Table of Contents

- TheySaid 3.0: AI-Powered Conversational Feedback Platform – Comprehensive Research Report

- 1. Executive Snapshot

- 2. Impact \& Evidence

- 3. Technical Blueprint

- 4. Trust \& Governance

- 5. Unique Capabilities

- 6. Adoption Pathways

- 7. Use Case Portfolio

- 8. Balanced Analysis

- 9. Transparent Pricing

- 10. Market Positioning

- 11. Leadership Profile

- 12. Community \& Endorsements

- 13. Strategic Outlook

- Final Thoughts

TheySaid 3.0: AI-Powered Conversational Feedback Platform – Comprehensive Research Report

1. Executive Snapshot

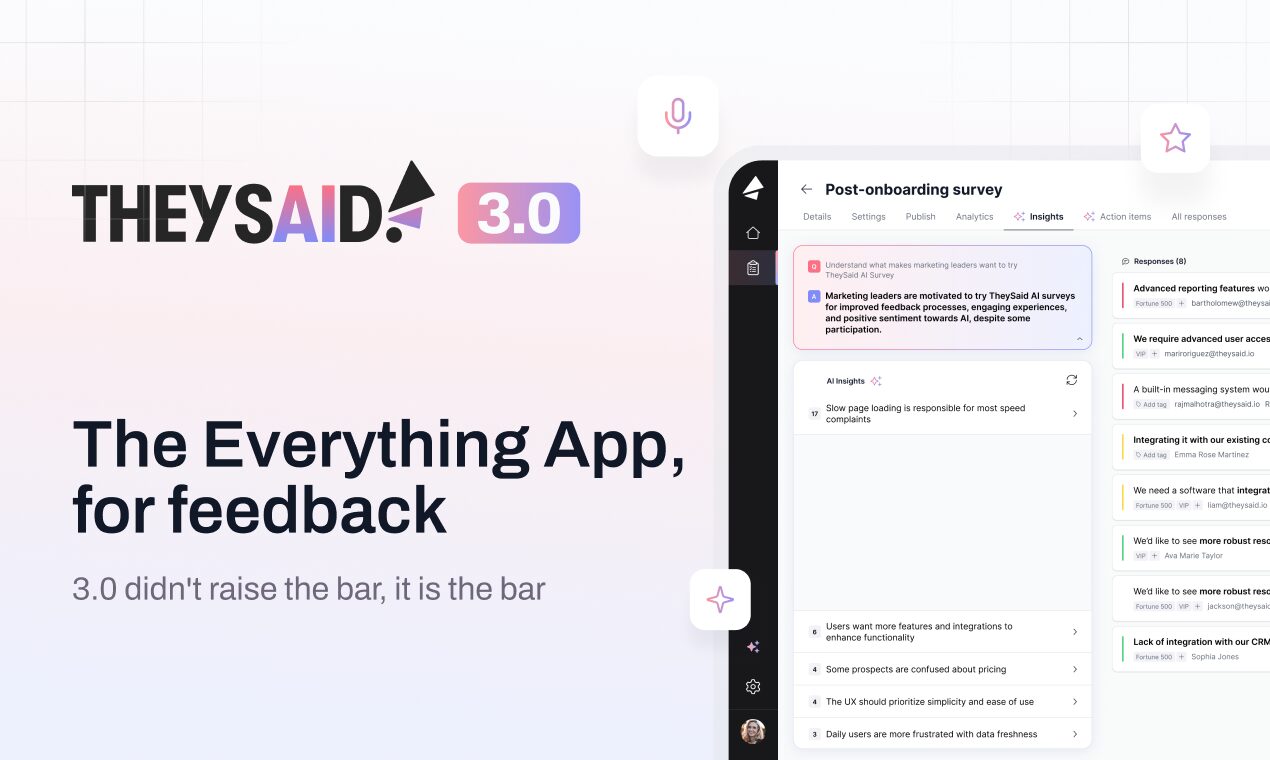

TheySaid 3.0 operates as an artificial intelligence-driven feedback platform that transforms traditional static surveys into dynamic conversational experiences resembling human interviews. Founded by Lihong Hicken, Chris Hicken, Amy, and Arn Karmakar, the company addresses fundamental limitations in conventional survey tools including low response rates, superficial insights, and lengthy manual analysis. The platform launched version 3.0 on Product Hunt in November 2025, positioning itself as the “everything app for feedback” by unifying surveys, interviews, forms, user testing, polls, and pulse checks into a single conversational AI engine.

