Table of Contents

Overview

In the evolving landscape of financial markets, artificial intelligence has emerged as a transformative tool for retail investors seeking to implement sophisticated trading strategies. Composer’s Trade with AI platform represents a comprehensive automated trading ecosystem designed to bridge the gap between institutional-grade algorithmic trading capabilities and individual investors. Launched in 2020 and significantly enhanced with the October 2025 introduction of its Trade with AI feature, Composer enables users to create, backtest, and automate trading strategies through natural language prompts or by selecting from over 3,000 community-contributed strategies called “symphonies.” The platform has facilitated over \$20 billion in lifetime trading volume and currently processes more than \$200 million in daily trading volume, positioning it as a significant player in the democratization of algorithmic trading.

Key Features

Composer offers a suite of capabilities designed to make algorithmic trading accessible to investors regardless of coding expertise:

AI-Powered Strategy Generation: The platform integrates GPT-4 and custom large language models fine-tuned specifically for trading applications, enabling users to describe investment objectives in plain English and receive fully executable trading strategies. The system interprets natural language inputs such as “Create a momentum strategy that switches to bonds during high volatility” and translates them into programmatic trading logic.

Extensive Community Strategy Library: Users can access and invest in over 3,000 pre-built trading strategies contributed by the Composer community. These symphonies span various categories including long-term growth, technology focus, diversification, sector rotation, and volatility-based approaches. According to Composer’s data, approximately 80 percent of users invest in community-built symphonies, creating a network effect that benefits the entire user base.

Advanced Backtesting Infrastructure: The platform provides sub-second backtesting capabilities against historical market data, incorporating realistic factors including transaction fees, slippage, and spread adjustments. Users can model portfolio value, compare strategies against benchmarks like the S\&P 500, and iterate rapidly on strategy parameters before committing capital.

Multi-Asset Support: As of October 2025, Composer supports automated trading across U.S. stocks, exchange-traded funds (ETFs), cryptocurrencies, and options contracts, enabling diversified portfolio construction within a single platform.

No-Code Visual Editor: For users preferring hands-on strategy customization, Composer offers a visual, drag-and-drop interface for building trading logic using conditional statements, technical indicators (RSI, EMA, SMA, cumulative returns, standard deviation), dynamic asset selection, and custom weighting schemes without requiring programming knowledge.

Proprietary Trading Language: Composer has developed a specialized programming language optimized for expressing trading strategies, enabling large language models to efficiently build, deploy, and execute strategies while maintaining precision in financial logic.

Model Context Protocol (MCP) Integration: Advanced users can connect Composer to other AI tools including Claude, Cursor, n8n, and Perplexity through Composer’s MCP server, enabling automated workflows for market scanning, strategy testing, and trade execution through conversational AI interfaces.

