenue leakage from incorrect billing, potential compliance violations, and reputation damage from billing-related customer frustrations. Sentra’s tested, validated code generation reduces error rates by leveraging well-exercised implementation patterns rather than custom code requiring comprehensive edge case consideration and testing investment.

The strategic value of reduced technical debt proves hardest to quantify but perhaps most significant long-term. Billing systems implemented quickly during early growth phases often accumulate design compromises, incomplete implementations, and architectural shortcuts that become progressively costlier to unwind as customer bases scale and business complexity grows. Sentra’s generation of clean, idiomatic, maintainable code reduces technical debt accumulation while the conversational interface enables ongoing refinements without wholesale reimplementation projects—preserving agility as businesses evolve from initial products to mature platforms serving diverse customer segments with sophisticated requirements.

8. Balanced Analysis

Strengths with evidential support

Sentra’s fundamental strength lies in paradigm shift from configuration interfaces to conversational workflows, collapsing multi-week billing implementations into hour-scale interactions. This velocity advantage compounds over time as organizations iterate on pricing strategies—each refinement cycle that previously consumed developer sprint capacity now completes in single sessions, enabling experimentation velocity matching product development pace rather than lagging months behind. Early Alpha feedback consistently highlights implementation speed as the most immediately apparent value proposition, with developers expressing surprise at completing in afternoons what they budgeted weeks to accomplish.

The comprehensive Merchant of Record model differentiates Dodo Payments from pure billing platforms or payment gateways, providing genuine end-to-end solution spanning payment acceptance across 25-plus methods, global tax calculation and remittance, regulatory compliance management, and financial settlement. This breadth eliminates integration sprawl where companies otherwise assemble capabilities from Stripe for payments, Avalara for tax, separate compliance consultants, and treasury management services—each adding integration overhead, vendor management complexity, and potential point-of-failure. The unified approach particularly benefits small teams lacking dedicated finance, legal, or compliance resources to coordinate multiple specialized vendors.

Global-first architecture positions Dodo Payments uniquely for emerging market originators—Indian, Southeast Asian, Eastern European, and Latin American companies historically underserved by payment infrastructure designed for Western markets. The documented 40 to 60 percent payment success rates typical for emerging market companies using domestic gateways represent systematic barriers preventing talented founders from capturing global opportunities. Dodo Payments’ 90-percent-plus success rates specifically for cross-border transactions directly address this market failure, enabling emerging market innovation to compete effectively in global digital markets without relocating to Western financial centers.

The developer-centric philosophy permeates design decisions from IDE embedding through natural language interfaces to comprehensive SDK and API access for advanced customizations. This approach resonates strongly with technical founders and engineering-led organizations who appreciate tools respecting their workflows rather than forcing context shifts to vendor-centric interfaces. The ability to manage billing without leaving development environments maintains flow state—a subtle but meaningful productivity factor for deep technical work requiring sustained concentration.

Limitations & mitigation strategies

Alpha maturity status represents Sentra’s most obvious current limitation, with inevitable instabilities, incomplete features, and evolving interfaces typical of early-stage software. Early adopters must accept some friction and commit to providing feedback shaping platform evolution rather than expecting production-grade polish and comprehensive documentation. Organizations requiring battle-tested, stable platforms should defer adoption until Beta or General Availability releases demonstrate maturity appropriate for risk-averse deployments. Mitigation involves setting appropriate expectations, maintaining fallback options to traditional API usage if agent capabilities prove insufficient, and engaging closely with Dodo Payments team to influence prioritization addressing blockers.

Limited IDE coverage during Alpha restricts access to Visual Studio Code users initially, excluding developers preferring other editors or relying on AI-enhanced alternatives like Cursor and Windsurf where Sentra will eventually deploy. The roadmap addresses this through planned multi-platform expansion, but early adoption requires either using VS Code or waiting for preferred environment support. Organizations can mitigate by using VS Code for billing-specific work while maintaining primary development in preferred environments, or by influencing roadmap prioritization through Alpha feedback to accelerate desired platform support.