The core innovation centers on AI-powered follow-up questions that adapt dynamically based on user responses, converting brief checkbox interactions into rich qualitative conversations without human moderator involvement. When a customer indicates dissatisfaction with a product, the AI automatically probes deeper: “Can you describe what specific aspect disappointed you?” or “How would you have preferred that feature to work?” This conversational approach reportedly generates 10x richer insights compared to traditional surveys while boosting response completion rates from typical 33% to 73% according to industry research on conversational survey methodologies.

TheySaid operates within the broader 757.58 billion USD global AI market projected to reach 3.68 trillion USD by 2034 at a 19.2% compound annual growth rate. The company serves marketing teams conducting customer research, product managers validating features, HR departments gathering employee feedback, sales teams performing win-loss analysis, and customer experience professionals measuring satisfaction across touchpoints. Early customer testimonials report 5-10% reductions in churn alongside increases in qualified leads, though independent validation of these metrics remains limited given the recent November 2025 major release.

2. Impact \& Evidence

Customer testimonials highlight specific business outcomes from TheySaid implementations. One client reported achieving a 5-10% increase in qualified leads from existing customers within months while simultaneously reducing churn. Another customer described a 5-10% decrease in customer churn with corresponding increases in upsell opportunities following TheySaid integration. These early results suggest the platform delivers measurable revenue impact, though the lack of controlled studies or third-party audits means causality cannot be definitively established.

User feedback emphasizes ease of implementation and surprising question quality. One reviewer noted: “How did TheySaid AI come up with such great question recommendations? These are questions that our teams really want to know and discussed internally a lot.” This observation validates the AI’s capability to identify non-obvious inquiry angles that human surveyors might overlook when constrained by time or creative bandwidth. The platform maintains 4.8-4.9 ratings across review sites including Capterra, GetApp, and G2, indicating consistent user satisfaction across diverse customer segments.

Performance benchmarks from broader conversational survey research provide context for TheySaid’s claims. Academic studies demonstrate that conversational interviewing reduces response bias for complex questions relative to standardized surveys, while improving data quality without significantly increasing intra-interviewer correlations that could compromise estimate reliability. Industry data shows conversational formats achieve 40-60% higher completion rates compared to static forms, with per-question drop-off rates of 3% versus 18% for traditional surveys. These patterns align with TheySaid’s positioning, though platform-specific validation would strengthen credibility.

Third-party endorsements include Forbes Technology Council membership for founder Lihong Hicken, who contributes articles on AI market research trends and win-loss analysis methodologies. This thought leadership visibility establishes domain expertise and positions TheySaid within professional discourse on feedback innovation. However, formal analyst recognition from Gartner, Forrester, or other enterprise research firms has not yet emerged, reflecting the company’s early-stage status in a rapidly evolving market.

3. Technical Blueprint

TheySaid employs a three-layer conversational AI architecture beginning with natural language processing that interprets user responses in real-time. When a respondent answers a rating scale question, the system analyzes sentiment, identifies key themes, and generates contextually relevant follow-up questions. For example, if someone rates customer support poorly, the AI might ask: “What would have made your support experience better?” or “Can you walk me through what happened when you contacted us?” This dynamic questioning replicates skilled human interviewer behavior without requiring live moderators.

The platform’s setup workflow emphasizes rapid deployment through AI-assisted survey generation. Users input their website URL or upload internal documentation, and the AI scans content to understand business context, product features, and customer terminology. Within one minute, the system produces professionally structured surveys with appropriate question types including rating scales, multiple choice, ranking, and open-ended queries. This automation eliminates the blank-page problem that paralyzes non-expert survey creators who struggle determining which questions will yield actionable insights.

Version 3.0 introduces full two-way voice support, enabling participants to speak responses rather than typing, while the AI reads questions aloud. This accessibility enhancement serves users with mobility limitations, increases engagement for time-pressed respondents providing feedback during commutes, and captures emotional nuance through tone of voice that text cannot convey. User testing video recordings document participant interactions with prototypes, wireframes, or live products, generating multimedia qualitative data that product teams review alongside transcribed verbal commentary.

