Table of Contents

Overview

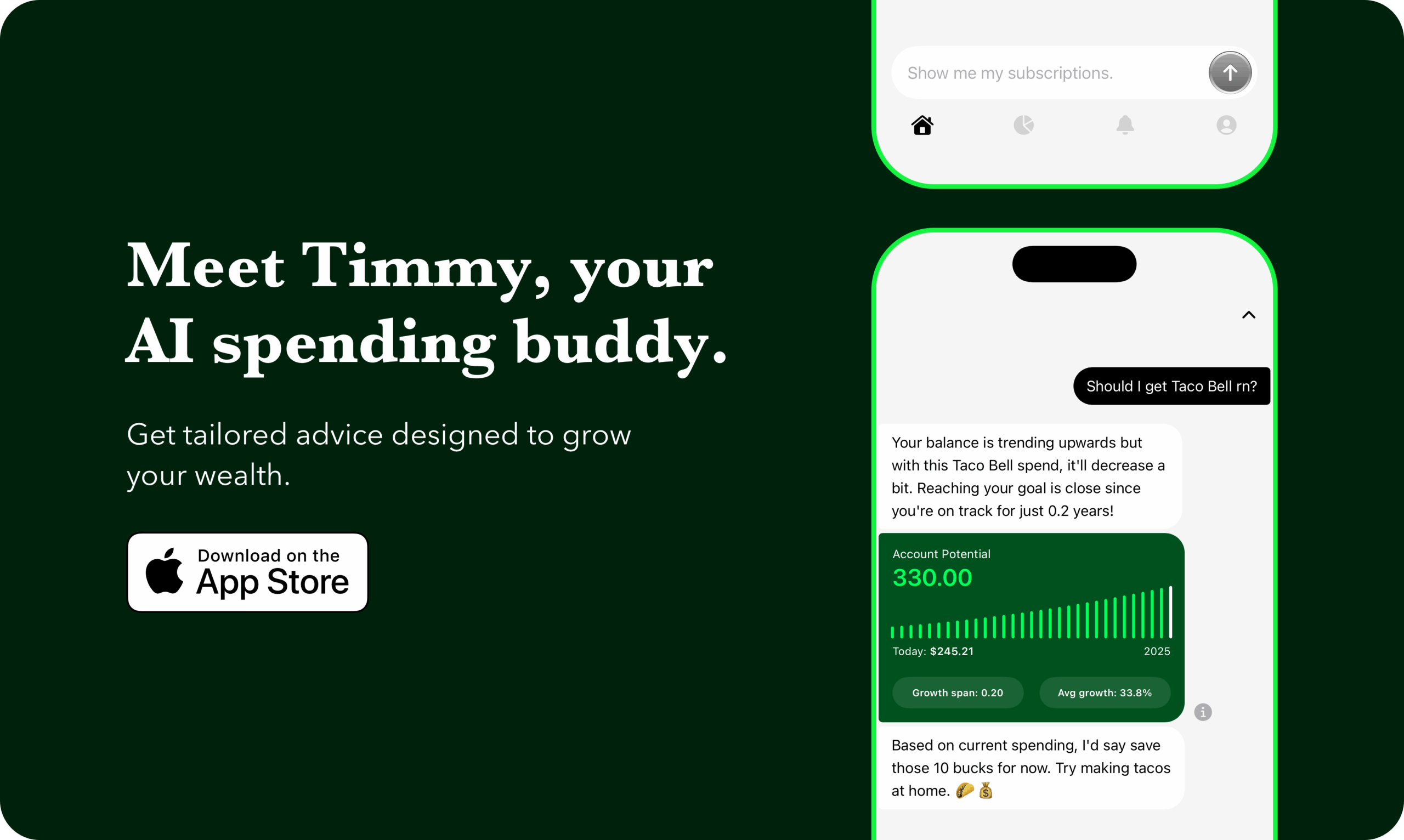

Tired of wondering where your money goes each month? Meet Timmy, your new AI-powered spending assistant designed to help you take control of your finances and achieve your savings goals. Timmy connects to your bank accounts, analyzes your spending habits, and provides personalized advice to guide you towards smarter financial decisions. Let’s dive into how Timmy can help you transform your relationship with money.

Key Features

- Bank Account Integration: Securely links to your bank accounts to automatically track income and expenses, eliminating manual data entry.

- AI-Generated Monthly Budgets: Creates personalized budgets based on your income, spending patterns, and savings goals, making budgeting simple and effective.

- Personalized Spending Insights: Identifies your spending patterns and provides actionable insights to help you understand where your money is going.

- Weekly Financial Challenges: Offers fun and engaging weekly challenges to encourage you to save more and spend less.

- Push Notifications for Spending Alerts: Sends real-time notifications when you’re about to overspend or when a potential savings opportunity arises.

How It Works

Getting started with Timmy is straightforward. First, you securely connect your bank accounts to the platform. Then, you set your savings goals, whether it’s saving for a down payment, a vacation, or simply building an emergency fund. Timmy then gets to work, monitoring your transactions in real-time. Based on your spending habits, Timmy identifies patterns and sends you personalized notifications with advice and suggestions to help you stay on track and reach your financial objectives.

Use Cases

Timmy is a versatile tool that can be used in various financial situations:

- Improving Financial Habits: Timmy helps you identify and break bad spending habits by providing insights into your spending patterns and offering personalized advice.

- Achieving Specific Savings Goals: Whether you’re saving for a down payment on a house or a dream vacation, Timmy helps you create a plan and stay on track to reach your goals.

- Receiving Proactive Spending Advice: Timmy doesn’t just track your spending; it proactively offers suggestions and advice to help you make smarter financial decisions in real-time.

- Enhancing Financial Awareness: By providing clear and concise insights into your spending, Timmy helps you become more aware of your financial situation and make informed decisions.

Pros & Cons

Advantages

- Personalized and proactive advice tailored to your specific spending habits and goals.

- Easy to use interface makes managing your finances simple and intuitive.

- Encourages better spending habits through insights, challenges, and real-time notifications.

Disadvantages

- Requires bank account linkage, which may raise privacy concerns for some users.

- Premium features, such as advanced budgeting tools and personalized coaching, are behind a paywall.

How Does It Compare?

When comparing Timmy to other budgeting and financial management apps, it’s important to consider its unique strengths. Cleo offers budgeting with a fun, conversational interface, but it lacks the personalized goal tracking that Timmy provides. Rocket Money focuses on subscription management and cancellation, whereas Timmy emphasizes proactive spending advice and personalized insights to help you achieve your savings goals.

Final Thoughts

Timmy offers a compelling solution for anyone looking to improve their financial habits and achieve their savings goals. While the requirement for bank account linkage and the paywall for premium features may be drawbacks for some, the personalized and proactive nature of Timmy’s advice makes it a valuable tool for enhancing financial awareness and making smarter spending decisions. Give Timmy a try and see how it can transform your financial future.

https://www.timmyapp.com/