The conversational interface introduces new skills requirements around effective prompt engineering—crafting requests that clearly communicate intent without ambiguity, evaluating generated plans for correctness and appropriateness, and iteratively refining prompts when initial results miss the mark. While generally more intuitive than traditional API programming, prompt engineering still requires learning and practice to achieve proficiency. Organizations can mitigate through investing in training, building internal prompt libraries capturing effective patterns, and participating in community knowledge sharing where experienced users document successful approaches.

The agentic model’s autonomous code generation creates potential for generated implementations diverging from organizational standards or introducing subtle bugs not immediately apparent during review. Comprehensive testing remains essential despite implementation automation, and organizations should establish validation procedures ensuring generated code meets quality standards before production deployment. Mitigation strategies include maintaining test suites validating billing behavior, implementing staging environments for validation before production deployment, and gradually expanding trust boundaries as confidence in agent output quality grows through experience.

Integration dependencies on Dodo Payments’ platform create vendor lock-in considerations, where migrating away after deep integration requires substantial effort rebuilding billing infrastructure with alternative providers. This risk applies to all payment and billing platforms but deserves explicit consideration given the additional abstraction layer Sentra introduces. Organizations can mitigate by maintaining clear separation between billing logic and core application code, documenting integration points for potential future migration, and periodically evaluating the Dodo Payments relationship against alternatives to ensure continued competitive positioning.

9. Transparent Pricing

Plan tiers & cost breakdown

Dodo Payments employs straightforward, transaction-based pricing structure avoiding complex subscriptions or hidden fees. The Standard Plan charges 4 percent plus 40 cents per transaction, providing access to the complete integrated platform spanning payments, billing, and distribution capabilities. This all-inclusive rate covers cross-border tax and compliance handling, built-in merchant of record services, fraud protection infrastructure, and support operations—eliminating surprise charges for features often billed separately by competitors. The zero-fixed-cost model particularly suits early-stage startups and small businesses where predictable per-transaction economics enable clear unit economics calculations without monthly baseline expenses during slow periods.

The percentage-plus-fixed-fee structure aligns well with transaction values typical for digital products and SaaS subscriptions. For a $100 digital product sale, the merchant pays $4.00 percentage fee plus $0.40 fixed fee totaling $4.40, keeping $95.60 after payment processing. Higher-value transactions see percentage components dominate while smaller transactions spread fixed costs across larger bases. This structure incentivizes Dodo Payments to support merchant growth—as transaction volumes and values increase, platform revenue scales proportionally while per-transaction costs remain controlled through economies of scale in infrastructure and compliance operations.

Additional pricing considerations include domestic versus international transaction differentials. Domestic United States card and wallet transactions use the base 4 percent plus 40 cent rate, while domestic India INR transactions charge 4 percent plus ₹4. International payments add 1.5 percent premium reflecting higher interchange fees and compliance complexity for cross-border flows. Buy-now-pay-later options through services like Klarna and Affirm carry additional 3 percent fees covering those providers’ charges.

The Enterprise tier offers custom pricing negotiated directly with sales teams based on transaction volumes, specific requirements, and desired service levels. Enterprise agreements typically include dedicated customer success managers providing proactive account management, premium feature access including priority support and advanced reporting, and migration and implementation support de-risking transitions from existing billing platforms. Volume discounts become negotiable at enterprise scale where transaction economics justify custom commercial terms better reflecting specific deployment characteristics.

Billing-specific features layer additional charges onto base payment processing rates. Subscription management adds 0.5 percent per transaction, invoicing includes baseline 0.4 percent, tax management contributes 0.5 percent, analytics and reporting costs $10 monthly, and usage-based billing infrastructure charges $1 per million metered events. Digital distribution features including storefront operations charge 5 percent per transaction, while license key management and digital product delivery range from 4 to 5 percent depending on specific configurations.