The AI Insights 2.0 analysis engine processes incoming responses continuously, identifying themes, sentiment patterns, and statistically significant trends without waiting for survey closure. The “Ask AI” feature allows researchers to query results in natural language: “What are the top three reasons customers churn?” or “How do pricing perceptions vary by company size?” The system generates on-demand charts, summary reports, and actionable recommendations, compressing analysis workflows from hours or days to seconds.

Integration capabilities span CRM platforms including HubSpot and Salesforce for bidirectional contact synchronization, collaboration tools like Slack for real-time alert routing, and project management systems including Asana, Monday, and ClickUp for automatic task creation triggered by specific feedback patterns. Import functionality from Qualtrics, SurveyMonkey, and Typeform enables migration without rebuilding existing survey infrastructure. The platform lacks a public API according to review site documentation, potentially limiting custom integration scenarios for enterprise development teams.

4. Trust \& Governance

TheySaid maintains SOC 2 Type 2 compliance and ISO 27001 information security certification, providing third-party validated assurance that controls meet established security frameworks. The company anticipates HIPAA certification by February 2026, enabling healthcare organizations to collect patient feedback while maintaining regulatory compliance. These certifications position TheySaid appropriately for enterprise procurement processes that mandate documented security postures before vendor approval.

Data handling protocols include TLS 1.2 encryption for data in transit and AES encryption for data at rest, employing industry-standard cryptographic protection. The platform maintains GDPR compliance with explicit support for data deletion requests, ensuring European customers meet privacy regulation requirements. Single sign-on capabilities through major identity providers enable centralized access control, while role-based access controls limit internal user permissions according to organizational hierarchies and least-privilege principles.

The infrastructure runs on Google Cloud Platform, inheriting Google’s extensive physical security, network protections, and operational safeguards documented through their own compliance certifications. TheySaid undergoes independent third-party penetration testing and vulnerability assessments, though the frequency and findings from these exercises remain undisclosed in public materials. Continuous security monitoring tracks anomalies and potential threats, with incident response procedures presumably documented but not publicly detailed.

Customer control over AI behavior represents a notable governance feature. Organizations can customize the AI’s allowed interaction boundaries, train models using proprietary internal documentation to improve domain-specific accuracy, and review AI-generated follow-up questions before enabling automated deployment. This oversight mechanism addresses valid concerns about AI generating inappropriate, off-brand, or legally problematic questions without human review, particularly for sensitive topics like employee feedback or healthcare experiences.

5. Unique Capabilities

Conversational AI Moderator: TheySaid’s distinguishing technical capability centers on its adaptive questioning engine that replicates human interviewer skills at scale. Traditional surveys present identical static questions to all respondents, regardless of their initial answers. TheySaid’s AI analyzes each response, determines what additional context would yield actionable insights, and poses personalized follow-up questions in real-time. A customer rating product quality as 8/10 receives different probes than someone rating it 3/10, maximizing relevant information extraction while minimizing respondent burden through targeted inquiry.

One-Minute AI Survey Generation: The platform eliminates survey design paralysis through automated question recommendation based on business context extraction. Users specify their feedback objective or provide their company URL, and the AI generates complete survey structures including appropriate question types, logical flow sequences, and response option scales. This acceleration compresses survey creation from typical 2-4 hour manual design sessions to under 60 seconds, democratizing feedback collection for small teams lacking dedicated research specialists.

Unified Feedback Ecosystem: Unlike competitors focused narrowly on surveys or user testing, TheySaid consolidates six feedback modalities under single conversational AI infrastructure: surveys for structured questions with AI follow-ups, interviews for open-ended exploration, forms for data collection with conversational enhancements, user testing with video capture and task observation, polls for single-question pulse checks with “why” probing, and pulses for longitudinal tracking at customer journey milestones. This architectural unification eliminates tool sprawl where organizations previously subscribed to separate platforms for each methodology.

Real-Time AI Analysis and Recommendations: The platform processes qualitative open-ended responses as they arrive, identifying themes, sentiment trends, and emerging patterns without waiting for statistical significance thresholds. The system automatically flags responses requiring immediate action, such as customers expressing cancellation intent or employees reporting workplace safety concerns. Recommended workflows trigger CRM tasks, Slack notifications, or support ticket creation, closing the feedback-to-action loop that traditionally suffers weeks of delay while data accumulates and manual analysis completes.

