Table of Contents

Zown Research Report

Description Rewrite

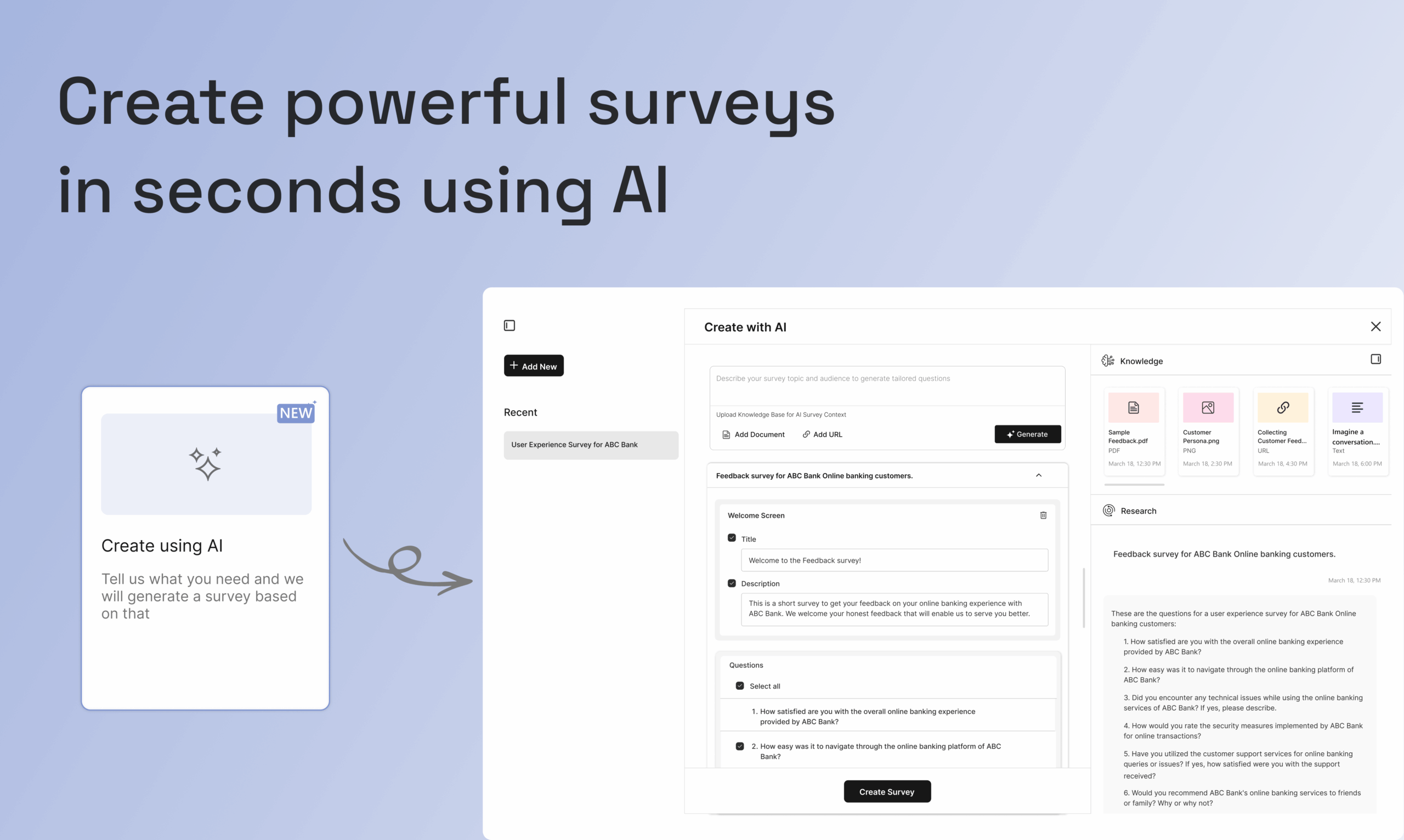

Zown is a tech-powered real estate platform that revolutionizes homebuying by redirecting traditional buyer-agent commissions as upfront cash to homebuyers. The platform provides up to 2% of the home purchase price as an immediate down payment boost, helping buyers overcome financial barriers in competitive housing markets. Zown’s AI-powered system automates affordability checks, delivers mortgage pre-approvals in under five minutes, provides smart property matching based on preferences and budget, and offers acceptance probability tools for competitive bidding. The platform combines dedicated account managers, on-demand showing agents, and comprehensive digital tools to create a seamless, transparent homebuying experience that prioritizes buyer financial benefit over traditional commission structures.Deep Service Report