Total Cost of Ownership projections

Total cost of ownership calculations must account for both direct platform fees and indirect savings from merchant of record benefits, compliance offloading, and development velocity improvements. Consider a SaaS startup processing $10,000 monthly recurring revenue primarily through United States customers with average subscription values around $50. Base transaction costs approximate $440 monthly assuming 200 transactions at $50 each. Additional billing feature costs add roughly $100 monthly for subscription management, tax automation, and analytics—totaling approximately $540 monthly platform spend or 5.4 percent of gross revenue.

This 5.4 percent all-in rate compares reasonably to alternatives when accounting for bundled capabilities. Stripe’s comparable offering costs 2.9 percent plus 30 cents per transaction for payment processing, with Stripe Billing adding 0.5 percent for subscription management and Stripe Tax adding 0.5 percent for automated tax calculation—totaling 3.9 percent plus 30 cents before accounting for international transaction premiums or additional compliance tooling. The Dodo Payments premium buys merchant of record services eliminating direct tax filing responsibilities and broader payment method coverage particularly valuable for international expansion.

Chargebee, a specialized subscription billing platform, charges percentage-of-revenue fees starting around 1 percent but requires separate payment gateway integration through Stripe, Braintree, or alternatives—adding their respective transaction fees on top. Total costs often exceed 4 to 5 percent when combining billing platform and payment gateway expenses, approaching Dodo Payments’ bundled pricing without merchant of record benefits or embedded agentic tooling.

Opportunity value from faster implementation velocity and ongoing iteration speed compounds significantly for growth-stage companies. If Sentra eliminates two-week billing implementation project that would otherwise cost $16,000 in loaded developer time, and enables monthly pricing iteration cycles versus quarterly traditional cadences, the cumulative productivity gains quickly exceed platform fees. Organizations processing $100,000-plus monthly revenue where 5 percent platform fees cost $5,000 monthly gain net positive ROI if productivity improvements exceed that threshold—often achievable through combination of faster launches, reduced error rates, and eliminated alternative tooling costs.

Hidden costs to consider include payment gateway fees from underlying processors that Dodo Payments works with, though these are embedded in stated transaction rates rather than separately charged. Currency conversion costs apply when accepting payments in currencies different from settlement preferences. Refund and dispute handling includes operational support but merchants still bear underlying payment network fees. International tax registration in specific jurisdictions may require legal assistance beyond Dodo Payments’ automated filing, though such cases represent edge scenarios rather than common workflows.

10. Market Positioning

Competitor comparison table with analyst ratings

| Platform | Primary Focus | Pricing Model | Agentic Features | Payment Methods | Geographic Coverage | Merchant of Record | Best For |

|---|---|---|---|---|---|---|---|

| Sentra by Dodo Payments | AI-native billing automation | 4% + $0.40 per transaction | IDE-embedded agent, prompt-driven configuration | 25+ including Apple Pay, Klarna, UPI, PIX | 150+ countries | Yes | Emerging market startups, AI-native SaaS, developers prioritizing velocity |

| Stripe Billing | Developer-first payments | 2.9% + $0.30 base + 0.5-0.8% billing | API-first, limited AI features | Extensive global coverage | 135+ currencies, 45+ countries | No (separate Stripe Atlas) | Technical teams, established companies, complex customization needs |

| Chargebee | Subscription optimization | ~1% + payment gateway fees | Traditional dashboard, no agent | Integrates with multiple gateways | Global via gateway partnerships | No | Mid-market subscription businesses, revenue operations teams |

| Paddle | Merchant of Record | 5% + $0.50 per transaction | Traditional interface | Comprehensive coverage | Global MoR coverage | Yes | Software companies avoiding tax complexity, international SaaS |

| Recurly | Revenue recovery | Percentage-based + add-ons | Dashboard-based, advanced dunning | Multiple gateway support | Global via partnerships | No | Companies focused on churn reduction, B2C subscriptions |

| Zuora | Enterprise billing | $50k+ annually | Traditional CPQ, no agent | Via payment gateway integrations | Global enterprise coverage | No | Large enterprises, complex billing requirements, compliance-heavy |

Unique differentiators

Sentra’s agentic architecture represents its most fundamental differentiator, transforming billing from configured infrastructure into conversational workflows. While competitors offer APIs, dashboards, and configuration interfaces, only Sentra embeds directly into developer IDEs as an autonomous agent generating implementation code, answering revenue analytics questions, and executing financial operations through natural language prompts. This paradigm shift creates discontinuous productivity improvements impossible to achieve through incremental dashboard enhancements or API documentation improvements.