6. Adoption Pathways

Users begin at theysaid.io with account creation through the free plan providing 25 survey responses monthly, sufficient for small-scale testing or low-volume feedback collection. The onboarding process guides users through AI training by uploading company documentation or pointing to website URLs, enabling context-aware question generation aligned with specific business terminology and product features. Setup completion typically requires less than five minutes from registration to first survey deployment.

Survey creation workflows offer two pathways: manual question construction using drag-and-drop interfaces for users preferring full control, or AI-assisted generation where natural language prompts like “I want to understand why customers churn” produce complete survey structures. Users customize generated questions, adjust AI follow-up sensitivity from conservative to exploratory, and configure conditional logic routing respondents through personalized question paths based on previous answers.

Distribution occurs through multiple channels including email invitations, embeddable website widgets, mobile app integrations, SMS text message links, and social media sharing. The platform tracks delivery metrics including open rates, start rates, completion rates, and per-question abandonment patterns, enabling iterative optimization of invitation copy and survey structure. Real-time response monitoring displays incoming answers as participants submit them, providing immediate visibility into feedback patterns before formal analysis.

Analysis tools center on the AI Insights dashboard presenting theme summaries, sentiment distributions, and statistical breakdowns across demographic segments or response cohorts. The Ask AI interface accepts natural language queries generating custom reports, charts, and data exports without requiring SQL knowledge or business intelligence expertise. Users configure automated alert rules triggering notifications when specific response patterns emerge, such as NPS scores dropping below thresholds or product bug mentions exceeding frequency limits.

Customization extends to white-label branding where enterprise customers apply their own logos, color schemes, and domain names to survey interfaces, maintaining brand consistency throughout the feedback experience. Conditional logic and advanced branching enable complex survey flows adapting dynamically to respondent characteristics, previous answers, or external data from CRM integrations. Panel recruiting services connect customers with pre-qualified research participants matching demographic or behavioral targeting criteria when internal audiences prove insufficient.

7. Use Case Portfolio

Marketing Win-Loss Analysis: Revenue teams deploy TheySaid for post-sales interviews understanding why deals closed successfully or failed. The AI conducts standardized interviews with prospects who selected competitors, probing decision criteria, pricing perceptions, and feature gaps. Automatically generated reports aggregate common objection themes, enabling marketing teams to refine messaging, sales enablement to address recurring concerns, and product managers to prioritize roadmap items directly addressing competitive disadvantages.

Product Feature Validation: Product teams test concepts, wireframes, and prototypes through AI-moderated user testing sessions combining video recordings with conversational feedback. Participants complete assigned tasks while verbalizing thought processes, with the AI asking clarifying questions when confusion or hesitation appears. Post-task interviews explore satisfaction drivers and improvement suggestions, generating qualitative insight portfolios that complement quantitative usability metrics like task completion rates and time-on-task measurements.

Employee Engagement Monitoring: HR departments launch pulse surveys at regular intervals throughout employee journeys, measuring satisfaction, workload stress, manager relationship quality, and flight risk indicators. The conversational format encourages honest feedback through perceived anonymity and natural dialogue flow, surfacing issues that formal annual reviews miss. AI analysis identifies department-specific patterns, management training gaps, and systemic organizational challenges requiring executive attention before manifesting as attrition spikes.

Customer Journey Feedback Collection: Customer experience teams embed micro-surveys at critical touchpoints including post-purchase confirmation, support ticket resolution, onboarding milestone completion, and subscription renewal decisions. The brief single-question format minimizes response friction while AI follow-ups extract meaningful context. Longitudinal tracking reveals how perceptions evolve across customer lifecycle stages, identifying where experiences deteriorate and interventions would prevent churn most cost-effectively.

8. Balanced Analysis

Strengths with Evidential Support: TheySaid addresses genuine market frustrations where traditional surveys generate poor response rates due to length and monotony, produce shallow data lacking actionable context, and require extensive manual analysis consuming days or weeks before insights reach stakeholders. The conversational AI approach demonstrably improves completion rates based on academic research showing 73% versus 33% for static surveys, while dynamic follow-up questions extract qualitative richness that fixed questionnaires cannot capture.

The platform’s rapid deployment capability through AI-assisted generation eliminates bottlenecks where non-experts struggle formulating effective questions, enabling distributed feedback collection by product managers, customer success representatives, and team leads without centralized research department gatekeeping. The unified feedback ecosystem consolidates tool subscriptions, reducing vendor management overhead and enabling cross-method analysis comparing survey responses with user testing observations or employee interview themes within single platforms.

