Table of Contents

Overview

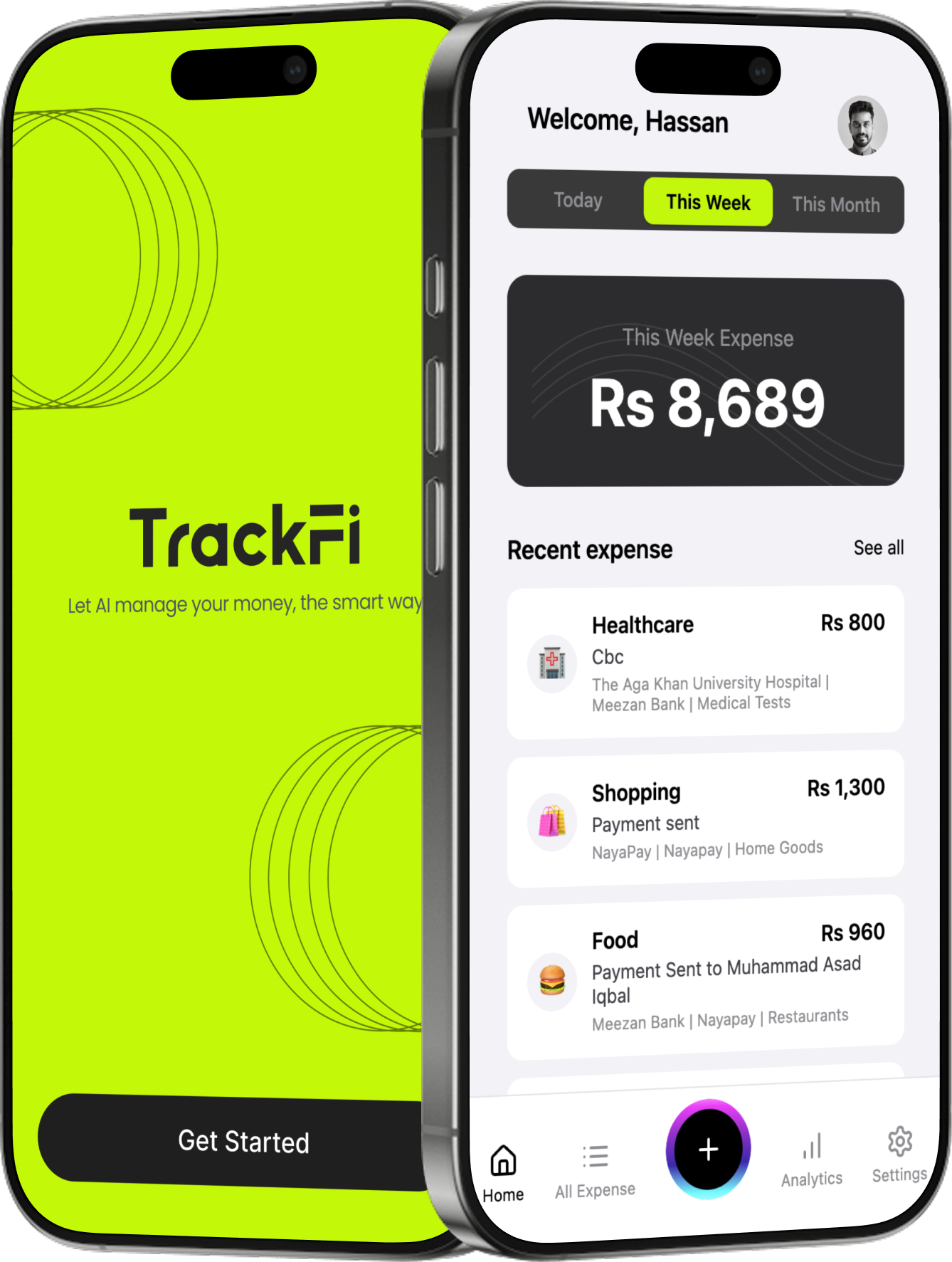

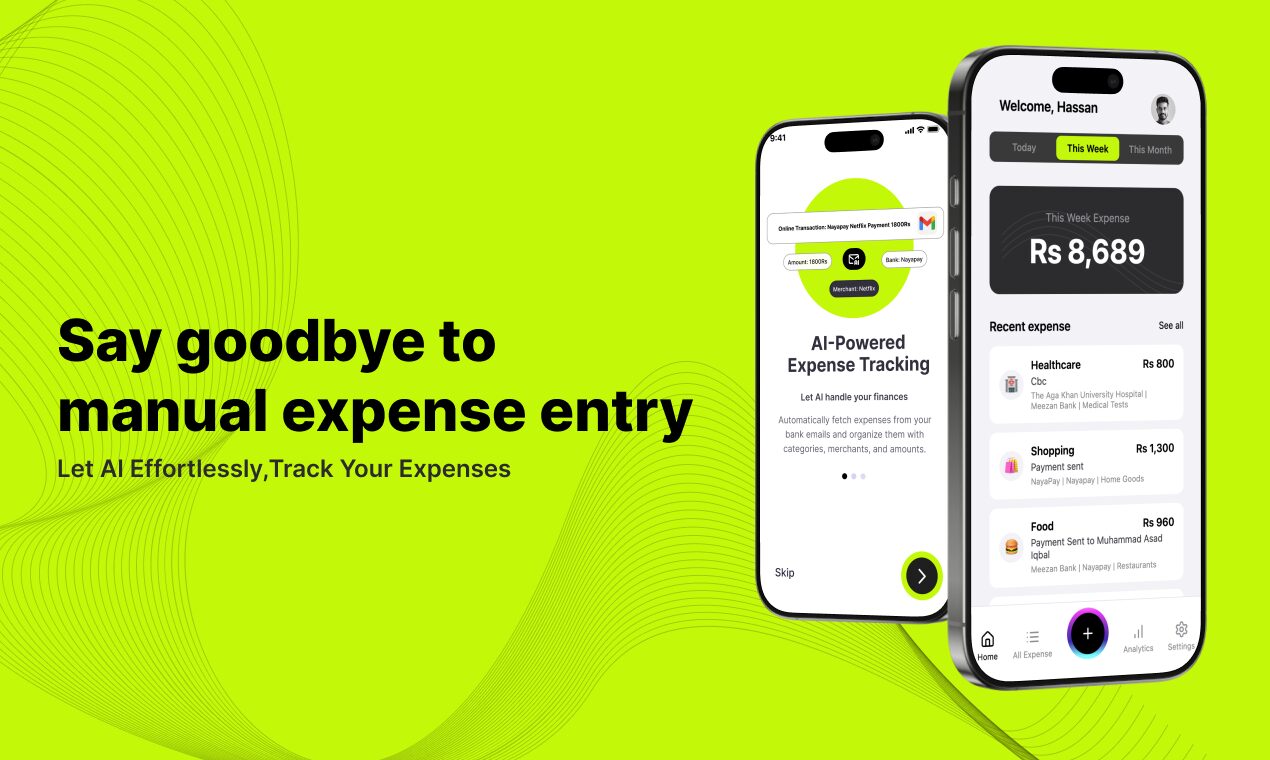

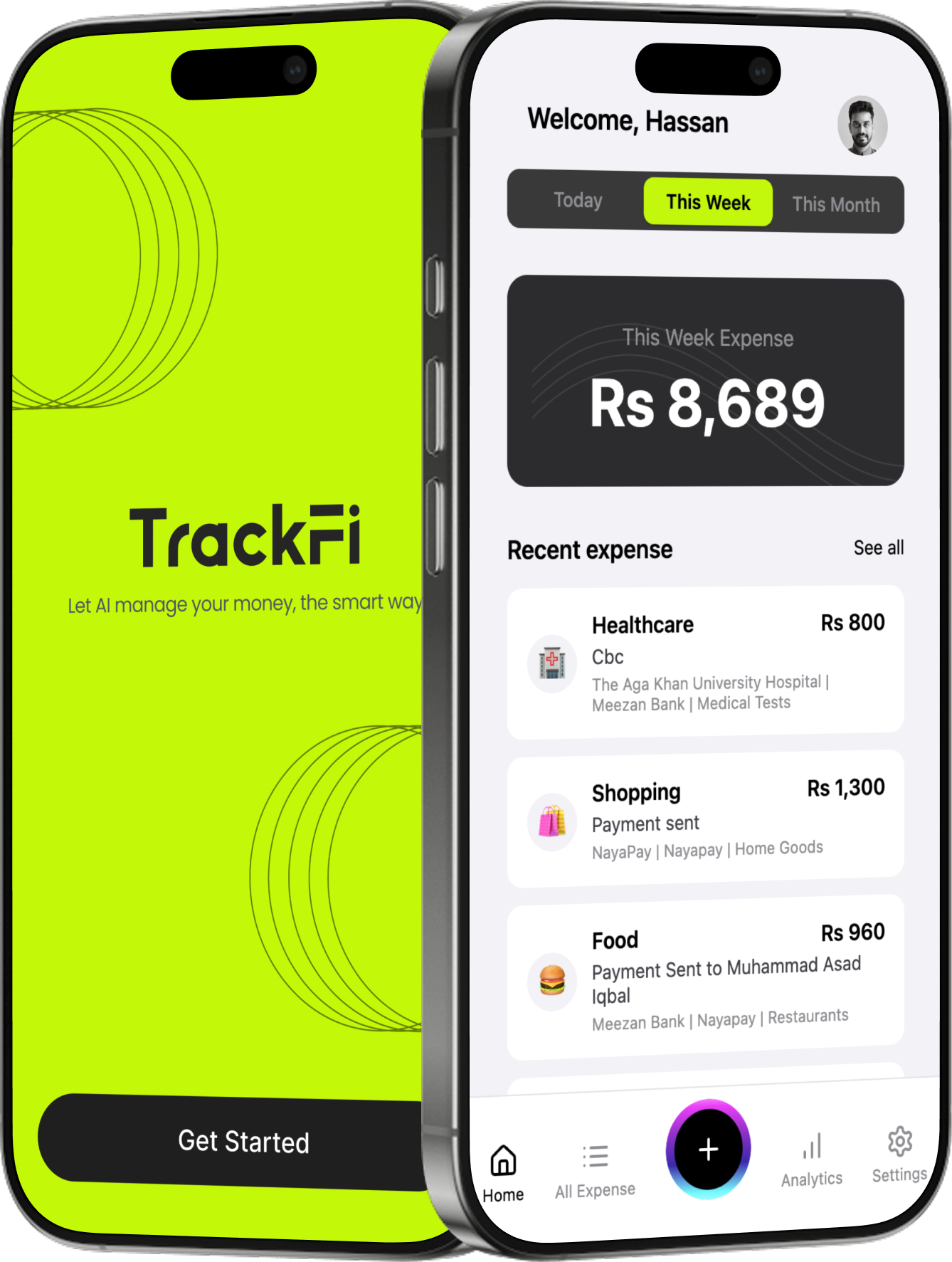

In today’s fast-paced world, managing expenses can feel like a never-ending chore. Manual data entry, sifting through receipts, and categorizing transactions consume valuable time and energy. Enter TrackFi, a newly launched AI-based expense tracking app that launched on Product Hunt in July 2025, designed to streamline personal finance management. TrackFi eliminates the need for manual entries by automatically capturing, categorizing, and organizing expenses from various sources, making financial management more accessible and efficient for individual users.

Key Features

TrackFi offers a focused set of features designed to simplify expense tracking through automation:

- Automatic expense capture from emails and receipts: TrackFi intelligently scans bank images to extract transaction details, reducing manual data entry requirements.

- Voice input integration: Users can speak their expenses directly into the app for on-the-go convenience, with AI processing converting speech to structured expense data.

- AI-powered categorization: The app’s artificial intelligence automatically categorizes expenses into appropriate spending categories, helping maintain organized financial records without user intervention.

- Real-time organization of expenses: Financial data remains current and systematically organized, providing users with immediate insights into their spending patterns.