The emerging market origin story and resulting global-first architecture differentiate Dodo Payments from Western competitors optimized for developed market conditions. The platform’s 90-percent-plus cross-border payment success rates specifically address systematic barriers preventing emerging market founders from competing effectively in global digital markets—a genuine market failure that established players have not prioritized solving. Founders in Bangalore, Jakarta, São Paulo, or Warsaw benefit from infrastructure treating their geographic origins as features rather than bugs requiring workarounds.

Comprehensive merchant of record capabilities bundled with payment processing and agentic tooling eliminate vendor sprawl typical of assembled billing stacks. Companies otherwise coordinate separate relationships with payment gateways like Stripe, billing platforms like Chargebee, tax automation services like Avalara, compliance consultants, and potentially fraud prevention vendors—each adding integration overhead, vendor management complexity, and potential failure points. Dodo Payments’ unified approach particularly suits small teams lacking specialized finance and legal resources to orchestrate multi-vendor ecosystems.

The developer-first philosophy manifest in IDE embedding, natural language interfaces, and SDK quality resonates with technical audiences increasingly expecting AI-enhanced tooling across development workflows. As AI coding assistants like GitHub Copilot, Cursor, and Windsurf achieve mainstream adoption, developers naturally expect similar intelligence applied to adjacent domains including infrastructure provisioning, monitoring, and billing. Sentra positions at this intersection where billing operations meet agentic development workflows.

The early-stage maturity currently constrains market positioning—Alpha status limits appeal for risk-averse enterprises while creating opportunities for forward-thinking technical teams willing to shape platform evolution through active feedback. As maturity progresses through Beta toward General Availability, positioning will naturally expand from bleeding-edge early adopters toward mainstream developer audiences and eventually conservative enterprises requiring battle-tested stability.

11. Leadership Profile

Bios highlighting expertise & awards

Rishabh Goel serves as Co-founder and CEO of Dodo Payments, bringing deep fintech and international growth expertise from previous roles spanning cross-border education lending, embedded fintech in e-commerce, and payment infrastructure. Before founding Dodo Payments in 2023, Goel spent five years at Prodigy Finance, a UK-based cross-border education loan platform, where he established the India office as the company’s first Indian hire and subsequently scaled the global growth team. During his tenure, the organization disbursed $620 million in education loans with 86 percent year-over-year growth, while Goel’s team established over 50 strategic university partnerships, built a 40,000-member higher education community, hosted 200-plus study abroad events, and generated 700,000-plus views through thought leadership content.

His international expansion leadership extended across South Asia, Southeast Asia, Gulf Cooperation Council countries, and Africa—growing target regions by 50 to 90 percent year-over-year while launching growth teams in China, Latin America, and Korea. He conducted exploratory field trips to Brazil, Hong Kong, Nepal, and Bangladesh assessing market opportunities under complex regulatory constraints. Before Prodigy Finance, Goel held Entrepreneur in Residence role at BZAAR working on embedded fintech solutions for cross-border e-commerce. He earned education from London Business School, bringing both operational experience and strategic frameworks to Dodo Payments’ leadership.

Ayush Agarwal serves as Co-founder and Chief Product and Technology Officer, bringing product development, gaming industry, and blockchain expertise to the founding team. Before co-founding Dodo Payments, Agarwal founded Tournafest, India’s first unified esports tournament platform enabling players to compete in organized competitions across popular games. The venture operated from May 2020 through January 2024, building player community and tournament infrastructure. His technical background includes leadership roles at Mobile Development Group during his time at IIT Roorkee, managing teams of 40-plus developers building mobile applications serving student populations.