Security certifications including SOC 2 Type 2 and ISO 27001 provide enterprise-grade assurance satisfying procurement requirements, while anticipated HIPAA compliance extends addressable markets to regulated healthcare organizations. The founding team’s track record including three successful exits and CRO experience growing companies 300-400% year-over-year demonstrates execution capability and understanding of revenue-focused customer needs.

Limitations and Mitigation Strategies: AI-generated follow-up questions risk producing inappropriate, confusing, or legally problematic inquiries without human oversight, particularly for sensitive topics like discrimination experiences or medical conditions. While TheySaid provides AI behavior controls and preview capabilities, organizations must establish review protocols before enabling fully automated conversational surveys where brand reputation or compliance risks exist.

The lack of public API according to review site documentation constrains custom integration scenarios where enterprise development teams require programmatic survey creation, response data streaming, or embedding feedback collection within proprietary applications. Organizations with complex technical requirements should verify current API availability and roadmap before committing.

Response rate improvements depend heavily on survey context, audience characteristics, and invitation strategies. While conversational formats consistently outperform static alternatives, absolute completion rates still suffer when surveys target disengaged audiences, arrive at inopportune moments, or ask overly personal questions that participants decline answering regardless of interface design. TheySaid cannot overcome fundamental engagement challenges stemming from poor audience targeting or excessive survey frequency fatiguing respondents.

The relative novelty of version 3.0 launched November 2025 means limited real-world validation of new capabilities including voice support, video user testing, and enhanced AI Insights 2.0 features. Early adopters should expect iterative refinement as the product matures and edge cases emerge through diverse customer deployments across industries with varying feedback collection needs.

9. Transparent Pricing

TheySaid offers tiered subscription plans accommodating different organizational scales and usage intensities. The Free Forever plan provides 25 responses monthly with basic survey and feedback tools plus limited AI analysis features, enabling meaningful evaluation for small teams or low-volume applications without financial commitment. This entry tier removes adoption friction for startups and individual practitioners testing platform fit before budget allocation.

The Starter plan costs 29 USD monthly, expanding response capacity and unlocking advanced feedback tools alongside CRM integration capabilities. This tier suits small businesses conducting regular customer feedback collection or employee engagement monitoring without enterprise-scale requirements. The specific response limit remains undisclosed in available sources, requiring direct sales inquiry for precise capacity planning.

Professional and Enterprise tiers provide custom pricing reflecting higher response volumes, advanced features including white-label branding and dedicated support, plus potentially priority access to new capabilities as the platform evolves. Enterprise customers likely negotiate service level agreements defining uptime guarantees, support response times, and data residency requirements that self-service tiers do not formalize.

Total cost of ownership extends beyond subscription fees to include time investments training AI with company context, designing initial survey templates adapted to specific use cases, and establishing internal workflows routing insights to appropriate stakeholders. Organizations should budget approximately 4-8 hours for initial setup and team training, plus ongoing maintenance hours reviewing AI-generated questions and refining follow-up logic as feedback needs evolve.

Compared to traditional research methodologies, TheySaid delivers substantial cost efficiencies. Professional market research firms charge 5,000-15,000 USD for moderated interview studies reaching 10-15 participants, while TheySaid’s conversational AI conducts unlimited interviews at flat subscription rates. Win-loss analysis consulting engagements cost 3,000-8,000 USD per quarter for manual telephone interviews with 20-30 contacts, versus TheySaid’s automated approach scalable to hundreds of respondents monthly without proportional cost increases.

10. Market Positioning

The survey and feedback software market encompasses traditional form builders, research-focused platforms, and emerging AI-enhanced solutions. TheySaid competes across multiple categories depending on customer use case priorities.

| Platform | Primary Focus | Key Technology | Pricing Model | Core Strengths | Primary Limitations |

|---|---|---|---|---|---|

| TheySaid 3.0 | Conversational AI feedback | Dynamic follow-up AI, voice/video | Free + \$29/month Starter | AI moderation, unified feedback types, real-time analysis | Newer platform, API limitations, less template variety |

| SurveyMonkey | Traditional survey research | Static surveys, benchmarking | Free + \$25-99/month | Extensive templates, large user base, enterprise credibility | Static format, limited AI, traditional UX |

| Typeform | Conversational forms | One-question-at-time flow | Free + \$25-83/month | Beautiful design, high engagement, strong integrations | Limited AI analysis, form-focused vs research |

| Qualtrics XM | Enterprise experience management | Advanced analytics, journey mapping | Custom enterprise pricing | Comprehensive platform, deep analytics, academic rigor | Complex, expensive, steep learning curve |

| Google Forms | Basic form creation | Simple drag-and-drop | Free | Zero cost, Google Workspace integration, unlimited responses | Minimal features, no AI, basic analysis |

| Jotform | Form building and workflows | Visual builder, payment collection | Free + \$34-99/month | Extensive integrations, payment processing, form logic | Not research-focused, limited qualitative analysis |