How It Works

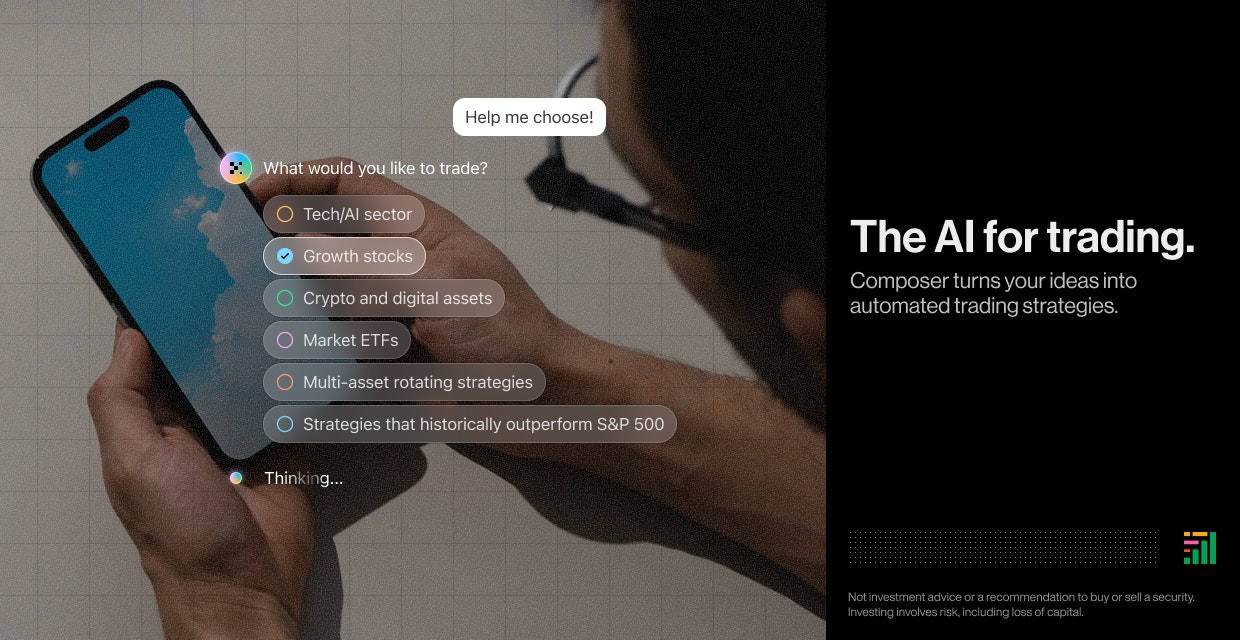

Composer operates as a vertically integrated trading platform handling the entire workflow from strategy conceptualization to live execution. Users begin by either selecting from the “Find My First Symphony” browser featuring top-performing algorithms, using the “Help Me Choose” guided discovery that asks three simple questions about investment goals and risk tolerance, or utilizing “Make My Own Symphony” to build custom strategies.

The AI system analyzes user inputs and either retrieves matching community strategies or generates new ones by leveraging clustering analysis of thousands of real user strategies to identify common trading patterns. The platform then constructs strategies incorporating appropriate technical indicators, asset selection criteria, and risk management parameters.

Once a strategy is created, users conduct comprehensive backtesting to evaluate historical performance across various market conditions. The backtesting engine calculates precise performance metrics including total returns, maximum drawdown, Sharpe ratio, and volatility, while accounting for realistic transaction costs.

After validation, users connect their Composer account to the Alpaca brokerage infrastructure, which Composer uses as its white-label execution partner. When activated, symphonies continuously monitor market conditions and automatically execute trades according to programmed rules, rebalancing portfolios as needed without requiring manual intervention. The platform provides real-time performance monitoring dashboards displaying aggregate account performance and individual symphony metrics.

Use Cases

Composer addresses several distinct investment scenarios across different user segments:

Retail Algorithmic Trading: Individual investors can implement sophisticated quantitative strategies previously accessible only to institutional players, including factor-based investing, momentum strategies, mean reversion approaches, and dynamic asset allocation models.

Hedge Fund-Style Portfolio Management: Users can deploy multiple uncorrelated strategies simultaneously, creating diversified portfolios of algorithmic approaches designed to perform across different market regimes, similar to multi-strategy hedge fund structures.

Automated Retirement Investing: The platform supports tax-advantaged Individual Retirement Accounts (Traditional and Roth IRAs), enabling automated, tax-smart active trading within retirement portfolios. Composer covers transfer fees for accounts moving from other brokers.

Quantitative Strategy Research and Development: Traders and quants can rapidly prototype trading ideas, conduct extensive backtesting with historical data spanning multiple market cycles, and iterate on strategy parameters to identify optimal configurations before risking capital.

Educational Exploration: Investors seeking to understand algorithmic trading concepts can learn by examining community strategies, modifying existing symphonies, and observing how different trading rules respond to various market conditions.

Pros \& Cons

Advantages

Elimination of Coding Barriers: The natural language interface and visual editor democratize access to algorithmic trading, enabling investors without programming backgrounds to implement sophisticated quantitative strategies that would traditionally require Python, R, or C# expertise.

Comprehensive End-to-End Platform: Unlike competitors requiring integration of multiple tools, Composer provides unified research, backtesting, and execution infrastructure with integrated brokerage services, streamlining the workflow from concept to live trading.

Powerful Community Network Effects: The extensive library of 3,000+ community-built strategies creates significant value through shared knowledge, allowing users to learn from successful approaches and implement proven strategies rather than starting from scratch.

Transparent, Predictable Pricing: The straightforward subscription model charges \$32 per month for stocks and ETFs (billed annually at \$384 per year) with zero commissions or management fees, or 0.2 percent commission per trade for cryptocurrency trading with no monthly subscription. This pricing transparency contrasts favorably with traditional financial advisors charging 1-2 percent annual fees.