- Mobile app support: Available on iOS devices with intuitive mobile functionality for managing finances anywhere, anytime.

How It Works

TrackFi operates through a streamlined process designed for maximum automation and user convenience. Users begin by connecting their email accounts to the app, allowing TrackFi to monitor incoming bank notifications and transaction alerts. Additionally, users can capture receipts through the smartphone camera or input expenses via voice commands. The app’s AI technology processes this information, automatically extracting transaction details such as amounts, merchants, dates, and categories. All captured data is then organized into a comprehensive expense log, creating a real-time view of spending without requiring manual categorization or data entry from users.

Use Cases

TrackFi’s automation-focused approach makes it valuable for various personal finance scenarios:

- Personal finance management: Ideal for individuals seeking to track daily spending habits, monitor budget adherence, and gain insights into money allocation patterns.

- Small business expense tracking: Suitable for freelancers, consultants, and small business owners who need to log business expenditures for tax purposes and client reimbursements.

- Travel budget monitoring: Helpful for managing expenses during trips by automatically capturing receipts and categorizing travel-related costs without manual logging.

- Student budget management: Useful for students and young professionals starting their financial management journey with an automated, low-maintenance approach.

- Receipt digitization: Serves as a digital repository for important purchase documentation, eliminating the need for physical receipt storage.

Pricing and Availability

TrackFi is currently available as a free app on the iOS App Store, making it accessible to users without upfront costs. As a newly launched application from July 2025, the long-term pricing strategy has not been announced. Users interested in the app should monitor official channels for potential future pricing changes or premium feature introductions as the platform matures and expands its user base.

Pros \& Cons

Understanding TrackFi’s advantages and limitations provides insight into its suitability for different users:

Advantages

- Eliminates manual entry: Significantly reduces time spent on expense logging through automated email scanning and receipt processing.

- Multi-source input flexibility: Supports various input methods including email integration, camera scanning, and voice commands to accommodate different user preferences.

- Real-time expense tracking: Provides immediate expense organization and categorization, keeping financial information current and accessible.

- Free availability: Currently offered at no cost, making it accessible for budget-conscious users and those testing expense tracking apps.

- Privacy-focused design: According to App Store information, the app claims to collect no user data, addressing privacy concerns.