TheySaid differentiates through its AI moderator that adapts questioning dynamically, eliminating the static limitations that plague SurveyMonkey and Google Forms where all respondents receive identical questions regardless of previous answers. The unified ecosystem spanning surveys, interviews, user testing, and pulse checks consolidates tool subscriptions that organizations traditionally manage separately through vendors like UserTesting for usability research, Typeform for forms, and dedicated employee engagement platforms.

However, established platforms offer advantages TheySaid currently lacks. SurveyMonkey’s 400+ templates, extensive question bank, and 200+ native integrations provide breadth that newer entrants cannot immediately replicate. Typeform’s polished visual design and mainstream brand recognition create lower adoption friction for non-technical users. Qualtrics dominates enterprise markets through comprehensive experience management capabilities including customer journey orchestration, closed-loop workflow automation, and advanced statistical analysis that TheySaid’s current feature set does not match.

11. Leadership Profile

Lihong Hicken serves as co-founder and CEO, bringing exceptional entrepreneurial credentials including three successful exits spanning acquisitions and an IPO. Her journey from a remote village in China to Silicon Valley technology leadership demonstrates remarkable resilience and cross-cultural adaptability. Hicken learned five languages before immigrating to the United States, where she rapidly ascended from individual contributor sales roles to Chief Revenue Officer at GitPrime, growing revenues 300-400% year-over-year. GitPrime co-founder Ben Thompson described her as “the most impactful hire they ever made,” validating her operational excellence and strategic contribution.

Her executive background includes senior roles at UserTesting as one of the company’s first female employees, providing deep domain expertise in user research methodologies and feedback collection platforms. This experience directly informs TheySaid’s product vision, as Hicken personally encountered the limitations of traditional survey tools during her tenure building customer insights programs at high-growth technology companies. Her Forbes Technology Council membership and published articles on AI market research trends position her as a recognized thought leader in the feedback innovation space.

Chris Hicken serves as co-founder, with the surname suggesting family relationship to Lihong though available sources do not explicitly confirm. His background and specific expertise remain less documented in public materials, though his involvement in founding multiple ventures alongside Lihong implies complementary product or technical capabilities. The founding team includes Amy and Arn Karmakar in undisclosed roles, with limited biographical information available regarding their backgrounds, expertise, or specific contributions to TheySaid’s development.

The team operates from Salt Lake City, Utah, positioning them outside major coastal technology hubs but within a growing Mountain West ecosystem that includes significant enterprise software companies. This geographic location potentially provides cost advantages for talent acquisition while maintaining proximity to organizations like Qualtrics (acquired by SAP for 8 billion USD) that validate Utah’s capability incubating successful experience management platforms.

12. Community \& Endorsements

TheySaid achieved Product Hunt recognition through its November 2025 version 3.0 launch, accumulating significant community engagement though specific upvote counts remain undisclosed in available sources. The platform maintains 4.8-4.9 ratings across multiple review sites including Capterra, G2, GetApp, and Software Advice, indicating consistent satisfaction across diverse customer segments. Reviewers particularly praise ease of use, AI-generated question quality, and time savings compared to manual survey creation.

The company’s presence on Forbes Technology Council through Lihong Hicken’s membership provides credibility markers and visibility within executive audiences evaluating feedback platforms. Her published articles addressing AI Net Promoter Score methodologies and win-loss analysis best practices demonstrate thought leadership and domain expertise that competitors may lack. However, formal analyst recognition from Gartner Magic Quadrants, Forrester Waves, or other enterprise research firms has not yet materialized, reflecting TheySaid’s early-stage market position.