Institutional-Grade Infrastructure: The platform’s sub-second backtesting, purpose-built trading language, and capacity to process \$200+ million in daily trading volume demonstrate enterprise-level technical capabilities accessible to retail investors.

Disadvantages

Geographic and Market Limitations: The platform focuses primarily on U.S. market data, limiting utility for investors seeking exposure to international equities, European markets, Asian markets, or non-U.S. cryptocurrency exchanges. This U.S.-centric approach may not serve globally diversified portfolios.

Subscription Cost for Active Trading: While the 14-day free trial enables evaluation, the \$32 monthly subscription (\$384 annually) represents ongoing costs that may be significant for investors with smaller account sizes, potentially requiring substantial portfolio values to justify the expense relative to commission-free passive investing alternatives.

Limited Demonstrated Track Record: Although launched in 2020, the platform remains relatively young compared to established brokerages, with limited long-term performance data across full market cycles including bear markets, recessions, and various volatility regimes. Independent third-party validation of symphony performance remains scarce.

Execution Partner Dependency: Composer’s reliance on Alpaca as its exclusive brokerage partner creates potential risks including execution quality concerns, limited asset availability compared to multi-broker platforms, and concentration risk if the partnership experiences disruptions.

Strategy Performance Variability: While backtesting provides historical performance estimates, real-world results may differ due to changing market dynamics, overfitting to historical data, and the common challenge that past performance does not guarantee future results—particularly important for AI-generated strategies that may not have been tested through diverse market conditions.

How Does It Compare?

The automated trading landscape in October 2025 features several distinct platform categories, each serving different investor needs and trading philosophies:

QuantConnect: Represents the professional-grade algorithmic trading infrastructure targeting quantitative researchers and developers. QuantConnect requires coding proficiency in Python or C#, offering institutional-quality features including access to 50+ years of historical data, cloud-hosted Jupyter notebooks, extensive alternative data sources (SEC filings, sentiment metrics), and multi-asset support across equities, futures, options, forex, and cryptocurrencies. The platform’s strength lies in its research-grade environment, Alpha Stream marketplace for leasing trading signals, and co-located servers ensuring sub-100ms broker latency. However, its coding requirement and complexity create barriers for non-technical investors. QuantConnect competes directly with Composer for quantitative traders willing to invest time in strategy development, whereas Composer targets users seeking similar capabilities without programming demands.

Alpaca: It is critically important to note that Alpaca is NOT a competitor to Composer—it is Composer’s brokerage infrastructure partner. The original content’s inclusion of Alpaca as a competitor represents a significant factual error. Alpaca operates as an API-first, commission-free broker providing the backend execution infrastructure that powers Composer’s trading automation. Alpaca specializes in algorithmic trading infrastructure, offering APIs that enable fintech companies, trading platforms, and developers to build custom trading applications. Rather than competing, Composer and Alpaca have a symbiotic relationship where Composer provides the user-facing strategy creation and management interface while Alpaca handles trade execution, custody, and regulatory compliance.

TradeStation: Offers a comprehensive brokerage platform with advanced trading tools, representing a different business model than Composer. TradeStation provides its proprietary desktop platform featuring EasyLanguage scripting for custom indicator and strategy development, RadarScreen for real-time market scanning of 1,000+ symbols simultaneously, OptionsStation Pro for sophisticated derivatives trading, and extensive futures trading capabilities. While TradeStation includes automation features, it functions primarily as a full-service broker offering direct market access, extensive charting tools, and professional-grade analytics rather than focusing exclusively on no-code algorithmic strategy creation. TradeStation appeals to active traders and technical analysts comfortable with platform complexity, whereas Composer targets investors prioritizing automation and simplicity. The pricing models also differ significantly—TradeStation uses commission-based or subscription tiers based on trading activity, while Composer employs flat monthly subscriptions.

AI-Powered Crypto Trading Platforms: For cryptocurrency-focused automated trading, platforms including Cryptohopper (supporting Algorithm Intelligence with machine learning for strategy selection, multi-exchange integration, and \$0-\$107.50/month pricing), WunderTrading (offering quantitative strategies including mean reversion and arbitrage with free to \$62.97/month pricing), TradeSanta (featuring DCA and Grid bots for various market conditions with tiered pricing), and Pionex (providing pre-built trading bots used by millions of traders) represent specialized competitors. These platforms focus exclusively on cryptocurrency markets with deep exchange integrations, whereas Composer offers broader multi-asset support including stocks and ETFs alongside crypto.