Disadvantages

- Limited track record: As a newly launched app from July 2025, it lacks extensive user feedback, proven reliability, and long-term stability data.

- Email access requirements: Full automation requires granting access to email accounts, which may concern users prioritizing data privacy and security.

- iOS-only availability: Currently limited to Apple devices, excluding Android users from accessing the platform.

- Feature uncertainty: As a new app, the breadth and depth of features may be limited compared to established expense tracking solutions.

How Does It Compare?

The personal finance app landscape in 2025 offers numerous established alternatives, each with distinct approaches to expense management:

Versus Expensify: Expensify remains a leading expense management platform serving businesses of all sizes, from individuals to large enterprises. With pricing ranging from \$5 to \$36 per user per month, Expensify offers SmartScan technology with 99% accuracy, extensive integrations with accounting software, and robust approval workflows. While TrackFi focuses on simplicity and automation for personal use, Expensify provides comprehensive business expense management with established reliability and enterprise-grade features.

Versus Mint/Credit Karma: Following Mint’s transition to Credit Karma in 2024, users now access budgeting and expense tracking through the Credit Karma platform. This established solution offers comprehensive financial management including credit monitoring, investment tracking, and detailed spending analysis. Credit Karma’s extensive feature set and proven track record contrast with TrackFi’s focused, automation-first approach for straightforward expense logging.

Versus Wally: The Wally ecosystem now includes both the original Wally expense tracker and the newer Wally AI money manager. Wally AI offers intelligent budgeting assistance, goal setting, and collaborative features for couples, while maintaining the clean interface Wally is known for. Compared to TrackFi’s email-centric automation, Wally provides more comprehensive budgeting tools and financial planning capabilities.

Versus PocketGuard: PocketGuard offers simplified budgeting at \$74.99 annually, focusing on showing users exactly how much they can safely spend after accounting for bills and savings goals. Its “In My Pocket” feature provides daily spending guidance, while TrackFi emphasizes automated expense capture and categorization rather than spending limits and budget guidance.

Versus YNAB (You Need A Budget): YNAB commands \$109 annually for its proven zero-based budgeting methodology, where users assign every dollar a specific purpose. YNAB’s approach requires active budget management and planning, contrasting sharply with TrackFi’s passive, automated expense tracking philosophy. YNAB serves users wanting detailed financial control, while TrackFi appeals to those preferring minimal manual involvement.

Versus Monarch Money: Built by former Mint developers, Monarch Money costs \$99.99 annually and offers comprehensive financial tracking including investment monitoring, collaborative budgeting, and advanced analytics. Monarch’s robust feature set and established development team provide more comprehensive financial management compared to TrackFi’s focused automation approach.

Versus Dedicated Receipt Scanner Apps: The 2025 market includes specialized receipt scanning solutions like Receiptor AI, Neat, and Shoeboxed, which focus specifically on receipt digitization and expense extraction. These apps often provide higher accuracy rates and more advanced OCR capabilities than general expense apps, though they typically lack the comprehensive financial management features that broader solutions offer.

Platform Specifications

- Platform availability: Currently iOS only (iPhone, iPad, iPod touch, Mac with Apple M1 chip)

- System requirements: iOS 15.1 or later, iPadOS 15.1 or later, macOS 12.0 or later

- App size: 28.7 MB

- Current version: 1.0.1 (with recent bug fixes for voice features and UI improvements)

- Privacy approach: Claims no data collection according to App Store privacy label

- Integration capabilities: Email forwarding system, camera-based receipt scanning

- Developer: Abdul Hannan Tariq

Final Thoughts

TrackFi represents an interesting entry into the personal finance space, offering a streamlined approach to expense tracking through automation and AI-powered categorization. As a newly launched app from July 2025, it addresses the growing demand for minimal-effort financial management tools that reduce manual data entry burdens.

The app’s strength lies in its simplicity and automation-first philosophy, making it potentially attractive for users who want expense tracking without the complexity of comprehensive budgeting software. Its current free availability lowers the barrier to entry for users exploring automated expense management solutions.

However, TrackFi’s newness presents both opportunities and challenges. While it offers fresh approaches to expense automation, it lacks the proven reliability, extensive feature sets, and user communities that established alternatives provide. Users seeking comprehensive financial management, detailed budgeting capabilities, or proven long-term stability may find more value in established platforms like Monarch Money, YNAB, or Credit Karma.

The app’s success will depend on its ability to maintain reliable automation accuracy, expand platform availability beyond iOS, and potentially develop additional features while preserving its core simplicity. For users prioritizing ease of use over comprehensive functionality, and willing to try newer solutions, TrackFi offers a promising approach to automated expense tracking.

As the personal finance app market continues evolving toward greater automation and AI integration, TrackFi’s focused approach may find its niche among users seeking straightforward expense capture without the learning curve or ongoing management required by more comprehensive financial planning tools.