Industry partnerships and technology integrations include connections with HubSpot, Salesforce, Slack, Asana, Monday, and ClickUp, enabling workflow automation across marketing, sales, and customer success operations. Import tools supporting migration from Qualtrics, SurveyMonkey, and Typeform acknowledge competitive dynamics while reducing switching friction for customers evaluating alternatives. The absence of announced strategic partnerships with major platforms like Microsoft Teams, Zendesk, or Atlassian represents potential expansion opportunities as the company scales.

Media coverage appears concentrated in product discovery directories, AI tool aggregators, and startup announcement channels rather than mainstream business publications or dedicated market research trade journals. Coverage in outlets like Complete AI Training and FutureTools reflects basic awareness-building activities without deep investigative journalism or third-party validation of platform capabilities and customer claims.

13. Strategic Outlook

TheySaid faces intense competitive pressure from multiple directions as AI capabilities democratize across the survey software market. Established players including SurveyMonkey, Qualtrics, and Typeform all actively integrate conversational AI features, leveraging their existing customer bases, brand recognition, and integration ecosystems to match TheySaid’s core differentiators. Microsoft and Google could introduce similar capabilities within their ubiquitous productivity suites, creating formidable free alternatives that commoditize basic conversational survey functionality.

The platform’s strategic advantage centers on its AI-first architecture designed specifically for adaptive questioning rather than retrofitting AI onto legacy form-building infrastructure. This foundational differentiation enables more sophisticated conversational flows, deeper context awareness, and tighter integration between question generation, response analysis, and action recommendation. Sustaining this technical lead requires continuous investment in machine learning model improvements, prompt engineering refinement, and expanding training data diversity across industries and feedback modalities.

Future roadmap priorities should address current capability gaps including public API availability for enterprise integrations, expanded template libraries spanning industry-specific use cases, advanced statistical analysis matching Qualtrics’ rigor, and multilingual support enabling global deployments. Version 3.0’s voice and video capabilities position TheySaid favorably for remote user research trends, though competition from specialized usability testing platforms like UserTesting and Lookback requires continued differentiation through superior AI analysis rather than feature parity alone.

Market trends strongly favor TheySaid’s positioning. The global AI market’s 19.2% compound annual growth through 2034, increasing organizational focus on customer experience differentiation, and widespread recognition that traditional surveys generate inadequate insights all create tailwinds. The democratization of research capabilities enabling product managers and customer success teams to conduct sophisticated feedback collection without dedicated research specialists expands TheySaid’s addressable market beyond traditional market research buyers to broader cross-functional teams.

However, commoditization risks emerge as foundational AI models improve and competitors access similar capabilities through OpenAI, Anthropic, or Google APIs. Sustainable differentiation requires building proprietary advantages through domain-specific model training on feedback collection patterns, workflow integrations creating switching costs, and community network effects where users share survey templates and best practices. The company’s three-exit founding team demonstrates monetization capability, though capturing enterprise market share requires sales infrastructure investment, compliance expansion, and reference customer development beyond early adopter segments.

Final Thoughts

TheySaid 3.0 represents a sophisticated execution of conversational AI applied to the chronically underserved feedback collection market. The platform’s adaptive questioning engine addresses genuine frustrations where static surveys generate poor response rates and shallow insights, while real-time AI analysis compresses insight-to-action cycles that traditionally consume weeks. The founding team’s exceptional credentials including three previous exits and proven revenue growth expertise provide credibility that many AI startups lack.

However, the November 2025 version 3.0 launch means limited real-world validation of new capabilities beyond early testimonials. The competitive landscape intensifies rapidly as established platforms integrate similar AI features, leveraging existing customer relationships and integration ecosystems. TheySaid’s long-term success depends on maintaining technical differentiation through superior conversational quality, expanding beyond core survey functionality into comprehensive experience management, and building switching costs through workflow embedding rather than competing solely on standalone feature parity.

For organizations frustrated with traditional survey tools generating low response rates and superficial insights, TheySaid offers compelling value through demonstrably better engagement and richer qualitative data. The free 25-response plan enables meaningful evaluation without commitment. However, enterprises requiring deep statistical analysis, extensive template libraries, or complex research methodologies may find current capabilities insufficient compared to mature platforms like Qualtrics. TheySaid occupies an appealing middle ground: more sophisticated than free alternatives like Google Forms, more accessible than enterprise research platforms, and differentiated through AI that established survey vendors are still retrofitting onto legacy architectures. The platform shows strong potential for capturing market share among growth-stage companies prioritizing actionable insights over academic research rigor.