Stock-Focused AI Trading Bots: Platforms like Trade Ideas (offering AI-powered market scanning and trade signal generation starting at \$89/month), StockHero (automated stock trading bot platform), Tickeron (providing AI trading robots with pattern recognition and \$60-\$250/month pricing), and Kavout (machine learning-based predictive analysis with Kai Score system) compete in the AI stock trading space. These platforms vary in their approaches—some focus on signal generation requiring manual execution, while others provide fuller automation. Composer differentiates through its unified end-to-end platform combining strategy creation, backtesting, and automated execution with community sharing features.

Composer occupies a unique position in the automated trading ecosystem by combining institutional-grade algorithmic capabilities, natural language accessibility, comprehensive multi-asset support, and integrated execution—all packaged in a no-code platform designed for retail investors. Its primary competitive advantages include the extensive community strategy library creating network effects, the sophisticated AI-powered strategy generation using fine-tuned LLMs, and the vertically integrated infrastructure eliminating the need to connect disparate tools. However, investors should evaluate whether Composer’s U.S. market focus, subscription costs, and platform-specific features align with their trading objectives, account sizes, and geographic diversification needs compared to alternatives offering different trade-offs.

Final Thoughts

Composer’s Trade with AI platform represents a meaningful advancement in democratizing algorithmic trading for retail investors, successfully translating institutional-grade quantitative strategies into accessible, no-code interfaces powered by artificial intelligence. The platform’s strengths—particularly its natural language strategy generation, extensive community library exceeding 3,000 symphonies, comprehensive backtesting infrastructure, and transparent pricing—create compelling value propositions for investors seeking to automate sophisticated trading approaches without programming expertise.

The October 2025 enhancement introducing conversational AI features further streamlines the onboarding process, potentially lowering barriers for investors intimidated by traditional algorithmic trading complexity. The platform’s processing of over \$200 million in daily trading volume demonstrates meaningful traction and operational scalability, suggesting genuine market validation beyond marketing claims.

However, prospective users should approach with measured expectations and clear understanding of limitations. The subscription cost of \$32 monthly (\$384 annually) for stocks and ETFs requires meaningful portfolio sizes to justify expenses—investors with accounts below \$25,000-\$50,000 may find the subscription represents a significant percentage of returns. The platform’s U.S.-centric market data focus limits geographic diversification opportunities for globally oriented portfolios.

Most critically, the original content’s characterization of competitors contains a significant factual error: Alpaca is Composer’s brokerage infrastructure partner, not a competitor. This misrepresentation undermines credibility and suggests careful verification of platform claims is warranted. Additionally, while backtesting provides historical performance insights, the relatively limited track record across full market cycles (launched 2020, major AI features in 2025) means long-term performance through bear markets, recessions, and regime changes remains uncertain.

The comparison with competitors requires nuanced understanding: QuantConnect offers superior research capabilities for technically proficient users, cryptocurrency-specialized platforms provide deeper exchange integrations for crypto traders, and TradeStation delivers comprehensive brokerage services for active traders. Composer differentiates through accessibility and unified workflow rather than superiority across all dimensions.

Ideal Composer users include: retail investors with moderate-to-large portfolios seeking to implement quantitative strategies without coding, individuals comfortable with subscription costs relative to account size, investors focused primarily on U.S. equities and ETFs with some crypto exposure, those valuing community-shared strategies and collaborative learning, and traders willing to accept the inherent uncertainties of AI-generated strategies and automated execution.

Investors should leverage the 14-day free trial to rigorously evaluate whether the platform’s capabilities deliver measurable improvements over simpler alternatives including low-cost index funds, commission-free buy-and-hold approaches, or traditional financial advisors. The platform’s long-term success will depend on demonstrating consistent strategy performance across varying market conditions, expanding international market coverage, maintaining competitive pricing as competitors emerge, and building trust through transparency regarding both successes and limitations of AI-powered trading automation.

For those committed to algorithmic trading and seeking accessible entry points, Composer offers genuine innovation worthy of consideration—provided users maintain realistic expectations, practice appropriate risk management, and recognize that AI-assisted trading tools enhance rather than replace the need for sound investment judgment and discipline.