Agarwal’s technical expertise spans mobile and web development, blockchain implementations, and system architecture—skills directly applicable to building scalable payment infrastructure. His gaming industry experience provides perspective on user engagement, viral growth mechanics, and community building that inform Dodo Payments’ developer-centric approach. His education from IIT Roorkee, one of India’s premier engineering institutions, provides rigorous technical foundation complementing Goel’s business and growth orientation. The complementary skill sets between commercial leadership and technical execution create balanced founding team dynamics typical of successful fintech ventures.

Patent filings & publications

While specific patent filings are not extensively documented in public records given the company’s early stage, Dodo Payments’ technical innovations in agentic billing interfaces, prompt-driven code generation for financial operations, and guardrailed autonomous execution represent potentially patentable approaches. The specific implementation of large language models for billing system configuration, the workflow designs balancing automation against human oversight, and the integration patterns embedding agents within development environments could constitute novel technical contributions warranting intellectual property protection.

The company’s blog publishes thought leadership content addressing cross-border payment challenges, AI-native billing architecture, usage-based pricing strategies, and merchant of record benefits—establishing expertise and educating market audiences. Recent publications include analysis of how emerging market startups lose significant revenue from failed global payments, comparisons of billing platforms for AI companies, and practical guides to usage-based billing implementations. This content marketing approach builds authority while serving genuine educational purposes for target developer and founder audiences navigating complex monetization decisions.

The founding team actively participates in startup communities, fintech forums, and developer platforms including Reddit, Product Hunt, and LinkedIn—engaging directly with potential customers, gathering feedback, and contributing to ecosystem knowledge sharing. This transparent, community-engaged approach builds trust and awareness while providing qualitative research informing product development priorities. The Reddit AMA session specifically documented founding journey, technical decisions, and lessons learned scaling cross-border payment infrastructure—demystifying fintech entrepreneurship for aspiring founders considering similar ventures.

12. Community & Endorsements

Industry partnerships

Dodo Payments maintains strategic relationships with payment processors, card networks, and financial infrastructure providers enabling the comprehensive payment method coverage and global processing capabilities underlying Sentra’s billing automation. The platform integrates with major card networks including Visa, Mastercard, American Express, and Discover, alongside digital wallet providers like Apple Pay and Google Pay, buy-now-pay-later services including Klarna and Affirm, regional payment methods such as UPI for India and PIX for Brazil, and ACH bank transfers for US domestic transactions.

These partnerships require certifications, contractual agreements, technical integrations, and ongoing relationship management to maintain compliance with network rules, pricing agreements, and service level commitments. The company’s ability to aggregate these relationships into unified developer experience represents significant operational investment and relationship capital that newer entrants struggle to replicate. As a PCI DSS certified service provider, Dodo Payments maintains the trust and compliance standing necessary to sustain these critical partnerships.

Cloud infrastructure partnerships likely include major providers like AWS, Google Cloud, or Azure supporting the platform’s global deployment, though specific infrastructure dependencies are not extensively documented in public materials. IDE partnerships with Microsoft for Visual Studio Code integration, and planned relationships with Anysphere for Cursor and Codeium for Windsurf integration, enable the embedded agent experiences central to Sentra’s value proposition. These integrations require technical coordination, potentially marketplace listings, and ongoing compatibility maintenance as IDE platforms evolve.

The venture capital and angel investor network extends beyond capital to strategic advisory relationships. Investors including former executives from PayU, Oyo, Flipkart, a16z, and Boom Supersonic provide operational insights, pattern matching from adjacent markets, and introductions to potential customers and partners. This informal advisory network accelerates decision-making velocity and helps avoid common pitfalls that derail first-time fintech founders navigating complex regulatory and operational challenges.

Media mentions & awards