Zown emerged from a viral Reddit post in 2022 when founder Rishard Rameez shared his frustrating experience losing his entire down payment to real estate commissions. This “rage post” generated over 1 million views and widespread resonance, inspiring Rameez to build a solution that would fundamentally restructure real estate transactions to benefit buyers.Founded in 2022 and launched commercially in 2024, Zown has achieved remarkable growth in the Canadian market, facilitating over $300 million in real estate transactions and helping more than 250 homebuyers. The company maintains a 4.9-star Google rating with over 150 reviews and has demonstrated consistent 20% month-over-month growth. In June 2025, Zown expanded into the United States, launching operations across California.

The platform’s core innovation lies in its commission restructuring model. Instead of the traditional 2.5-3% buyer-agent commission disappearing into broker fees, Zown retains only 1% and returns the remainder directly to buyers as upfront cash. This approach can provide buyers with up to $25,000 in immediate financial assistance, which can be applied toward down payments, closing costs, or mortgage rate buy-downs.

Zown’s technology stack includes AI-powered property matching that considers buyer preferences, budget constraints, and market conditions. The platform’s valuation tools project property appreciation over two-year periods, enabling smarter investment decisions. Smart offer suggestions and acceptance probability algorithms help buyers craft competitive bids while avoiding overpayment.

The company operates with a hybrid model combining technology automation with human expertise. Each buyer receives a dedicated account manager who leverages Zown’s AI tools while providing personalized guidance through negotiations and paperwork. Additionally, Zown maintains a statewide network of “showing agents” who provide flexible, on-demand property tours, eliminating the delays common in traditional single-agent models.

Zown’s comprehensive platform integrates multiple services traditionally handled by separate providers. Through partnerships with Equifax and major banks, the platform delivers mortgage pre-approvals in under three minutes. The system includes instant showing scheduling, connecting buyers with local realtors within 5 kilometers of target properties. Advanced listing databases consolidate information on commute times, school ratings, crime statistics, and market comparables.

The company has positioned itself as a disruptor in an industry known for resistance to change. Zown’s model addresses the primary barrier to homeownership identified by research: the down payment challenge. By providing immediate cash assistance where buyers need it most, the platform enables middle-income earners who earn too much for traditional assistance programs but struggle to save for down payments in rapidly appreciating markets.

Country

Canada (headquarters in North York/Toronto, Ontario) with expansion into the United States (California) as of June 2025.Pros & Cons

Pros

- Immediate Financial Benefit: Provides up to 2% of home purchase price as upfront cash, potentially saving buyers $15,000-$25,000

- AI-Powered Efficiency: Automated affordability checks, property matching, and offer predictions streamline the homebuying process

- Fast Pre-Approval: Mortgage pre-qualification delivered in under five minutes through integrated partnerships

- Transparent Pricing: Clear commission structure with buyers knowing exactly how much cash they’ll receive upfront

- Flexible Showing Model: On-demand property tours eliminate scheduling delays common with traditional agents

- Comprehensive Platform: End-to-end service integration from search to closing in a single platform

- Proven Track Record: 4.9-star rating with 150+ reviews and $300M+ in successful transactions

- No Hidden Fees: Buyers pay no commission fees and receive cash back instead

Cons

- Limited Geographic Coverage: Currently available only in Canada and California, limiting accessibility for most U.S. buyers

- Market Dependency: Commission-based savings model depends on traditional market structures that may evolve

- Technology Learning Curve: AI-powered tools may require adaptation for buyers accustomed to traditional processes

- New Company Risk: Founded in 2022, lacks the long-term track record of established brokerages

- Agent Network Limitations: Showing agent availability may vary by location and market conditions

- Refinancing Requirements: Some financing options may require refinancing within specific timeframes

- Market Acceptance: Success depends on buyer and seller acceptance of non-traditional real estate models

Pricing

Zown operates on a commission restructuring model that provides financial benefit to buyers rather than charging traditional fees. The pricing structure includes:For Buyers:

- No commission fees charged to buyers

- Receive 1.5-2% of home purchase price as upfront cash (up to $25,000)

- Cash can be applied to down payment, closing costs, or mortgage rate buy-downs

- No additional platform fees or subscription costs

For Sellers:

- Flat fee structure of 1% (capped at $7,999 in some markets)

- Eliminates traditional percentage-based commission fees

- Includes staging, professional photography, MLS listing, and offer handling

Revenue Model:

- Zown retains 1% commission from restructured buyer-agent fees

- Additional revenue from mortgage brokering, title insurance, and related services

- No ongoing fees or subscription charges for platform users

Competitor Comparison

| Feature | Zown | Flyhomes | reAlpha | Traditional Brokerages | Opendoor |

|---|---|---|---|---|---|

| Business Model | Commission-to-cash conversion | Cash offer facilitation | AI-driven, commission-free | Traditional agent model | iBuying with fees |

| Buyer Commission | $0 (receives cash back) | 3% commission | $0 commission | 2.5-3% commission | Varies by market |

| Cash Benefit | Up to 2% upfront | Short-term loans | No cash benefit | No cash benefit | Quick sale option |

| AI Integration | Property matching, valuations | Limited technology | Full AI automation | Minimal | Automated valuations |

| Geographic Coverage | Canada + California | Multiple U.S. states | Select U.S. markets | Nationwide | Major U.S. cities |

| Pre-Approval Speed | Under 5 minutes | Standard timeline | AI-powered | Traditional process | N/A (seller-focused) |

| Agent Model | Dedicated + showing agents | Traditional agents | AI agent “Claire” | Traditional agents | Internal team |

Team Members

- Rishard Rameez – Co-Founder and Chief Executive Officer

- Vinura Abeysundara – Founding Team and Head of Sales

- Afraj Gill – President

Based on available information, Zown has a lean executive team of 3 primary leaders, with the company employing 11-50 total staff members according to organizational data.

Team Members About

- Rishard Rameez serves as Co-Founder and CEO of Zown. He is an experienced entrepreneur with a demonstrated history in the software industry and strong advocacy for mental health awareness. Rameez holds a degree from the University of Waterloo and has founded multiple ventures prior to Zown. His previous experience includes co-founding RealMe Property (a tokenized real estate platform), serving as Founder/VP of Facedrive Health (AI-powered contact tracing devices with contracts including Air Canada and Microsoft), and founding team member of HiRide (a carpooling app that was acquired). He also worked as a Pilot Plant Engineer at South Dakota State University from 2016-2018. Rameez’s frustrating experience selling his home and losing his down payment to commissions directly inspired Zown’s creation.

- Vinura Abeysundara is a founding team member and Head of Sales at Zown, focusing on making homeownership more affordable for Canadians. Prior to Zown, he served as Co-founder and CEO of Turtle from 2019-2022, where he invented the world’s first software-powered MagSafe wireless portable charger for iPhones with automatic charging capabilities designed for content creators and business professionals. Abeysundara has educational background from RMIT University in Biotechnology, Seneca College in Creative Advertising, Gateway College Sri Lanka, and Colombo International School. He is based in San Francisco, California.

- Afraj Gill serves as President of Zown and plays a key role in the company’s expansion strategy, particularly the California market entry. Gill has been instrumental in addressing the challenges facing homebuyers in high-cost markets like Los Angeles, San Diego, and San Francisco, where average down payments have increased by 86% over the past two decades. His leadership focuses on Zown’s mission to provide tangible financial support to buyers who face the challenge of saving for down payments while home prices continue climbing.

Team Members SNS Links

Rishard Rameez:

- LinkedIn: https://www.linkedin.com/in/rishard-rameez-702628b0

- Professional Profile: Co-Founder/CEO at Zown, AI-powered real estate

- Location: San Francisco, California

Vinura Abeysundara:

- LinkedIn: https://ca.linkedin.com/in/vinura-abeysundara-9b0472199

- Professional Profile: Founding Team & Head of Sales at Zown

- Location: San Francisco, California

Company Profiles:

- Zown Official Website: https://zownhomes.com

- Product Hunt Profile: Listed as “The AI-Powered Homebuying Platform”

- The Org Company Profile: Available with team structure and company information

The founding team maintains active professional profiles showcasing their commitment to revolutionizing real estate through technology and making homeownership more accessible across North America.